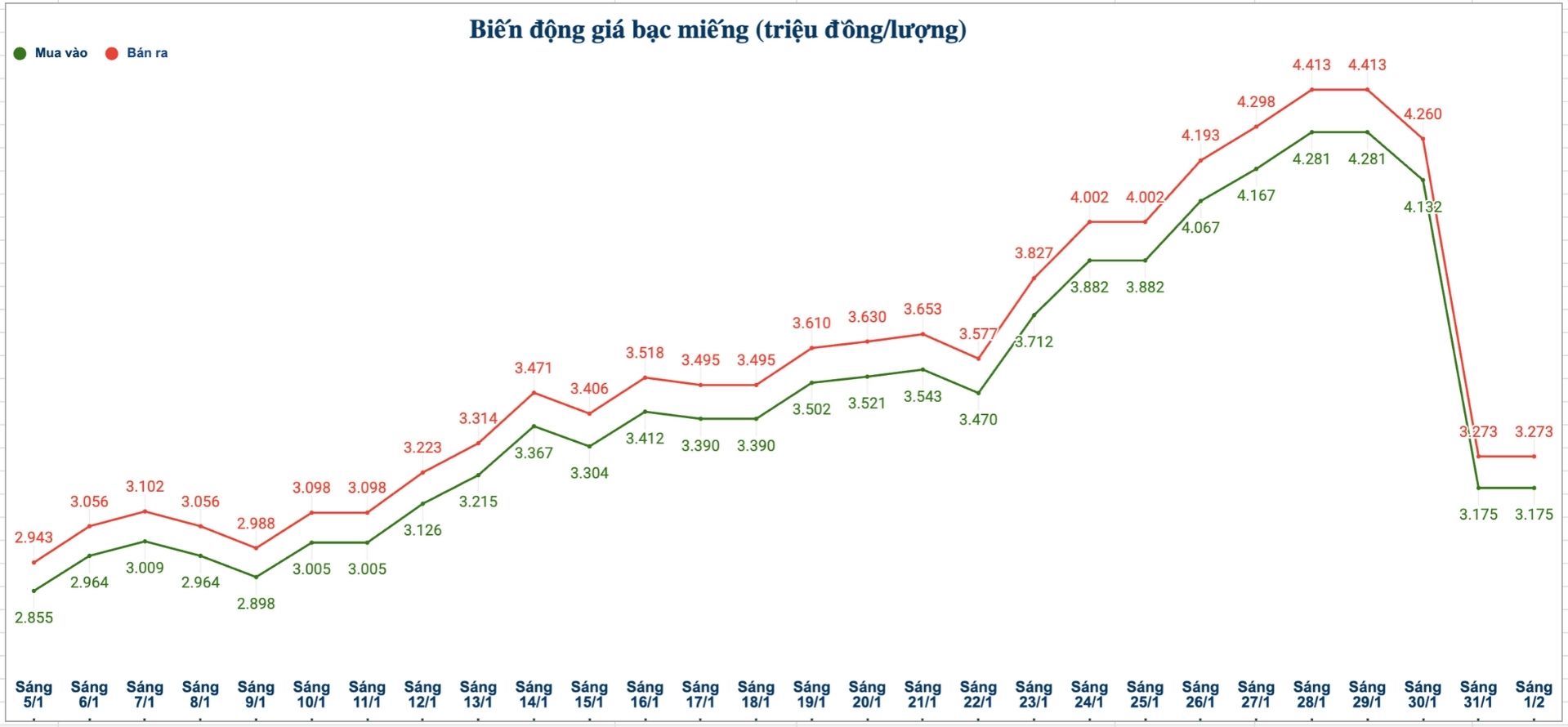

Domestic silver prices

As of 9:45 am on February 1st, the price of Kim Phuc Loc 999 silver bars (1 tael) of Saigon Thuong Tin Commercial Joint Stock Company Limited (Sacombank-SBJ) was listed at the threshold of 4.047 - 4.164 million VND/tael (buying - selling).

The price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Gem Company is listed at the threshold of 3.274 - 3.354 million VND/tael (buying - selling).

The price of 2025 Ancarat 999 silver ingots (1kg) at Ancarat Gem Company is listed at 86,320 - 88,940 million VND/kg (buying - selling).

In the previous week's trading session (morning of January 25, 2026), the price of silver ingots 2025 Ancarat 999 (1kg) at Ancarat Gem Company was listed at 102.566 - 105.686 million VND/kg (buying - selling).

Thus, if you buy 2025 Ancarat 999 silver ingots (1kg) at Ancarat Gem Company on January 25, 2026 and sell them on this morning's session (February 1, 2026), the buyer will lose 19.366 million VND/kg.

At the same time, the price of 999 silver bars (1 tael) at Phu Quy Jewelry Group was listed at 3.175 - 3.273 million VND/tael (buying - selling).

The price of 999 silver ingots (1kg) at Phu Quy Jewelry Group is listed at 84.666 - 87.279 million VND/kg (buying - selling).

In the previous week's trading session (morning of January 25, 2026), the price of 999 silver ingots (1kg) at Phu Quy Jewelry Group was listed at 103.519 - 106.719 million VND/kg (buying - selling).

