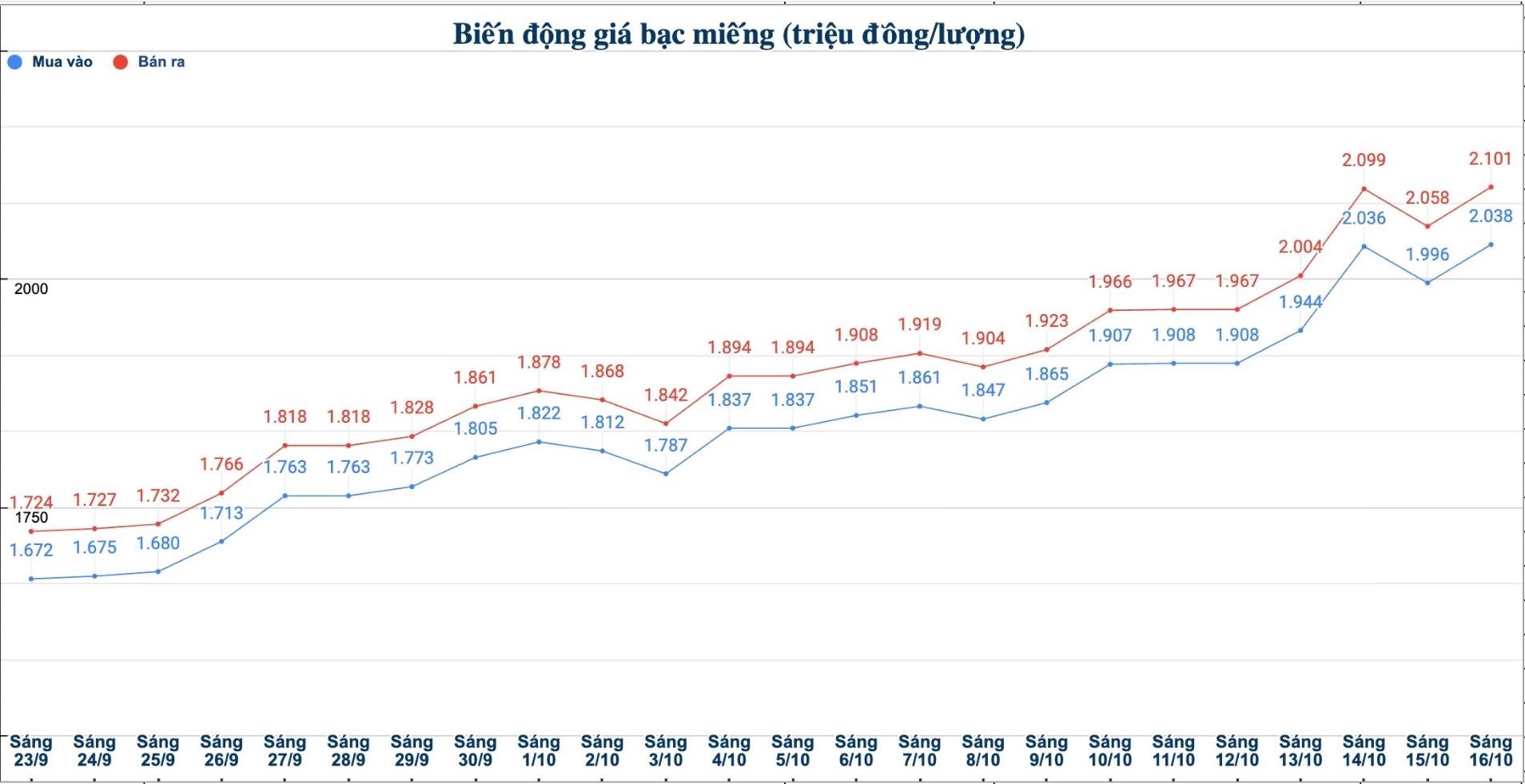

Domestic silver price

As of 9:25 a.m. on October 16, the price of 999 taels of Golden Rooster 999 taels (1 tael) of Saigon Thuong Tin Bank Gold and Gemstone Co., Ltd. (Sacombank-SBJ) was listed at VND 2.055 - VND 2.106 million/tael (buy - sell); an increase of VND 36,000/tael in both directions compared to yesterday morning.

At the same time, the price of 999 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 2.038 - 2.01 million VND/tael (buy - sell); an increase of 42,000 VND/tael for buying and an increase of 43,000 VND/tael for selling compared to yesterday morning.

The price of 999 gold bars (1kg) at Phu Quy Jewelry Group was listed at VND54.346 - 56.026 million/kg (buy - sell); an increase of VND1.120 million/kg for buying and an increase of VND1.147 million/kg for selling compared to yesterday morning.

