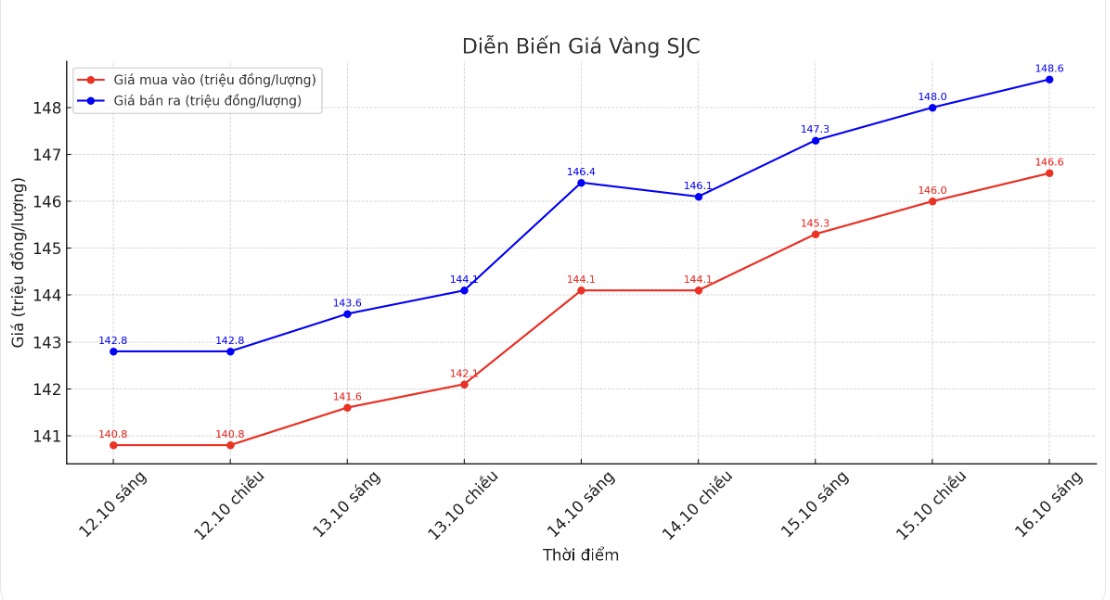

Updated SJC gold price

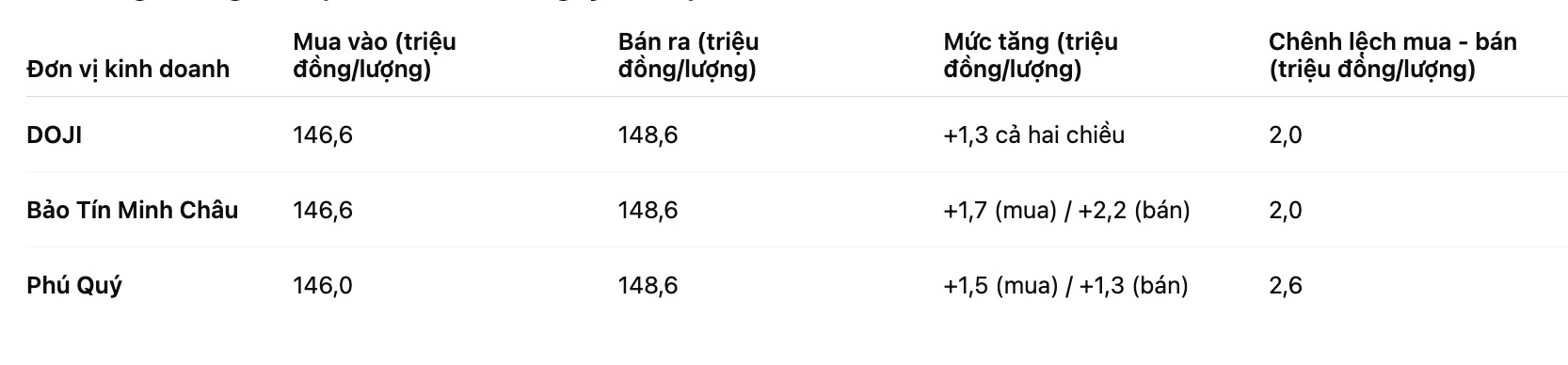

As of 9:00 a.m., DOJI Group listed the price of SJC gold bars at 146.6-148.6 million VND/tael (buy - sell), an increase of 1.3 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 146.6-148.6 million VND/tael (buy - sell), an increase of 1.7 million VND/tael for buying and an increase of 2.2 million VND/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 146-148.6 million VND/tael (buy - sell), an increase of 1.5 million VND/tael for buying and an increase of 1.3 million VND/tael for selling. The difference between buying and selling prices is at 2.6 million VND/tael.

