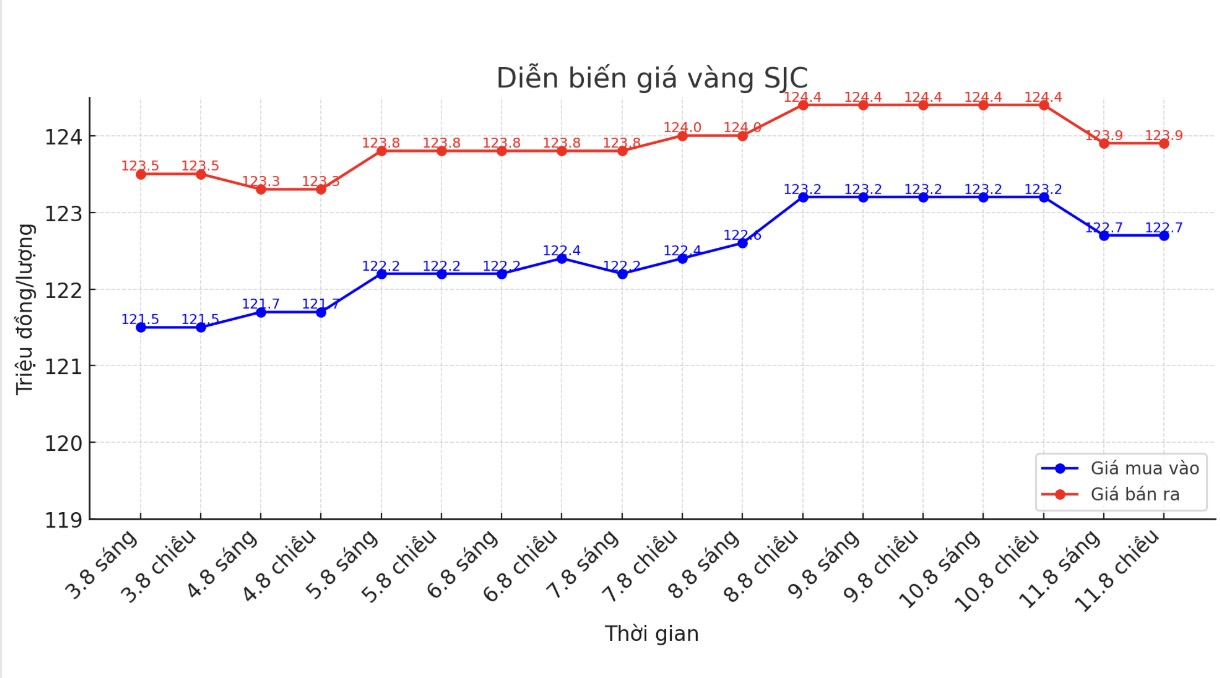

SJC gold bar price

As of 5:00 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND122.7-123.9 million/tael (buy in - sell out), down VND500,000/tael in both directions. The difference between buying and selling prices is at 1.2 million VND/tael.

DOJI Group listed at 122.7-123.9 million VND/tael (buy - sell), down 500,000 VND/tael in both directions. The difference between buying and selling prices is at 1.2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 122.7-123.9 million VND/tael (buy - sell), down 500,000 VND/tael in both directions. The difference between buying and selling prices is at 1.2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 121.9-123.9 million VND/tael (buy - sell), down 300,000 VND/tael for buying and down 500,000 VND/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

