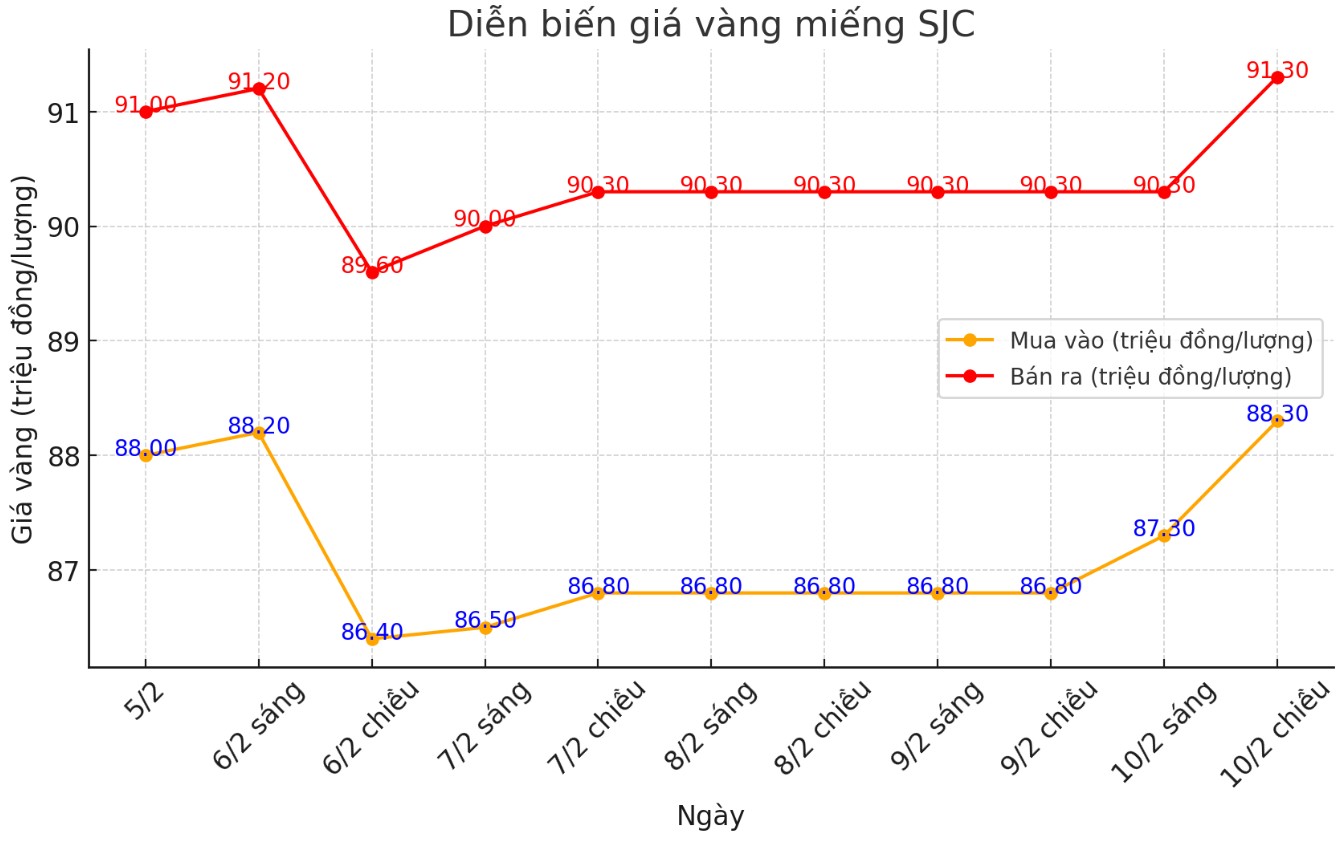

Updated SJC gold price

As of 6:15 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company SJC at 88.3-91.3 million VND/tael (buy - sell), an increase of 1.5 million VND/tael for buying and an increase of 1 million VND/tael for selling. The difference between the buying and selling prices of SJC gold at Saigon Jewelry Company SJC is at 3 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bar at the threshold of 88.85-91.25 million VND/tael (purchased - sold), up 2.05 million VND/tael buying and up 950,000 VND /The amount of sale. Buying difference - sold at 2.4 million VND/tael.

The price of SJC gold bars was listed by DOJI Group at 88.3-91.3 million VND/tael (buy - sell), an increase of 1.5 million VND/tael for buying and an increase of 1 million VND/tael for selling. The difference between buying and selling prices of SJC gold was adjusted down to 3 million VND/tael.

