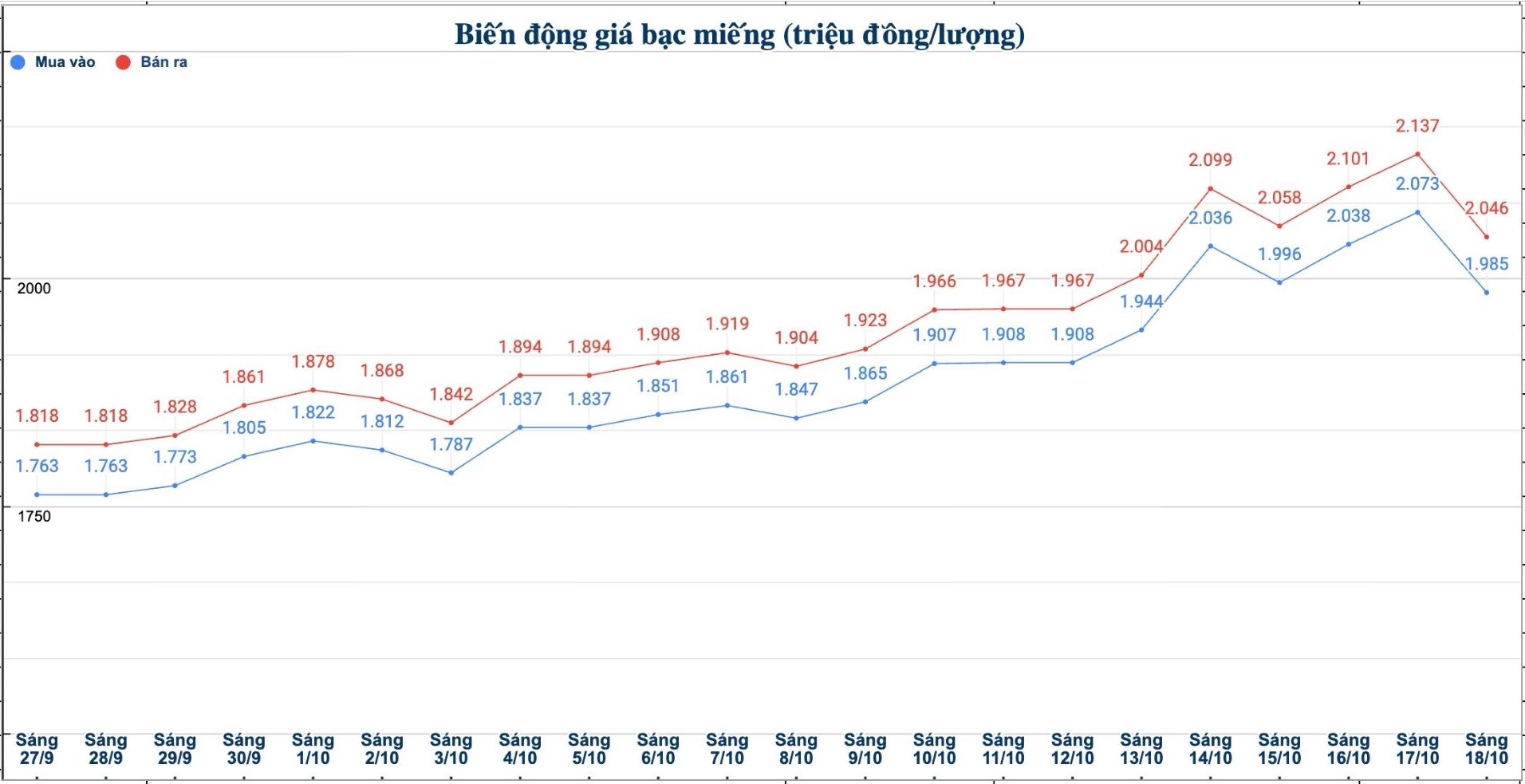

Domestic silver price

As of 9:20 a.m. on October 18, the price of 999 Phuc Loc 999 gold bars (1 tael) of Saigon Thuong Tin Bank Gold and Gemstone Company Limited (Sacombank-SBJ) was listed at VND 2.097 - 2.148 million/tael (buy - sell).

At the same time, the price of 999 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 1.985 - 2.046 million VND/tael (buy - sell); down 88,000 VND/tael for buying and down 91,000 VND/tael for selling compared to yesterday morning.

The price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 52.933 - 54.559 million VND/kg (buy - sell); down 2.346 million VND/kg for buying and down 2.427 million VND/kg for selling compared to yesterday morning.