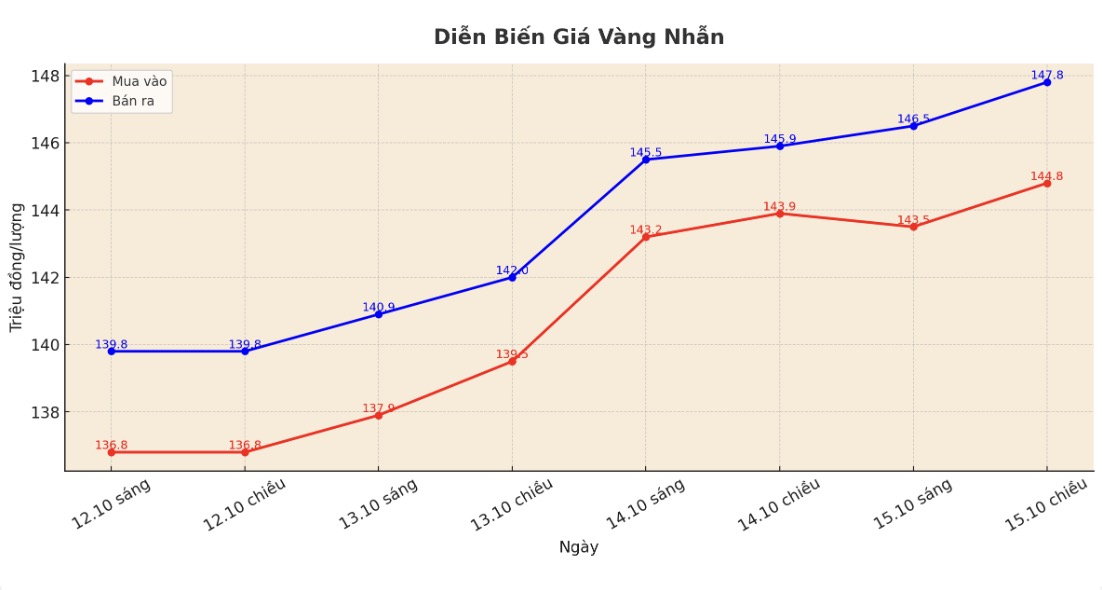

9999 round gold ring price

As of 9:00 a.m., DOJI Group listed the price of gold rings at 146-148.5 million VND/tael (buy - sell), an increase of 2.5 million VND/tael for buying and an increase of 2 million VND/tael for selling. The difference between buying and selling is 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 150-153 million VND/tael (buy - sell), an increase of 6.4 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 145.6-148.6 million VND/tael (buy - sell), an increase of 1.8 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

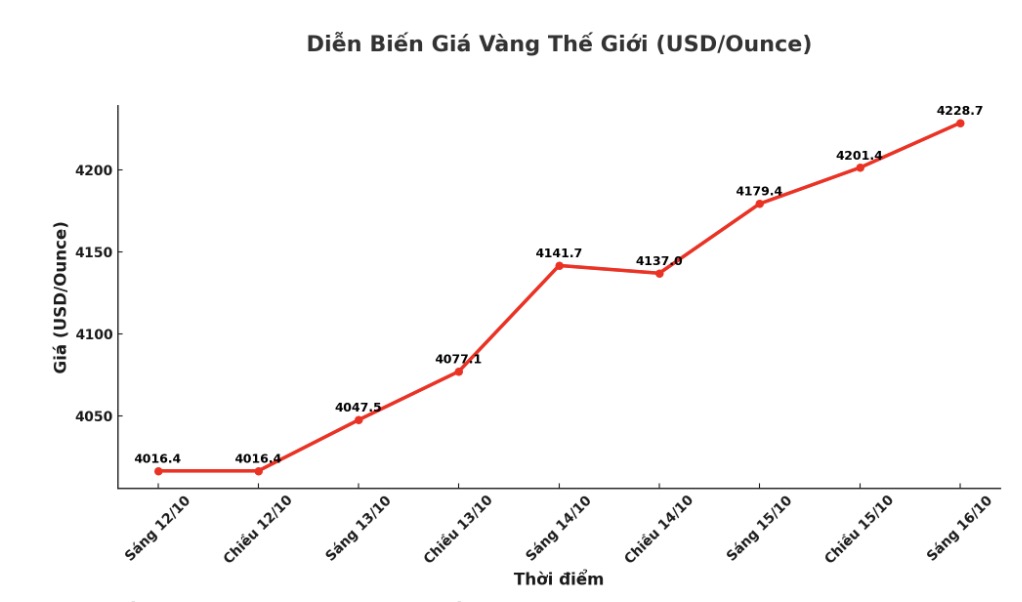

World gold price

At 9:00 a.m., the world gold price was listed around 4,228.7 USD/ounce, up 49.3 USD.

Gold price forecast

World gold prices hit a new peak in the context of increased demand for safe havens. Silver prices also broke out due to scarce supply.

Both metals recorded safe-haven demand amid rising US-China trade tensions and US government shutdowns.

When asked about owning gold, JPMorgan CEO Jamie Dimon said: Im not a gold buyer owning it costs about 4% of the cost a year, he said at Fortunes Most Powerful Women conference in Washington on Tuesday.

However, in the current environment, prices can easily reach $5,000/ounce, or even $10,000/ounce. This is one of the few times in my life that I have found holding a little gold in my portfolio quite reasonable, he added, according to Bloomberg.

Federal Reserve Chairman Jerome Powell also signaled on Tuesday a softer monetary policy which is in the favor of gold prices.

In a speech to an economic group, he said the Fed is expected to make another 0.25 percentage point interest rate cut later this month.

Powell stressed the low recruitment rate and the possibility of a further weakening in the labor market, while noting that the decline in the number of recruitment positions may be reflected in the unemployment rate.

Due to the US government's shutdown, the Fed is having to look to alternative data sources to assess the economic situation. The upcoming Fed policy meeting is scheduled to take place on October 28-29.

Investors are paying attention to Fed Philadelphia's business performance survey data, an early indicator of the health of the US manufacturing sector. The results of this survey are considered an important signal reflecting the growth trend and inflationary pressures in the world's largest economy.

If the index shows a recovery in manufacturing activities, expectations of the FED maintaining higher interest rates could strengthen the USD, thereby putting downward pressure on gold prices. Conversely, if data weakens, the market could increase betting on the possibility of the Fed loosening monetary policy soon, supporting gold to maintain its upward momentum.

Technically, December gold futures are still in a strong uptrend and maintain a clear technical advantage in the short term, but the increase may be close to the limit. The next target for buyers is to close above the solid resistance level of 4,300 USD/ounce. Meanwhile, the target for the sellers is to push the price below $4,000/ounce.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...