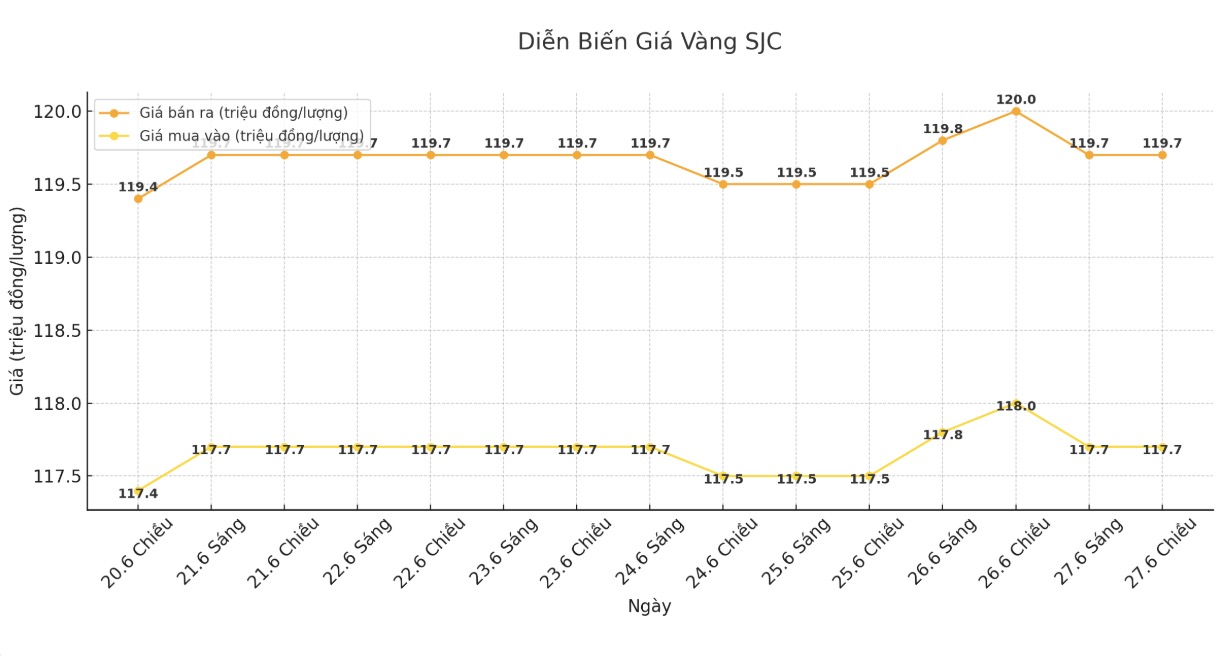

SJC gold bar price

On June 28, the price of SJC gold bars was listed by Saigon Jewelry Company at 117.7 right-of-way at 117.7 need to be 19.7 million VND/tael (buy in - sell out); down 300,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

DOJI Group listed at 117.7 crore VND/tael (buy - sell); down VND300,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 117.5-119 seven million VND/tael (buy in - sell out); down 300,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 117.2-119 seven million VND/tael (buy in - sell out); kept the same for buying and decreased by 300,000 VND/tael for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

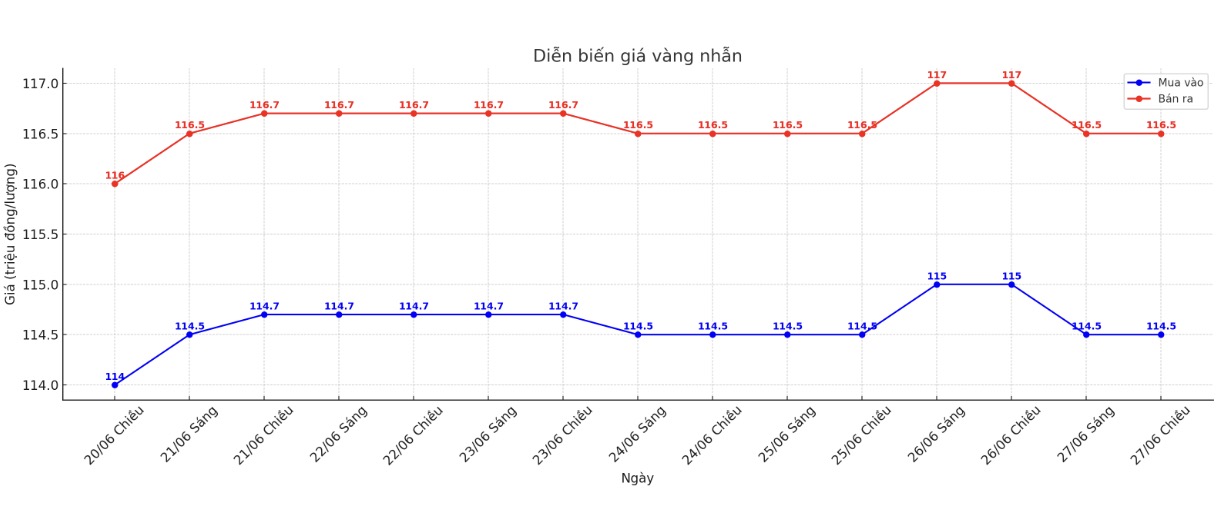

9999 gold ring price

On June 28, DOJI Group listed the price of gold rings at VND 114.5-116.5 million/tael (buy - sell), down VND 500,000/tael in both directions. The difference between buying and selling is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 114.5-117.5 million VND/tael (buy - sell), down 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 113.4-116.4 million VND/tael (buy in - sell out), down 400,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

