Domestic silver price

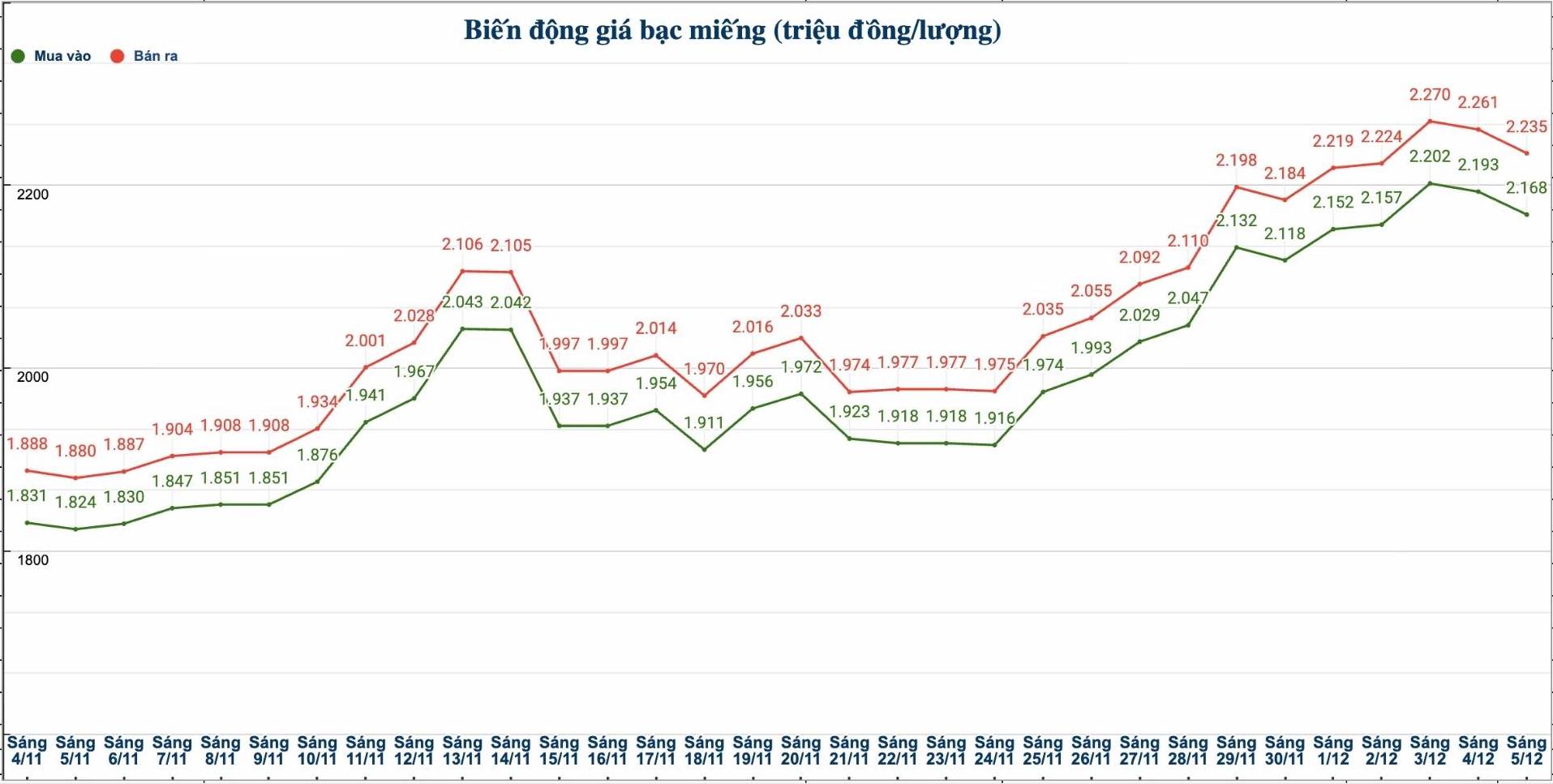

As of 11:40 a.m. on December 5, the price of 2024 Ancarat 999 coins (1 tael) at Ancarat Metallurgy Company was listed at VND2.166 - 2.216 million/tael (buy - sell); down VND21,000/tael in both directions compared to yesterday morning.

The price of 999 Ancarat 999 (1kg) at Ancarat Petrochemical Company was listed at 56.864 - 58.594 million VND/kg (buy - sell); down 540,000 VND/kg for buying and down 560,000 VND/kg for selling compared to yesterday morning.

The price of 999 gold bars of Saigon Thuong Tin Bank Gold and Gemstone One Member Co., Ltd. (Sacombank-SBJ) was listed at VND 2.124 - 2.178 million/tael (buy - sell); down VND 15,000/tael in both directions compared to yesterday morning.

At the same time, the price of 999 999 coins (1 tael) at Phu Quy Jewelry Group was listed at VND 2.168 - VND 2.235 million/tael (buy - sell); down VND 25,000/tael for buying and down VND 26,000/tael for selling compared to yesterday morning.

The price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 57.813 - 59.599 million VND/kg (buy - sell); down 666,000 VND/kg for buying and down 694,000 VND/kg for selling compared to yesterday morning.

