Domestic silver price

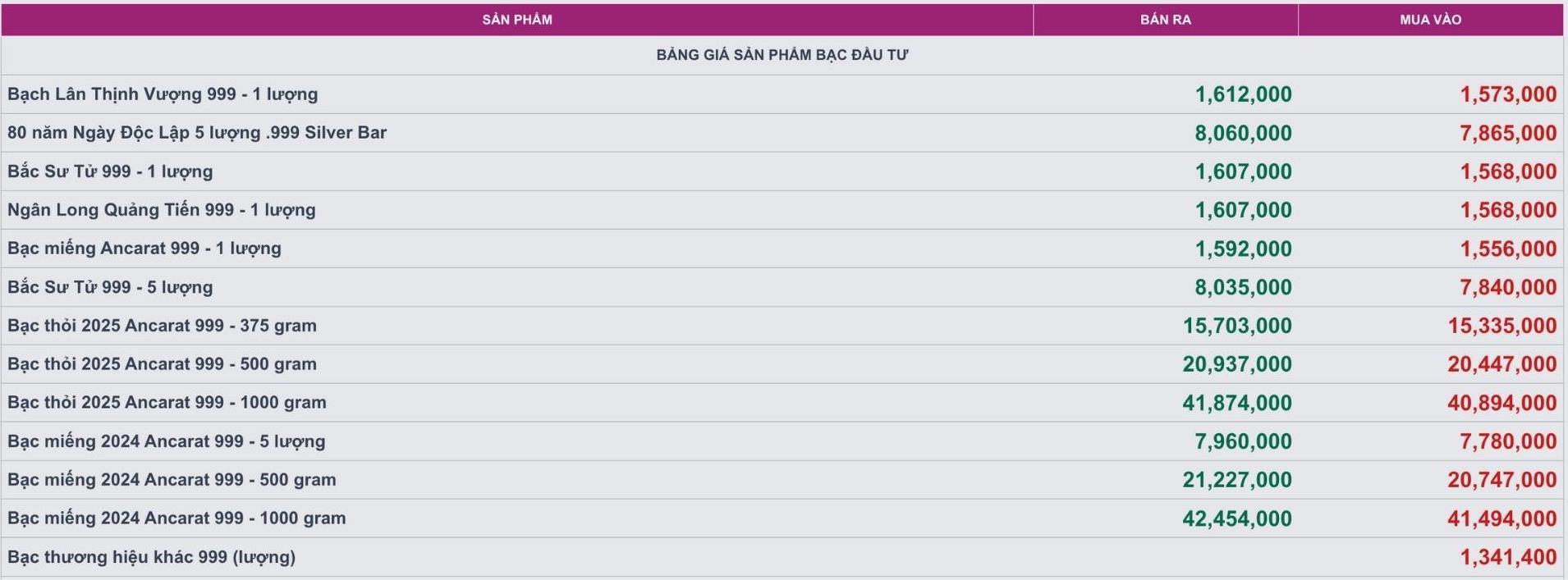

As of 10:09 on September 3, the price of 999 999 coins (1 tael) at Ancarat Golden Rooster Company was listed at VND 1.556 - 1.592 million/tael (buy - sell).

The price of 999 999 Ancarat silver bars (1kg) at Ancarat Metallurgy Company is listed at 40.894 - 41.874 million VND/kg (buy - sell).

The price of 2024 Ancarat 999 (1kg) silver bars at Ancarat Metallurgy Company was listed at 41.494 - 42.454 million VND/kg (buy - sell).

