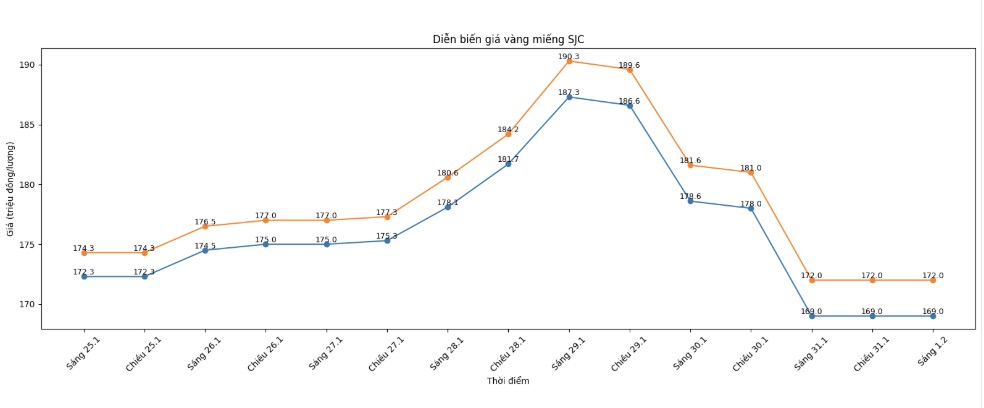

SJC gold bar price

Closing the week's trading session, Saigon SJC Jewelry Company listed SJC gold prices at 169-172 million VND/tael (buying - selling). The buying - selling difference is at 3 million VND/tael.

Compared to the closing session of last week's trading (January 25), the price of SJC gold bars at Saigon SJC Jewelry Company decreased by 3.3 million VND/tael on the buying side and decreased by 2.3 million VND/tael on the selling side.

Meanwhile, DOJI listed SJC gold price at 169-172 million VND/tael (buying - selling). The buying - selling difference is at 3 million VND/tael.

Compared to the closing session of last week's trading (January 25), SJC gold bar price at DOJI decreased by 3.3 million VND/tael on the buying side and decreased by 2.3 million VND/tael on the selling side.

Notably, Bao Tin Minh Chau this morning did not list the buying and selling prices of stockpiled gold, including SJC gold bars and plain round gold rings.

Thus, if buying SJC gold bars in the January 25th session and selling them in today's session (February 1st), buyers at Saigon SJC Jewelry Company and the Group will both lose 5.3 million VND/tael. Meanwhile, the level of loss when buying SJC gold bars at Bao Tin Minh Chau is not clear, as this enterprise has not updated the price to the system.

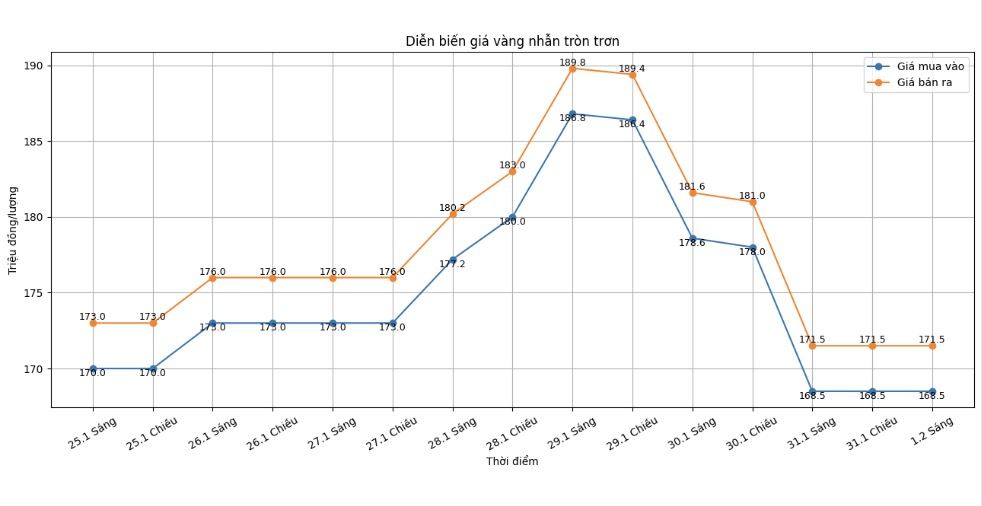

9999 gold ring price

At the same time, DOJI Group listed the price of gold rings at the threshold of 168.5-171.5 million VND/tael (buying - selling), down 1.5 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Jewelry Group listed the price of gold rings at the threshold of 168.8-171.8 million VND/tael (buying - selling), down 1.7 million VND/tael in both directions compared to a week ago. The buying - selling difference is at 3 million VND/tael.

If buying gold rings in the session on January 25 and selling them in today's session (February 1), buyers at DOJI will lose 4.5 million VND/tael, while the loss for gold ring buyers in Phu Quy is 4.7 million VND/tael.

