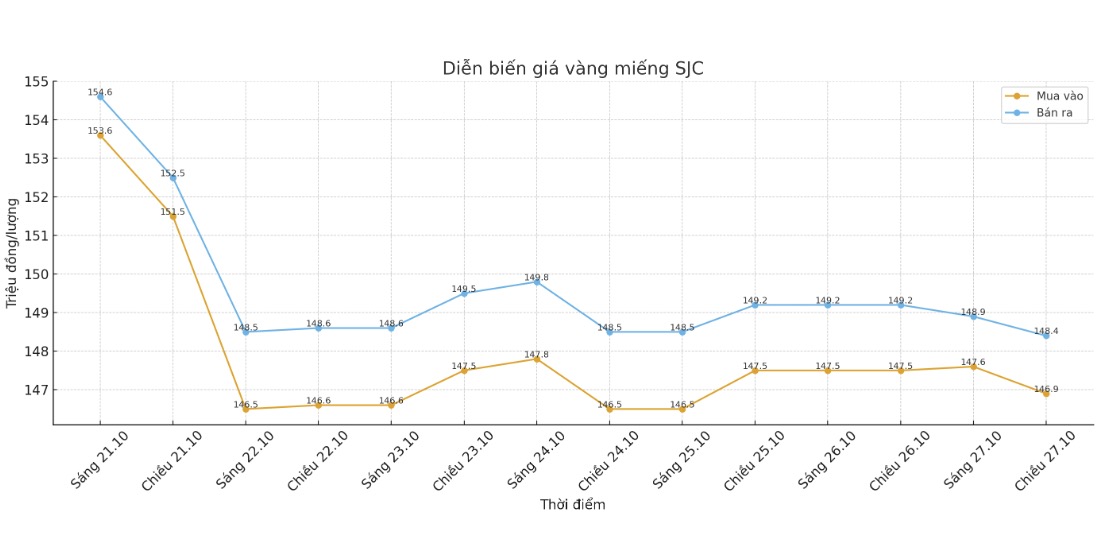

SJC gold bar price

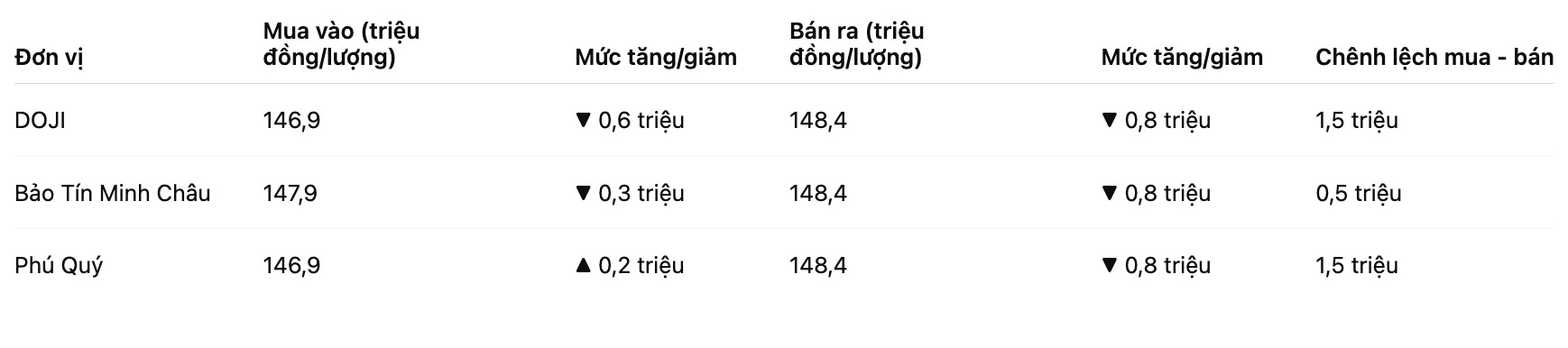

As of 6:00 a.m., DOJI Group listed the price of SJC gold bars at 146.9-148.4 million VND/tael (buy - sell), down 600,000 VND/tael for buying and down 800,000 VND/tael for selling. The difference between buying and selling prices is at 1.5 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 147.9-148.4 million VND/tael (buy - sell), down 300,000 VND/tael for buying and down 800,000 VND/tael for selling. The difference between buying and selling prices is at 500,000 VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 146.9-148.4 million VND/tael (buy - sell), an increase of 200,000 VND/tael for buying and a decrease of 800,000 VND/tael for selling. The difference between buying and selling prices is at 1.5 million VND/tael.