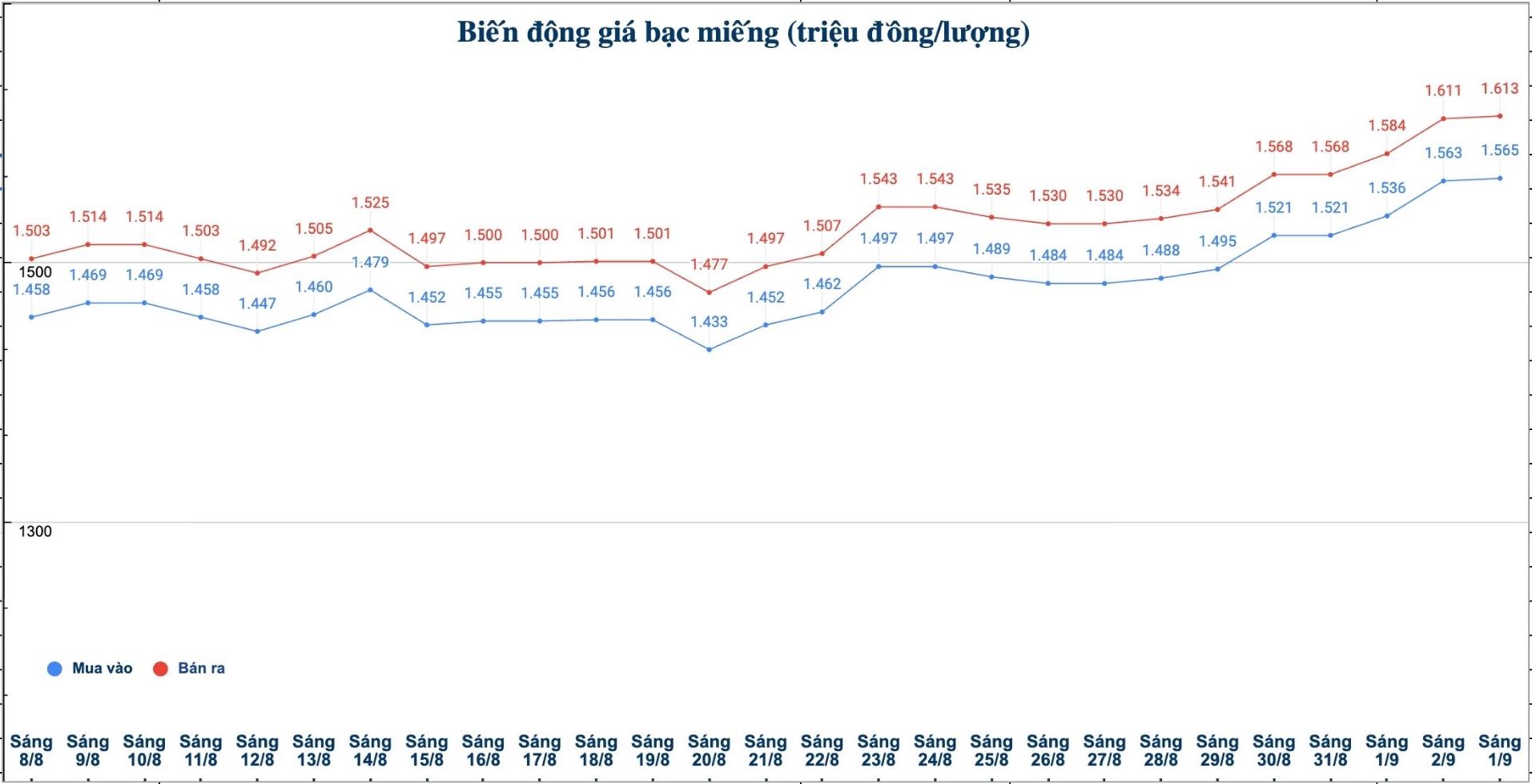

At the same time, the price of 999 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 1.565 - 1.613 million VND/tael (buy - sell); an increase of 2,000 VND/tael for both buying and selling compared to yesterday morning.

The price of 999 gold bars (1 tael) at Phu Quy Jewelry Group was listed at 1.565 - 1.613 million VND/tael (buy - sell); an increase of 2,000 VND/tael for both buying and selling compared to yesterday morning.

The price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 41.733 - 43.013 million VND/kg (buy - sell); an increase of 54,000 VND/kg in both buying and selling directions compared to yesterday morning.

