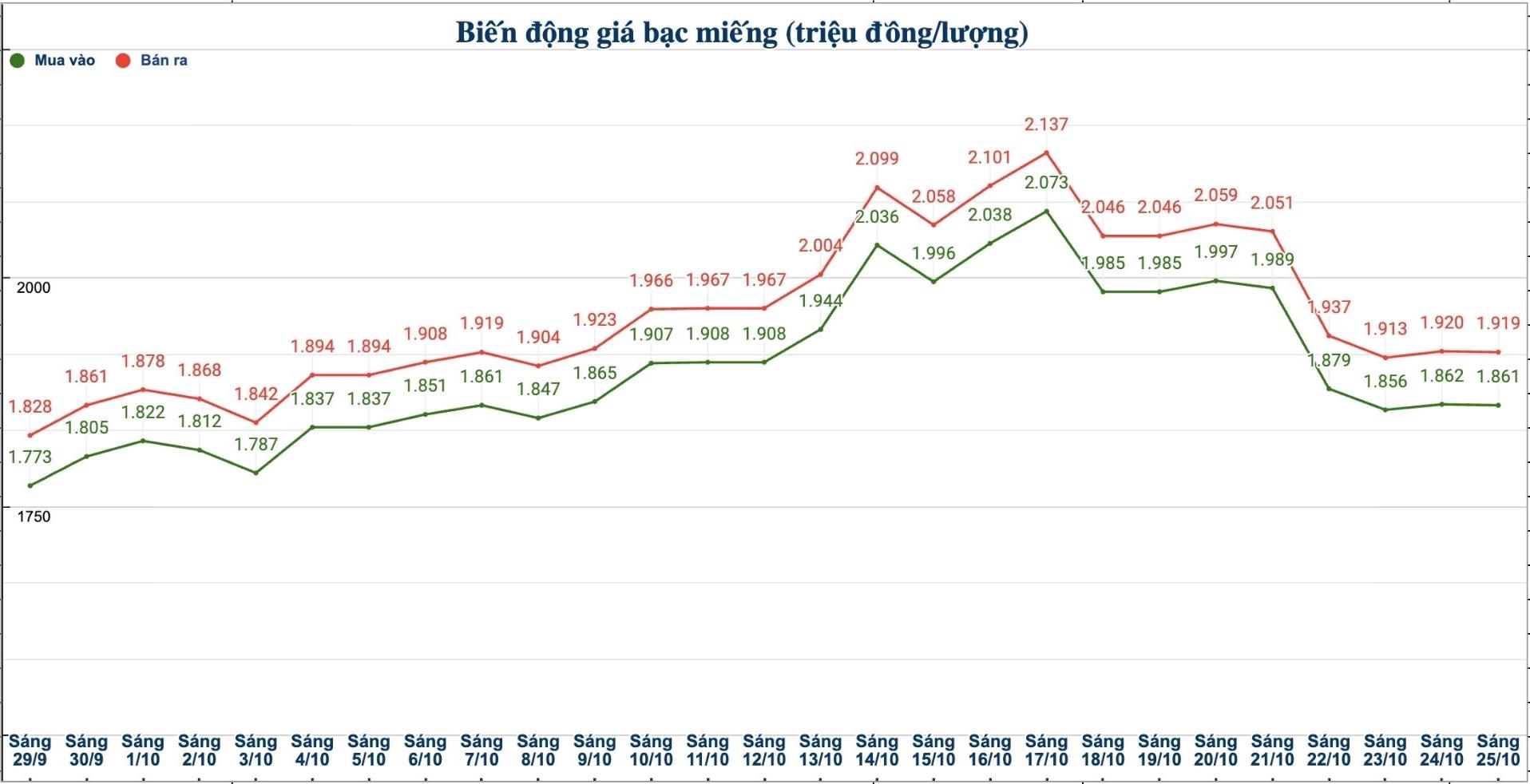

Domestic silver price

As of 10:30 a.m. on October 25, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Metallurgy Company was listed at 1.864 - 1.906 million VND/tael (buy - sell); down 2,000 VND/tael in both directions compared to yesterday morning.

The price of 999 Ancarat 999 (1kg) of silver bars at Ancarat Metallurgy Company was listed at 48.956 - 50.376 million VND/kg (buy - sell); down 54,000 VND/kg in both directions compared to yesterday morning.

The price of 999 gold bars of Saigon Thuong Tin Bank Gold and Gemstone Company Limited (Sacombank-SBJ) was listed at VND1.881 - 1.929 million/tael (buy - sell); down VND15,000/tael in both directions compared to yesterday morning.

At the same time, the price of 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 1.861 - 1.919 million VND/tael (buy - sell); down 1,000 VND/tael in both directions compared to yesterday morning.

The price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 49,626 - 51,173 million VND/kg (buy - sell); down 27,000 VND/kg for buying and down 26,000 VND/kg for selling compared to yesterday morning.

