Domestic silver price

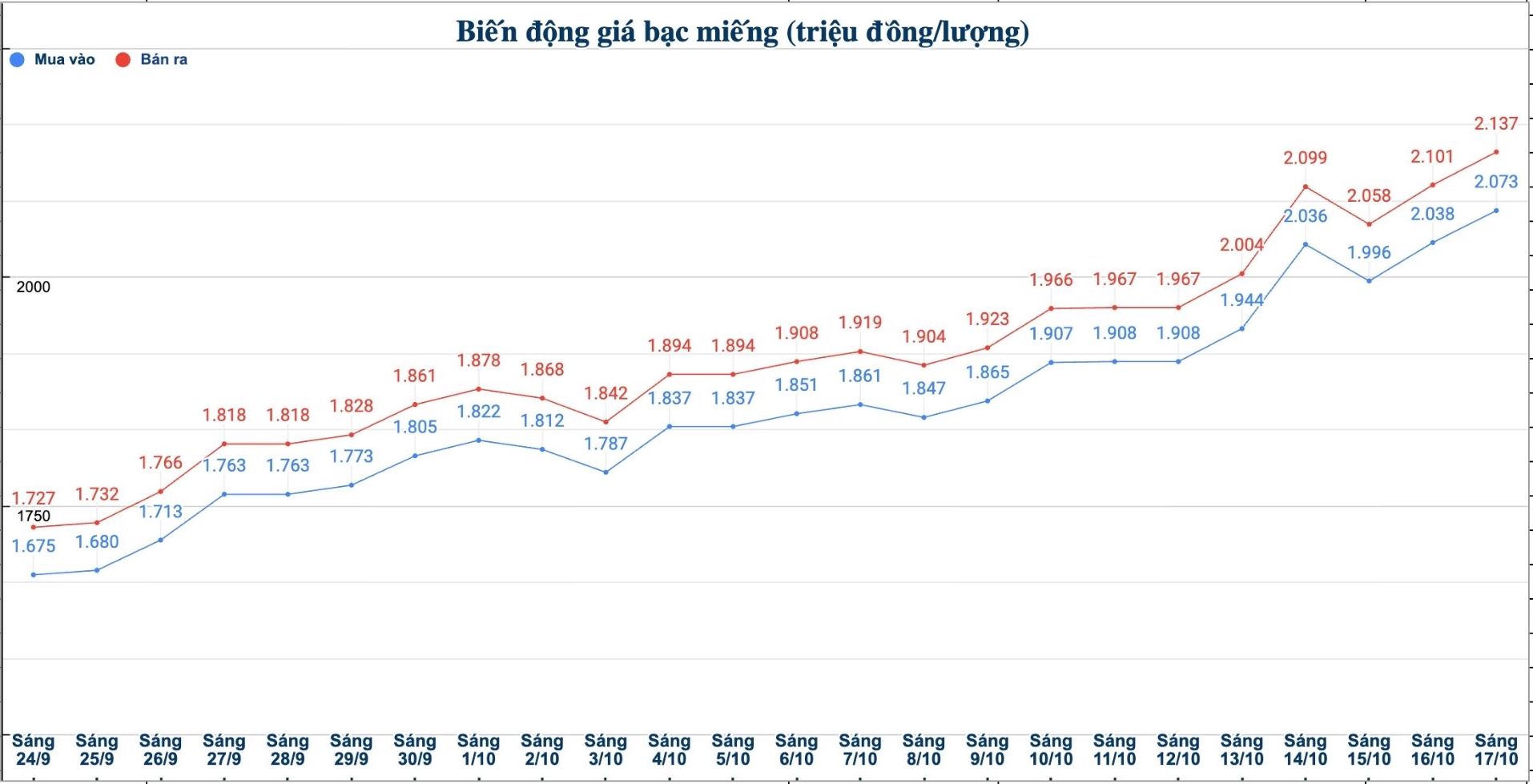

As of 10:30 a.m. on October 17, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Metallurgy Company was listed at VND 2.075 - VND 2.117 million/tael (buy - sell); an increase of VND 34,000/tael in both directions compared to yesterday morning.

The price of 999 Ancarat 999 (1kg) of silver bars at Ancarat Metallurgy Company was listed at VND54.080 - 55.580 million/kg (buy - sell); an increase of VND614,000/kg in both directions compared to yesterday morning.

The price of 999 gold bars of Saigon Thuong Tin Bank Gold and Gemstone Company Limited (Sacombank-SBJ) was listed at VND 2.085 - VND 2.136 million/tael (buy - sell); increased by VND 30,000/tael in both directions compared to yesterday morning.

At the same time, the price of 999 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 2.073 - 2.137 million VND/tael (buy - sell); an increase of 35,000 VND/tael for buying and an increase of 36,000 VND/tael for selling compared to yesterday morning.

The price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 55,279 - 56,986 million VND/kg (buy - sell); an increase of 933,000 VND/kg for buying and an increase of 960,000 VND/kg for selling compared to yesterday morning.