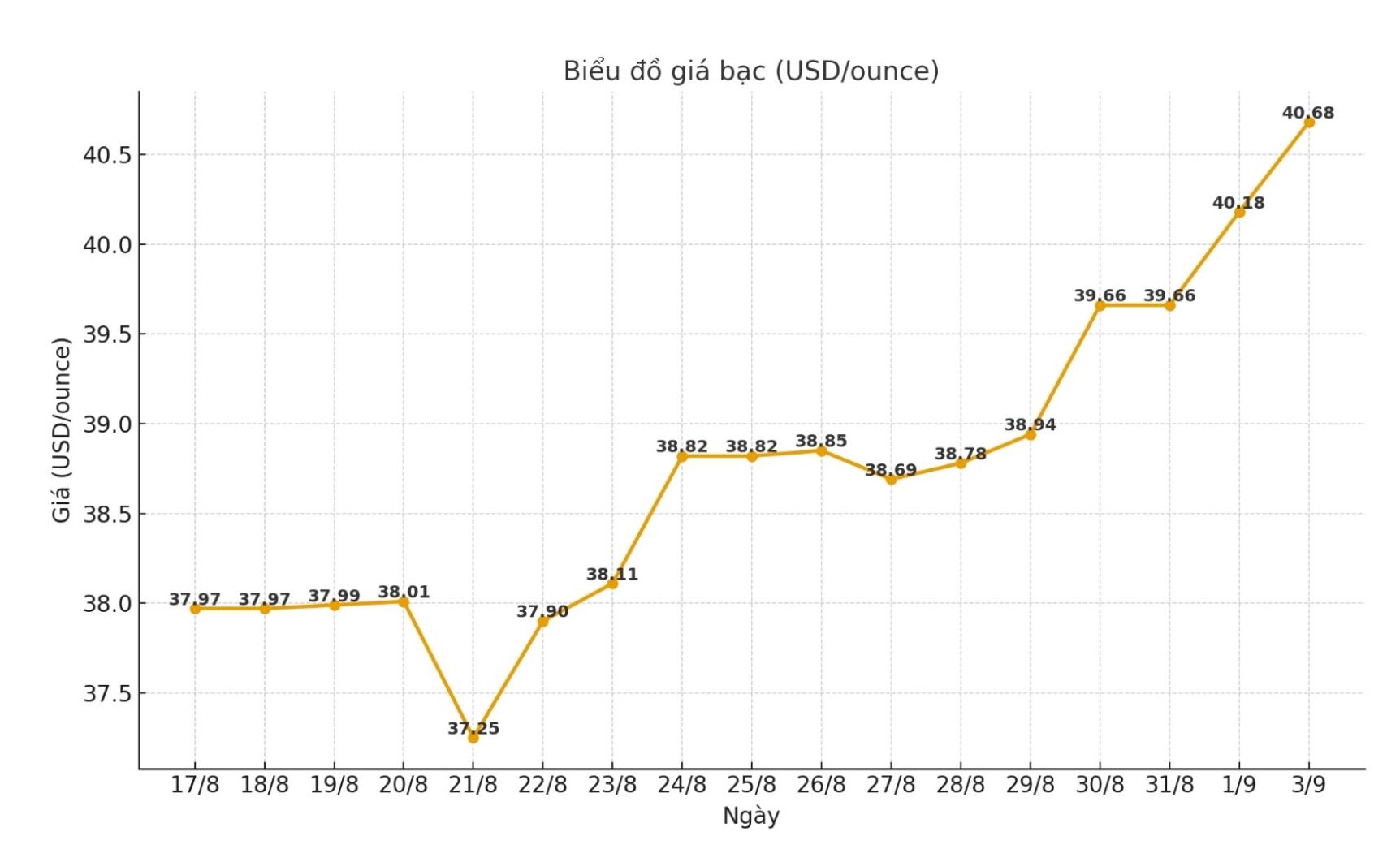

World silver price

On the world market, as of 10:09 on September 3 (Vietnam time), the world silver price was listed at 40.68 USD/ounce.

Causes and predictions

The silver market has increased sharply in many consecutive sessions. However, according to senior analysts. Christopher Lewis said that when prices increase too quickly, the risk of a downward correction is entirely possible.

"In the past three sessions, silver has continuously increased and is now approaching the peak of the price channel, while reaching the important threshold of 42 USD/ounce. This is a milestone that investors are very interested in, because if selling pressure appears, prices could completely retreat to the $40/ounce area - which was a strong support zone, used to be resistance" - Christopher Lewis commented.

The expert added that if the $40/ounce mark does not hold firm, the gap of nearly $39/ounce will also be closely monitored.

"Although there is a possibility of a short-term sell-off, it is seen as an opportunity to buy, instead of a signal to sell in a fake way," he said.

In fact, Christopher Lewis believes that the main trend is still up, with a further target that could be towards $50/ounce. Price history shows that silver often increases for 2 - 4 consecutive sessions and then moves sideways before continuing the trend.

"Therefore, investors need to be cautious in positioning, because silver is always a volatile asset. In addition, the announcement of the US non-farm payroll on Friday could have a short-term impact on silver through the impact on the US dollar and the bond market," said Christopher Lewis.

See more news related to silver prices HERE...