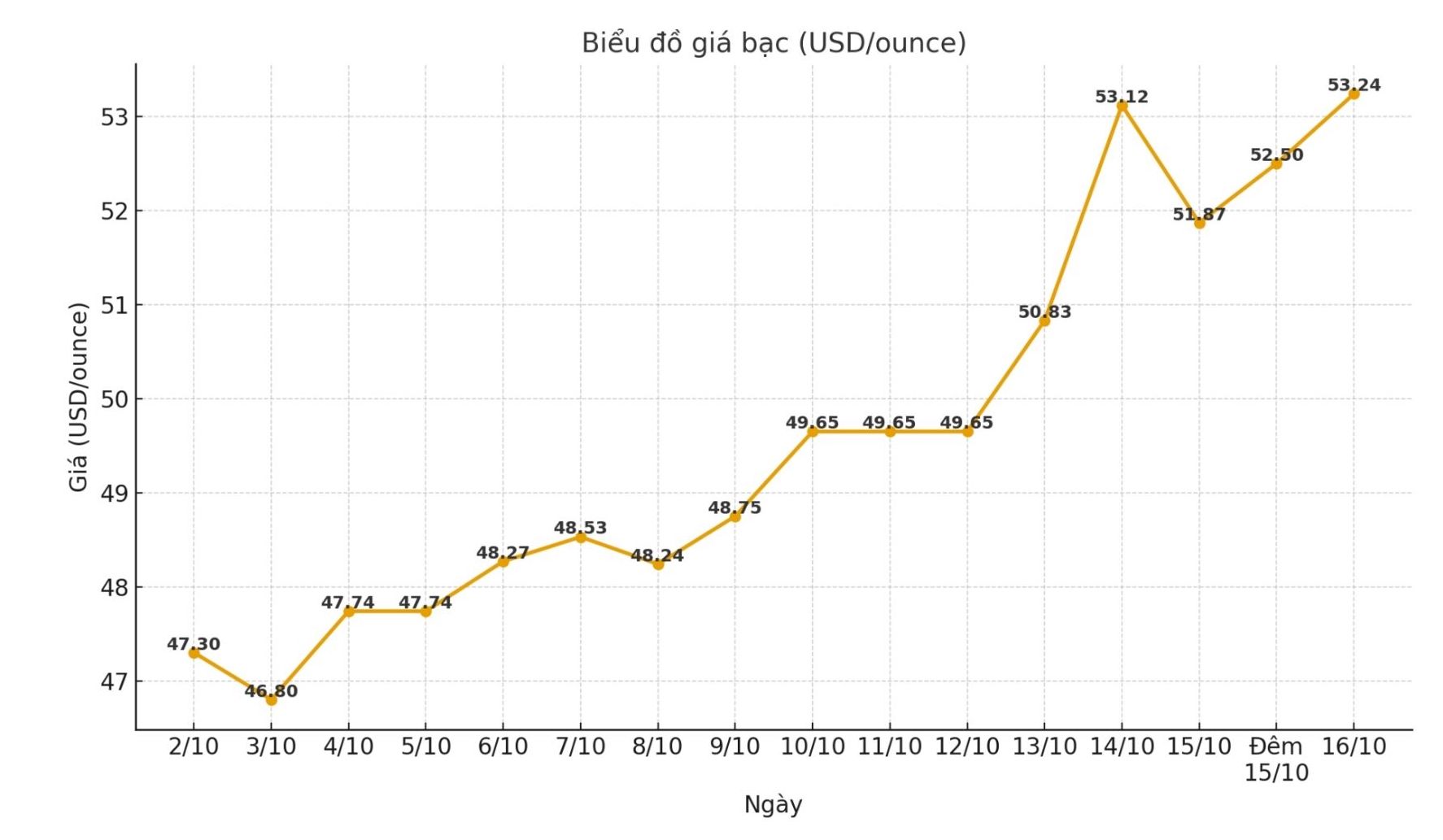

World silver price

On the world market, as of 9:25 a.m. on October 16 (Vietnam time), the world silver price was listed at 53.24 USD/ounce; an increase of 1.37 USD compared to yesterday morning.

Causes and predictions

The silver market is still trading vibrantly. However, precious metals analyst Christopher Lewis believes that caution is needed because the increase in silver is too strong, posing many potential risks.

"Cillary prices have increased around $52/ounce at times, but have quickly decreased again. This development shows that selling pressure is appearing again. Investors should limit opening large positions, especially when gold still maintains its strength while silver shows signs of unpredictable fluctuations" - Christopher Lewis assessed.

The expert said that in reality, gold and silver are not necessarily in the same market. In addition to being a precious metal, silver is also an industrial metal, so it should be affected by other factors such as production demand and technology trends, especially the wave of investment in AI. In addition, many people think that gold is too expensive, which also causes money to shift to silver.

"However, if prices fall below $48 an ounce, the market could see a strong sell-off. Silver is a high-risk asset, so when it fluctuates, the price often drops very quickly and strongly" - Christopher Lewis commented.

According to Christopher Lewis, the question now is whether the market will maintain stability around the $50/ounce mark. "If prices maintain this zone for a while, the uptrend may continue. However, this is still one of the most risky potential markets today," Christopher Lewis said.

See more news related to silver prices HERE...