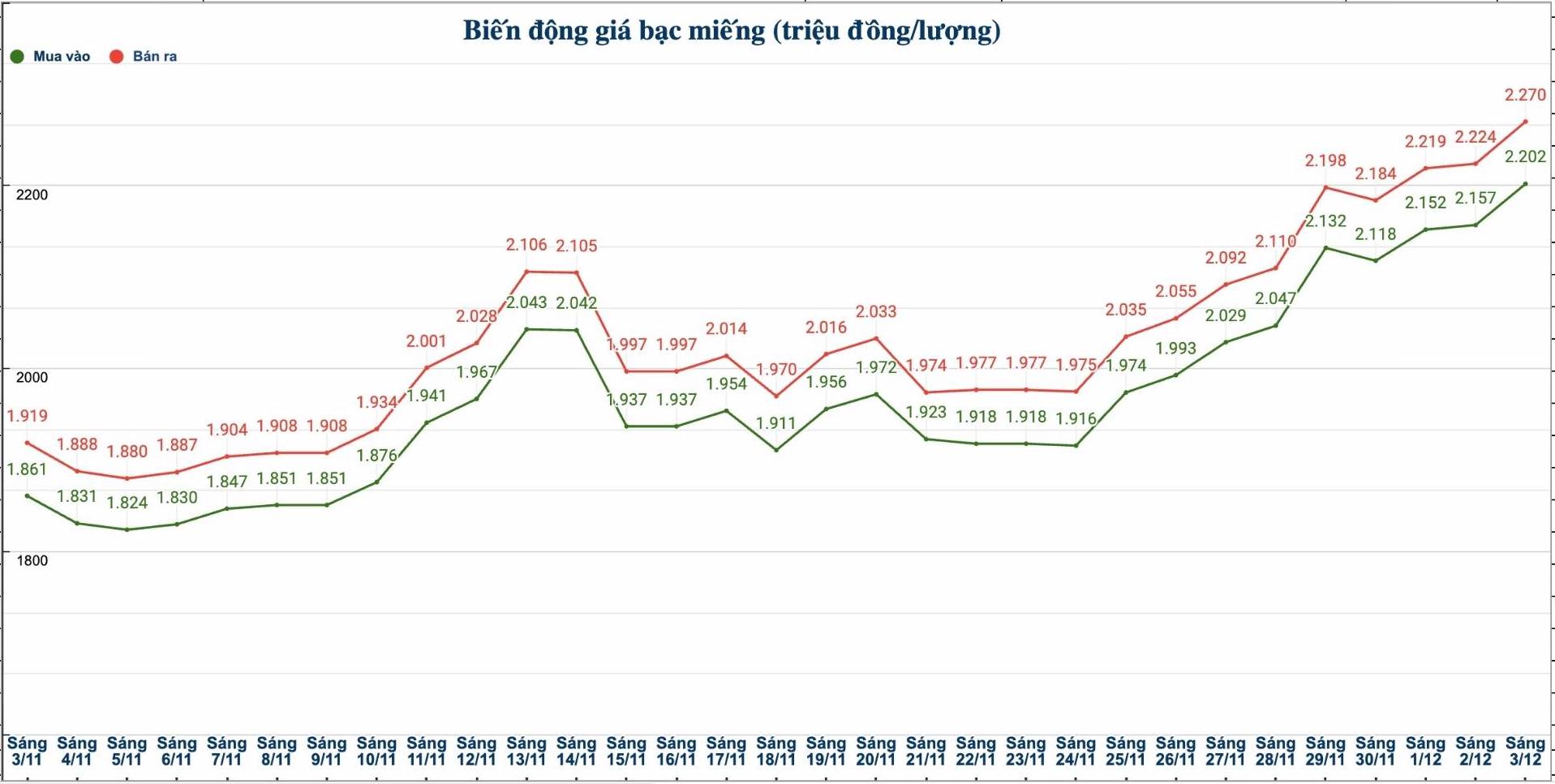

Domestic silver price

As of 10:20 a.m. on December 3, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Metallurgy Company was listed at VND 2.203 - VND 2.253 million/tael (buy - sell); increased by VND 53,000/tael in both directions compared to yesterday morning.

The price of 999 Ancarat 999 (1kg) at Ancarat Petrochemical Company was listed at 57.820 - 59.580 million VND/kg (buy - sell); an increase of 1.374 million VND/kg for buying and an increase of 1.414 million VND/kg for selling compared to yesterday morning.

The price of 999 gold bars of Saigon Thuong Tin Bank Gold and Gemstone One Member Co., Ltd. (Sacombank-SBJ) was listed at VND 2.148 - 2.199 million/tael (buy - sell); an increase of VND 42,000/tael in both directions compared to yesterday morning.

At the same time, the price of 999 999 coins (1 tael) at Phu Quy Jewelry Group was listed at VND 2.202 - 2.270 million/tael (buy - sell); an increase of VND 45,000/tael for buying and an increase of VND 46,000/tael for selling compared to yesterday morning.

The price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 58.719 - 60.533 million VND/kg (buy - sell); an increase of 1.2 million VND/kg for buying and an increase of 1.227 million VND/kg for selling compared to yesterday morning.

