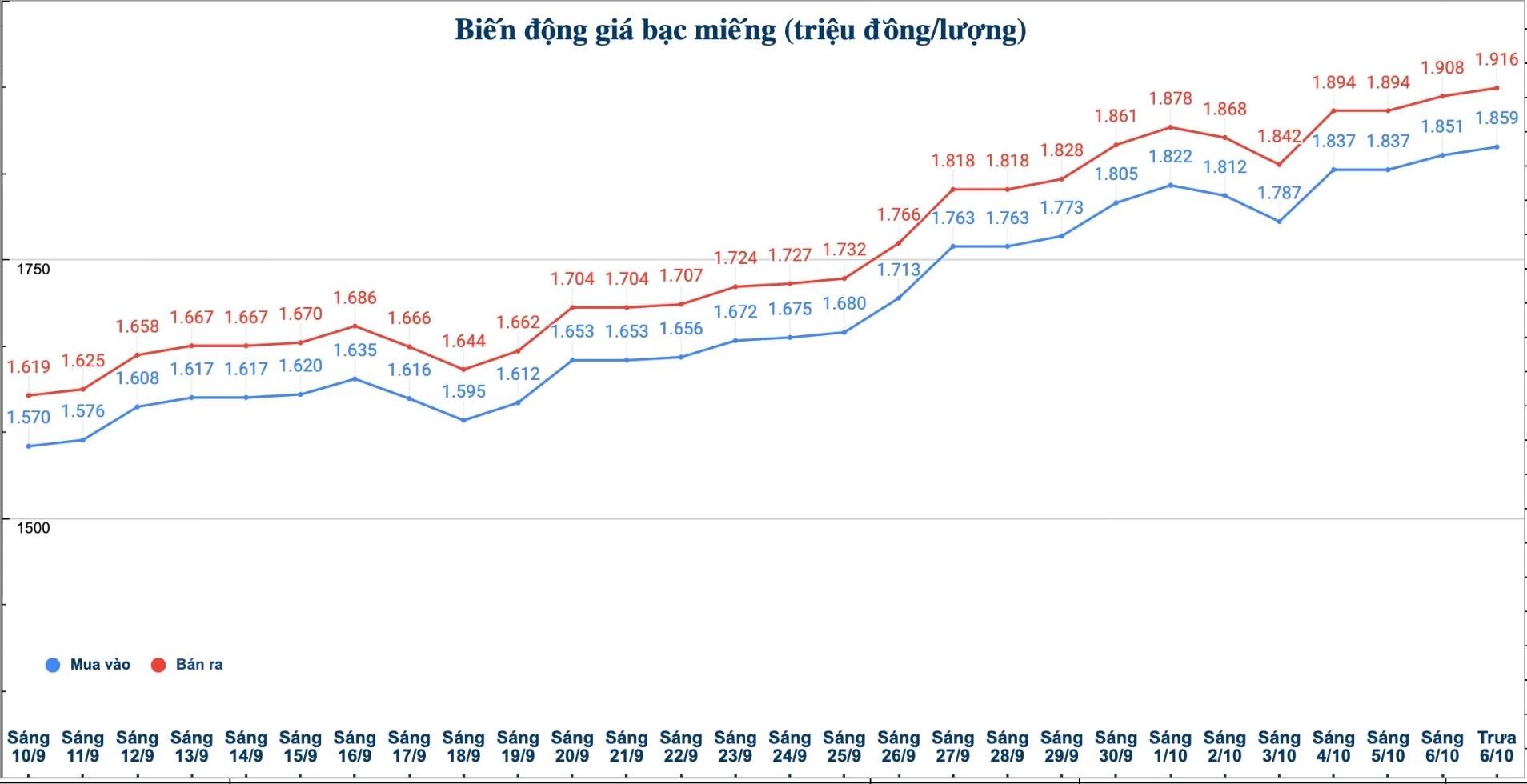

On October 6, domestic silver prices were adjusted up sharply by business units.

