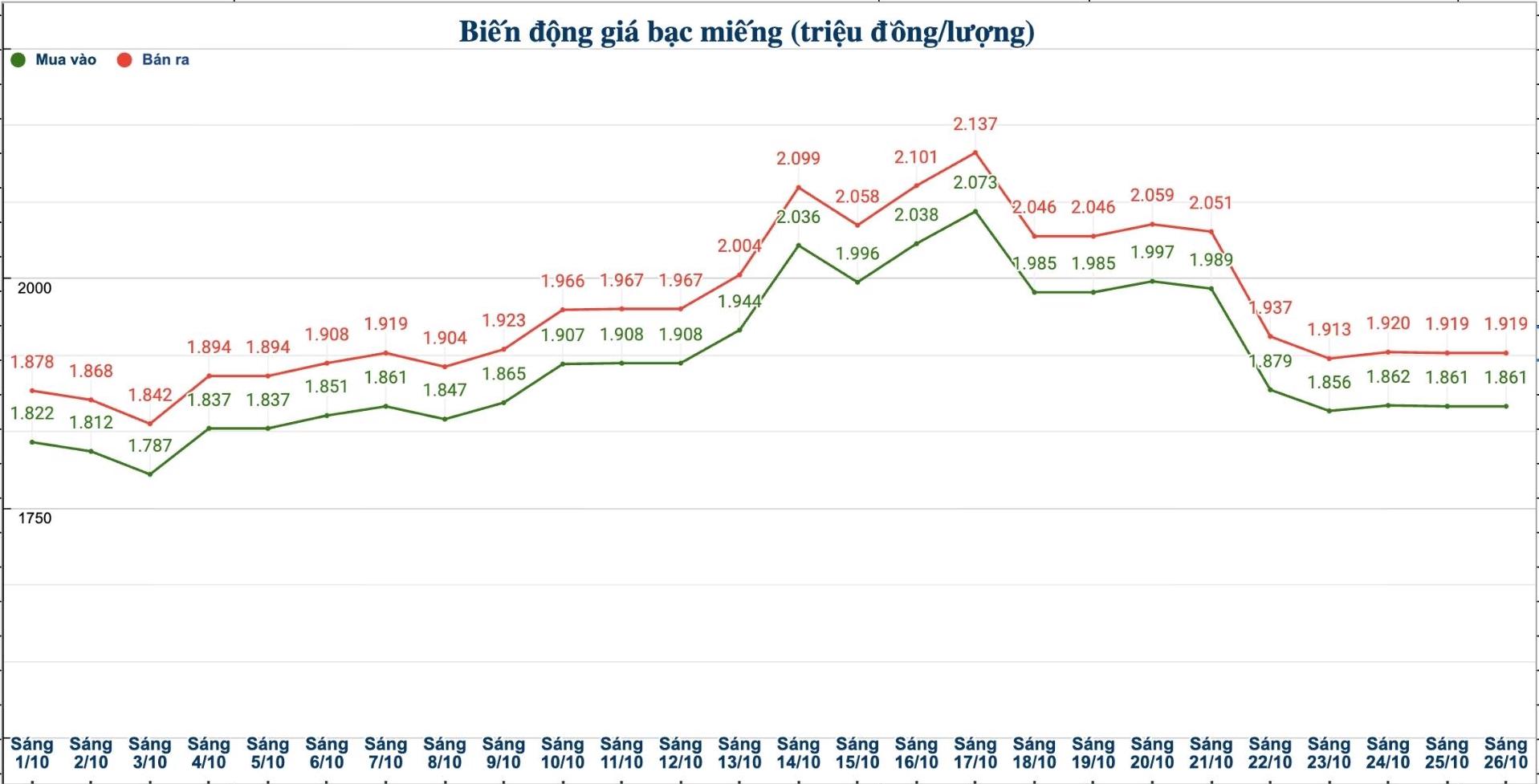

Domestic silver price

As of 9:45 a.m. on October 26, the price of 999 Phuc Loc 999 gold bars (1 tael) of Saigon Thuong Tin Bank Gold and Gemstone Co., Ltd. (Sacombank-SBJ) was listed at VND1.881 - 1.929 million/tael (buy - sell); down VND216,000/tael for buying and down VND219,000/tael for selling compared to the previous trading session.

At the same time, the price of 999 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 1.861 - 1.919 million VND/tael (buy - sell); down 124,000 VND/tael for buying and down 127,000 VND/tael for selling compared to the previous trading session.

The price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 49,626 - 51,173 million VND/kg (buy - sell); down 3.307 million VND/kg for buying and down 3.386 million VND/kg for selling compared to the previous trading session.

