Domestic silver price

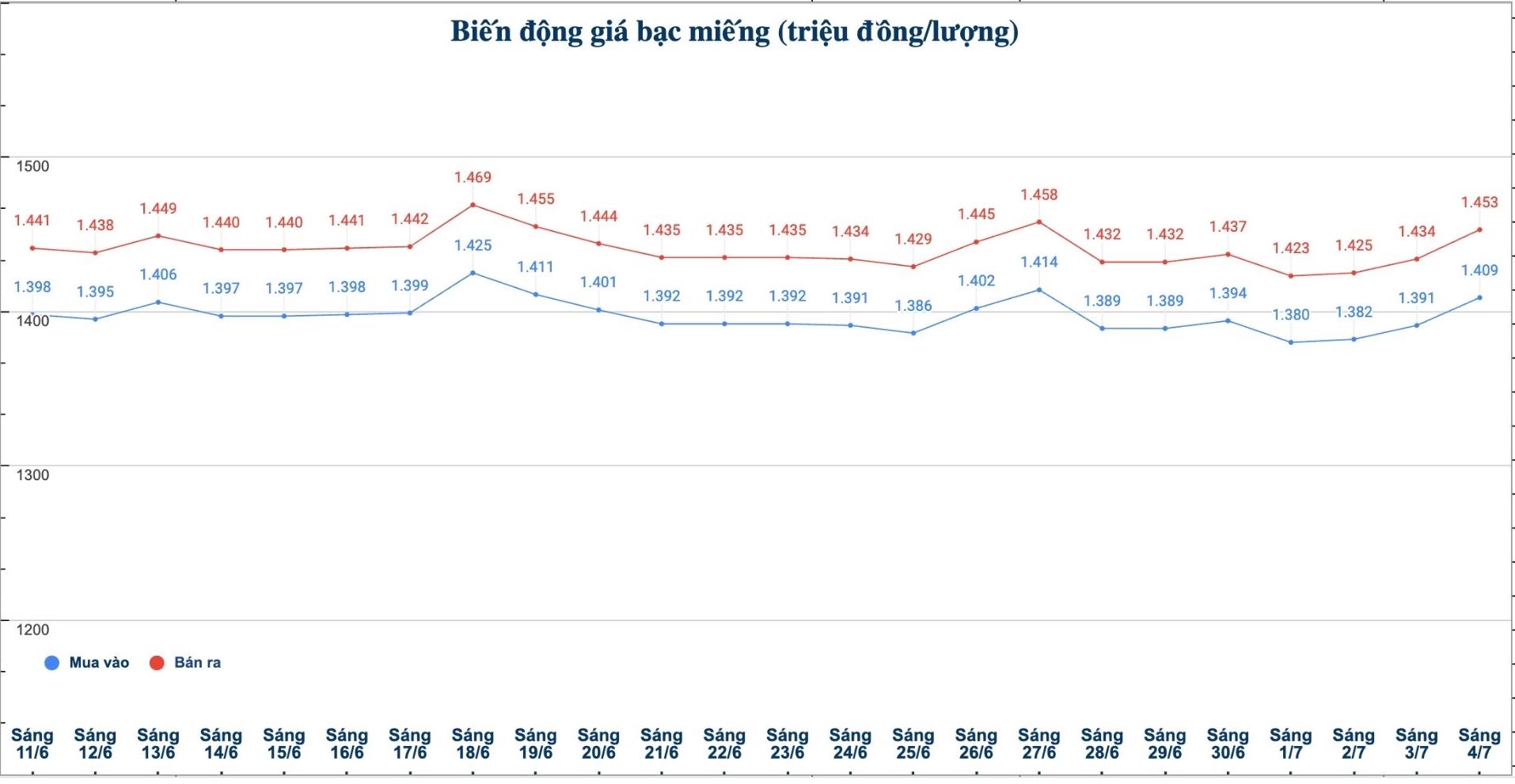

As of 9:35 a.m. on July 4, the price of 999 silver bars at Phu Quy Jewelry Group was listed at VND1.409 - VND1.453 million/tael (buy - sell); an increase of VND18,000/tael for buying and an increase of VND19,000/tael for selling compared to early this morning.

The price of 999 gold bars at Phu Quy Jewelry Group was listed at 1.409 - 1.453 million VND/tael (buy - sell); an increase of 18,000 VND/tael for buying and an increase of 19,000 VND/tael for selling compared to early this morning.

At the same time, the price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 37.573 - 38.746 million VND/kg (buy - sell); an increase of 480,000 VND/kg for buying and an increase of 507,000 VND/kg for selling compared to early this morning.