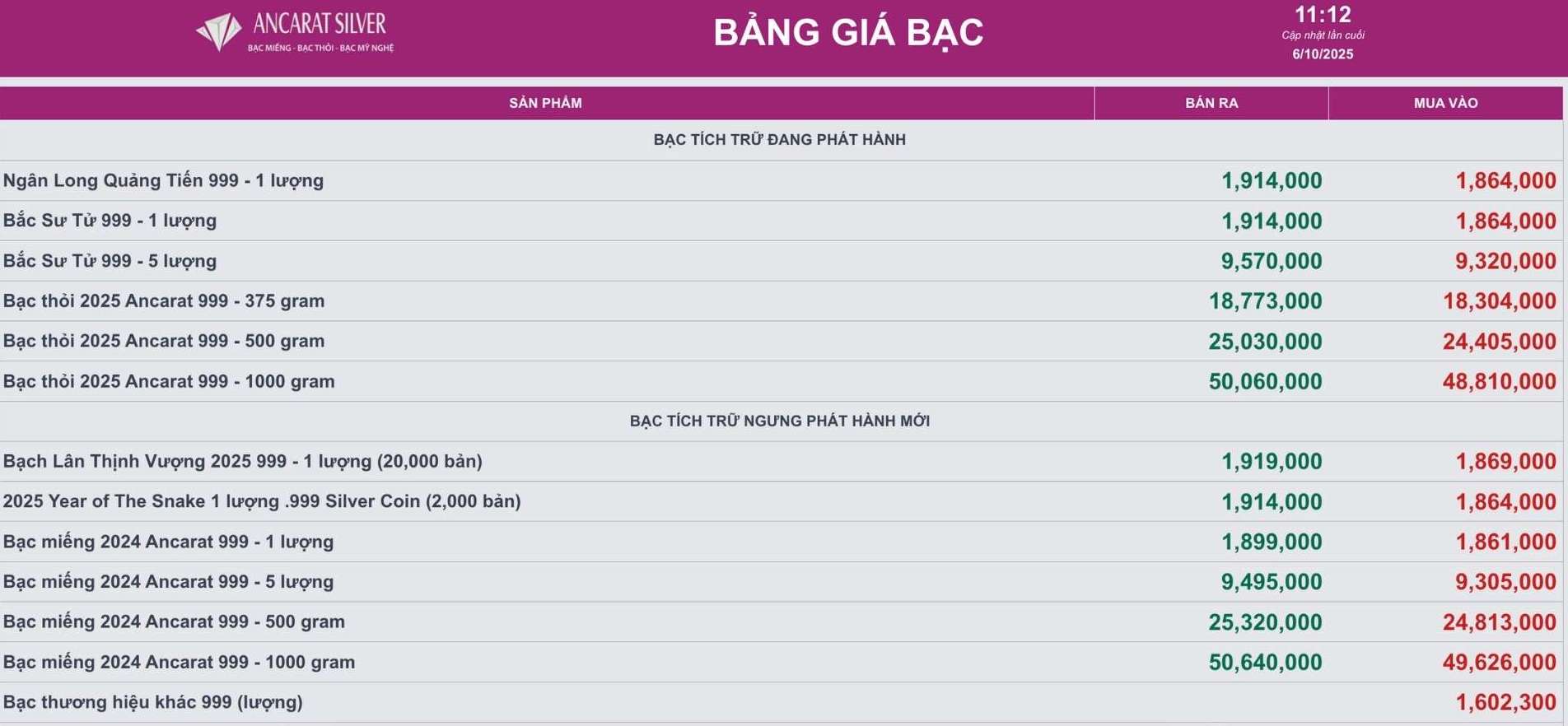

As of 12:50 p.m., the price of 999 Ancarat 999 (1kg) of silver bars at Ancarat Petrochemical Company was listed at 48.810 - 50.060 million VND/kg (buy - sell); an increase of 300,000 VND/kg for buying and an increase of 560,000 VND/kg for selling compared to this morning.

