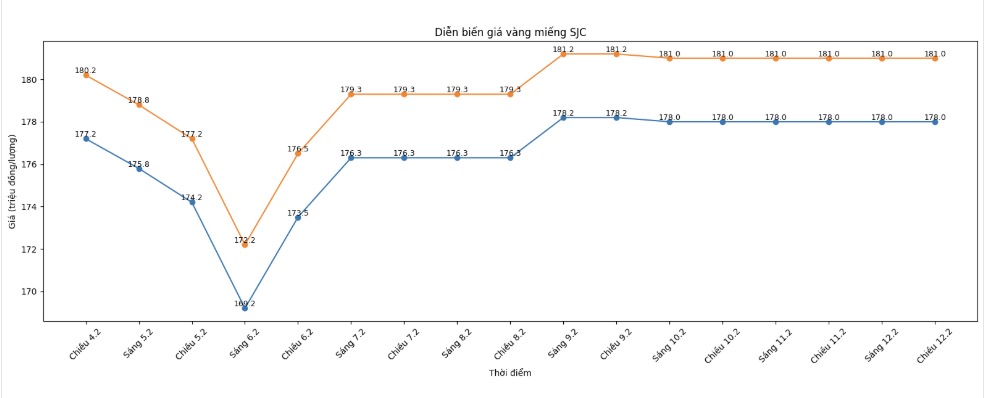

SJC gold bar price

As of 7:30 PM, SJC gold bar prices were listed by DOJI Group at 178-181 million VND/tael (buying - selling), unchanged in both directions. The difference between buying and selling prices is at 3 million VND/tael.

Bao Tin Minh Chau listed SJC gold bar prices at 178-181 million VND/tael (buying - selling), unchanged in both directions. The difference between buying and selling prices is at 3 million VND/tael.

SJC gold bar prices were listed by Phu Quy Gold and Gems Group at the threshold of 177.5-181 million VND/tael (buying - selling); unchanged in both directions. The difference between buying and selling prices is at 3.5 million VND/tael.

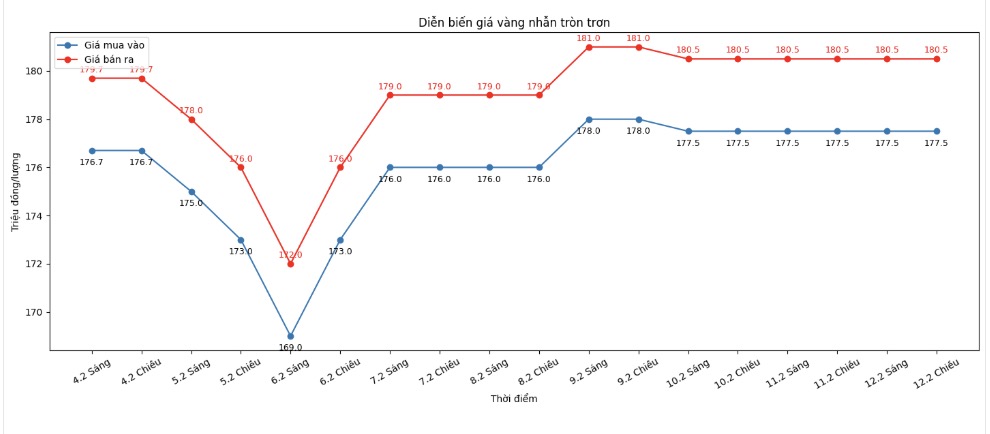

9999 gold ring price

As of 7:30 PM, DOJI Group listed the price of gold rings at 177.5-180.5 million VND/tael (buying - selling); unchanged in both directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 178-181 million VND/tael (buying - selling), unchanged in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold and Gems Group listed the price of gold rings at 177.5-180.5 million VND/tael (buying - selling), unchanged in both buying and selling directions. The buying - selling difference is at 3 million VND/tael.