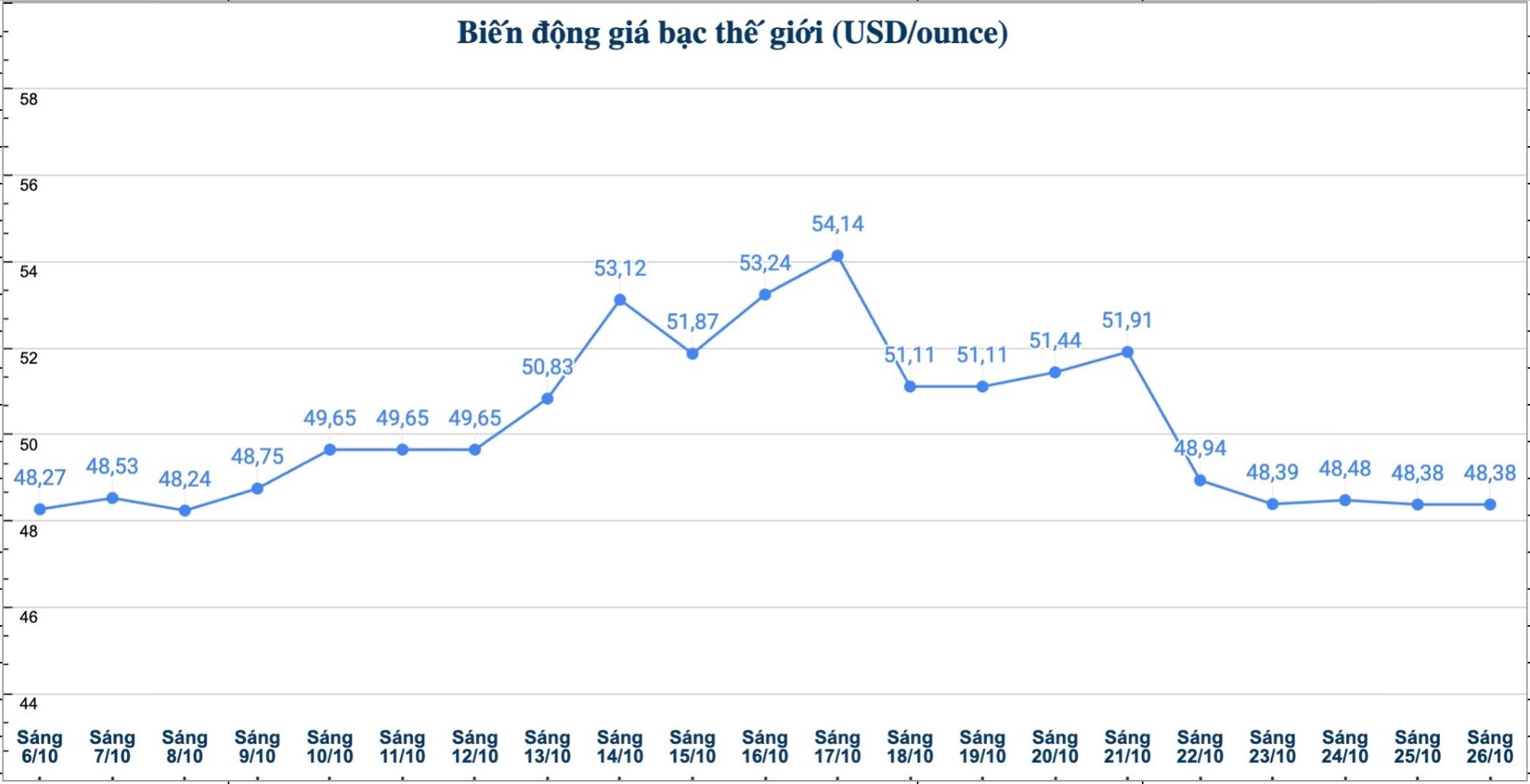

World silver price

On the world market, as of 9:45 a.m. on October 26 (Vietnam time), the world silver price was listed at 48.38 USD/ounce; down 2.73 USD compared to the previous trading session.

Causes and predictions

Silver prices fell in the last session of the week, trading below 49 USD/ounce after failing to surpass the 49.46 USD/ounce mark. According to precious metals analyst James Hyerczyk at FX Empire, the market is still holding firm above the support zone of 47.53 USD/ounce.

"This development shows the cautious sentiment of investors before the interest rate decision-making meeting of the US Federal Reserve (FED) - which will affect the price of precious metals in the coming time" - he said.

The expert said that the price turning below 49.46 USD/ounce has stopped the increase of silver, while the mark of 47.53 USD/ounce continues to be an important support zone. According to him, the lack of breakthrough transactions shows that investors are "waiting" for new signals.

"If silver prices surpass 49.56 USD/ounce, the rally could be boosted and head towards the 51.01 USD/ounce area when selling orders are forced to close. Conversely, if it falls below 47.53 USD/ounce, prices could fall sharply to around 44.44 USD/ounce - an area that often attracts cheap buying to return to the market" - James Hyerczyk commented.

He added that silver's tug-of-war also reflects the sentiment in the gold market. Gold has failed to hold its upward momentum after falling to $4,192.86/ounce and falling below $4,100/ounce. "The rising US dollar and rising US bond yields continue to put pressure on the precious metal group in the short term," said James Hyerczyk.

See more news related to silver prices HERE...