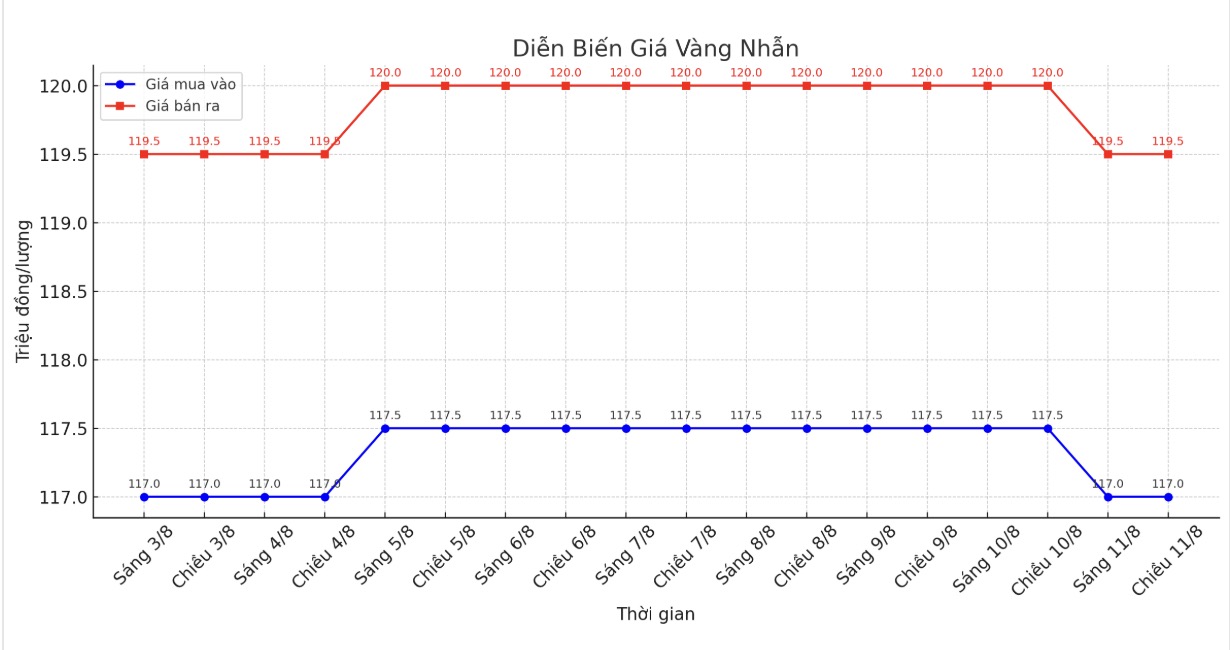

9999 gold ring price

As of 5:00 p.m., DOJI Group listed the price of gold rings at 117-111.5 million VND/tael (buy in - sell out), down 500,000 VND/tael in both directions. The difference between buying and selling is 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 117.3-120.3 million VND/tael (buy - sell), down 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 116.5-111.5 million VND/tael (buy in - sell out), down 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

