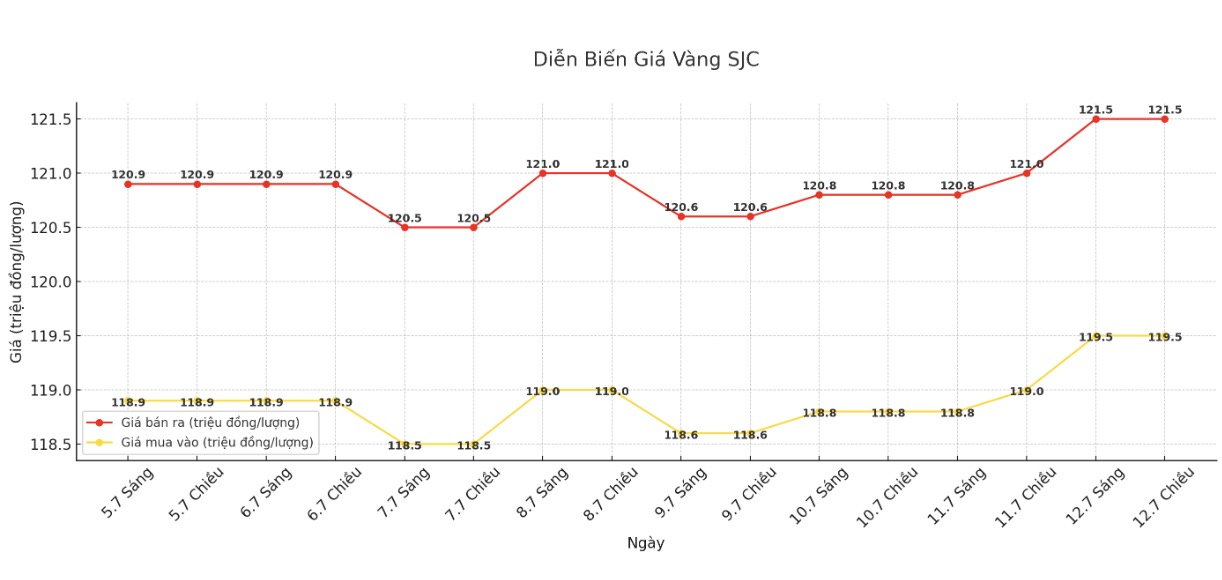

SJC gold bar price

As of 5:15 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 119.5-121.5 million/tael (buy in - sell out); increased by VND 500,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

DOJI Group listed at VND 119.5-121.5 million/tael (buy - sell); increased by VND 500,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at VND 119.5-121.5 million/tael (buy in - sell out); increased by VND 500,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 118.8-121.5 million VND/tael (buy - sell); increased by 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2.7 million VND/tael.

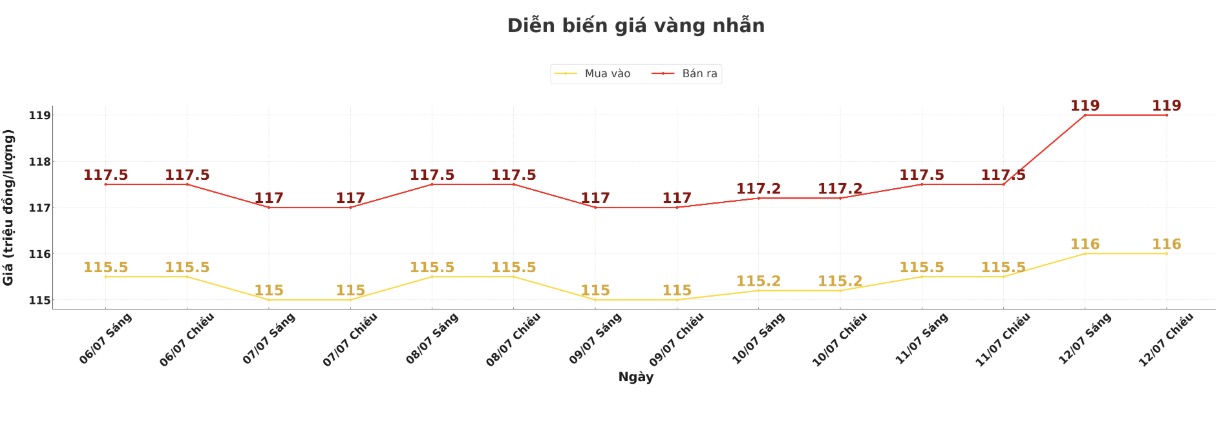

9999 gold ring price

As of 5:15 p.m., DOJI Group listed the price of gold rings at 116-119 million VND/tael (buy in - sell out), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 116.2-119.2 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 115.2-118.2 million VND/tael (buy in - sell out), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

