Domestic silver price

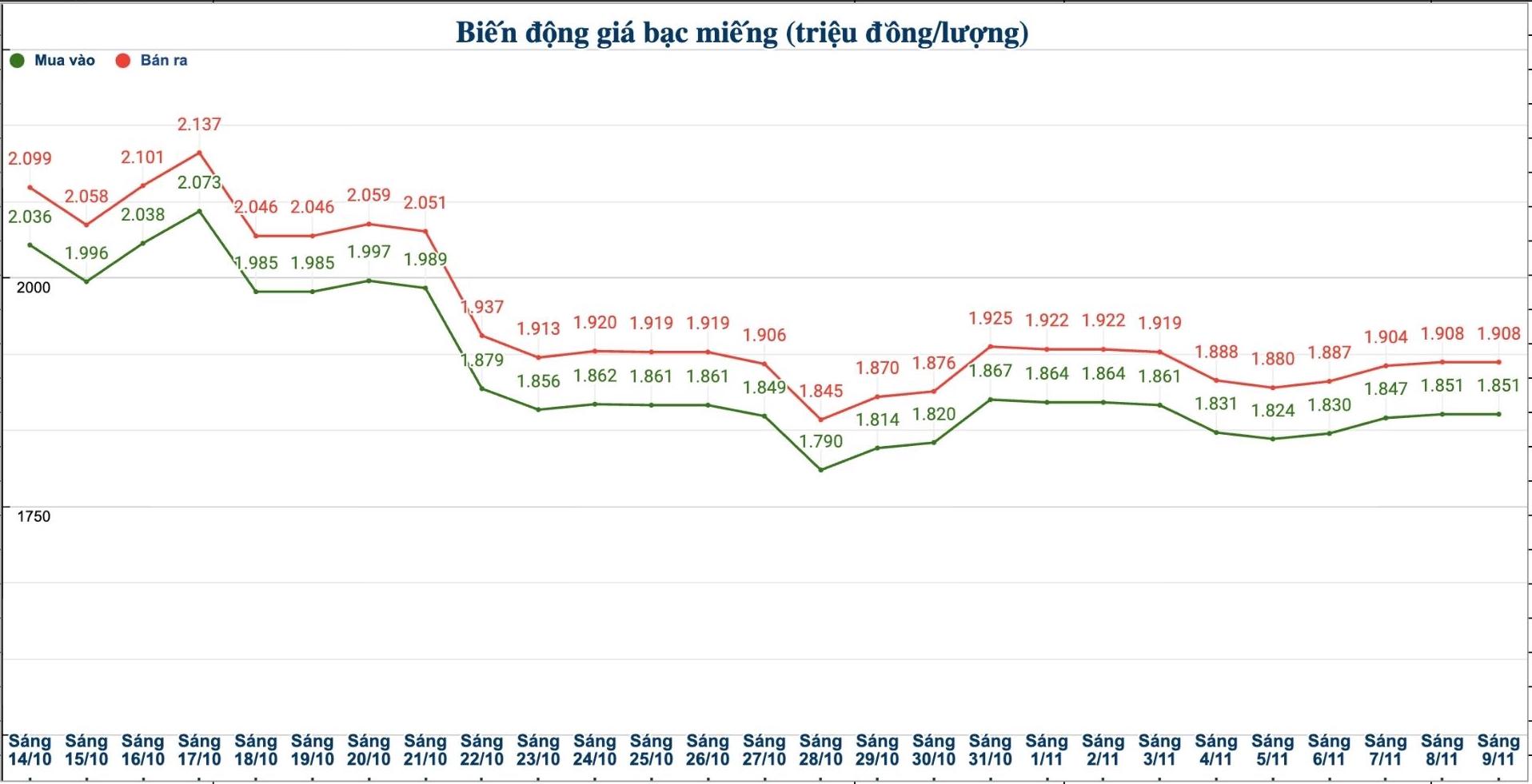

As of 9:30 a.m. on November 9, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Metallurgy Company was listed at 1.848 - 1.890 million VND/tael (buy - sell).

The price of 999 Ancarat 999 (1kg) at Ancarat Metallurgy Company is listed at 48,600 - 49.950 million VND/kg (buy - sell).

In the trading session of the previous 2 months (morning of September 9, 2025), the price of Ancarat 999 (1kg) silver bars at Ancarat Petrochemical Company was listed at 41.506 - 42.486 million VND/kg (buy - sell).

Thus, if buying 999 999 Ancarat 999 (1kg) of 2025 silver bars at Ancarat Golden Rooster Company on September 9 and selling them this morning (November 9), buyers will make a profit of VND 6.114 million/kg.

At the same time, the price of 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 1.851 - 1.908 million VND/tael (buy - sell).

The price of 999 taels (1kg) at Phu Quy Jewelry Group was listed at 49.359 - 50.879 million VND/kg (buy - sell).

In the trading session of the previous 2 months (morning of September 9, 2025), the price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 42.293 - 43.599 million VND/kg (buy - sell).

Thus, if buying 999 taels of silver (1kg) at Phu Quy Jewelry Group on September 9 and selling it this morning (November 9), buyers will make a profit of VND 5.76 million/kg.