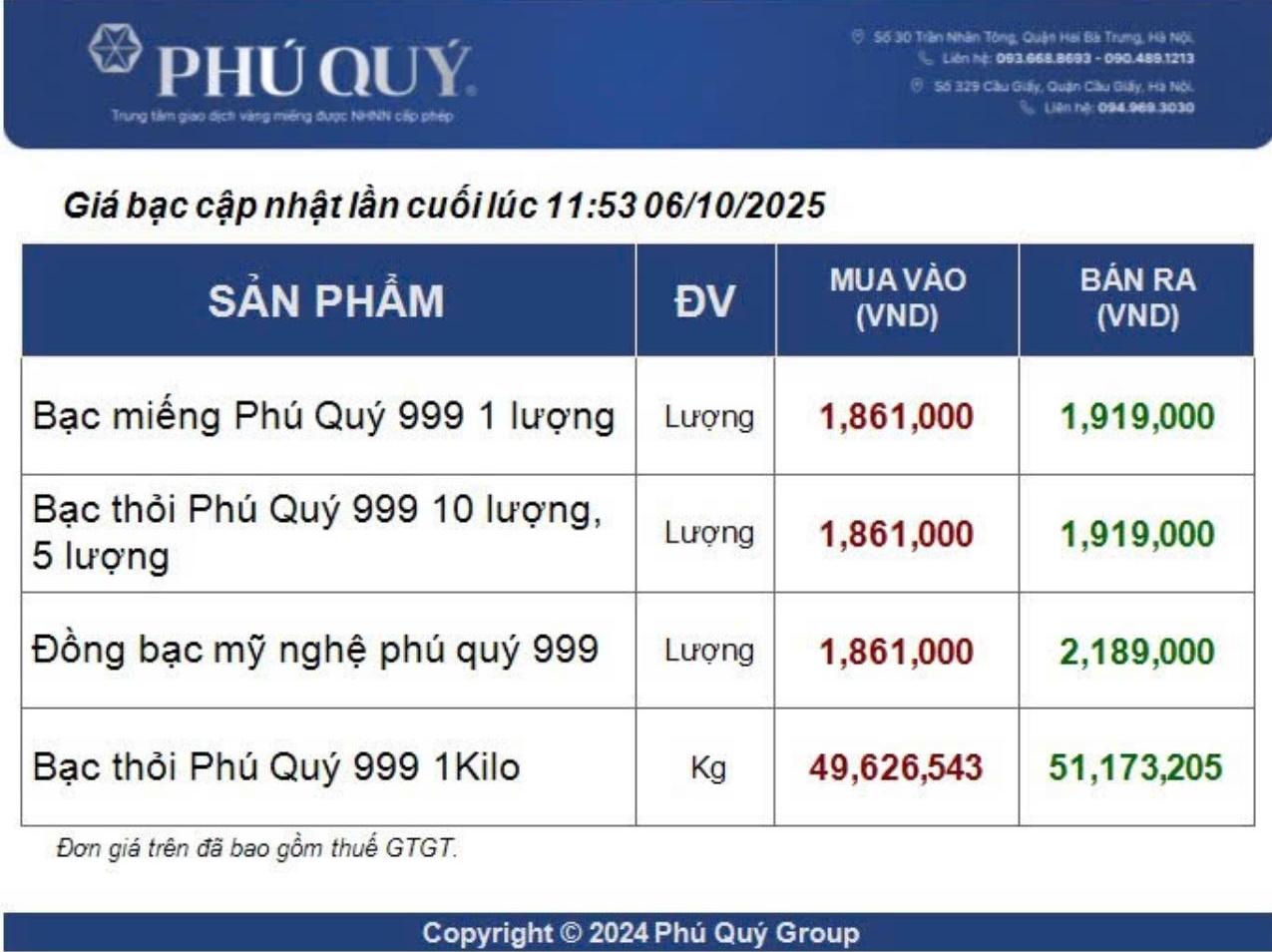

The price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 49.573 - 51.093 million VND/kg (buy - sell); an increase of 214,000 VND/kg in both directions compared to this morning.

At the same time, the price of silver bars of brands was also adjusted up.

The price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Metallurgy Company is listed at 1.861 - 1.899 million VND/tael (buy - sell).

The price of 999 999 pieces (1 tael) at Phu Quy Jewelry Group was listed at 1.859 - 1.916 million VND/tael (buy - sell); an increase of 8,000 VND/tael in both directions compared to this morning.

The price of 999 gold bars of Saigon Thuong Tin Bank Gold and Gemstone Company Limited (Sacombank-SBJ) was listed at 1.875 - 1.920 million VND/tael (buy - sell); an increase of 9,000 VND/tael in both directions compared to this morning.

