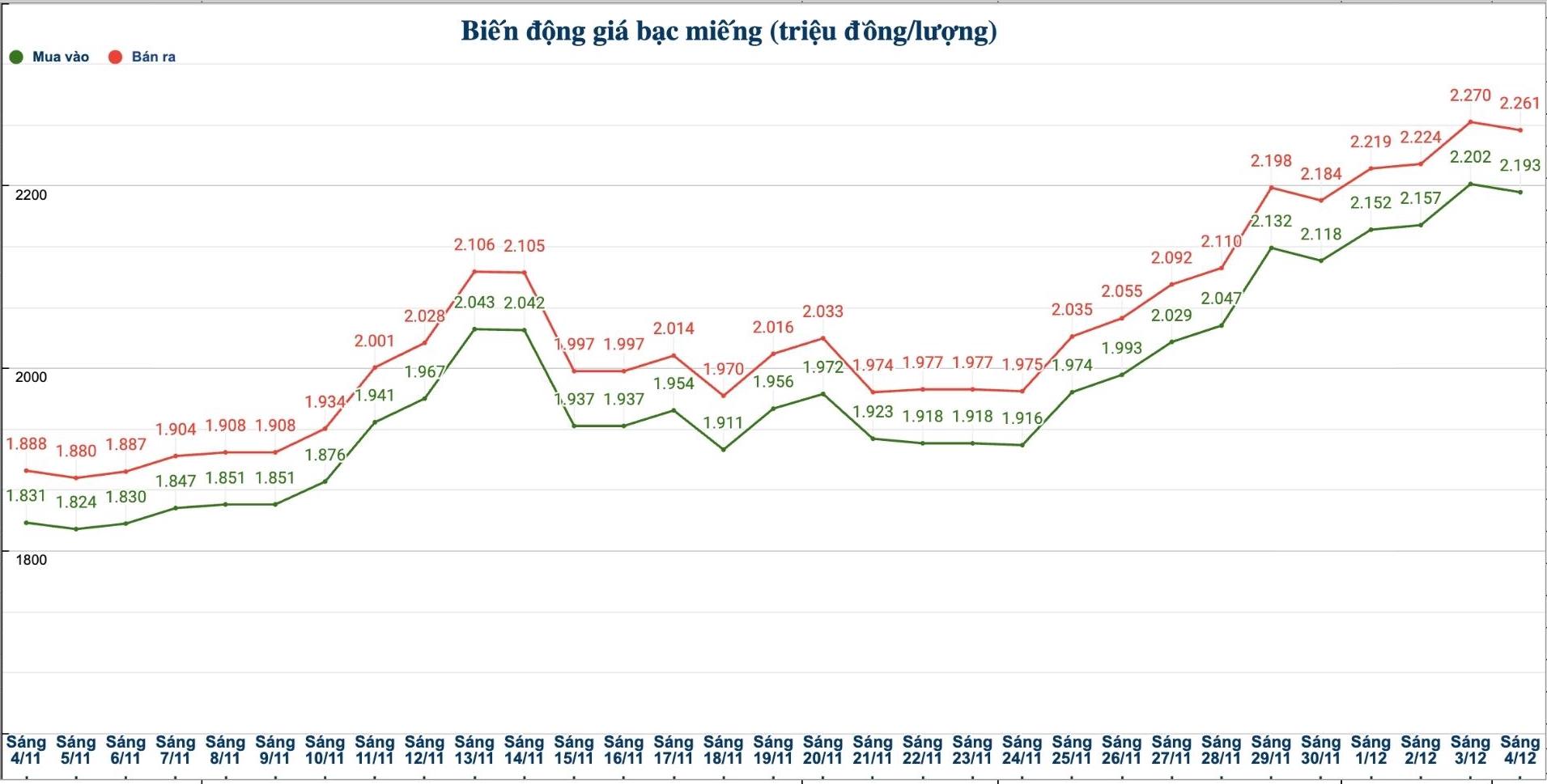

Domestic silver price

As of 10:20 a.m. on December 4, the price of 999 Phuc Loc Gold bars (1 tael) of Saigon Thuong Tin Bank Gold and Gemstone One Member Co., Ltd. (Sacombank-SBJ) was listed at VND 2.139 - VND 2.193 million/tael (buy - sell); down VND 9,000/tael for buying and down VND 6,000/tael for selling compared to yesterday morning.

At the same time, the price of 999 coins (1 tael) at Phu Quy Jewelry Group was listed at VND 2.193 - VND 2.261 million/tael (buy - sell); down VND 9,000/tael in both directions compared to yesterday morning.

The price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 58.479 - 60.293 million VND/kg (buy - sell); down 240,000 VND/kg in both directions compared to yesterday morning.