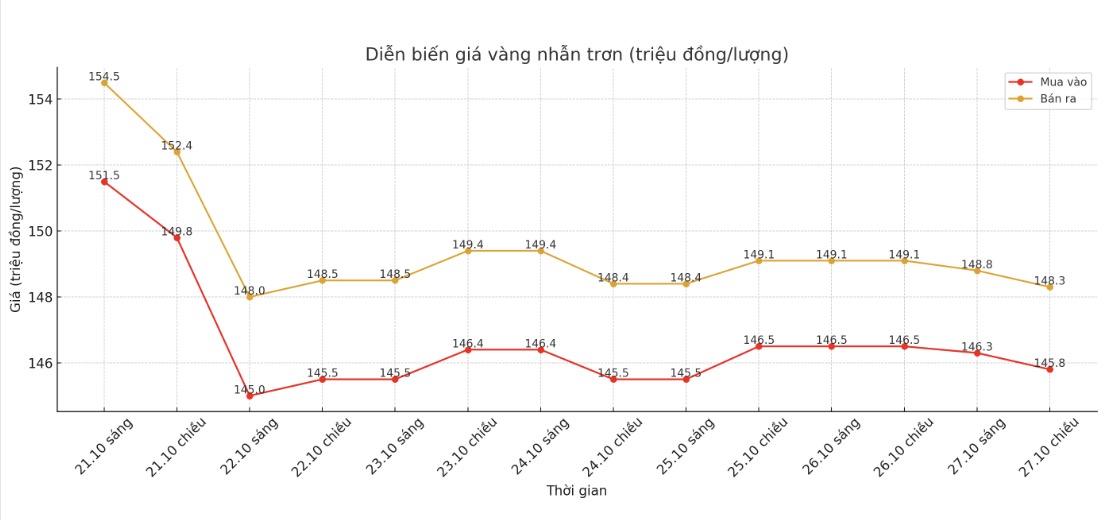

9999 gold ring price

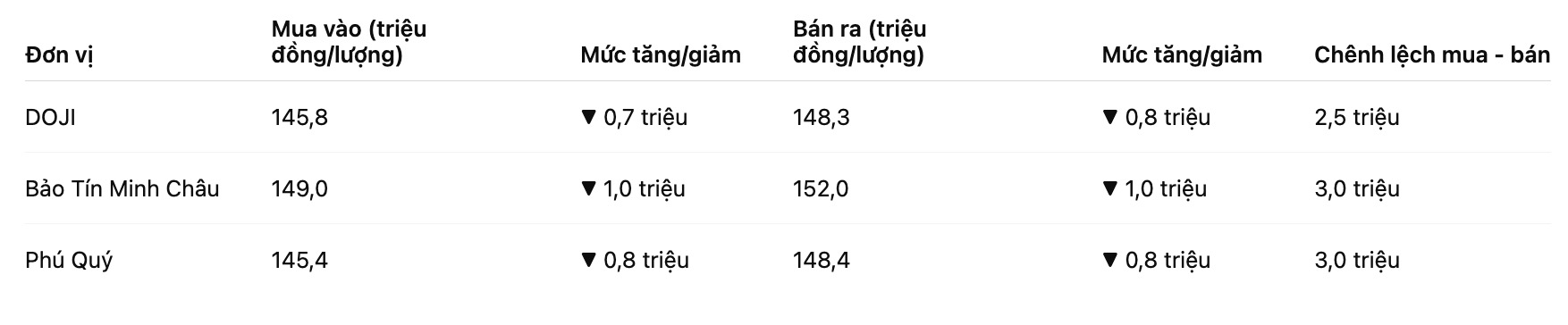

As of 6:00 a.m., DOJI Group listed the price of gold rings at 145.8-148.3 million VND/tael (buy - sell), down 700,000 VND/tael for buying and down 800,000 VND/tael for selling. The difference between buying and selling is 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 149-152 million VND/tael (buy - sell), down 1 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 145.4-148.4 million VND/tael (buy - sell), down 800,000 VND/tael for both buying and selling. The difference between buying and selling is 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

