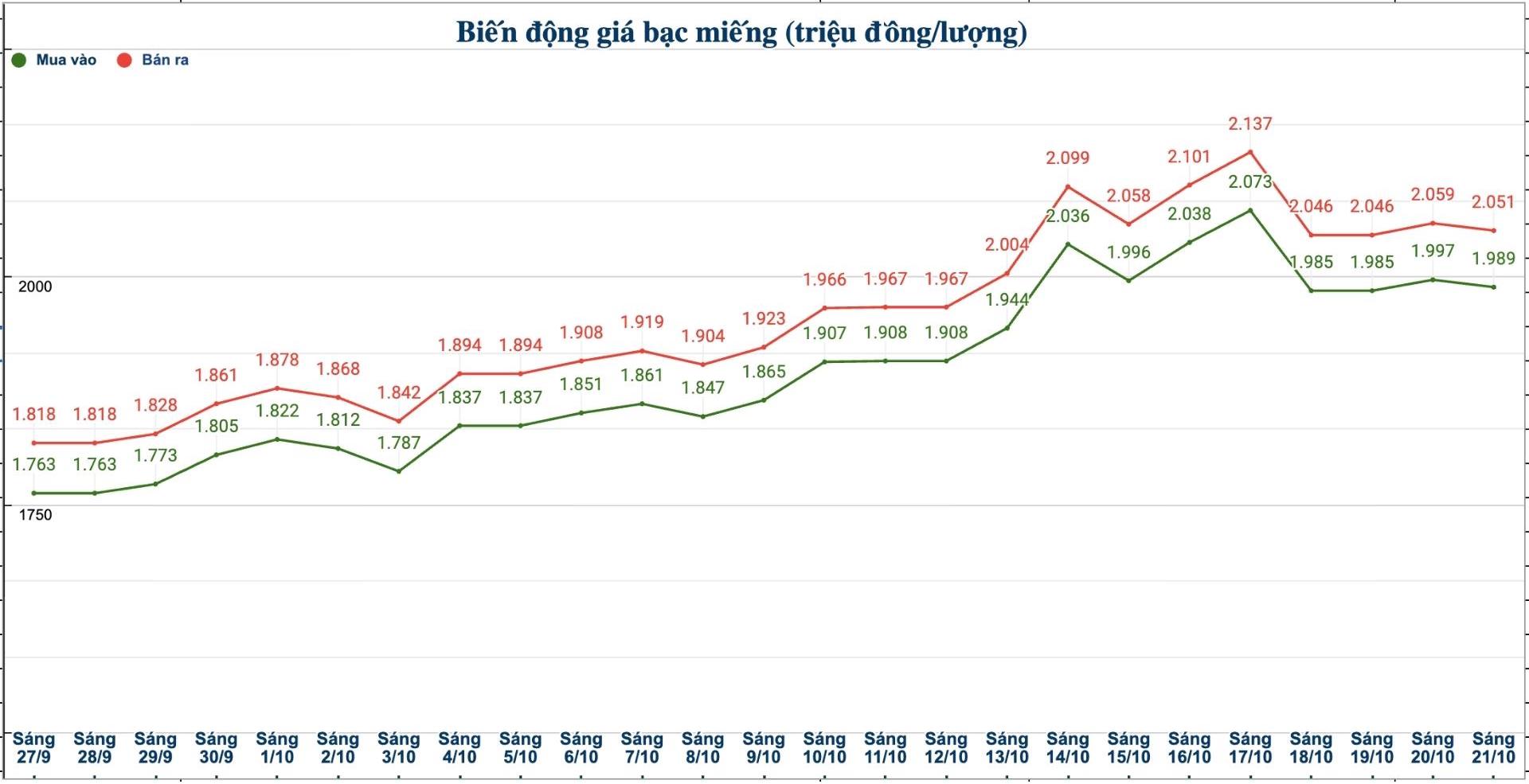

Domestic silver price

As of 10:30 a.m. on October 21, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Metallurgy Company was listed at VND1.993 - 2.035 million/tael (buy - sell).

The price of 999 Ancarat 999 (1kg) of silver bars at Ancarat Metallurgy Company was listed at 52.416 - 53.916 million VND/kg (buy - sell); down 240,000 VND/kg in both directions compared to yesterday morning.

The price of 999 gold bars of Saigon Thuong Tin Bank Gold and Gemstone Company Limited (Sacombank-SBJ) was listed at 2.016 - 2.067 million VND/tael (buy - sell); down 21,000 VND/tael in both directions compared to yesterday morning.

At the same time, the price of 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 1.989 - 2.051 million VND/tael (buy - sell); down 8,000 VND/tael in both directions compared to yesterday morning.

The price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 53.039 - 54.693 million VND/kg (buy - sell); down 214,000 VND/kg for buying and down 213,000 VND/kg for selling compared to yesterday morning.

