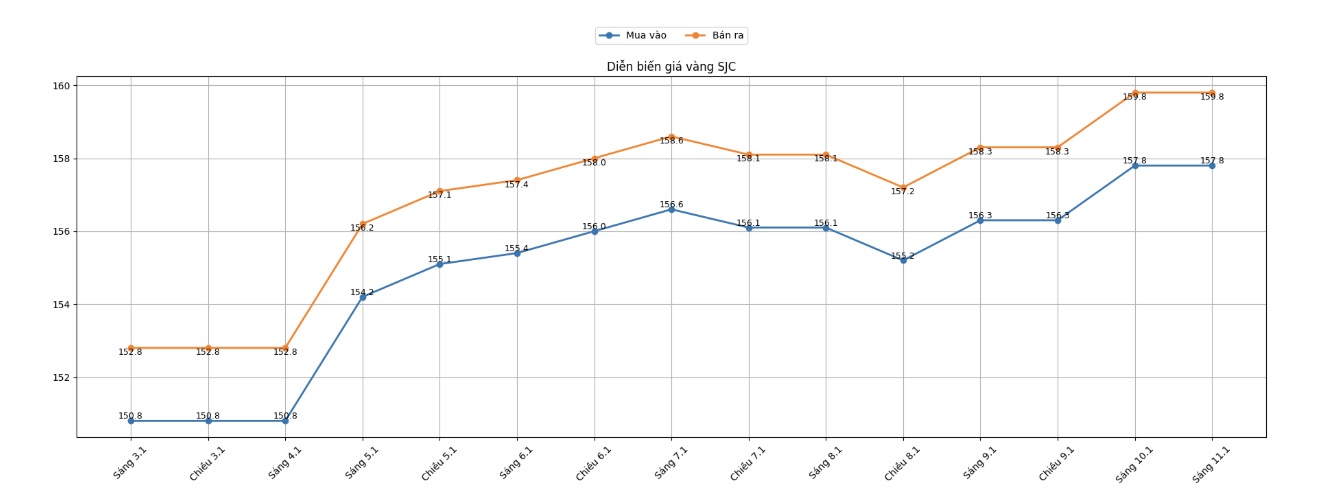

SJC gold bar price

Closing the weekly trading session, Saigon SJC Jewelry Company listed SJC gold price at 157.8-159.8 million VND/tael (buying - selling). The buying - selling difference is 2 million VND/tael.

Compared to the closing session of the previous week (November 4, 2025), the price of SJC gold bars at Saigon Jewelry Company SJC increased by 7 million VND/tael in both directions. The difference between buying and selling prices of SJC gold at Saigon Jewelry Company SJC is at the threshold of 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 157.8-159.8 million VND/tael (buying - selling). The difference between buying and selling is 2 million VND/tael.

Compared to a week ago, the price of SJC gold bars was increased by 7 million VND/tael by Bao Tin Minh Chau in both directions.

If you buy SJC gold at Saigon Jewelry Company SJC and Bao Tin Minh Chau on the November 4th session and sell it on today's session (January 11th), buyers will make a profit of 5 million VND/tael.

