Domestic silver price

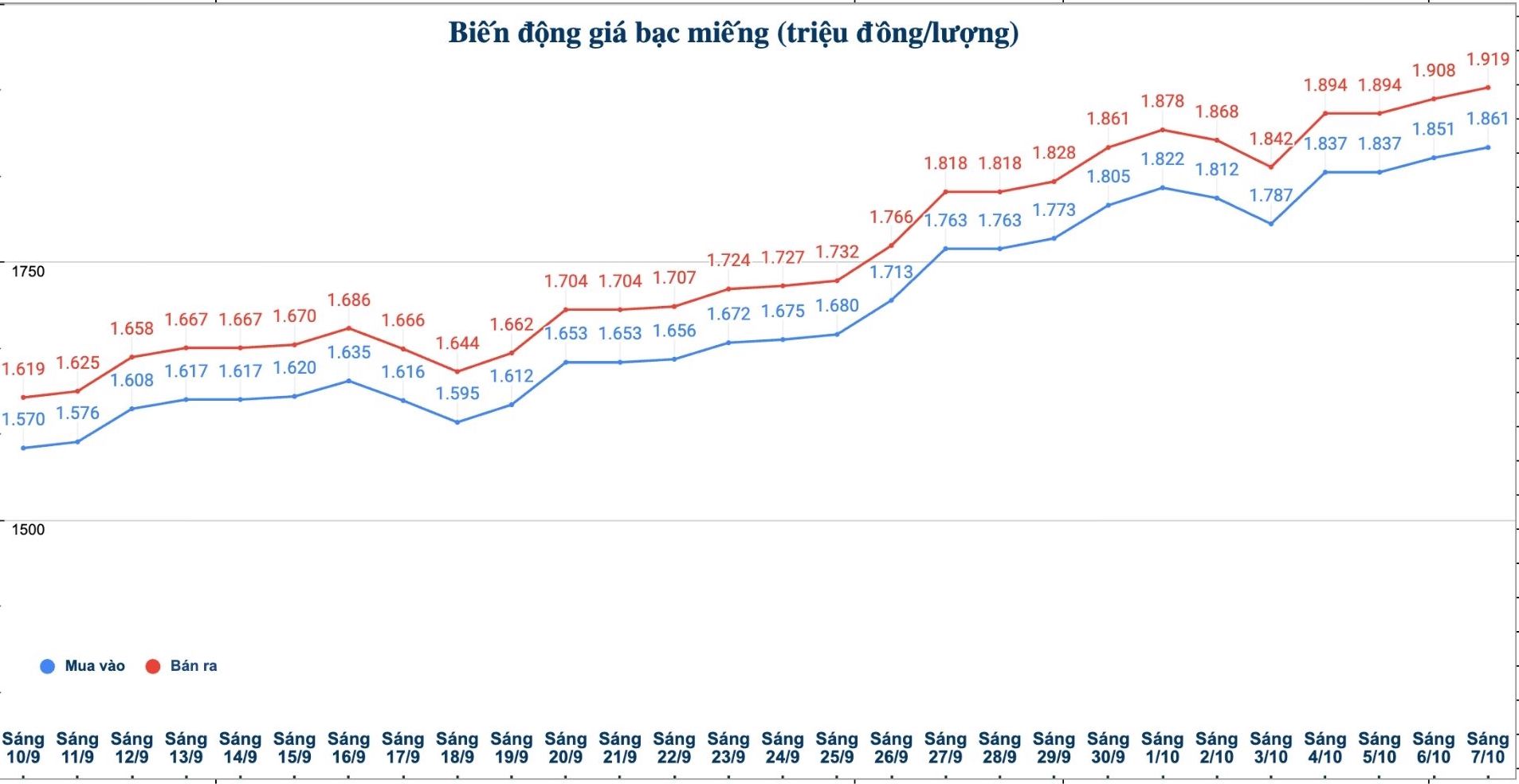

As of 11:50 on October 7, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Metallurgy Company was listed at 1.859 - 1.897 million VND/tael (buy - sell).

The price of 999 Ancarat 999 (1kg) at Ancarat Petrochemical Company was listed at 48.756 - 50.006 million VND/kg (buy - sell); an increase of 246,000 VND/kg in both directions compared to yesterday morning (October 5).

The price of 999 gold bars of Saigon Thuong Tin Bank Gold and Gemstone Company Limited (Sacombank-SBJ) was listed at 1.872 - 1.917 million VND/tael (buy - sell); an increase of 6,000 VND/tael in both directions compared to yesterday morning.

At the same time, the price of 999 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 1.861 - 1.919 million VND/tael (buy - sell); increased by 10,000 VND/tael for buying and increased by 11,000 VND/tael for selling compared to yesterday morning.

The price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 49,626 - 51,173 million VND/kg (buy - sell); an increase of 267,000 VND/kg for buying and an increase of 294,000 VND/kg for selling compared to yesterday morning.

