Silver prices continue to outperform gold, as the global market witnessed a strong increase approaching 50 USD/ounce. However, a research firm warned that the high price could affect industrial demand for the precious metal, creating certain fluctuations in the market.

Meanwhile, gold prices, which are approaching $4,000/ounce, have also increased by about 50% to date.

The gold/ silwer ratio is currently around 81 points - the lowest in nearly a year and still below the 5-year average.

Although the increase in silver is attracting strong attention from investors, commodity experts at Metals Focus believe that investors need to pay attention to industrial consumption, because high prices can force businesses to cut down on the amount of silver used, this process is called "thrifting".

The British precious metals research company said the solar industry is showing a clear picture of silver demand as prices move to $50/ounce, as silver is an essential metal in photovoltaic (PV) batteries.

According to the annual World Silver survey report of Silver Institute, compiled by Metals Focus, the solar energy sector is expected to consume 195.7 million ounces of silver this year, down 1% from the 2024 record.

Even before the recent price increase, fiber optic battery manufacturers have made a lot of progress in reducing the amount of silver used per watt.

However, this price increase has forced them to rush to seek breakthrough cost-cutting solutions. As technology continues to develop and expand, the demand for silver in the PV sector may gradually decrease, the analysis team said.

They say technological developments, even the possibility of replacing silver with other materials, could help reduce silver consumption per watt by about 15-20% this year.

Although the change in industrial demand may cause fluctuations in the silver market, Metals Focus believes that the overall trend is still not significantly affected.

In a recent interview, Mr. Philip Newman - CEO of Metals Focus, said that industrial demand will have to weaken very strongly to affect the current imbalance between supply and demand.

Although industrial demand is forecast to decline this year - partly due to prolonged economic instability, the supply deficit is still forecast to be at 187.6 million ounces, the third largest shortage in history.

As the rally continues to consolidate, I expect cash flow to continue to support silver prices. I believe silver will continue to be in short supply in the near future, and industrial demand will remain generally good, Newman said.

Although high prices may force businesses to reduce their use of silver, some experts believe that the strong growth of the solar energy industry will still be the main driver to maintain demand.

In the US, although investment sentiment is changing in the second half of the year, solar power and energy storage account for 82% of new electricity capacity in the first half of 2025.

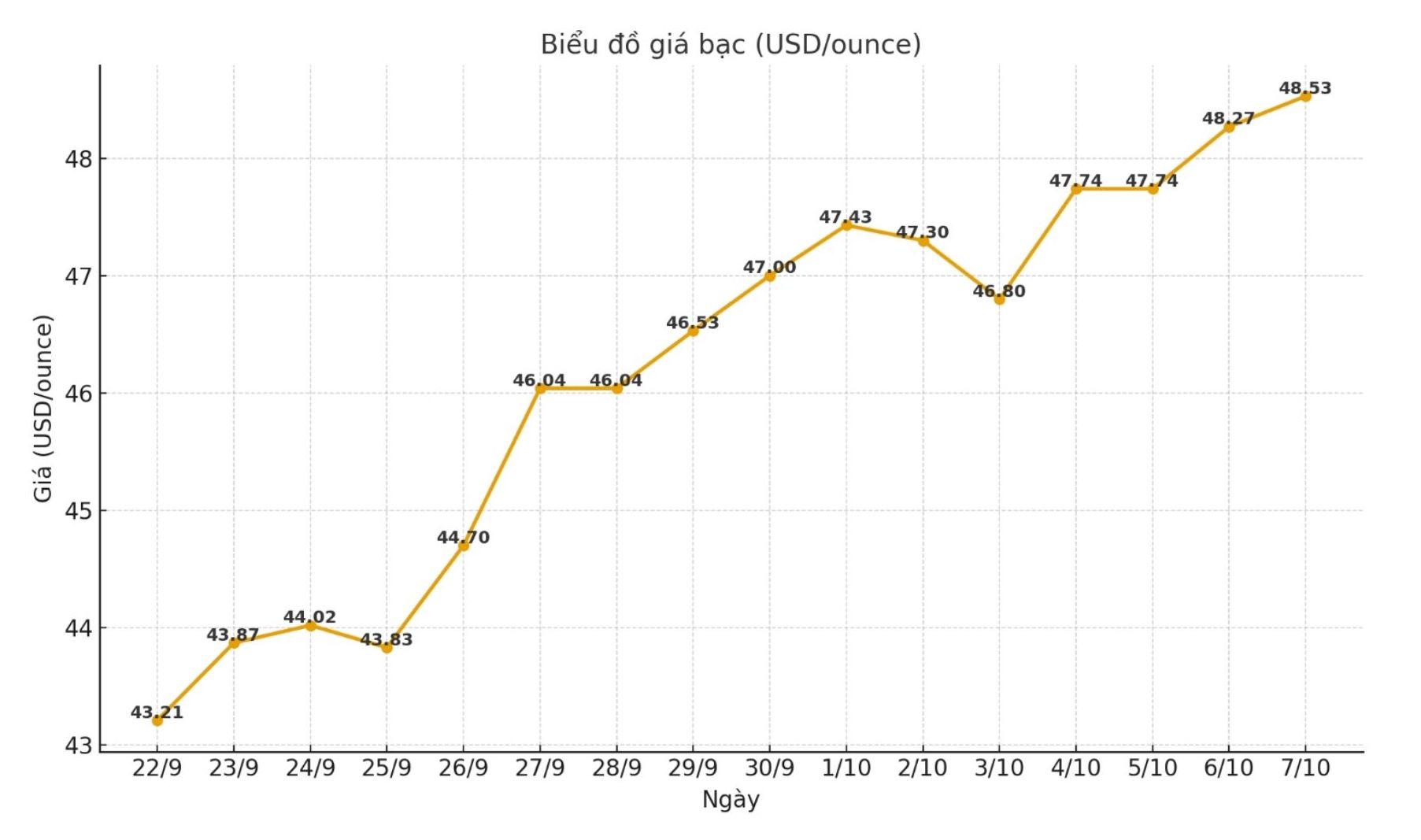

Updated silver price on October 7

As of 11:50 on October 7, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Metallurgy Company was listed at 1.859 - 1.897 million VND/tael (buy - sell).

The price of 999 Ancarat 999 (1kg) at Ancarat Petrochemical Company was listed at 48.756 - 50.006 million VND/kg (buy - sell); an increase of 246,000 VND/kg in both directions compared to yesterday morning (October 5).

The price of 999 gold bars of Saigon Thuong Tin Bank Gold and Gemstone Company Limited (Sacombank-SBJ) was listed at 1.872 - 1.917 million VND/tael (buy - sell); an increase of 6,000 VND/tael in both directions compared to yesterday morning.

At the same time, the price of 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 1.861 - 1.919 million VND/tael (buy - sell).

The price of 999 taels (1kg) at Phu Quy Jewelry Group was listed at 49,626 - 51.173 million VND/kg (buy - sell).

See more news related to silver prices HERE...