Thus, if buying 999 silver bars (1kg) at Phu Quy Jewelry Group on January 25, 2026 and selling them on this morning's session (February 1, 2026), buyers will lose 22.053 million VND/kg.

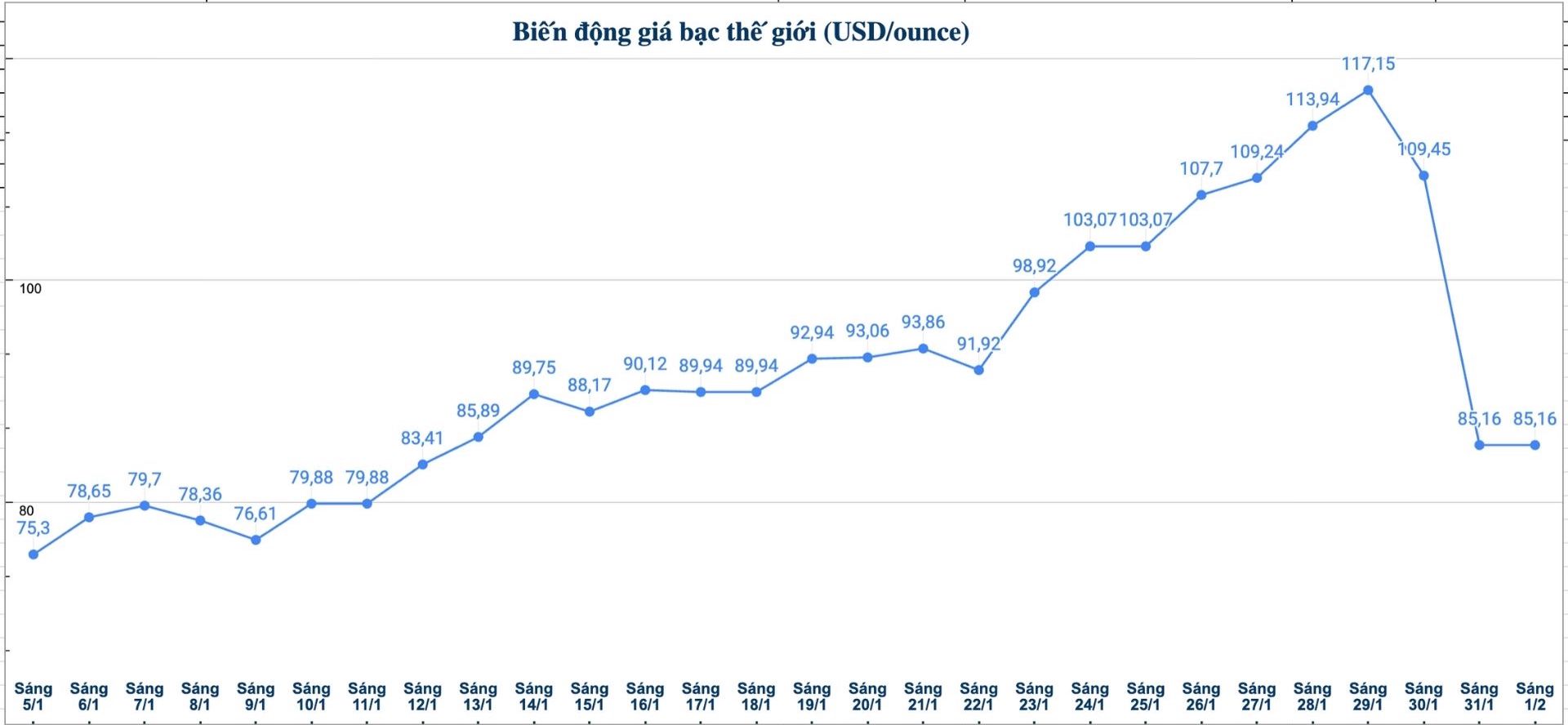

World silver price

On the world market, as of 9:45 AM on February 1st (Vietnam time), the world silver price is listed at 85.16 USD/ounce.

Causes and forecasts

The silver market has just experienced a volatile trading week when prices continuously fluctuated strongly in both directions of increase and decrease. The prolonged heat wave before that is causing investors to raise many questions about the sustainability of the current trend.

For most of the trading week, precious metal analyst Christopher Lewis at FX Empire said that silver prices increased very strongly, even at times setting new highs.

However, profit-taking pressure quickly appeared, pulling prices back down deeply. By the end of the week, silver prices even fell into a state of decline compared to the beginning of the week - a development showing that the market is showing signs of cooling down after a long period of too rapid increase" - he said.

According to technical analysis, Christopher Lewis believes that the increase in silver in recent times has many speculative factors and has far exceeded actual physical demand. This increases the possibility of the market entering a correction phase.

However, Christopher Lewis believes that the long-term outlook for silver is not necessarily over. This precious metal still has the potential to increase in price in the future, but it is difficult to maintain the hot growth rate as in the past.

The adjustment is considered necessary for the market to find a more reasonable price level" - Christopher Lewis said.

In the context of large fluctuations, the expert said that short-term risks are increasing, investors need to be more cautious in silver buying and selling decisions.

See more news related to silver prices HERE...