Domestic silver price

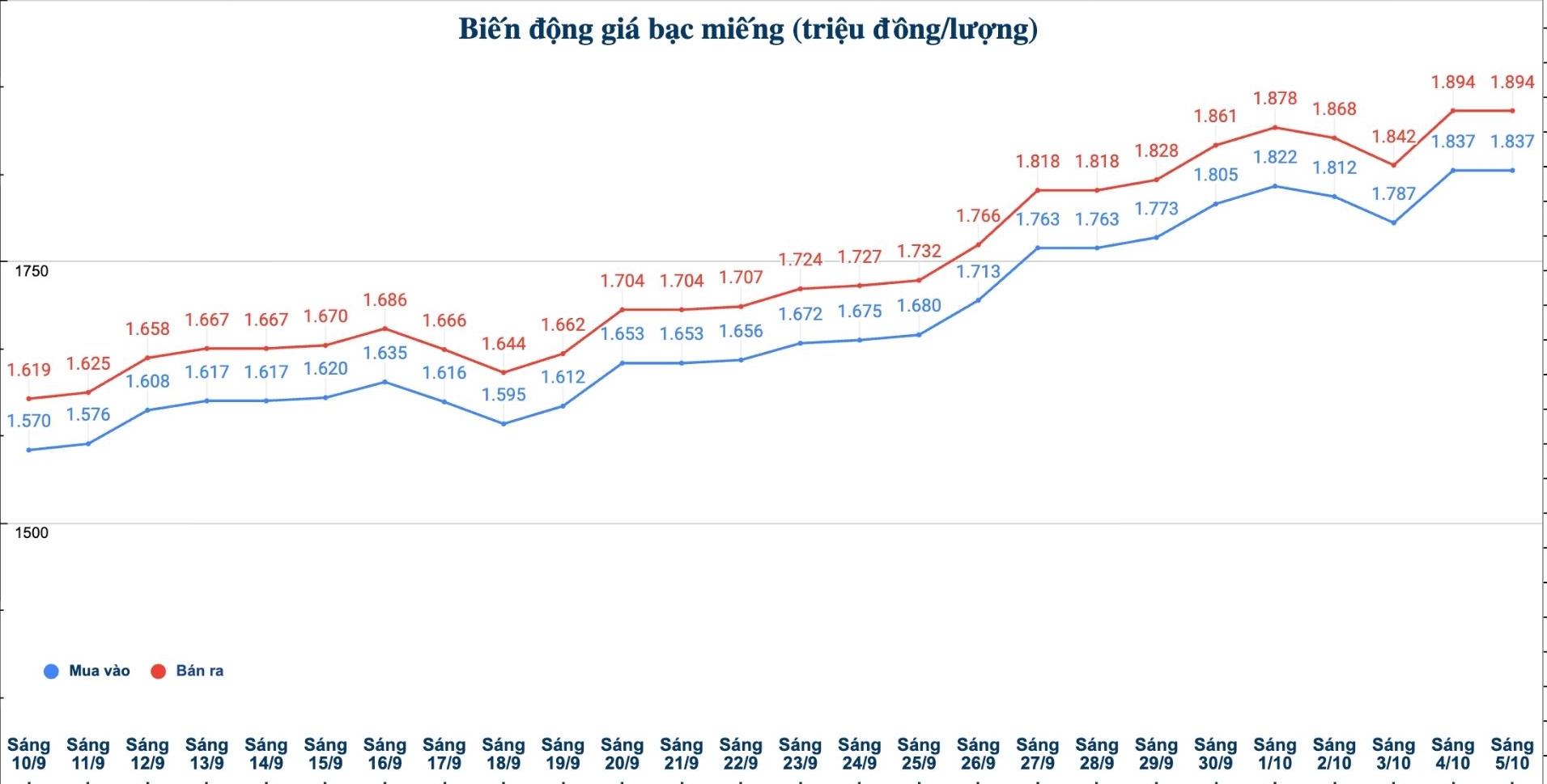

As of 9:50 a.m. on October 5, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Metallurgy Company was listed at 1.840 - 1.878 million VND/tael (buy - sell); unchanged in both directions compared to yesterday morning.

The price of 999 Ancarat 999 (1kg) of silver bars at Ancarat Chemical and Environmental Company was listed at 48.250 - 49.500 million VND/kg (buy - sell); unchanged in both directions compared to yesterday morning.

In the previous trading session (morning of September 5, 2025), the price of Ancarat 999 (1kg) was listed by Ancarat Ngoai Quy Company at 41.494 - 42.454 million VND/kg (buy - sell).

Thus, if buying 999 999 Ancarat (1kg) of Ancarat Golden Rooster Company in the session of September 5 and selling it in this morning's session (October 5), buyers will make a profit of VND 5.796 million/kg.

At the same time, the price of 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 1.837 - 1.894 million VND/tael (buy - sell); unchanged in both directions compared to yesterday morning.

The price of 999 taels (1kg) at Phu Quy Jewelry Group was listed at 48.986 - 50.506 million VND/kg (buy - sell); unchanged in both directions compared to yesterday morning.

In the previous trading session (morning of September 5, 2025), the price of 999 taels (1kg) at Phu Quy Jewelry Group was listed at 41.786 - 43.066 million VND/kg (buy - sell).

Thus, if buying 999 taels of silver (1kg) at Phu Quy Jewelry Group on September 5 and selling it this morning (October 5), buyers will make a profit of VND5.92 million/kg.

