Domestic silver price

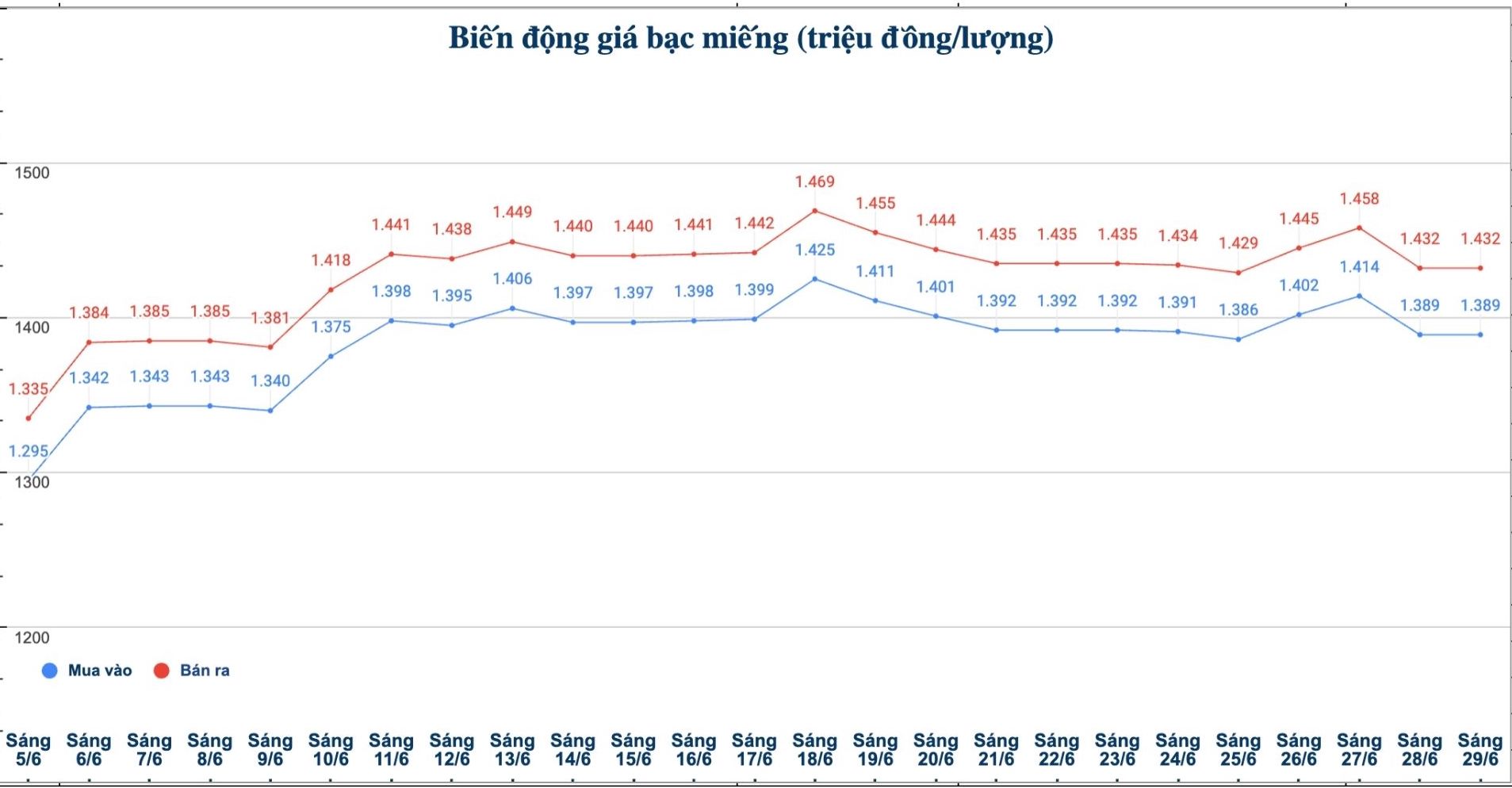

As of 9:00 a.m. on June 29, the price of 999 silver bars at Phu Quy Jewelry Group was listed at VND1.389 - 1.432 million/tael (buy - sell); unchanged in both buying and selling directions compared to early this morning.

The price of 999 gold bars at Phu Quy Jewelry Group was listed at 1.389 - 1.432 million VND/tael (buy - sell); unchanged in both buying and selling directions compared to early this morning.

At the same time, the price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 37.039 - 38.186 million VND/kg (buy - sell); unchanged in both buying and selling directions compared to early this morning.

In the previous trading session (morning of May 29, 2025), the price of 999 taels (1kg) at Phu Quy Jewelry Group was listed at 33.626 - 34.666 million VND/kg (buy - sell).

Thus, if buying 999 taels of silver (1kg) at Phu Quy Jewelry Group on May 29 and selling it this morning (6,6), buyers will make a profit of up to VND 2.373 million/kg.

