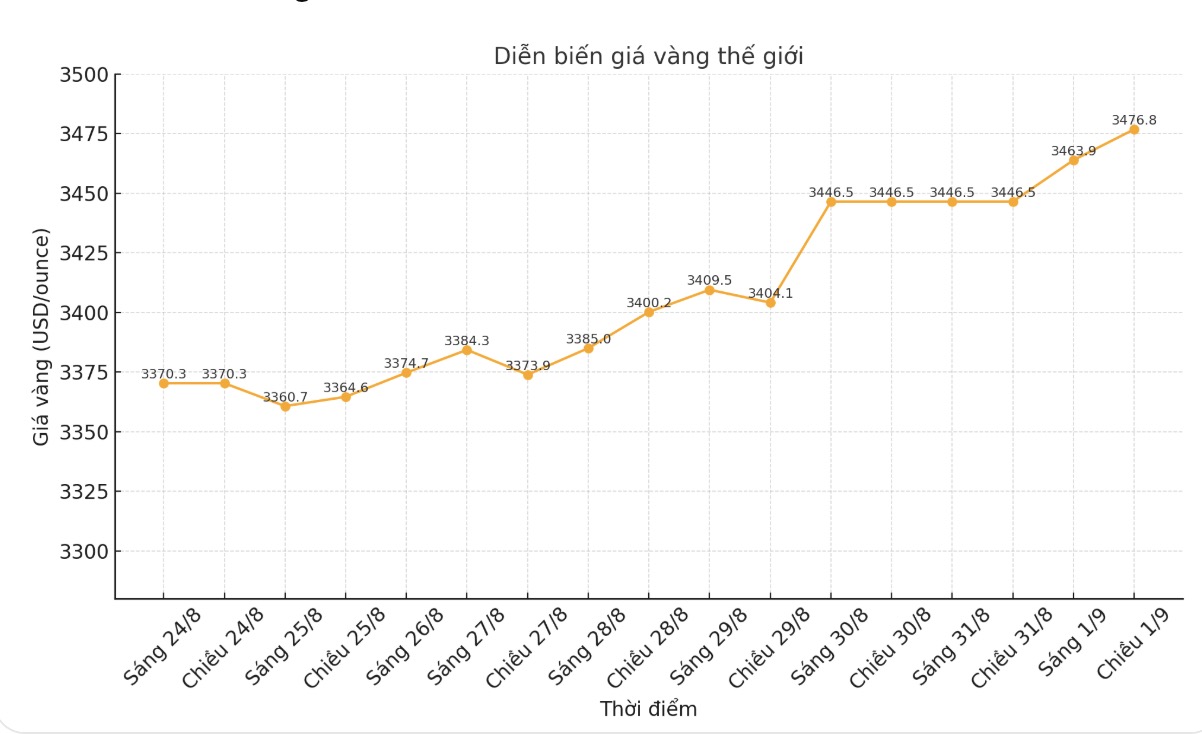

Gold prices hit a more than four-month high on September 1, as investors increasingly bet on the possibility of the US Federal Reserve (FED) cutting interest rates this month, increasing the appeal of the precious metal.

