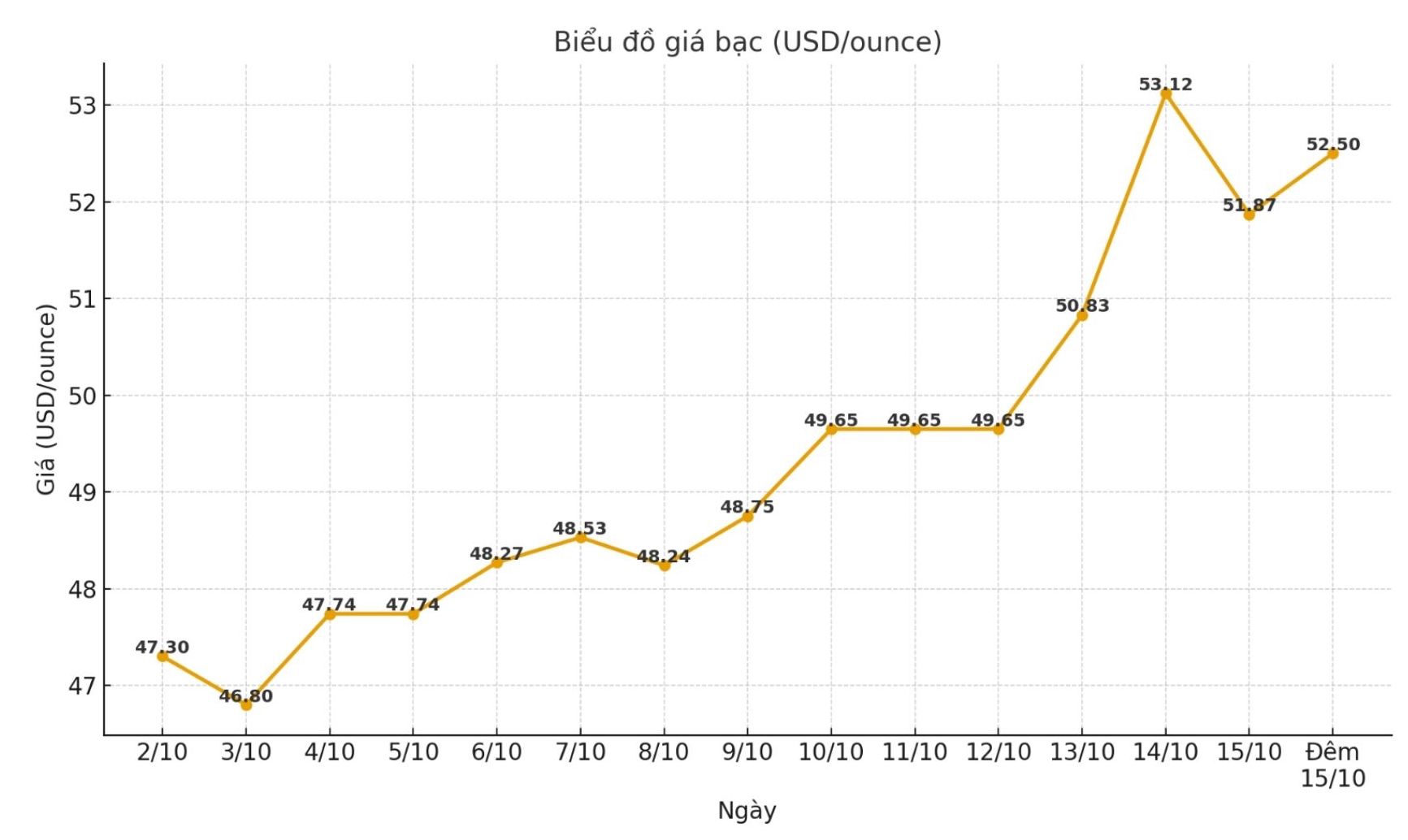

Gold prices have had a spectacular increase since the beginning of the year amid geopolitical instability and economic policies of the Donald Trump administration, causing investors and central banks to rush to safe-haven assets. However, silver is currently the new wave metal.

According to Bloomberg, due to scarce supply, silver prices in the London market have increased by 70% since the beginning of the year, compared to a 55% increase in gold as of mid-October. Both have recorded strong demand from investors, thanks to the characteristics of holding prices stable during times of political instability, inflation and currency weakness.

Unlike gold, silver is not only rare but also has high practical value, an important material in many industrial products. With reserves falling to a multi-year low and demand continuing to increase sharply, the risk of silver shortages could affect many industries.

Political and fiscal instability in major economies such as the US, France, and Japan is weakening their currencies. Investors seek to hedge against risks by buying gold and silver, known as "counter-currencies depreciation trading". Silver is an excellent electrical conductor, used in circuit boards, electric vehicles, batteries, solar panels and medical equipment. Like gold, silver is still a popular ingredient for jewelry and coins.

Compared to gold, silver is cheaper, making it easier to access for small investors, and price fluctuations are also stronger as the precious metal market increases. China and India are still the two largest silver consumers thanks to industrial demand and the traditional use of silver as storage.

According to Bloomberg, silver prices are affected by many factors such as the production cycle, interest rates and green energy policies. When the economy is booming, industrial demand increases, causing silver prices to increase; on the contrary, when the economy is recession, investors turn to silver as a safe haven.

Compared to gold, the silver market is smaller, the transaction and inventory are low, so liquidity is easily lost. Although there are actually more silver reserves, due to their lower value, the total amount of silver held in London is only a fraction of the value of gold (only about 40 billion USD compared to 1,100 billion USD of gold).

The London Gold Market Association (LBMA) said that inventory here has decreased by about a third since mid 2021, causing the amount of silver that can be lent or delivered to decrease sharply. Global demand has exceeded exploitation output for 4 consecutive years, gradually depleting reserves. silver ETFs attract new capital flows, forcing depositors to accumulate physical silver while the supply is increasingly limited.

In addition, the proposal to tax US metals imports has caused a huge buying spree, further straining supply. This has caused market liquidity to decrease and the demand for gold bars to increase sharply.

Bloomberg said that the current global silver shortage not only affects investors but can also put great pressure on manufacturing industries, especially clean energy. If silver prices continue to remain high, many businesses will be forced to consider the option of replacing silver with other materials.

As of 23:00 on October 15, the world silver price was listed at 52.5 USD/ounce.

See more news related to silver prices HERE...