World silver price

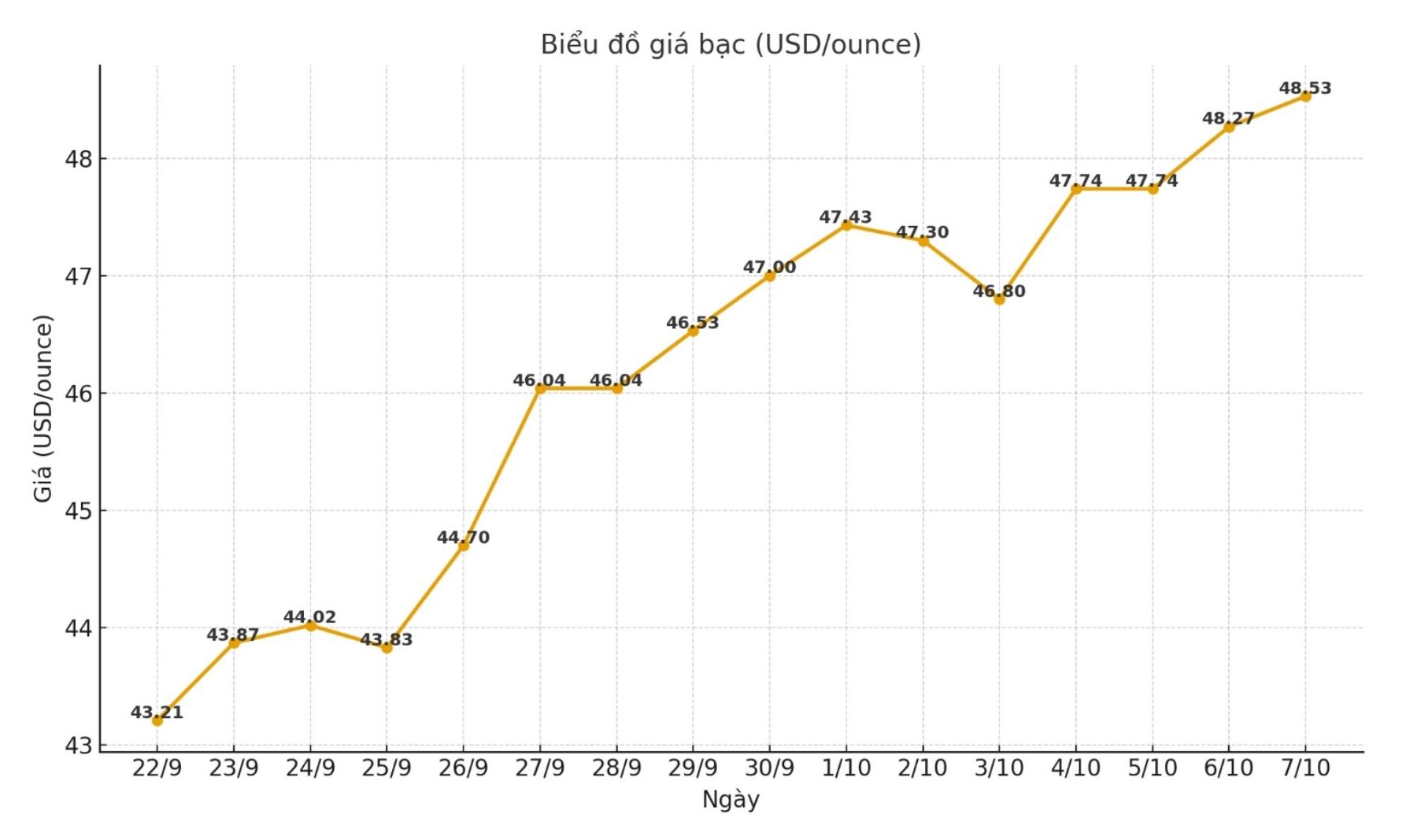

On the world market, as of 11:50 on October 7 (Vietnam time), the world silver price was listed at 48.53 USD/ounce; up 0.26 USD compared to yesterday morning.

Causes and predictions

Silver prices continued to increase strongly in the first session of the week, surpassing the peak of 48.38 USD/ounce last week. According to expert James Hyerczyk, this rally has returned to the target with the highest level in many years - 49.81 USD/ounce - with the psychological threshold of 50 USD/ounce very close.

"Siliver is benefiting from the rally in gold - a safe haven asset in the context of the US government's temporary suspension and expectations of the US Federal Reserve (FED) to soon cut interest rates," he said.

However, James Hyerczyk said traders are still cautious about monitoring the important resistance zone. The recovery of silver, similar to gold, is being supported by the stagnation of the US government, causing economic reports - including September employment data - to be delayed. This forces investors to rely on the Fed's statement for direction.

"The possibility of the Fed cutting 25 basis points at the upcoming meeting is increasing sharply, while the second rate cut could take place in December. The Fed Chairman's stance will greatly affect the price of precious metals," he stressed.

James Hyerczyk added that despite rising bond yields and the USD index, silver and gold prices remain strong - reflecting real demand, not just short-term trading. UBS has just raised its gold price forecast to $4,200/ounce by the end of the year, showing strong interest from institutional investors in both precious metals.

"The $50/ounce zone is considered an important psychological milestone, having caused the market to stagnate many times. If silver cannot hold above 49.81 USD/ounce, the risk of a downward correction will appear. On the contrary, a clear breakthrough through this threshold could open a new uptrend, taking prices into an unprecedented area," said James Hyerczyk.

See more news related to silver prices HERE...