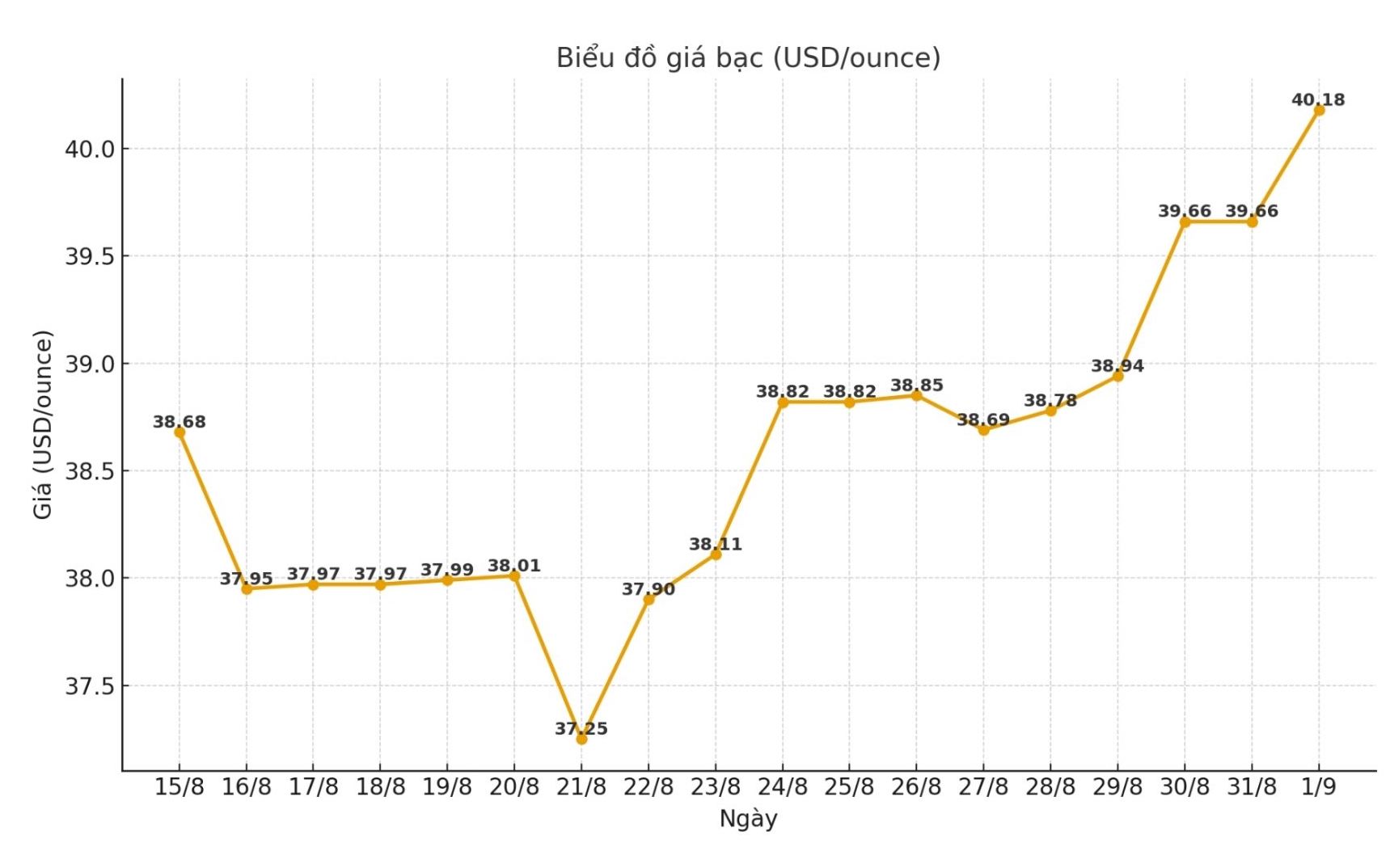

At the same time, silver surpassed $40/ounce for the first time in more than a decade.

Spot gold rose 1.2% to $3,486.86/ounce at 06:41 GMT, its highest level since April 23. December gold futures in the US increased 1.1% to $3,554.6 an ounce.

Matt Simpson, senior analyst at City Index, said: Motely comments from San Francisco Fed President Mary Daly helped the market ignore the PCE core inflation data (Personally Spending Index) that rose on Friday and left open the possibility of the Fed cutting interest rates by 25 basis points this month.

A US appeal court has also ruled that most of the tariffs issued by US President Donald Trump are illegal, putting pressure on the USD and supporting gold prices. The data showed that the US PCE index increased by 0.2% monthly and 2.6% annually, as expected.

In a social media post on Friday, Daly stressed continuing to support interest rate cuts due to concerns about risks to the labor market. Gold is not profitable, so it often benefits in a low interest rate environment.

Regarding trade, US Trade Representative Jamieson Greer affirmed that the Trump administration continues to negotiate with partners even though the appellate court has ruled that most of the tariffs are illegal.

Tim Waterer - market analyst at KCM Trade - said: Spot silver prices increased by 2.2% to 40.56 USD/ounce, the highest level since September 2011.

US bank holidays reduce liquidity, contributing to the amplification of gold and silver fluctuations. Silver is rising thanks to expectations of a US interest rate cut, while the shortage of supply also maintains an upward trend.

In addition, platinum increased 1.5% to 1,384.68 USD/ounce and gold increased 0.8% to 1,118.06 USD/ounce.

Update on domestic gold and silver prices

Regarding gold prices:

DOJI Group listed the price of SJC gold bars at 129.1-130.6 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 1.5 million VND/tael.

Bao Tin Minh Chau listed the price of SJC gold bars at 128.6-130.6 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2 million VND/tael.

Regarding gold rings, DOJI Group listed at 122.5-125.5 million VND/tael (buy in - sell out). The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 122.8-125.8 million VND/tael (buy - sell), an increase of 400,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Regarding silver prices:

This afternoon, the price of 999 coins (1 tael) at Ancarat Metallurgy Company was listed at 1.549 - 1.586 million VND/tael (buy - sell).

The price of 999 999 Ancarat silver bars (1kg) at Ancarat Metallurgy Company is listed at 40.664 - 41.714 million VND/kg (buy - sell).

The price of 2024 Ancarat 999 (1kg) silver bars at Ancarat Metallurgy Company was listed at 41.306 - 42.294 million VND/kg (buy - sell).

The price of 999 999 pieces (1 tael) at Phu Quy Jewelry Group was listed at 1.563 - 1.611 million VND/tael (buy - sell).

The price of 999 taels (1kg) at Phu Quy Jewelry Group was listed at 41.679-42.959 million VND/tael (buy - sell).