World silver price

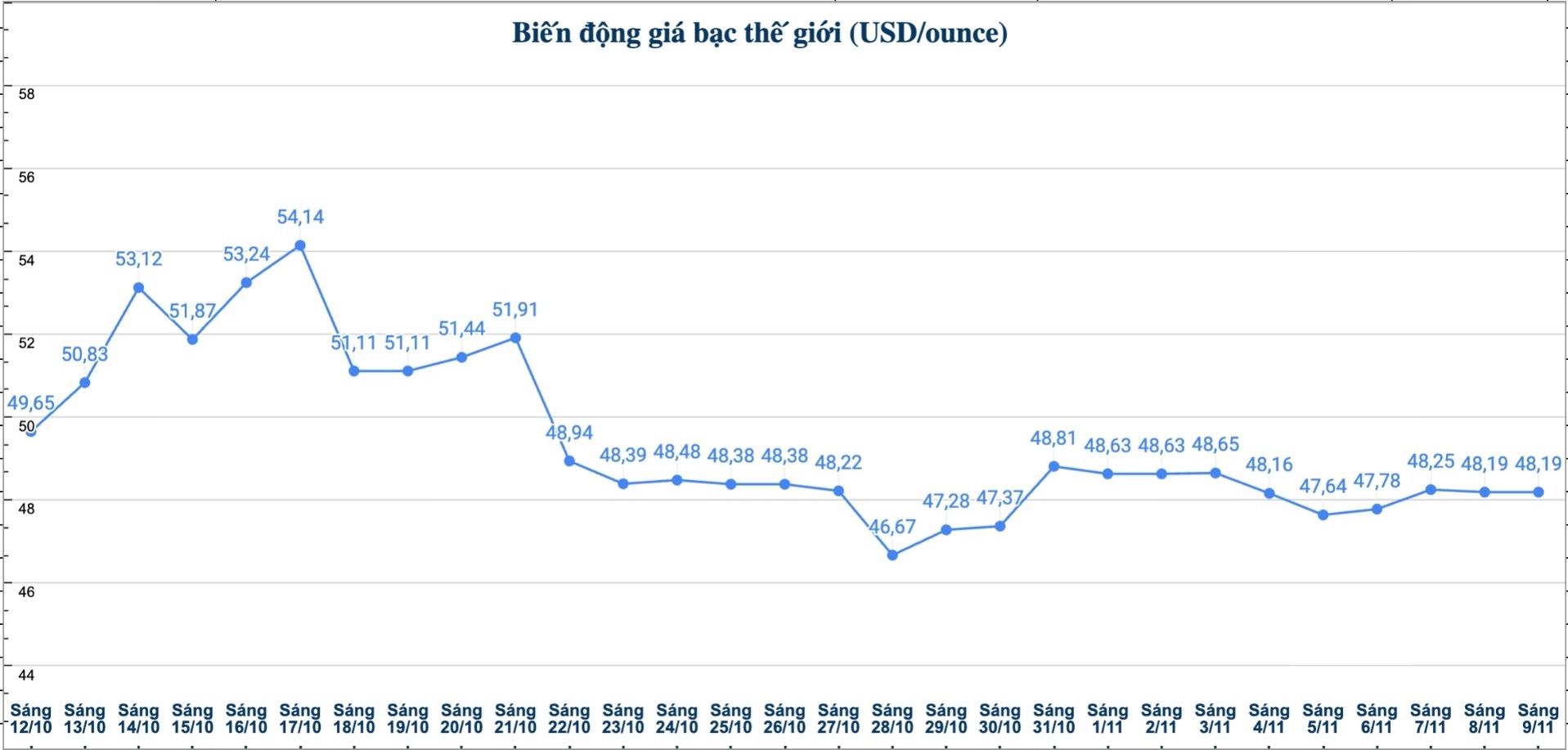

On the world market, as of 9:30 a.m. on November 9 (Vietnam time), the world silver price was listed at 48.19 USD/ounce.

Causes and predictions

In the trading session at the end of the week, both precious metals gold and silver increased slightly. Gold futures rose $27 (0.68%) to $4,012 an ounce, surpassing the psychological threshold of $4,000 an ounce. Silver prices rose $0.44 (0.92%) to $48.28 an ounce.

Gary Wagner - commodity broker and market analyst at Kitco - commented that the developments last week showed the tug-of-war in the precious metal market. Gold is mostly trading around $3,987 an ounce, after recovering from a previous decline. The bond market also fluctuated strongly, as US 10-year Treasury yields fell the most in about a month after worrying employment data was released.

According to a report by the job consulting firm Challenger, Gray & Christmas, the number of jobs cut in October reached its highest level in more than 20 years. "This information makes investors believe that the US Federal Reserve (FED) may continue to cut interest rates to support the economy, thereby making the precious metal more attractive due to reduced holding opportunity costs" - Gary Wagner analyzed.

Meanwhile, precious metals expert Christopher Lewis at FX Empire believes that market sentiment has now calmed down and this could be a sign that the uptrend will continue in the coming time.

"The silver market has rebounded, despite many complex fluctuations. However, I think the market is looking to stabilize after a strong rally in the past few months and a significant sell-off before," said Christopher Lewis.

See more news related to silver prices HERE...