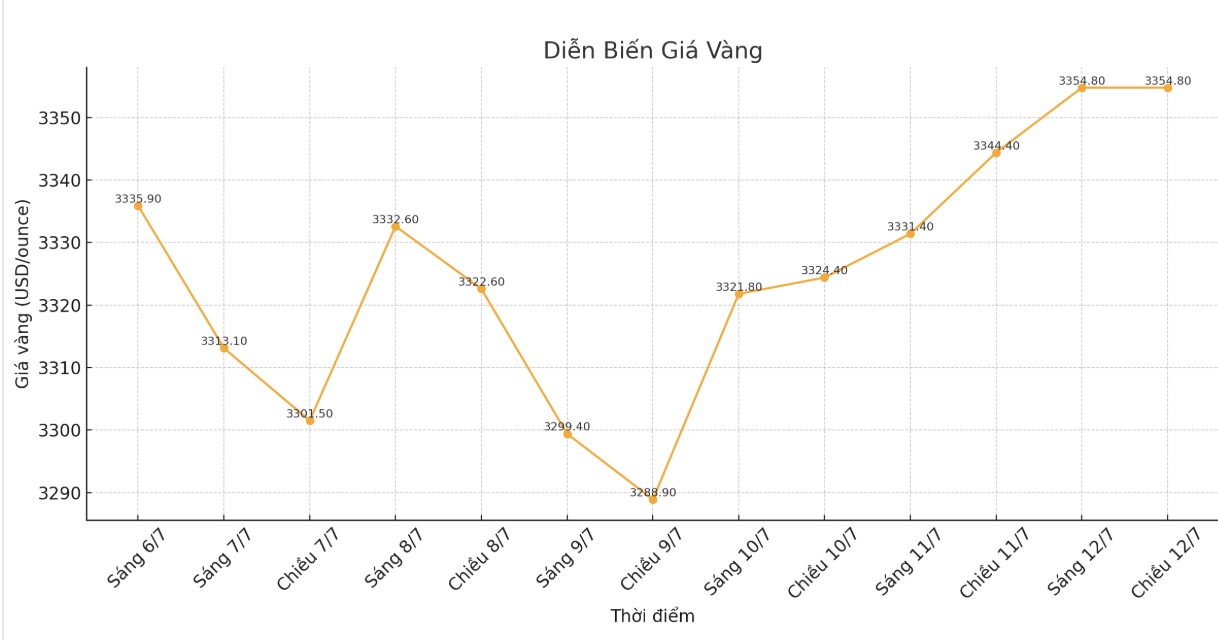

World gold price

The world gold price was listed at 5:15 p.m. at 3,354.8 USD/ounce, up 10.4 USD/ounce compared to 1 day ago.

Gold price forecast

Robert Minter - ETF Strategy Director at abrdn commented: "Gold is like big banks in a financial crisis - "too big to fail". Gold is the foundation of the monetary system, so it cannot be taxed. Gold is not, and so is silver.

It is not ruled out that silver will be the next metal to fall under the president's tariff watch. In addition, industrial metals such as copper and silver are taking the wind from the growth cycle, so it is inevitable to attract attention, said the expert.

However, analysts still note that although gold has built a solid support zone, the strong increase of copper and silver will somewhat curb gold's short-term breakthrough.

Callum Thomas - Head of Research at Topdown Charts commented: "Some risk factors that have driven gold demand are fading away, such as concerns that economic growth may be overwhelmed by positive signals, boring tariff risks, or temporarily quiet geopolitical situations. The key point is, after being left behind, now is the time for other commodities to take on the leading role from gold.

Meanwhile, Philip Streible - Chief Strategist at Blue Line Futures believes that the shift of cash flow to other commodities will be the main factor holding back gold.

He said he bought gold when prices fell to $3,244 an ounce two weeks ago and had closed some of his position in Friday's rally.

Ole Hansen - Head of Commodity Strategy at Saxo Bank - also commented that gold is currently lacking clear momentum to return to the historical high of 3,500 USD/ounce in April.

Economic data is unlikely to maintain a positive momentum as the impact of tariffs is becoming increasingly clear. Organizational investment accounts are selling stocks that individual investors are buying into, which will end early - increasing the risk of correction, which could support gold.

With high inflation and US President Donald Trump increasingly calling for the FED to cut interest rates, there is no reason to sell gold. The problem is whether these factors are strong enough to create a breakthrough. In my opinion, it will happen in the end, but the market is still struggling between medium-term support and short-term profit-taking pressure as trading floors reduce risks before the summer vacation, he said.

Economic data to watch next week

Tuesday: US Consumer Price Index (CPI), Empire State manufacturing survey.

Wednesday: US Producer Price Index (PPI).

Thursday: Retail sales, Philly Fed manufacturing survey, US weekly jobless claims.

Friday: Newly started houses, University of Michigan preliminary consumer confidence index.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...