The price of 999 gold bars of the same-named Jewelry Company Limited of Saigon Thuong Tin Bank (Sacombank-SBJ) was listed at 1.830 - 1.875 million VND/tael (buy - sell); unchanged in both directions compared to yesterday morning.

World silver price

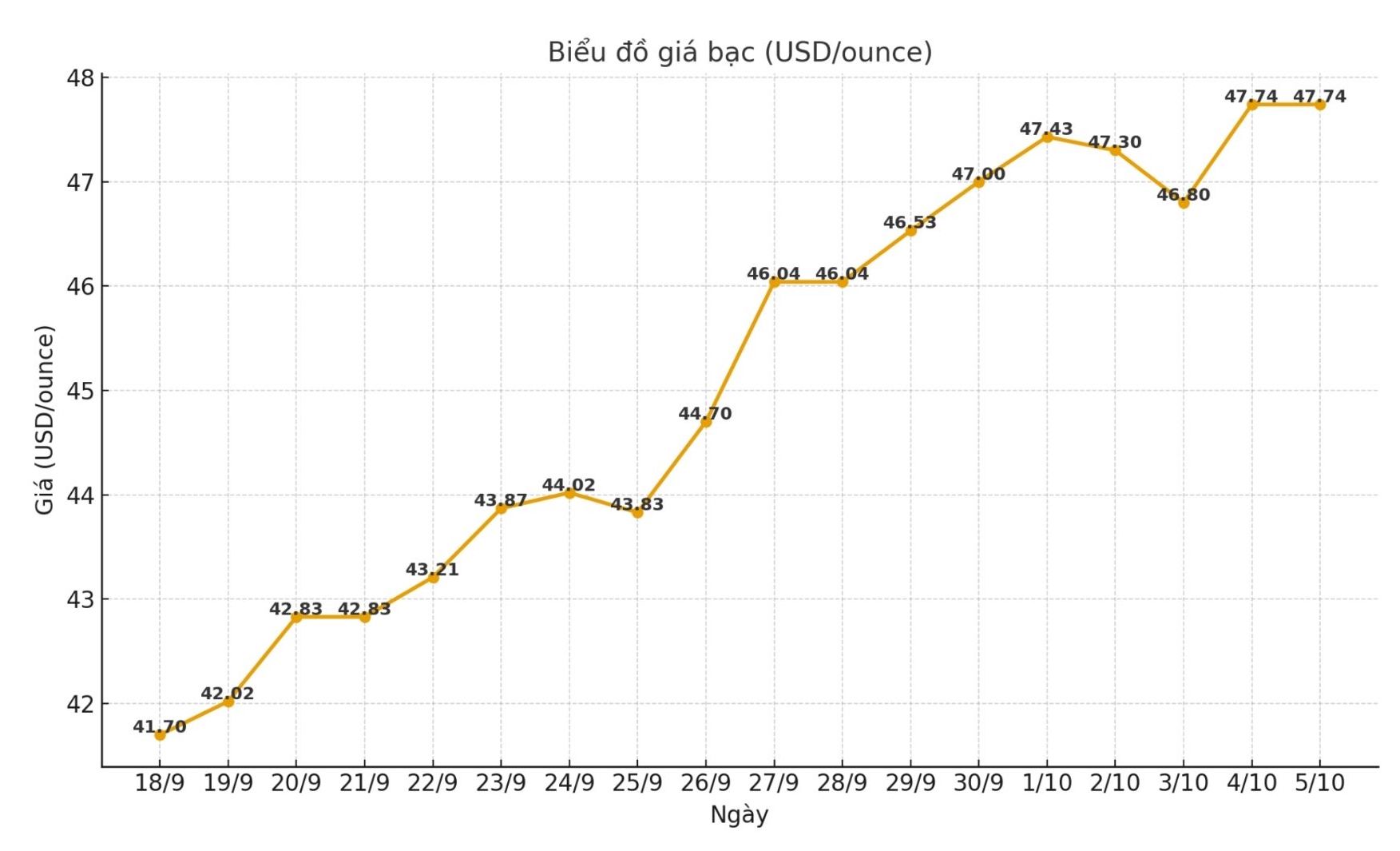

On the world market, as of 9:50 a.m. on October 5 (Vietnam time), the world silver price was listed at 47.74 USD/ounce; unchanged from yesterday morning.

Causes and predictions

Spot silver prices rose sharply, remaining above the important technical threshold of 46.93 USD/ounce. According to analyst James Hyerczyk, buyers are heading for $48.06/ounce - the highest level in many years.

He added that the market is being driven by growing expectations that the US Federal Reserve (FED) will soon cut interest rates, while the USD weakens and bond yields increase slightly.

"With gold prices consolidating near record levels and the Fed signaling a dovish stance, silver prices continue to benefit from both monetary and technical factors," said James Hyerczyk.

Technically, the expert said that if silver prices hold above 46.93 USD/ounce, the uptrend will continue. If it exceeds 48.06 USD/ounce, buying power could be strongly activated, bringing prices towards the 49.8 USD/ounce range - the highest mark in many years. On the other hand, if it falls below 46.93 USD/ounce, the price may adjust to the range of 45.8 USD/ounce and to 44.2 USD/ounce.

"In general, the current trend is still leaning towards buyers, especially if the FED confirms the interest rate cut roadmap next week" - James Hyerczyk expressed his opinion.

See more news related to silver prices HERE...