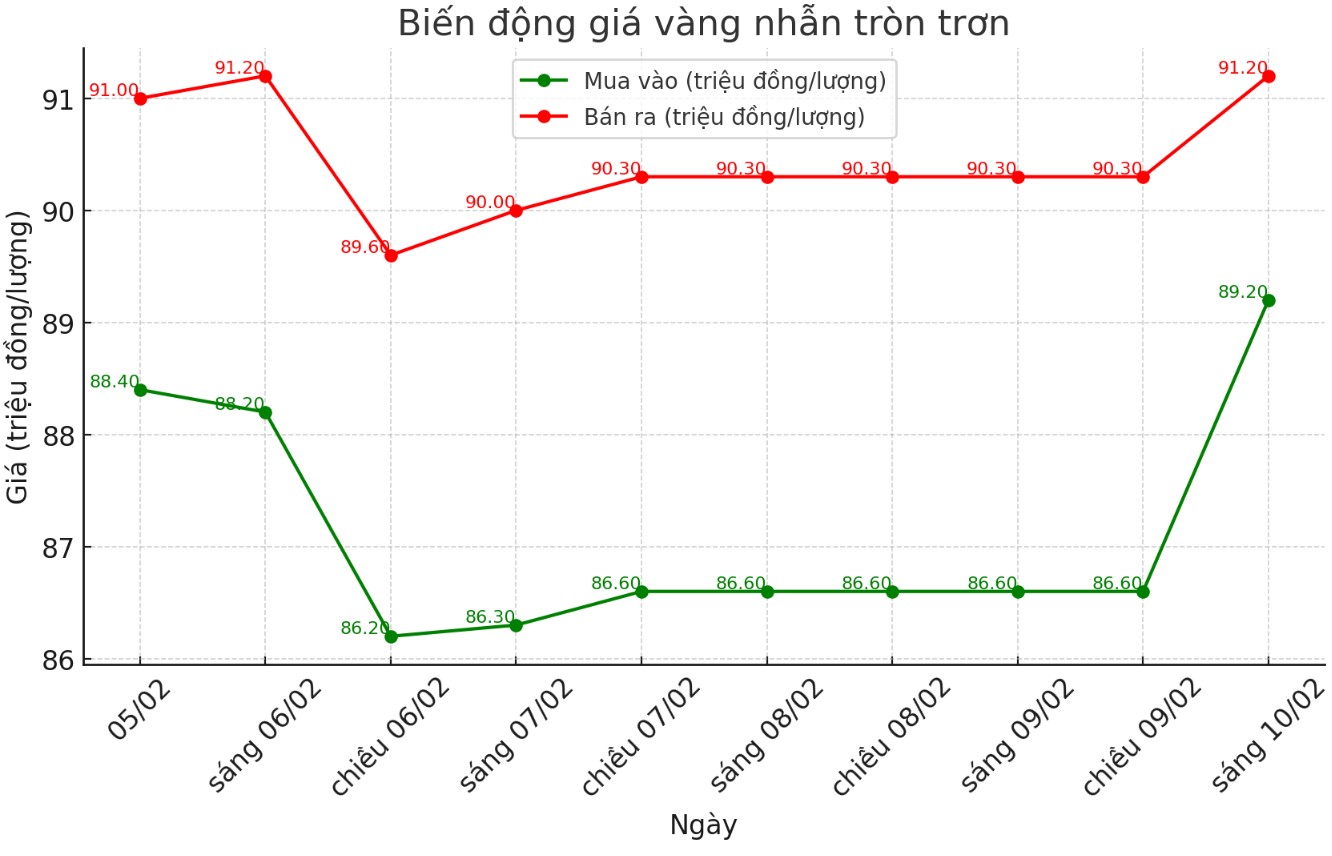

Gold price round 9999

As of 5:15 p.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 89.2-91.2 million VND/tael (buy - sell); an increase of 2.6 million VND/tael for buying and an increase of 900,000 VND/tael for selling. The difference between buying and selling decreased to VND2 million/tael.

Bao Tin Minh Chau listed the price of gold rings at the threshold of 88.85-91.25 million dong/tael (purchased - sold); Increasing VND 2.05 million/tael to buy and an increase of VND 1 million/tael. The difference in buying - selling decreases from 3.45 million VND/tael to 2.4 million dong/tael.

World gold price

As of 16h40 world gold price listed on Kitco at the threshold of $ 2,901.9/ounce, up 40.7 USD/ounce compared to the same time the previous session.

Gold Price Forecast

World gold prices increased despite the strengthening of the USD. Recorded at 6:30 p.m. on February 10, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 108.088 points (up 0.08%).

According to Kitco - the fact that central banks continue to diversify gold reserves will be an important factor for gold and silver prices. Individual investors and techno funds are increasing the holding of gold as a measure of economic growth and labor market decline. Future trading products with small scale, such as 1 ounce gold contract, can help investors easily access this market.

Adrian Day - Chairman of Adrian Day Asset Management commented that gold prices will increase this week: "The momentum of gold remains, the factors driving prices in the past year remain intact. Early or late, the market will need a pause and accumulation period, but it may not be this time".

Sharing the same view, Rich Checkan - President and COO of Asset Strategies International said: "The fluctuations and instability of the first weeks under the new US administration are prompting investors to seek gold as a safe haven. This trend will continue".

According to Krishan Goroalul, senior analyst for the EMEA region at the World Gold Council (WGC), gold prices continue to be supported when central banks start in early 2025 by increasing reserves and maintaining strong gold buying trends like at the end of 2024.

Analysts are paying special attention to China. This is the third consecutive month that the People's Bank of China has increased its official gold reserves, after a six-month pause, ending the previous 18-month gold purchase.

“Buying last month took China’s total gold reserves to 2,285 tonnes,” Goroul said.

Not only China buying gold. Goroul also cited data from the Polish National Bank showing that they bought 3 tonnes of gold in January. In Europe, Goroul said the Czech Republic National Bank also bought 3 tons of gold in January. Meanwhile, Uzbekistan was the country that bought the most gold in January when their central bank bought 8 tons of gold.

See more news related to gold prices HERE...