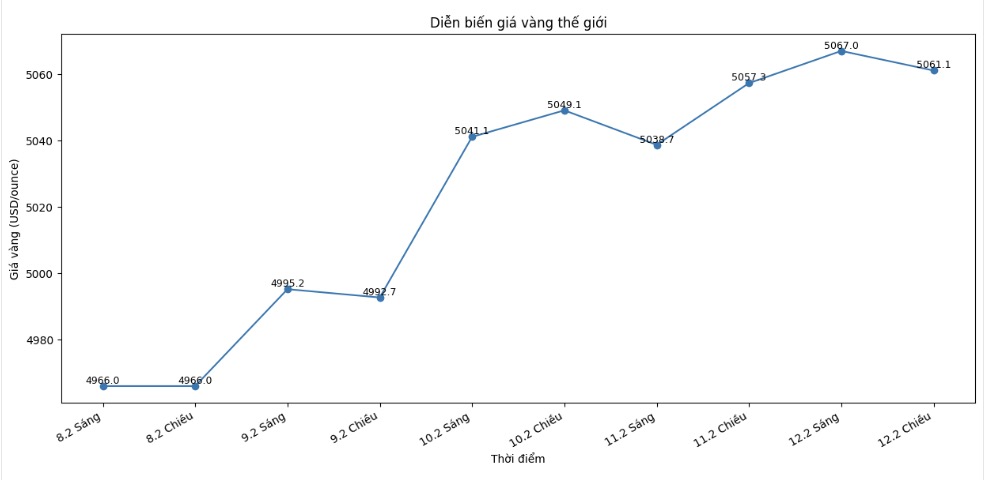

World gold price

At 7:30 PM, world gold prices were listed around the threshold of 5,061.1 USD/ounce; an increase of 3.8 USD compared to the previous day.

Gold price forecast

The gold market enters 2026 with a strong upward trend but accompanied by fierce fluctuations. The diễn biến in January is seen by many experts as a manifestation of high fluctuations in the record price range, rather than a sign of weakening of the long-term upward trend.

According to Imaru Casanova - Director of Gold and Precious Metals at Van Eck - gold prices had an "extraordinary but volatile start". She said that escalating geopolitical tensions, along with threats of tariffs and sanctions from the US, pushed gold beyond the psychological 5,000 USD/ounce mark by the end of January. Breaking this threshold triggered a wave of speculative buying, bringing prices to a peak of 5,595 USD/ounce on the day, nearly 1,300 USD higher than by the end of 2025.

However, after the hot increase, the market quickly adjusted. The information about nominating Kevin Warsh for the position of Chairman of the US Federal Reserve (Fed) has become a catalyst causing gold to plummet sharply, falling about 9% in just one day. However, Casanova emphasized that the core drivers of gold remain unchanged: solid investment demand, buying power from central banks and safe haven role in the face of global instability.

Strong fluctuations in the peak area should not distract investors," she said. According to this expert, geopolitical risks, inflation concerns, the possibility of the USD weakening and the risk of correction in the stock market will continue to support gold in 2026. New highs may appear interspersed with corrections and sideways phases, but the gold price increase cycle is expected to last for many years.

In the derivatives market, the Comex gold contract for February delivery recently increased by 67.8 USD/ounce, closing at 5,071.6 USD/ounce. Although the US jobs data for January exceeded expectations, narrowing the possibility of the Fed early interest rate cut, traders still maintained a defensive position against monetary policy incertitudes. The 5,000 USD/ounce mark is currently considered an important support zone; if maintained, technical prospects lean towards positive. Conversely, the 4,800 USD/ounce zone may play the role of the next support.

Since the beginning of the year, gold prices have increased by more than 17%, continuing the upward momentum of January. This development shows that cash flow is still turning to precious metals as a channel to preserve value in the context of macroeconomic and financial risks that have not cooled down.

Notable economic calendar of the week

US non-farm payroll.

US Weekly Unemployment Benefit Application; Current House Sales in the US.

US Consumer Price Index (CPI).

Gold price data is compared to the previous day.

See more news related to gold prices HERE...