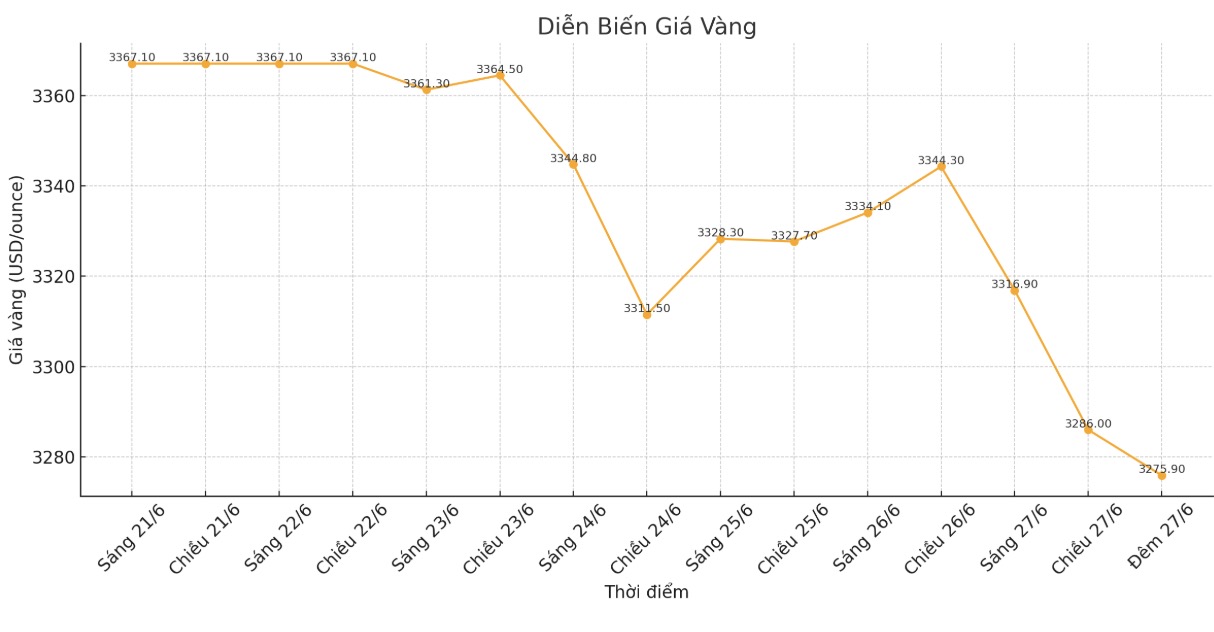

World gold price

Recorded at 11:30 p.m. on June 27, spot gold was listed at $3,275.9/ounce, down $46.

Gold price forecast

World gold prices fell to a four-week low as tensions in the Middle East quickly cooled down, negatively affecting demand for shelter in precious metals.

August gold contract is currently down 61.7 USD, down to 3,286.3 USD/ounce. July delivery silver prices also lost $0.796, down to $35.795 an ounce.

Asian and European stocks fluctuated in opposite directions overnight and tended to increase slightly. US stock indexes are expected to open up in New York today, with Nasdaq and the S&P 500 hitting a record high this week. The calm geopolitical situation in the Middle East has helped improve risk appetite in the market.

In another development, on Thursday, the Trump administration announced that the US and China had officially signed a new trade agreement, concluding many months of negotiations. Although the details are still limited, this information has been positively received by stock and commodity investors.

Investors welcome this confirmation as a positive signal for global supply chains and trade, said David Morrison of Trade Nation.

Morrison added: Investors were reassured when White House Press Secretary Karoline Leavitt told reporters that the July 8 and 9 deadlines set by President Trump to restart tariffs on the rest of US trade partners not mandatory and could be extended.

Technically, speculators who are willing to bid for August gold contracts still have an overall short-term advantage but are weakening. The next upside target for buyers is to close above the strong resistance level of $3,400/ounce. The downside target for the bears is to push prices below the key technical support at $3,200/ounce.

The first resistance level was $3,300/ounce, followed by an overnight peak of $3,341.4/ounce. First support was $3,269.1 an ounce, then $3,250 an ounce.

In outside markets, the USD index rose slightly after falling to a 3.5-year low on Thursday. Nymex crude oil prices have increased and are trading around 75.50 USD/barrel. The yield on the 10-year US Treasury note is currently at 4.27%.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...