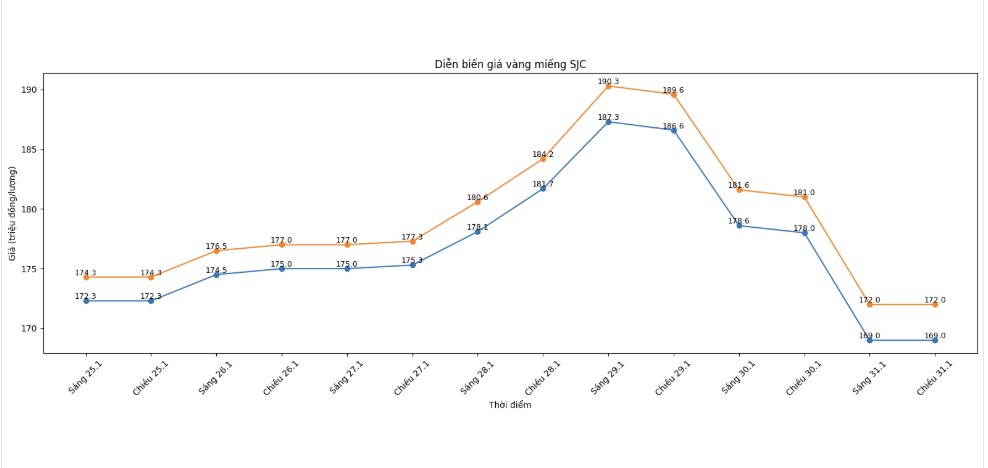

SJC gold bar price

As of 6:00 AM, SJC gold bar prices were listed by DOJI Group at the threshold of 169-172 million VND/tael (buying - selling), down 9 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 3 million VND/tael.

SJC gold bar prices were listed by Bao Tin Minh Chau at the threshold of 169-172 million VND/tael (buying - selling), down 9 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 3 million VND/tael.

Phu Quy Jewelry Group listed SJC gold bar prices at 169-172 million VND/tael (buying - selling), down 8.6 million VND/tael on the buying side and down 9 million VND/tael on the selling side. The difference between buying and selling prices is at 3 million VND/tael.

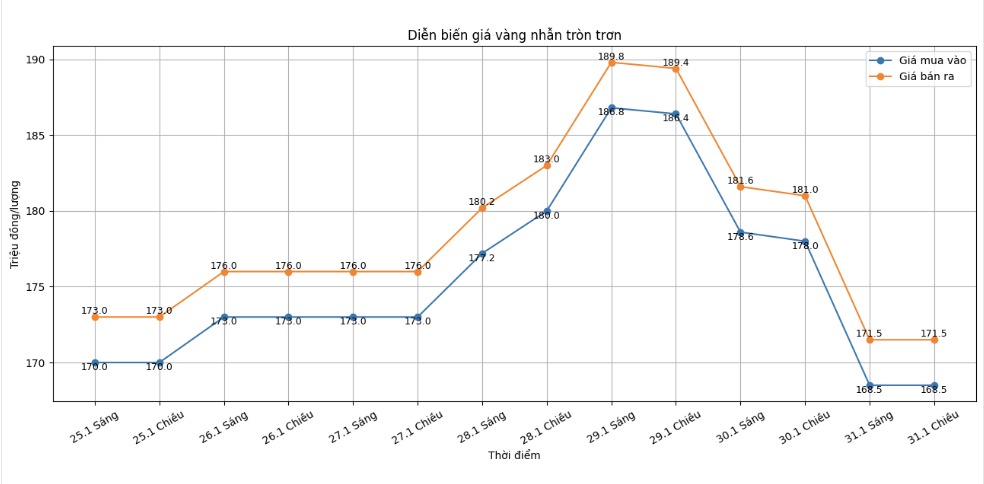

9999 gold ring price

As of 6:00 AM, DOJI Group listed the price of gold rings at the threshold of 168.5-171.5 million VND/tael (buying - selling), down 9.5 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 169-172 million VND/tael (buying - selling), down 9 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold and Gems Group listed the price of gold rings at 168.5-171.5 million VND/tael (buying - selling), down 8.8 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