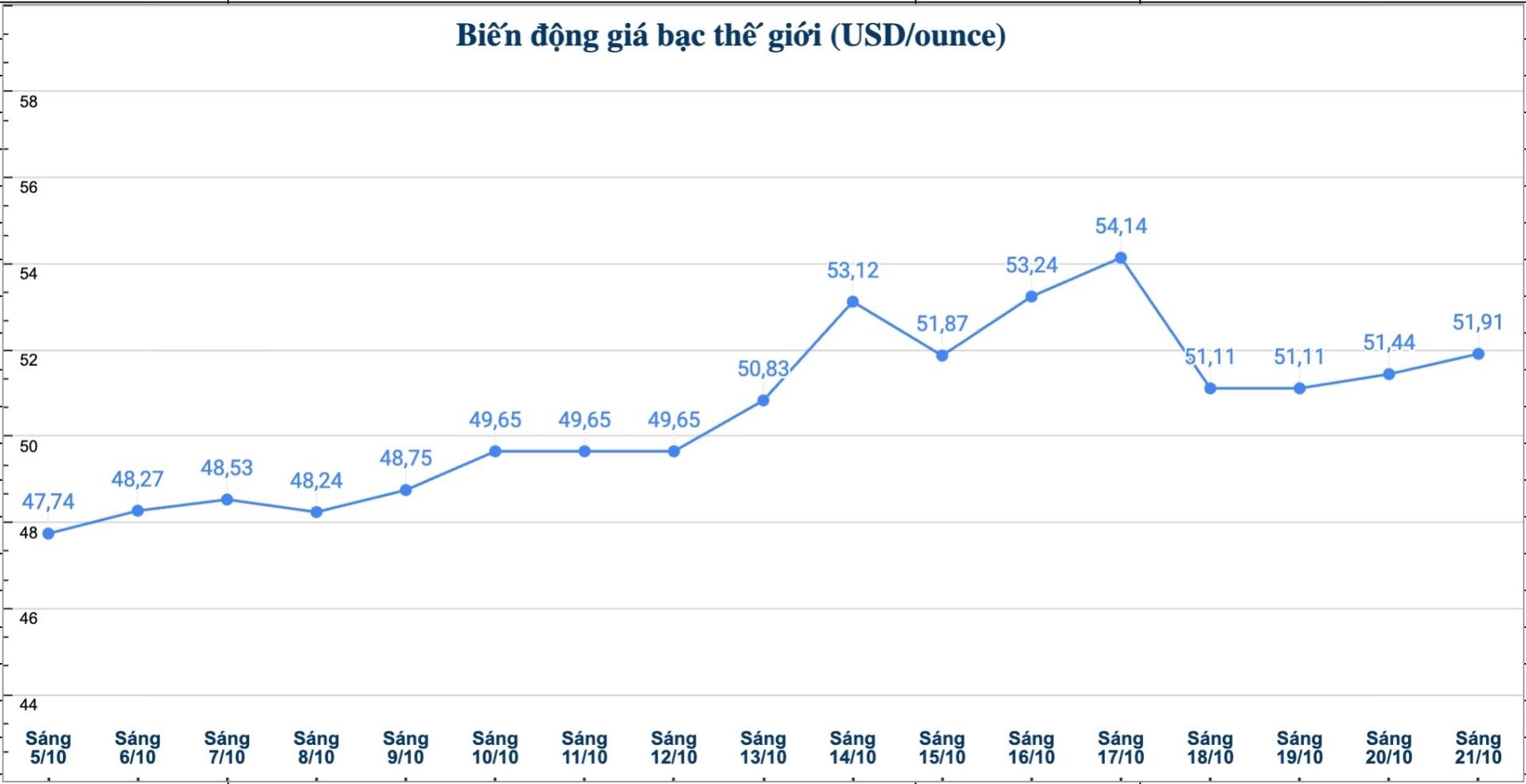

World silver price

On the world market, as of 10:30 a.m. on October 21 (Vietnam time), the world silver price was listed at 51.91 USD/ounce; up 0.47 USD compared to yesterday morning.

Causes and predictions

The first trading session of the week recorded a slight increase in silver prices as the upward trend was still maintained.

According to precious metals analyst Christopher Lewis, after a period of strong fluctuations, the market is in the process of natural adjustment, needing more time to accumulate and move sideways to create a more solid foundation for the next increase.

"The $50/ounce threshold is considered an important support zone, not only because of technical factors but also because of its psychological significance for investors. Meanwhile, $54 an ounce is a major barrier, which could limit the metal's short-term gains," he said.

Christopher Lewis commented that the fluctuation of silver prices in the range of 50 - 54 USD/ounce is a positive signal, helping to "coo down" after the heating period.

However, the expert said that the market still needs to be cautious about the possibility of forming a "price bubble".

"The fact that spot prices are higher than futures shows that investors expect the increase to slow down soon. When crowds are rallying up and people are lining up to buy silver, it is often a sign that the market is approaching a short-term peak," Christopher Lewis said.

See more news related to silver prices HERE...