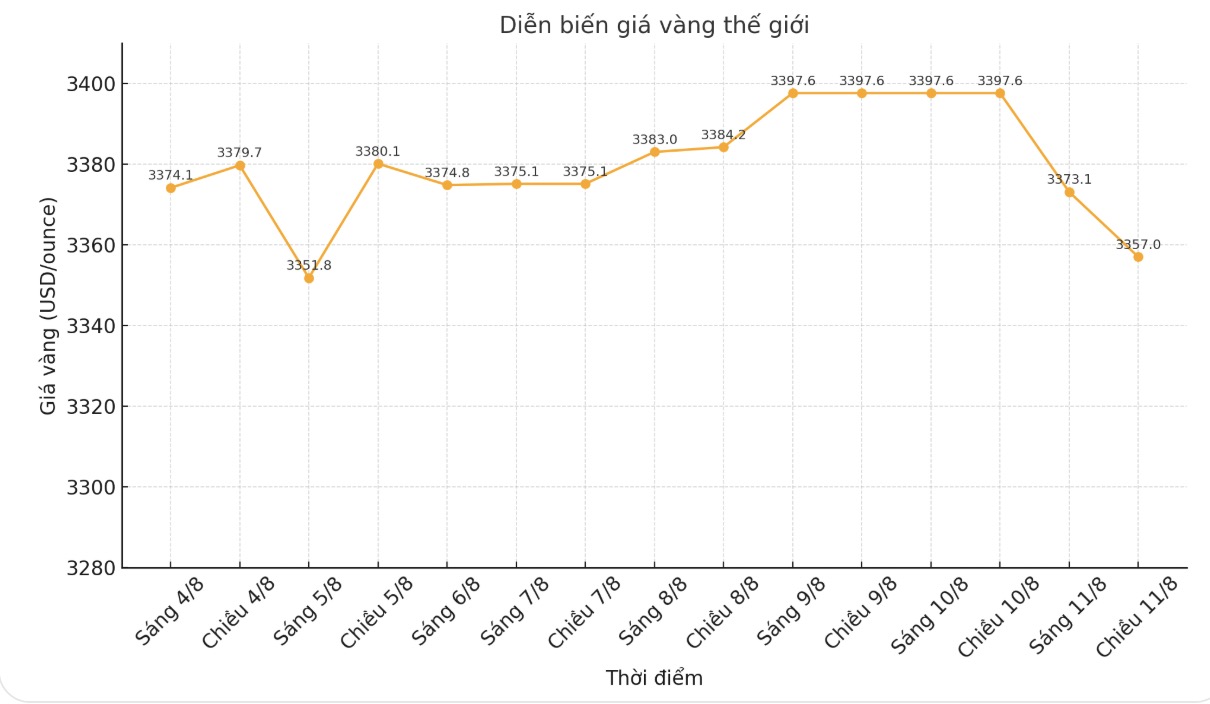

World gold price

The world gold price was listed at 5:10 p.m. at 3,357 USD/ounce, down sharply by 40.6 USD.

Gold price forecast

Gold prices fell 1% in the trading session on Monday (August 11) as the market focused on the upcoming negotiations between the US and Russia on the Ukrainian conflict, along with July inflation data that could provide more clues about the interest rate outlook of the US Federal Reserve (FED).

geopolitical tensions over the war in Ukraine have cooled gold prices further, after US President Donald Trump announced on Friday that he would meet Russian President Vladimir Putin in the US, said Matt Simpson, senior analyst at City Index.

Mr. Trump said on Friday that he will meet Mr. Putin on August 15 in Alaska to negotiate an end to the war.

Meanwhile, US consumer price data is expected to be released on Tuesday, with newly applied tax rates forecast to push the core index up 0.3%, bringing the annual growth rate to 3%, higher than the 2% target of the US Federal Reserve (FED).

If inflation rises, the US dollar could strengthen and make it difficult for gold prices to increase. However, I think gold prices will still be supported because investors will take advantage of buying when prices fall, Trump said.

The recent weaker-than-expected US jobs report has raised expectations of a Fed rate cut in September. The market is reflecting a 90% chance of easing in September and at least one more cut before the end of the year.

Gold - non-interest-bearing assets often benefit in a low interest rate environment. The market is also watching US-China trade talks as Trump's deadline for a deal between Washington and Beijing on August 12 is approaching.

James Stanley - senior market strategist at Forex.com predicted: "In. I have maintained an optimistic view for a long time and have not seen a reason to change. For spot gold, the $3,435/ounce mark stands out because it has been tested three times in May, June and July, but each time after the adjustment level is smaller, I think buyers will still be proactive and can create a breakthrough".

Stanley added: The larger rate is $3,500 an ounce, which was tested in April. I hope the next try will take place after a steady uptrend instead of a quick breakthrough, because if the increase is too fast, the buyers will easily stagnate."

Michael Moor founder of Moor Analytics analyzed that technical milestones showed many bullish signals that were confirmed at different time frames.

Economic data to watch this week

Tuesday: RBA interest rate decision, US CPI in July, speeches by Barkin and Schmid (FED).

Wednesday: Speeches by Barkin, Bostic and Goolsbee (FED).

Thursday: US PPI July, US jobless claims.

Friday: US retail sales in July, New York Empire State Production Index, Michigan Consumer Confidence Index (preliminary estimate).

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...