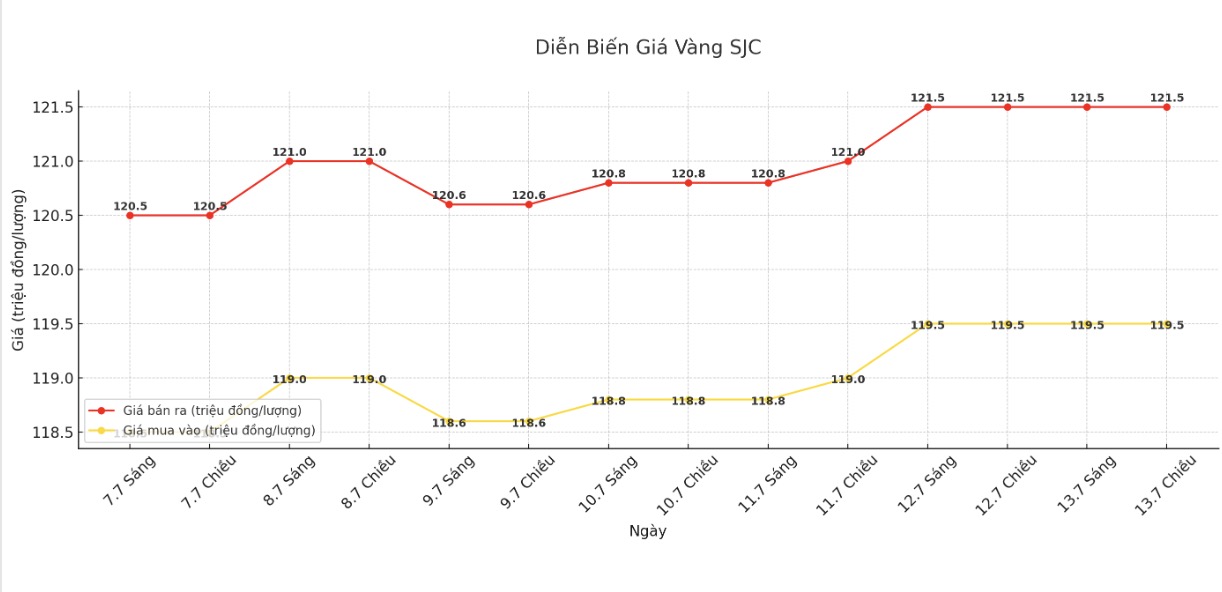

SJC gold bar price

At the end of the trading session of the week, Saigon Jewelry Company SJC listed the price of SJC gold at 119.5-121.5 million VND/tael (buy in - sell out).

Compared to the closing price of the previous trading session (July 6, 2025), the price of SJC gold bars at Saigon Jewelry Company SJC increased by 600,000 VND/tael in both directions.

The difference between the buying and selling prices of SJC gold at Saigon Jewelry Company SJC is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at VND 119.5-121.5 million/tael (buy in - sell out). Compared to a week ago, the price of SJC gold bars was adjusted by Bao Tin Minh Chau to increase by 600,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

If buying SJC gold at Bao Tin Minh Chau and Saigon Jewelry Company SJC in the session of July 6 and selling it in today's session (July 13), buyers will lose 1.4 million VND/tael.