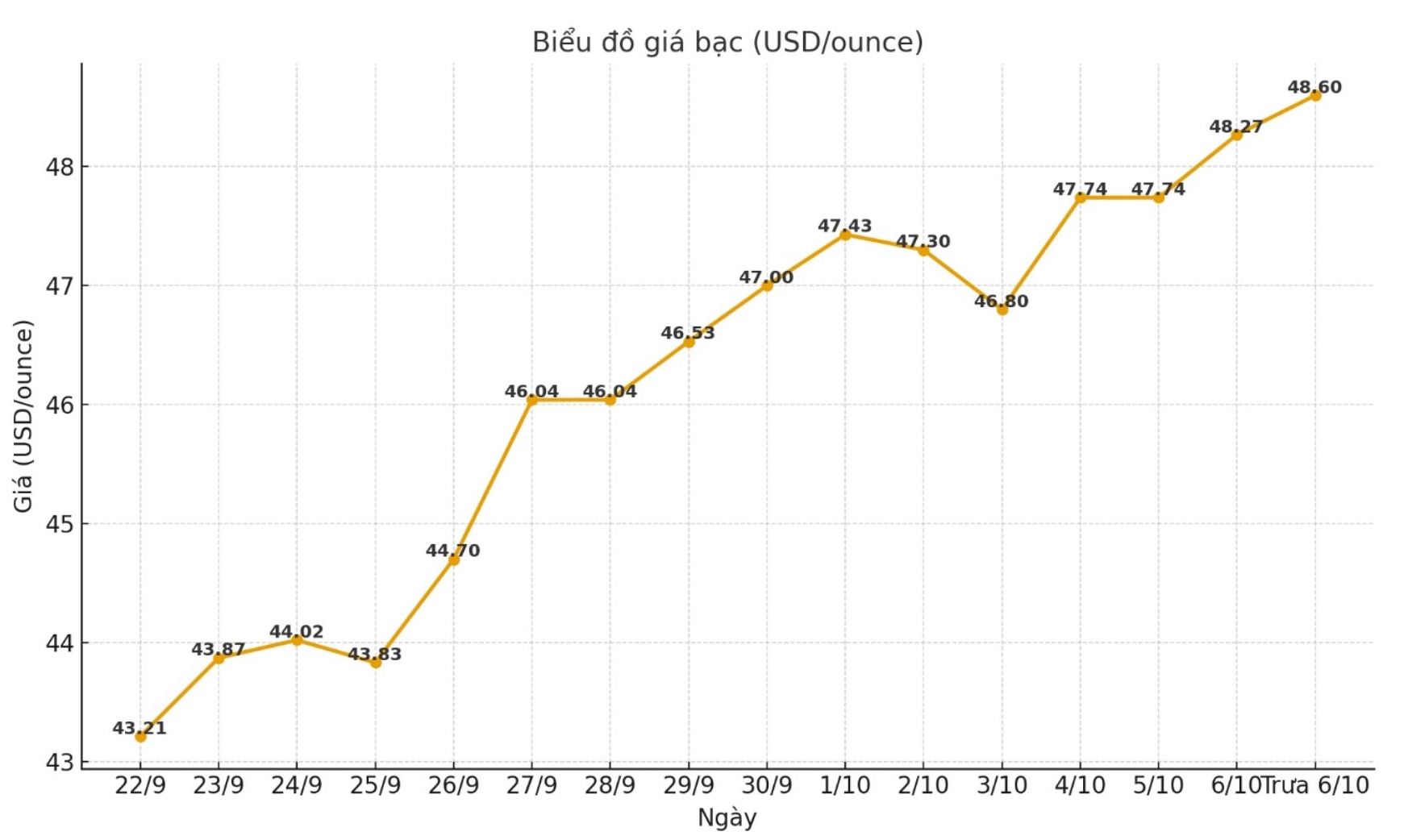

Domestic silver prices today increased sharply, largely due to the impact of the world silver price increase. As of 12:50 on October 6 (Vietnam time), the world silver price was listed at 48.6 USD/ounce (up 0.33 USD compared to this morning).

According to expert James Hyerczyk, the market is heading towards the resistance level of 49.81 USD/ounce and the psychological mark of 50 USD/ounce - a price area that has not been conquered for many years.

The continued US government shutdown has delayed important economic data such as the non-farm payroll and CPI, forcing the Fed to be more cautious in monetary policy. The CME FedWatch tool shows a 97% chance of a Fed rate cut in October and an 85% chance of another cut in December.

The weakening of the US dollar, falling bond yields and large capital flows into gold - a safe haven asset - are creating a favorable environment for silver. As a metal with high sensitivity to gold and silver fluctuations, silver is expected to continue to maintain its upward momentum, with the possibility of breaking out to the $50/ounce zone if the current trend is consolidated.

According to experts, those who intend to speculate in the short term need to be especially cautious, only disbursing when carefully calculating the risk and preparing a loss cut plan to avoid capital jams.

Below is the update on silver prices on the websites of domestic silver businesses at noon on October 6:

See more news related to silver prices HERE...