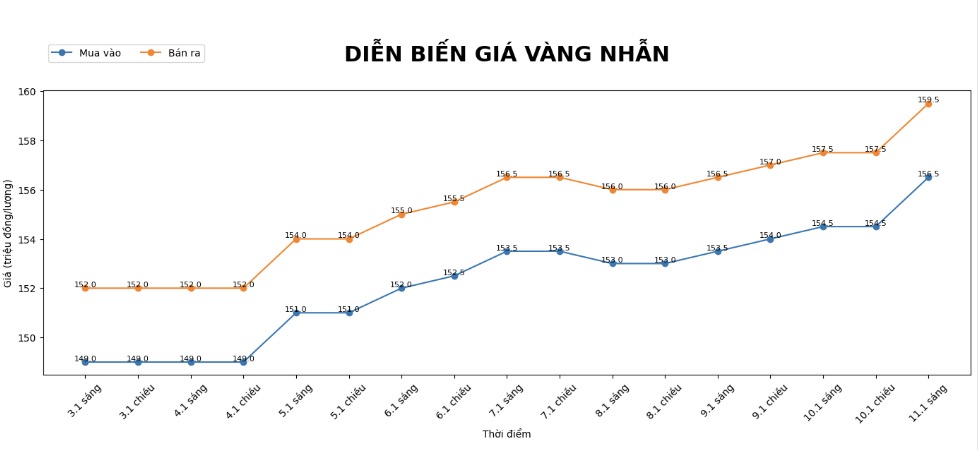

9999 gold ring price

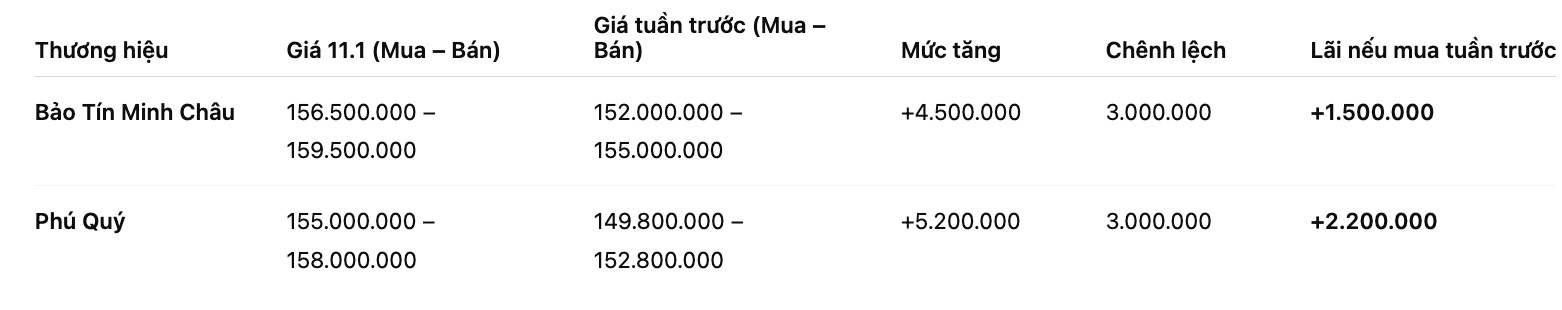

Bao Tin Minh Chau listed the price of gold rings at 156.5-159.5 million VND/tael (buying - selling); an increase of 4.5 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at 155-158 million VND/tael (buying - selling), an increase of 5.2 million VND/tael in both directions compared to a week ago. The buying - selling difference is at 3 million VND/tael.

If you buy gold rings in the session on November 4th and sell them in today's session (January 11th), buyers at Bao Tin Minh Chau will make a profit of 1.5 million VND/tael, while the profit when buying gold rings in Phu Quy is 2.2 million VND/tael.

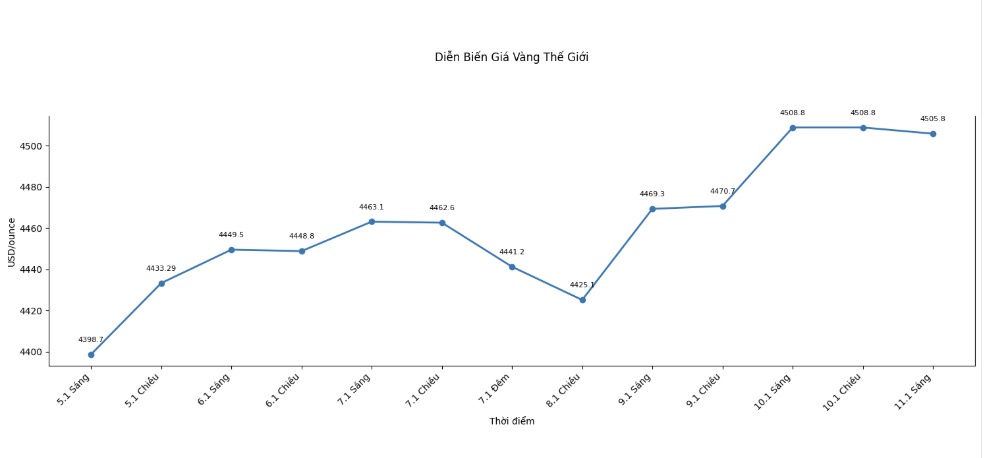

World gold price

Closing the weekly trading session, world gold prices were listed at the threshold of 4,505.8 USD/ounce, a sharp increase of 175.5 USD compared to a week ago.

Gold price forecast

After a week of strong volatility, world gold prices closed at 4,505.8 USD/ounce, an increase of more than 175 USD compared to the previous week, clearly reflecting the shelter demand of cash flow in the context of global risk still existing.

This development is creating an important support for the domestic gold market, especially SJC gold bars and gold rings, which have increased sharply in recent sessions.

According to Mr. Sean Lusk, Co-Director of Trade Risk Prevention at Walsh Trading, the increase in precious metals in the past week not only stemmed from economic data but was also dominated by geopolitical factors and investor defensive psychology.

He said that although gold prices slightly adjusted before the US jobs report was released, shelter demand remained good, even when the USD showed signs of recovery.

Notably, according to Mr. Lusk, the period from the end of the year to Valentine's Day is usually a positive period for the precious metals market thanks to seasonal factors and increased storage demand.

In addition, market liquidity after the holidays has not fully returned, which may make price fluctuations in the coming weeks stronger and more unpredictable. "Gold is still the focus of cash flow. It is highly likely that the market will have another upward momentum in the first quarter before entering the stage of re-evaluating trends," Mr. Lusk said.

From a technical perspective, Mr. Jim Wyckoff, senior analyst at Kitco, believes that buying power still appears steadily every time gold prices adjust. This shows that the market's fear of risk is still very high.

According to him, the 4.584 USD/ounce zone - the historical peak - is an important resistance level that buyers are aiming for. Meanwhile, the area around 4,400 USD/ounce continues to play the role of a near support zone, helping to limit the risk of deep correction.

With a complex geopolitical context, US monetary policy has not had a clear turning point and the trend of diversifying global reserves is increasing, many experts believe that gold's shelter role has not declined.

In the short term, although there may be fluctuations, the main trend of the precious metal market still leans towards a positive scenario, especially when defensive cash flow continues to turn to gold as a safe support.

See more news related to gold prices HERE...