World silver price

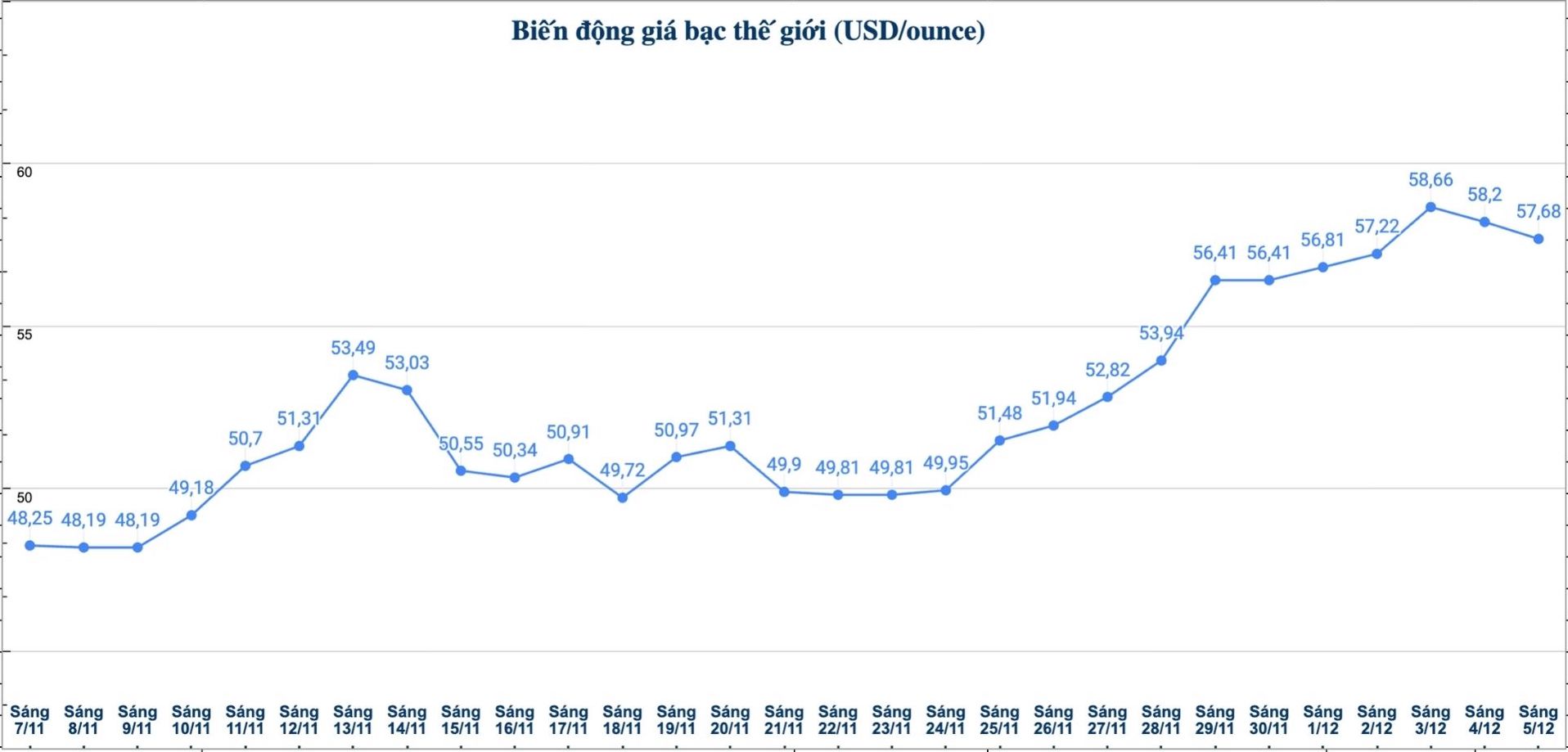

On the world market, as of 11:50 a.m. on December 5 (Vietnam time), the world silver price was listed at 57.68 USD/ounce; down 0.52 USD compared to yesterday morning.

Causes and predictions

According to precious metals analyst James Hyerczyk at FX Empire, the rapid decline in silver mainly comes from strong profit-taking activities after a long period of price increase, putting the market under pressure in the short term.

"This pullback has caused traders to debate whether this is just a necessary correction after a hot rally or a sign for a deeper downtrend.

The macro context also makes market sentiment more sensitive: positive US economic data has narrowed expectations of interest rate cuts by the US Federal Reserve (Fed), pushing real interest rates up and reducing the attractiveness of non-yielding assets such as silver," he said.

However, James Hyerczyk believes that the long-term outlook for the market is still positive.

"Unlike gold, silver plays an increasingly large role in industry, especially in the production of solar panels, electric vehicles and electronic devices. The solar industry alone consumes hundreds of millions of silver ounces per year, and this demand continues to increase as renewable energy projects expand globally," the expert said.

James Hyerczyk said that silver supply has not kept up as most of it is exploited as a by-product of other metal mining activities, causing many limitations in new production increases. This causes the market to fall into a state of supply shortage - a factor that often supports prices in the medium and long term.

In that context, James Hyerczyk said that silver prices may continue to be pressured in the next few sessions due to profit-taking and interest rate factors, but the long-term outlook is still supported by sustainable industrial demand and monetary protection factors.

"When the retracement period is calm, the silver market is likely to regain a more positive position" - James Hyerczyk expressed his opinion.

See more news related to silver prices HERE...