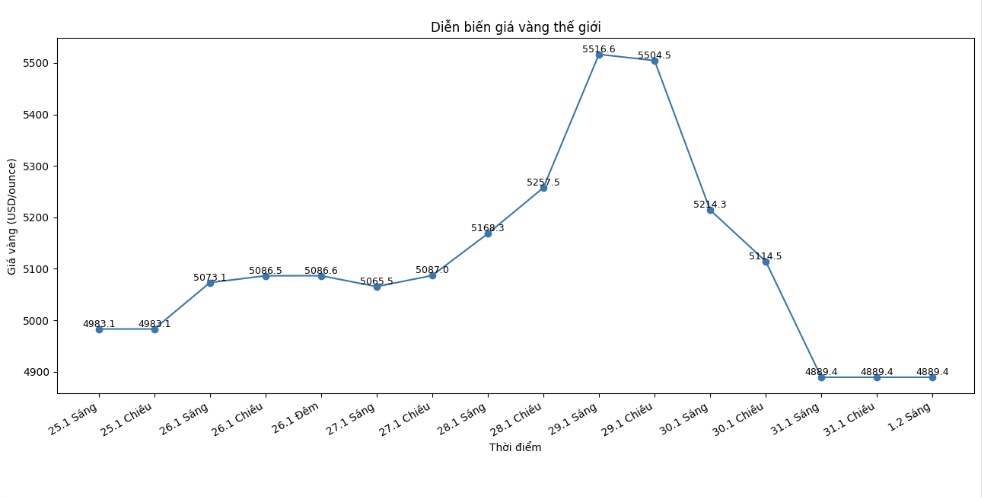

World gold price

Closing the week's trading session, world gold prices were listed at 4,889.4 USD/ounce, down 93.7 USD compared to a week ago.

Gold price forecast

After a week of trading considered "rare extreme in history", world gold prices entered a new phase with cautious sentiment covering the market. The fact that the precious metal continuously broke the peak, reaching the milestone above 5,600 USD/ounce and then quickly plunging deeply below 4,700 USD/ounce shows that the overheated state has been strongly sold off, while the short-term trend is still not really clear.

At the end of the week, world gold prices stopped at around 4,889 USD/ounce, down more than 90 USD compared to the previous week. Although the weekly decrease was only more than 2.6%, the fluctuation range in sessions was very large, reflecting the fierce tug-of-war between bottom-fishing buyers and profit-taking and loss-cutting selling forces.

According to assessments by many Wall Street experts, the gold market is facing an important turning point. A part believes that the current correction is just the beginning, as factors of pressure such as the stronger USD and increased US bond yields are still present. Meanwhile, the remaining group believes that low price zones are gradually attracting long-term cash flow, especially in the context that geopolitical risks and global financial instability have not disappeared.

Ms. Ipek Ozkardeskaya - Market Strategist at Swissquote - believes that gold prices may continue to test the deeper support zone around 4,600 USD/ounce. However, according to her, strong corrections like today are likely to be seen by investors as an opportunity to consolidate buying positions, because long-term drivers of gold such as high global public debt, demand for safe-haven assets and the weakening trend of the USD have not changed.

From a more cautious perspective, Mr. Alex Kuptsikevich - an analyst at FxPro - said that the 4,700 USD/ounce zone is an important technical support level in the short term. If this zone is decisively broken, gold prices could completely fall deeper, before forming a new sustainable bottom.

In the coming week, the diễn biến of gold prices is forecast to continue to be unpredictable, as the market must "digest" a series of important US economic data, especially jobs reports and new signals about monetary policy.

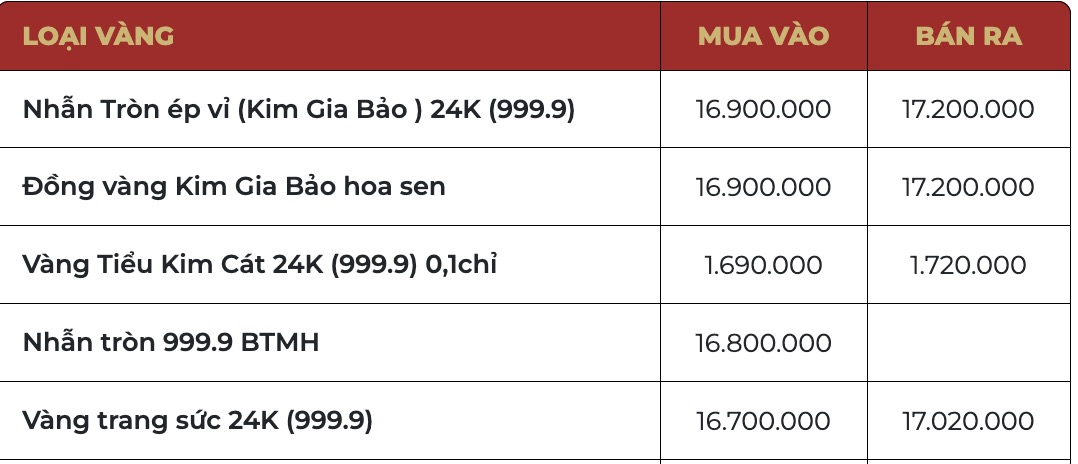

Below are price updates on the websites of some business units:

See more news related to gold prices HERE...