World silver price

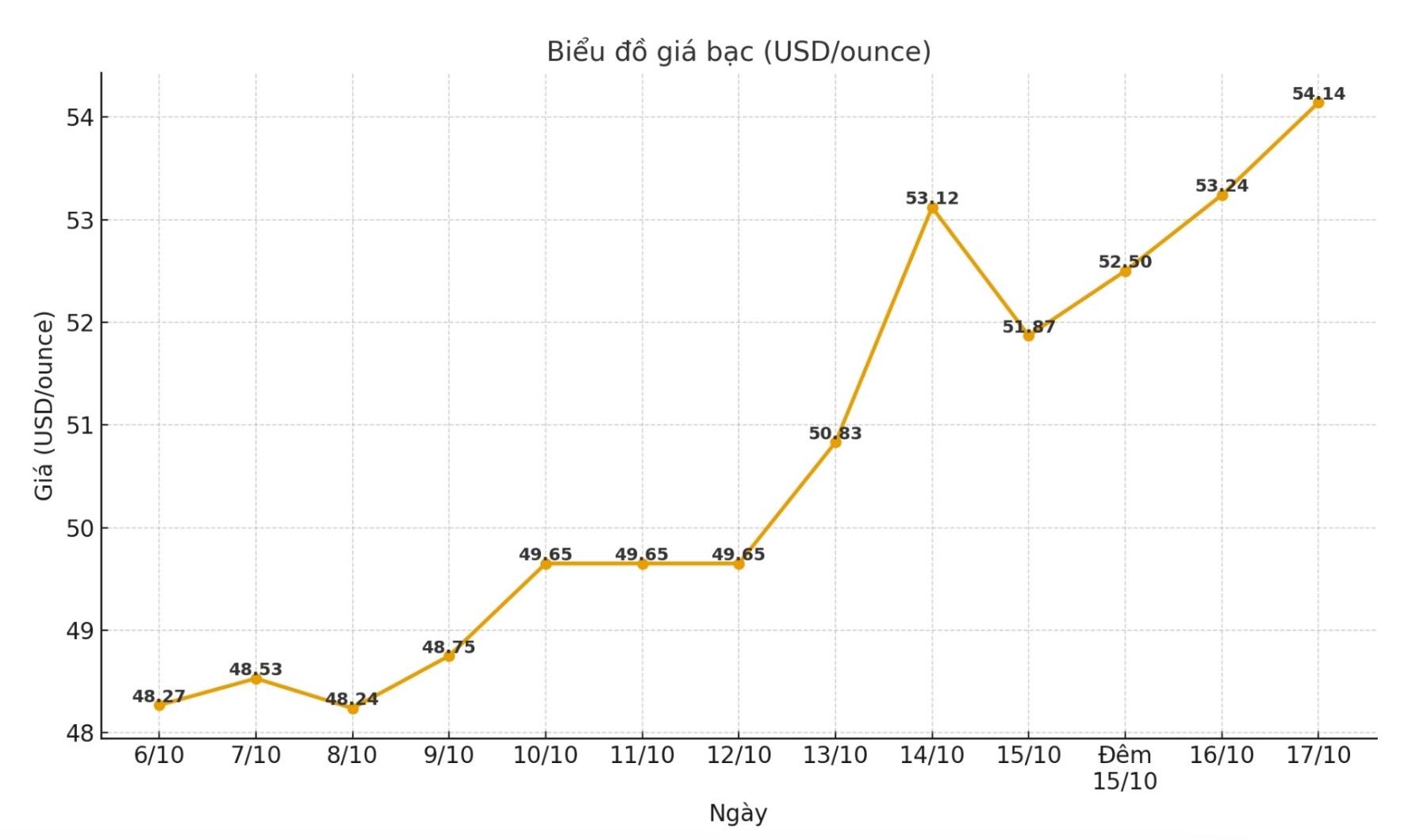

On the world market, as of 10:25 a.m. on October 17 (Vietnam time), the world silver price was listed at 54.14 USD/ounce; up 0.9 USD compared to yesterday morning.

Causes and predictions

The silver market has recently fluctuated strongly, attracting the attention of investors. Many people continue to rush to buy, precious metals analyst Christopher Lewis recommends that investors be cautious with their trading scale.

"In the trading session on Thursday, silver prices increased sharply at times, creating a space for price increases, then turned to adjust and recover, showing that the uptrend still dominated" - he said.

Christopher Lewis said that the $50/ounce mark is currently considered an important short-term support zone. If prices fall around this level, the market may have new buying momentum to seek good price opportunities.

"Although the developments are quite "noisy", the buyers are still holding the advantage. However, every time prices are about to break out, the market appears to be under pressure to take profits, making the trend unpredictable. This period should prioritize the strategy of "buying when prices decrease", avoiding trading too strongly" - the expert commented.

Christopher Lewis added that silver is still an attractive asset, but it is also full of volatility and high risks. In the current one-sided market context, Christopher Lewis believes that it is important to consider carefully - whether buyers can buy silver at a good enough price or not.

See more news related to silver prices HERE...