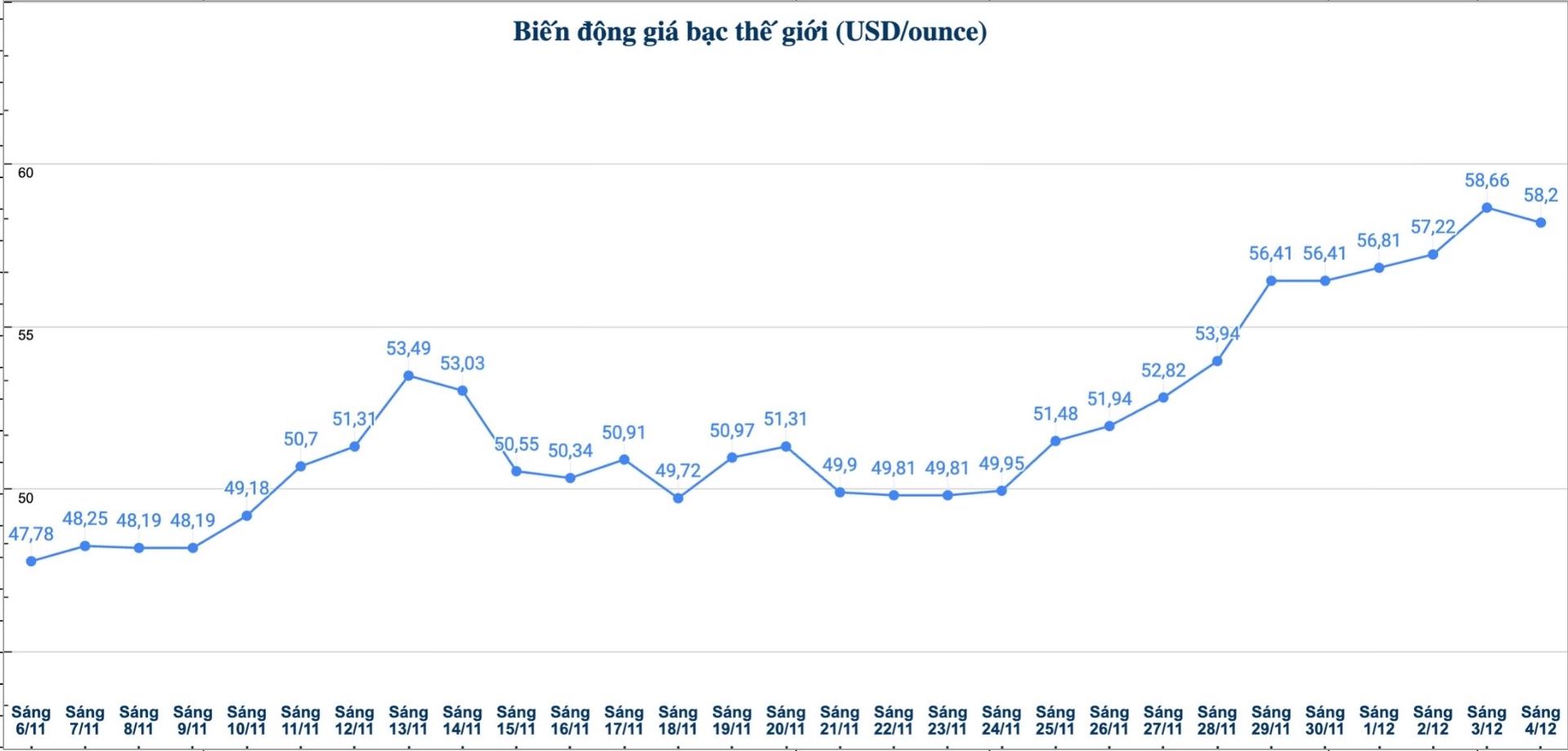

World silver price

On the world market, as of 10:30 a.m. on December 4 (Vietnam time), the world silver price was listed at 58.2 USD/ounce; down 0.64 USD compared to yesterday morning.

Causes and predictions

Silver prices cool down after a new peak, as the market begins to re-evaluate the current valuation. However, according to precious metals analyst James Hyerczyk at FX Empire, the metal has continued to increase by 101% since the beginning of the year thanks to scarce supply, strong purchasing power and the US list of essential minerals.

"The slight correction shows that prices may be far exceeding the fundamentals in the short term. The silver market is also greatly affected by the developments of gold, which is still holding in the important support zone and is likely to move towards new highs. The buying momentum on gold continues to create a positive sentiment spreading to the silver market" - he said.

James Hyerczyk said that expectations of the US Federal Reserve (Fed) cutting interest rates also led the trend for the precious metal market.

"The market is currently pricing in an 87% chance of a Fed rate cut in December - a sharp increase from 30% just two weeks ago. Governor Christopher Waller's weak jobs data and dovish comments have caused bond yields to fall, the US dollar to weaken continuously, thereby further supporting the precious metal," said James Hyerczyk.

James Hyerczyk added that the upward trend of silver is still maintained thanks to limited supply and strong investment cash flow. However, after stagnating at the high price zone, the market is at risk of entering the adjustment phase.

"If prices fall back to the support zone of 53.79 USD/ounce, the longer uptrend will not be affected and may even attract more buying momentum.

In the short term, the outlook for silver remains positive, but the market is likely to shift more balanced after the heats up last weekend" - James Hyerczyk expressed his opinion.

See more news related to silver prices HERE...