According to Kitco, silver prices remain below $50/ounce, but the prospect of price increases is becoming clearer after the United States Geological Survey (USGS) officially recognized silver as one of the "essential minerals" in 2025.

Neils Christensen - an analyst at Kitco News - commented that although silver has long been considered a precious metal and a valuable asset, more than 60% of today's demand for silver comes from industrial applications - especially electronics and solar energy. This strong demand is putting pressure on supply and leading to increasingly serious shortages.

"Being listed as an important mineral means that the metal could become a strategic commodity, affected by trade policy and national security - which makes the already volatile silver market more complicated," said Neils Christensen.

In many other countries, Neils Christensen said that silver supply is being tightened after many years of strong consumption, while physical reserves have been recorded to have decreased. This situation is clearly reflected in the sharp decline in silver supply at London warehouses, increased demand from India, and the silver rental market that has reached record levels.

Matthew piggott - Director of Gold and Silver at Metals Focus - commented that silver being recognized as an important mineral will increase market volatility.

According to piggott, silver prices will only ease volatility when supply issues are resolved - a process that he believes is not easy.

"The situation can only improve if we achieve a surplus in the silver market in the future. Certainly, this year we will fall into a deficit again. Looking to next year, we will see the same thing because we will not have any significant industrial weakness to reduce silver consumption" - he said.

He also noted that higher silver prices are expected to promote a more frugal trend in the solar energy sector, as silver accounts for a significant cost of PV panels.

"Looking ahead, we can see that silver prices may increase in the next 24 months, but it will all depend on the development of solar panel technology," Matthew piggott said.

Update on domestic silver prices

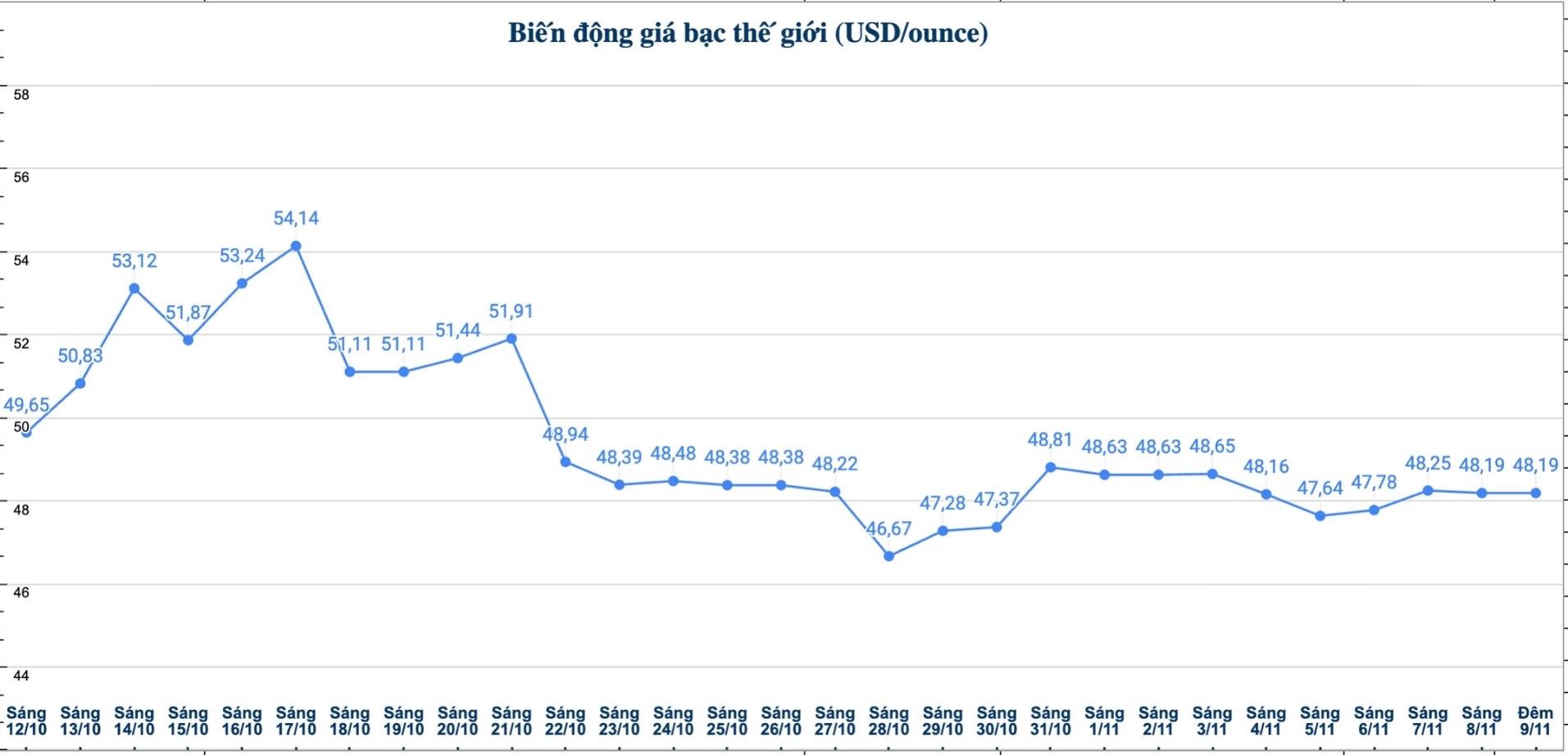

As of 6:00 a.m. on November 10, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Metallurgy Company was listed at 1.848 - 1.890 million VND/tael (buy - sell).

The price of 999 Ancarat 999 (1kg) at Ancarat Metallurgy Company is listed at 48,600 - 49.950 million VND/kg (buy - sell).

At the same time, the price of 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 1.851 - 1.908 million VND/tael (buy - sell).

The price of 999 taels (1kg) at Phu Quy Jewelry Group was listed at 49.359 - 50.879 million VND/kg (buy - sell).

See more news related to silver prices HERE...