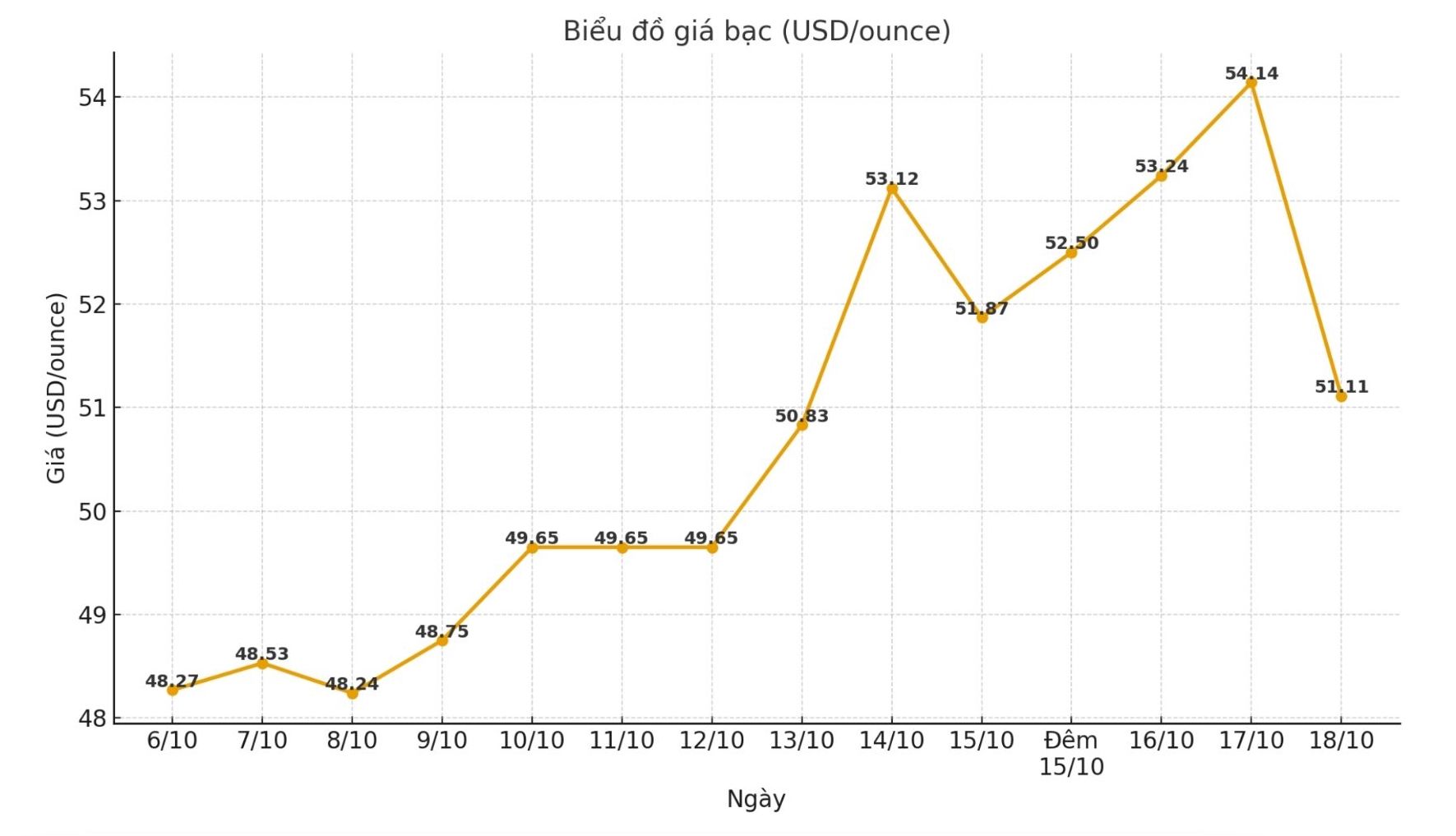

World silver price

On the world market, as of 9:20 a.m. on October 18 (Vietnam time), the world silver price was listed at 51.11 USD/ounce; down 3.03 USD compared to yesterday morning.

Causes and predictions

Spot silver prices fell after hitting a multi-year high of 54.49 USD/ounce, showing the possibility of a short-term correction. According to market analyst James Hyerczyk, although the uptrend is still dominant, this decline has made investors more cautious, waiting for a signal to confirm a temporary peak.

According to James Hyerczyk, if market sentiment continues to be negative, silver prices could fall further. Conversely, if prices quickly return to the 54.49 USD/ounce zone, the downtrend will lose effect and the market can recover its upward momentum.

The expert said that the strong increase in silver this month was largely due to expectations that the US Federal Reserve (FED) will soon change monetary policy. Several Fed officials, including Governor Christopher Waller and former adviser Stephen Miran, recently signaled support for a rate cut at a Federal Open Market Committee (FOMC) meeting.

The situation of US regional banks also contributed to strengthening demand for shelter. Uncertainty in the financial system has caused investors to seek precious metals, especially silver - an investment channel to replace legal tien.

He added that trade tensions between the US and China - although not a major factor - are still a risk that could affect industrial metal demand, thereby affecting silver. Because it is both a currency and an industrial commodity, silver is often sensitive to fluctuations in global trade and investment psychology.

The expert commented: "Springs in a short period of time make silver vulnerable to profit-taking pressure, especially when expectations of a temporary interest rate cut or geopolitical risks increase".

See more news related to silver prices HERE...