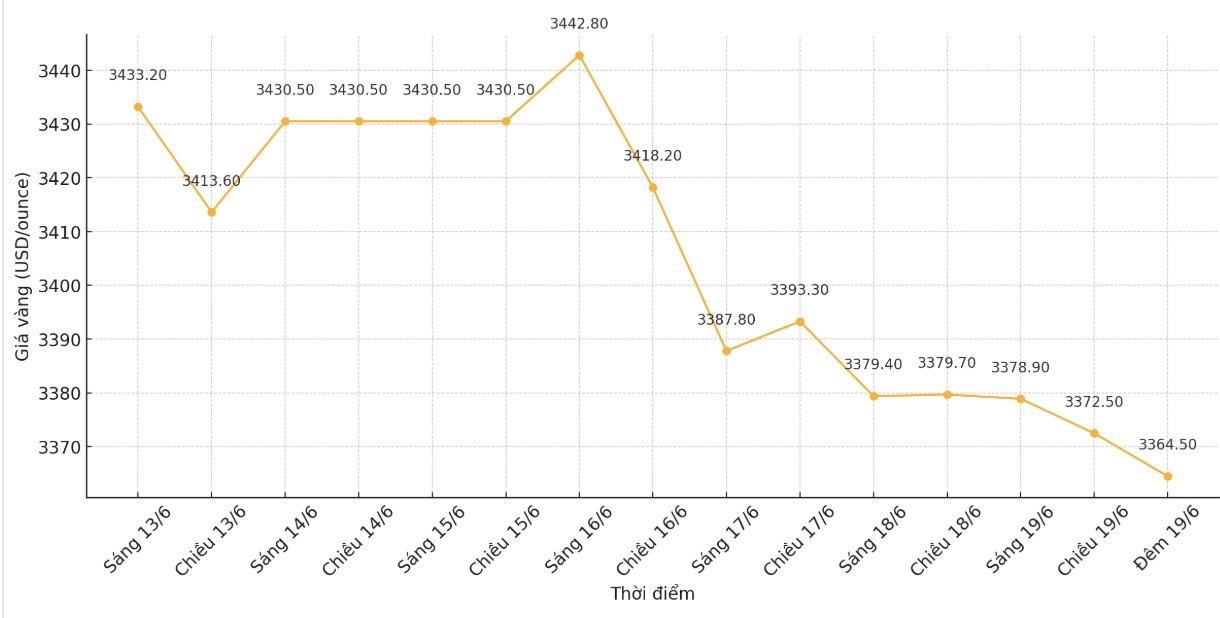

It all started last Friday, when Israel launched a military campaign against nuclear facilities in Iran, activating a wave of safe havens to push spot gold prices to a record close of $3,432.63/ounce, surpassing the old peak of $3,431.14/ounce set on May 6.

On the futures exchange, the August 2025 gold contract skyrocketed to $46, to $3,452.4/ounce, also surpassing the previous highest opening.

However, this excitement quickly disappeared. Despite its classic safe-haven role, gold cannot hold on to its high prices. Opening on Monday at $3,473/ounce, gold plummeted again in the session, losing $48.3, dragging the August contract down to $3,404.3/ounce when closing.

On Tuesday, prices temporarily moved sideways with a slight increase of $2.2 billion, but the technical picture was still unfavorable because they formed lower peaks and bottoms compared to the previous fall.

Selling pressure continued to return strongly today, causing the futures contract to lose an additional 20.1 USD, closing at 3,386.4 USD/ounce, falling below the psychological threshold of 3,400 USD.

The latest policy announcement from the US Federal Reserve (FED) further complicates the story of gold. The Fed kept the reference interest rate unchanged at around 4.25% - 4.50%, maintaining a cautious data-based approach, while continuing to monitor the impact of President Donald Trump's trade policies, especially tariffs.

The Fed forecasts inflationary pressures to increase in the next few months, but still maintains plans to cut rates by two more rates before the end of the year, as oriented in March.

Fed Chairman Jerome Powell stressed caution, saying policymakers are in a good position to wait for more information on the economic outlook before adjusting policy.

The Fed's statement also admitted that "the level of uncertainty about economic prospects has decreased", but is still "high", reflecting many intertwined factors that the Fed is facing.

The fundamental factors that pushed gold prices to the peak on Monday remain unchanged: central banks around the world continue to hoard gold heavily; tensions in Ukraine and the Middle East play a key role, strengthening gold's position as a hedge against instability; and expecting interest rates to decrease in the future is also beneficial for gold when reducing opportunity costs compared to other profitable assets.

This week's developments show two sides of the modern gold market: real safe-haven demand could be quickly replaced by profit-taking and technical selling. Geopolitical shocks were initially strong enough to push prices to the peak, but to maintain them requires more solid confidence from investors and supportive macro conditions.

The rapid decline in prices from the record opening at the beginning of the week to below the current 3,400 USD/ounce shows that market sentiment can change direction very quickly.

In the coming time, gold's path will depend on the interweaving of prolonged geopolitical risks, the FED's interest rate policy and the economic context affected by new trade policies.

The possibility of gold regaining its old peak will depend on whether current uncertainty is transforming into sustainable demand from institutional and individual investors, or whether this is just a hot rally due to the crisis and then quickly cooling down as the market adapts to new fluctuations.

See more news related to gold prices HERE...