World silver price

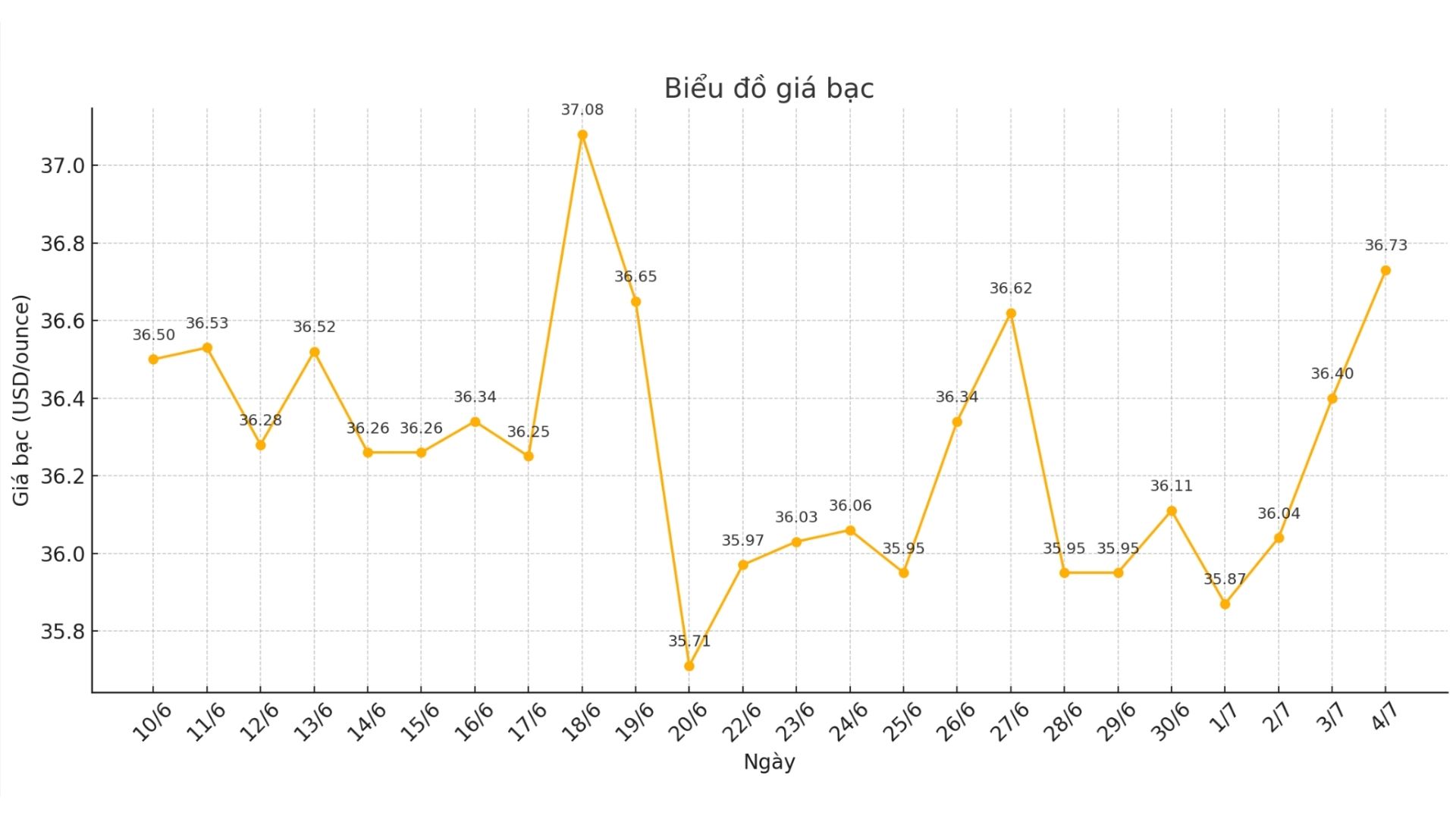

On the world market, as of 9:40 a.m. on July 4 (Vietnam time), the world silver price was listed at 36.73 USD/ounce; up 0.33 USD compared to yesterday morning.

Causes and predictions

Gold and silver are having a positive outlook as they enter the third quarter of 2025. Senior market analyst Christopher Lewis said that investors will focus on monitoring the moves of the US Federal Reserve (FED) and global geopolitical issues.

He commented that although the situation may fluctuate strongly, the general trend is still positive.

"If the Fed loosens monetary policy, silver could benefit from boosting industrial demand. As long as prices remain above 33.50 USD/ounce, the uptrend remains solid. It is not ruled out that silver will reach $40/ounce in the third quarter," said Christopher Lewis.

Meanwhile, the US dollar has fallen more than 10% since the beginning of the year, making it less costly to hold non-yielding assets like silver.

In the context of the two-year US Treasury yield falling to 3.721% the lowest level since early May traders continue to bet on the possibility of the Fed loosening policy, thereby boosting capital flows into hard assets, market analyst James Hyerczyk said.

The expert also said that concerns about the Fed's independence and new data showing a weakening US labor market further reinforce expectations of the Fed cutting interest rates. At the same time, geopolitical instability still maintains demand for safe havens such as gold and silver.

See more news related to silver prices HERE...