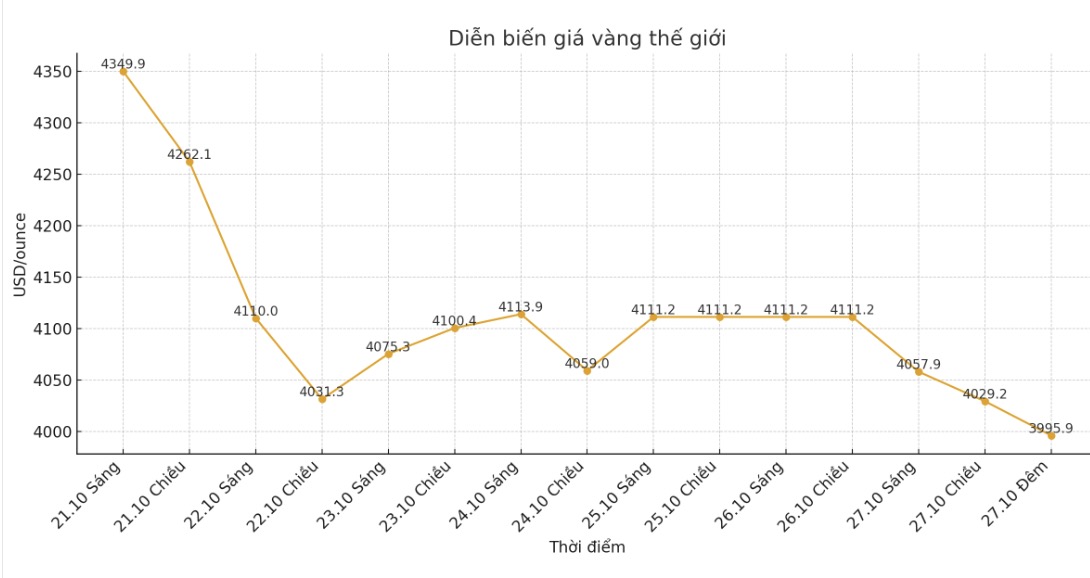

World gold price

The world gold price was listed at 23:20 on October 27 (Vietnam time) at 3,995.9 USD/ounce, down 97.8 USD/ounce.

Gold price forecast

Gold prices fell as the US dollar appreciated and signals of cooling trade tensions between the US and China put pressure on the precious metal - which is considered a safe asset.

Investors are waiting for important central bank meetings this week to find clues on monetary policy.

The heads of the China-US negotiation delegations last weekend said they had reached consensus on many key issues, paving the way for the leaders of the two countries to sign an agreement at this weekend's meeting.

US Treasury Secretary Bessent told CBS News that the risk of a 100% tax on Chinese goods is seen as being lifted, while Beijing plans to increase soybean purchases and expand control of rare earths.

He said a broader deal could extend the tariff war, address TikTok and maintain a rare earth magnet supply chain.

Although gold prices have not held the key support zone of $4,000/ounce, research firm Metals Focus predicts that the precious metal will continue to increase.

In its annual report Precious Metals Investment Focus, Metals Focus analysis team said that prolonged economic uncertainty will continue to be an important factor supporting gold prices next year.

Metals Focus forecasts that the average gold price in 2026 will be around 4,560 USD/ounce, up 40% compared to the average since the beginning of the year.

Technically, December gold buyers still have a short-term advantage but the increase has weakened significantly. The target for buyers is to close above the strong resistance zone of 4,200 USD/ounce, while the target for sellers is to push prices below the important support of 3,900 USD/ounce.

The most recent resistance level was 4,100 USD/ounce and 4,123.80 USD/ounce; the most recent support: 4,021.1 USD/ounce and 4,000 USD/ounce.

Notable economic data this week

Tuesday: US consumer confidence.

Wednesday: Bank of Canada policy decision, US waitress data, FED policy decision, Bank of Japan policy decision.

Thursday: ECB policy decision.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...