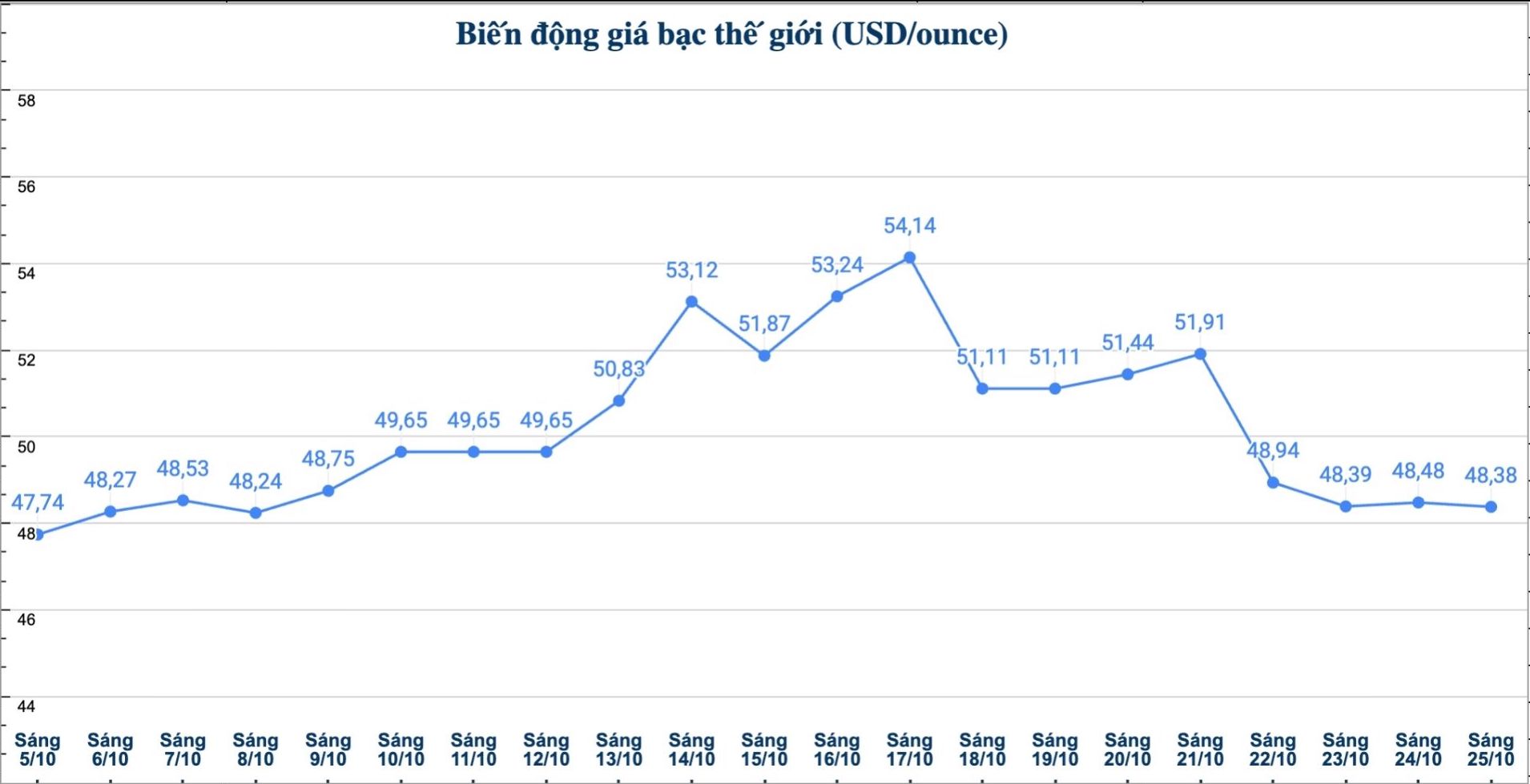

World silver price

On the world market, as of 10:25 a.m. on October 25 (Vietnam time), the world silver price was listed at 48.38 USD/ounce; down 0.1 USD compared to yesterday morning.

Causes and predictions

Silver prices continued to decline, as futures contracts at one point retreated close to the 47 USD/ounce mark. According to precious metals analyst Christopher Lewis, the gap between spot silver prices and futures is narrowing, showing signs of a stable return to the market after a period of strong fluctuations.

"Currently, spot silver prices are only about 0.25 USD higher than futures contract prices. If futures fall below $47 an ounce, the market could continue to fall into the support zone around $45 an ounce," he said.

The expert added that current short-term gains are still easily reversed, especially when purchasing power is weak. Therefore, he believes that the "technical sell-in" strategy is still prioritized by many traders rather than chasing.

"In the upward direction, the $50/ounce mark is still an important threshold to confirm the new uptrend. If we can overcome it, the buying signal will be clearer" - Christopher Lewis commented.

However, he also noted that the silver market has recently increased too much and is in a high-risk zone. "Investors should be cautious and wait for the market to move sideways before making a big decision" - Christopher Lewis expressed his opinion.

See more news related to silver prices HERE...