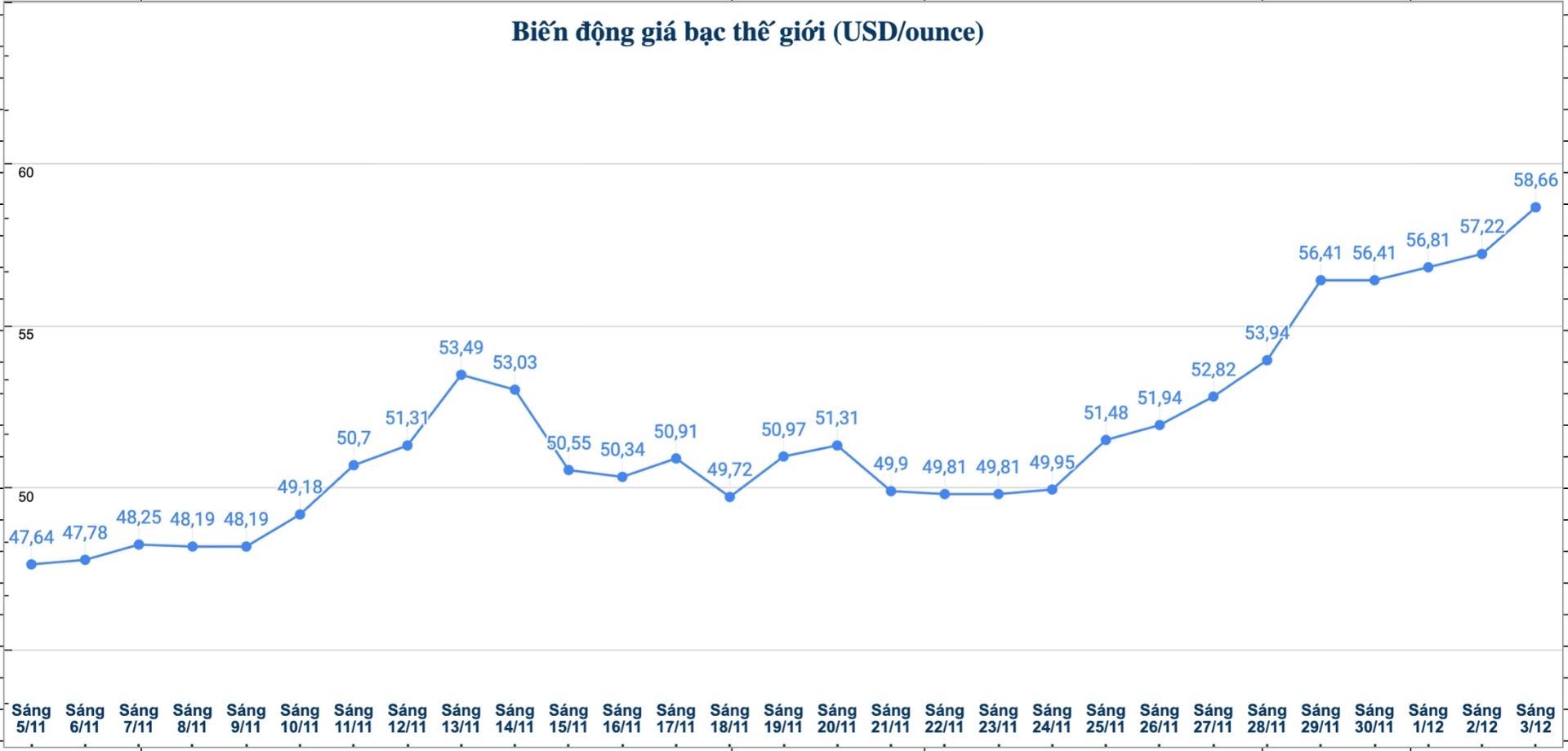

World silver price

On the world market, as of 10:20 a.m. on December 3 (Vietnam time), the world silver price was listed at 58.66 USD/ounce; an increase of 1.44 USD compared to yesterday morning.

Causes and predictions

According to precious metals analyst James Hyerczyk at FX Empire, silver continues to increase in price thanks to three main factors: Strong demand accompanied by the upward trend of gold, a prolonged shortage of material things, and the fact that silver is on the list of essential minerals of the US. "These factors help maintain a group of potential buyers, ready to participate when prices temporarily stagnate," he said.

The expert said that if the market maintains the threshold of 58 USD/ounce, the possibility of breaking the record of 58.85 USD/ounce will increase.

Meanwhile, James Hyerczyk said that investors are also looking forward to the US Federal Reserve (Fed) meeting on December 9-10.

"Currently, the market is pricing in an 87% chance of a 0.25 percentage point interest rate cut, up sharply from 35% two weeks ago. Low interest rates typically make precious metals more attractive, as other profitable assets are less attractive," he said.

James Hyerczyk added that US economic data this week, including the ADP jobs report, unemployment claims, and the September PCE report (delayed), are still very important. The latest ISM production report shows continued decline, while rumors about the possibility of Kevin Hassett becoming Fed chairman have also attracted attention.

See more news related to silver prices HERE...