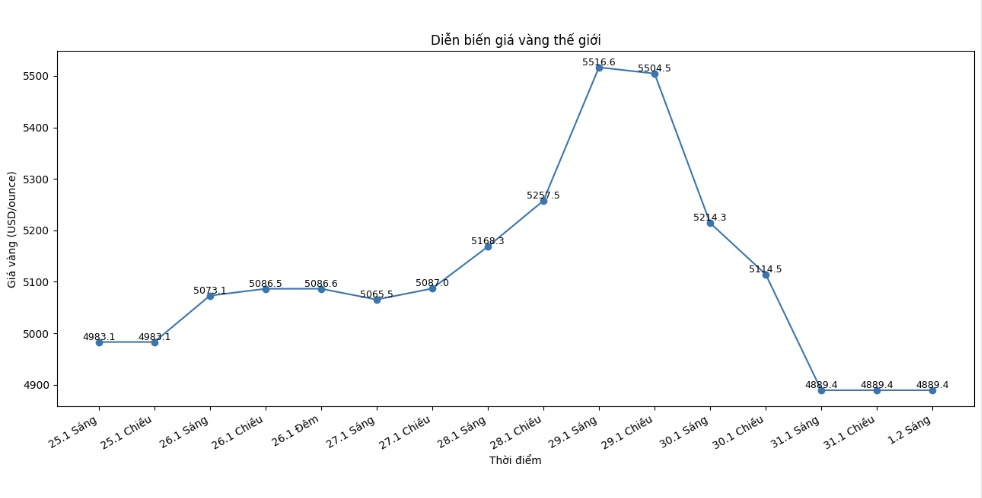

World gold price

At 6:00 AM, world gold prices were listed around the threshold of 4,889.4 USD/ounce, up 149.4 USD compared to the previous day.

Gold price forecast

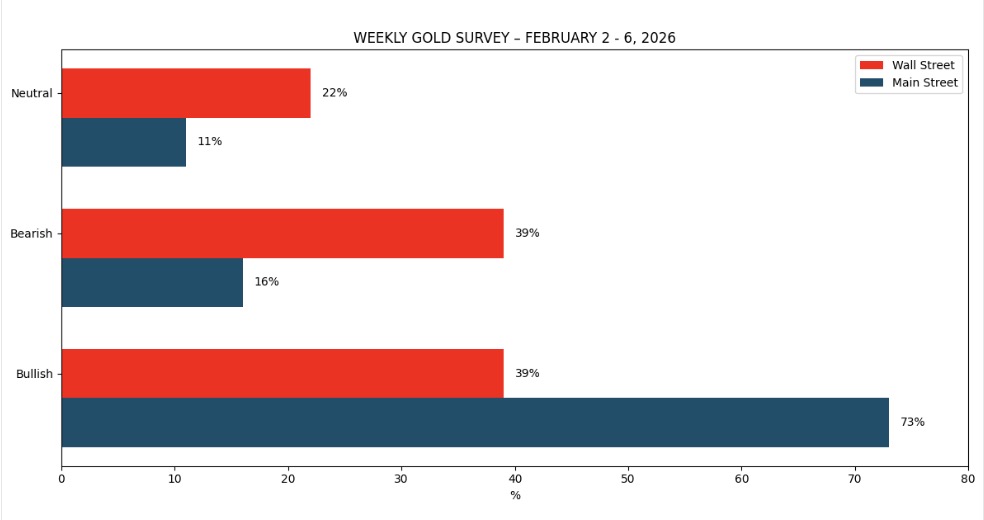

After the recent deep decline, the world gold market is entering a sensitive phase when supporting and pressing factors intertwine. The latest weekly gold survey shows that Wall Street analysts have not yet found common ground on the short-term trend of precious metals, in the context of price fluctuations taking place with great intensity.

This week, 18 experts participated in the survey. The results reflected a clear differentiation when the number of opinions predicting gold prices to increase and decrease both accounted for 39%. The rest believed that gold could fluctuate widely, waiting for new signals from the macroeconomy. This development shows that cautious sentiment is covering institutional investors after a period of "hot" increase and strong adjustment.

Some experts still maintain a positive view, saying that the recent decline is more technical than a reversal of the trend. According to Ole Hansen - Commodity Strategy Director at Saxo Bank, gold is still supported in the medium term thanks to its shelter role, but deep corrections are inevitable as the market has accumulated a large increase in a short time.

In the opposite direction, many opinions warn that the risk of price decline is still present, especially when the expectation of interest rate cuts by the US Federal Reserve (Fed) shows signs of weakening. The USD stabilizing and high US bond yields are putting significant pressure on gold - a non-performing asset.

Notably, the psychology of individual investors is in contrast to Wall Street. Kitco's online survey shows that more than 70% of small investors still believe that gold prices will recover next week. This reflects the belief that strong corrections may open up buying opportunities, especially in the context of economic and geopolitical instability that has not cooled down.

Next week, the market will closely monitor a series of important US economic data, focusing on job reports to shape interest rate expectations. In addition, policy decisions of many major central banks may also create strong fluctuations, causing gold prices to continue to fluctuate unpredictably in the short term.

Gold price data is compared to the previous day.

See more news related to gold prices HERE...