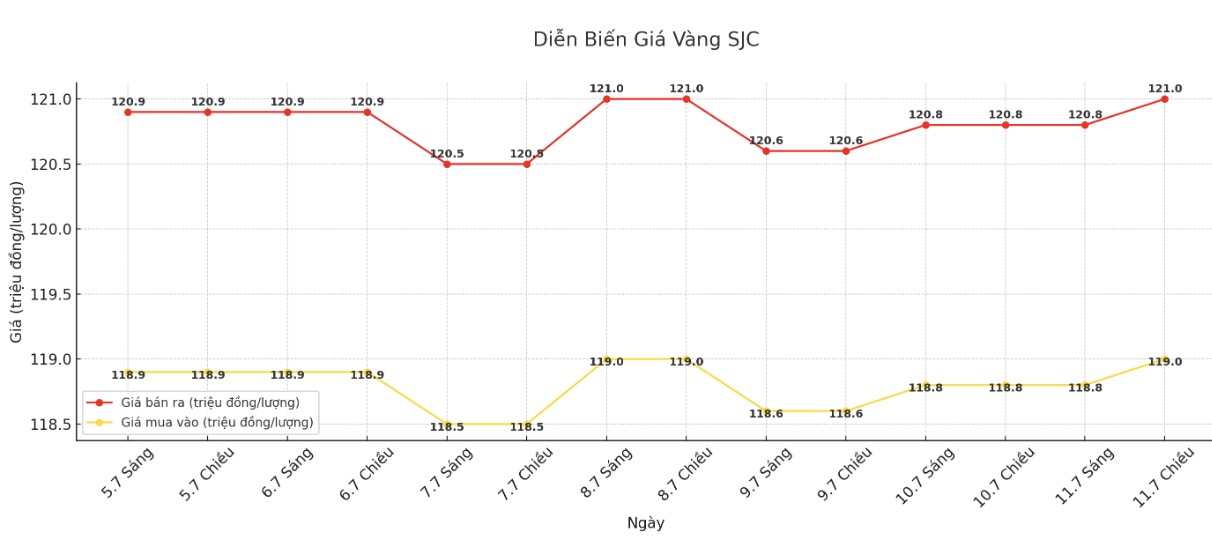

SJC gold bar price

As of 6:00 a.m. on July 12, the price of SJC gold bars was listed by Saigon Jewelry Company at VND119-121 million/tael (buy in - sell out); increased by VND200,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

DOJI Group listed at 119-121 million VND/tael (buy - sell); increased by 200,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 119-121 million VND/tael (buy - sell); increased by 200,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 118.3-121 million VND/tael (buy in - sell out); increased by 200,000 VND/tael in both directions. The difference between buying and selling prices is at 2.7 million VND/tael.

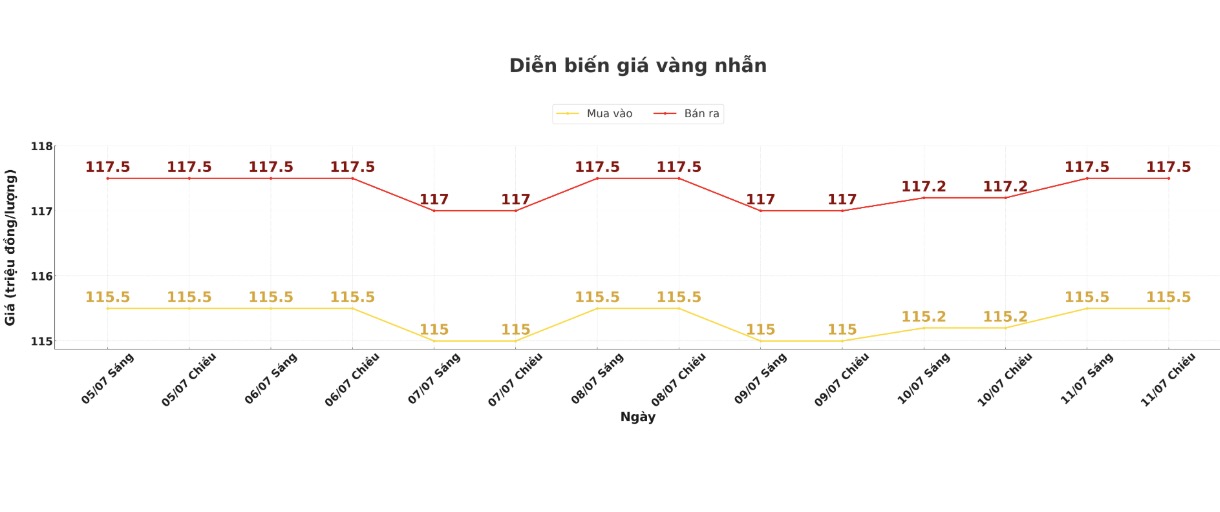

9999 gold ring price

As of 6:00 a.m. on July 12, DOJI Group listed the price of gold rings at VND 115.5-118.5 million/tael (buy - sell), an increase of VND 300,000/tael for buying and an increase of VND 1.3 million/tael for selling. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 115.7-118.7 million VND/tael (buy - sell), an increase of 400,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 114.7-117.7 million VND/tael (buy in - sell out), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

World gold price

Recorded at 10:30 p.m. on July 11, spot gold was listed at $3,365.30/ounce, up5.4 USD.

Gold price forecast

World gold prices increased sharply as the risk-off sentiment increased at the end of the week, supporting safe-haven metals. August gold futures are currently up 33.6 USD, up to 3,359.3 USD/ounce. September silver futures are currently up $1.03, up to $38.335 an ounce.

Risk fears will increase this weekend as the US steps up threats of tariffs on other countries, tensions between the US and Russia escalate, and the Middle East situation could become more unstable.

stocks in Asia and Europe fluctuated in opposite directions in the overnight trading session. US stock indexes are expected to open lower than today in New York.

Technically, August gold buyers have a short-term technical advantage. The next price target for buyers is to close above the solid resistance level of 3,400 USD/ounce. The next price target for the sellers is to push the price below the technical support level of 3,250.5 USD/ounce.

The first resistance level was seen at $3,376.9/ounce and then $3,400/ounce. The first support level was an overnight low of $3,332.30 an ounce and then $3,300 an ounce.

Key outside markets today showed a slight increase in the USD index. Nymex crude oil prices are stable and trading around 67.25 USD/barrel. The yield on the 10-year US Treasury note is currently at 4.391%.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...