World silver price

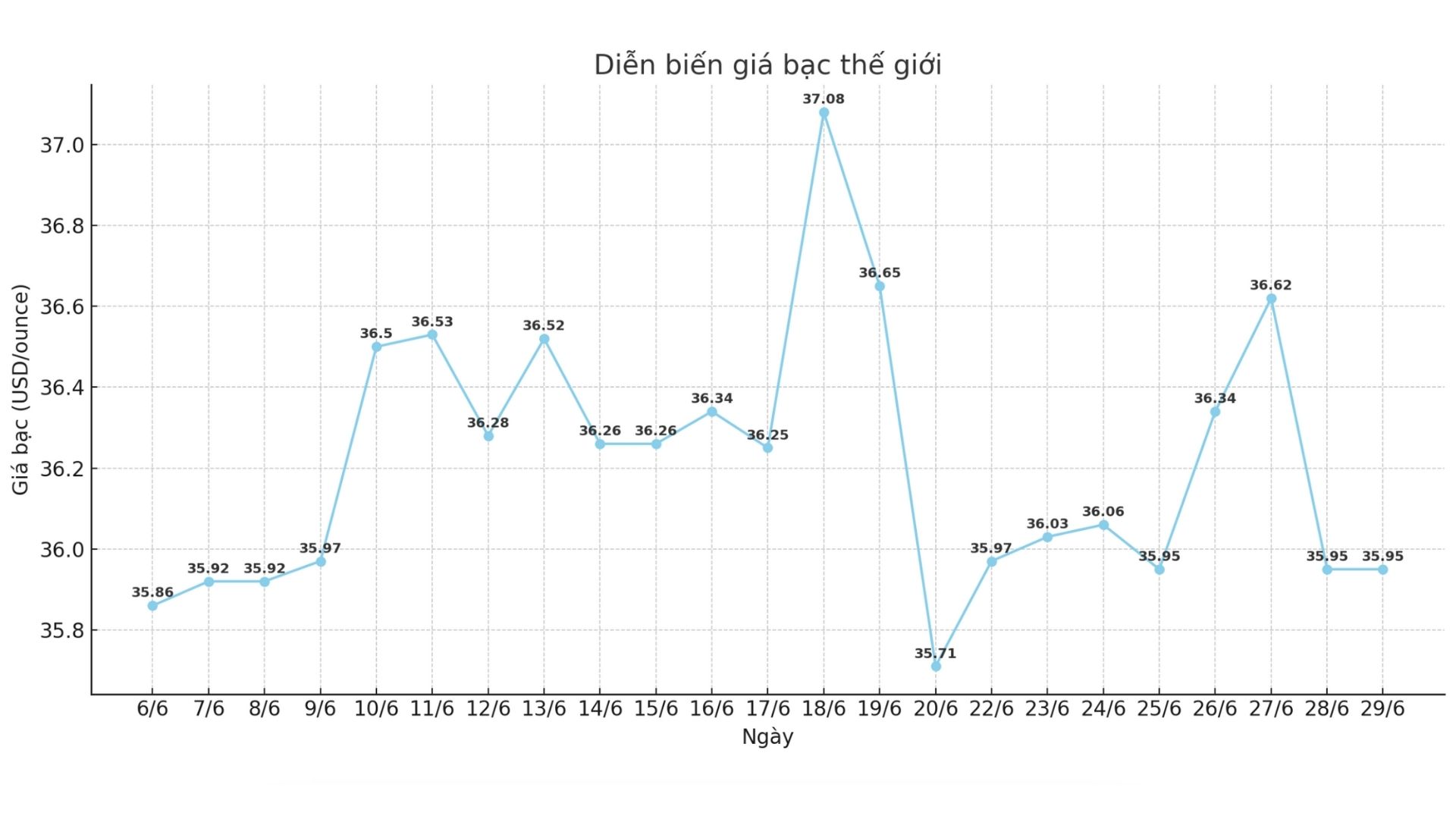

On the world market, as of 9:05 a.m. on June 29 (Vietnam time), the world silver price was listed at 35.95 USD/ounce.

Causes and predictions

Silver prices are still at a high level but have cooled down, ending a long-standing streak of price increases.

However, according to market analyst James Hyerczyk, silver has increased by more than 20% since the beginning of the year, reflecting a market adjustment rather than a trend reversal.

"The main reason for the decline in silver prices is the cooling geopolitical tensions. Investors have reduced safe-haven positions as tensions in the Middle East eased, eliminating the defensive factor that helped silver increase by 30% in the first half of the year.

This change in sentiment has taken away an important pillar of silvers recent support, said James Hyerczyk.

According to James Hyerczyk, the USD and bond yields also affect metal prices. The USD index decreased, US Treasury yields for the 10-year term increased sharply, making fixed-income assets more attractive than silver.

"Higher bond yields make holding precious metals such as silver - an asset that is not profitable - less attractive, so investors move to bonds even though the USD is weakening. This situation shows that silver prices are very sensitive to real interest rates, and this impact is even stronger than short-term exchange rate fluctuations" - he said.

Despite the price decrease, James Hyerczy said that long-term factors such as limited supply, strong industrial demand and low inventories remain unchanged.

"This could be a healthy consolidation in a broader bull market, opening up the possibility of silver prices recovering as fundamental factors return to lead the market in the coming time" - James Hyerczy expressed his opinion.

See more news related to silver prices HERE...