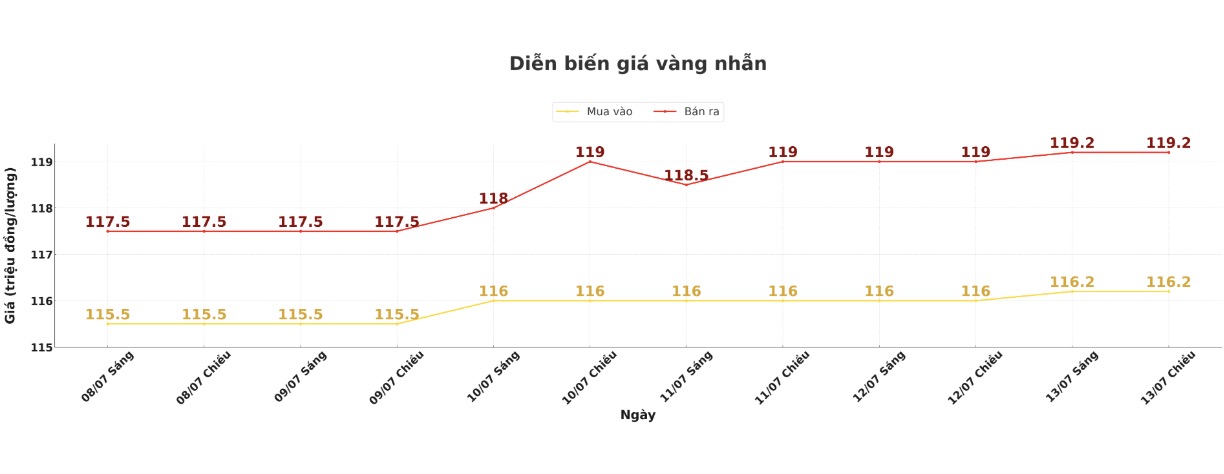

9999 gold ring price

This afternoon, Bao Tin Minh Chau listed the price of gold rings at 116.2-119.2 million VND/tael (buy - sell); an increase of 500,000 VND/tael in both directions compared to a week ago. The difference between buying and selling is at 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 115.2-118.2 million VND/tael (buy - sell), an increase of 900,000 VND/tael in both directions compared to a week ago. The difference between buying and selling is 3 million VND/tael.

If buying gold rings in the session of July 6 and selling in today's session (July 13), buyers at Bao Tin Minh Chau will lose 2.5 million VND/tael, while the loss when buying in Phu Quy is 2.1 million VND/tael.

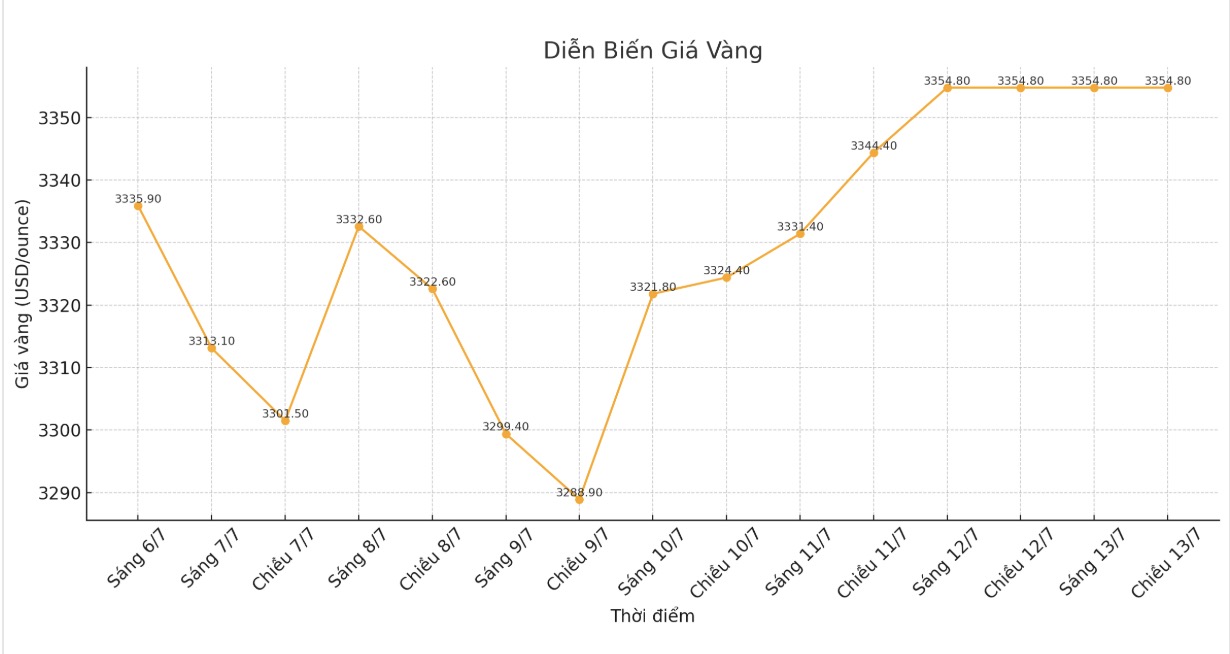

World gold price

At the end of the trading session of the week, the world gold price was listed at 3,354.8 USD/ounce, up 18.9 USD/ounce compared to the closing price of the previous trading session.

Gold price forecast

The majority of Wall Street experts are optimistic and neutral on gold's short-term outlook.

Gold fell on Monday and Tuesday but ended the week with three straight sessions of increase, said Marc Chandler, managing director at Bannockburn Global Forex. US tariffs seem to have helped the precious metal recover. However, it is unclear whether the accumulation process since the peak of nearly 3,500 USD/ounce has ended.

Chandler said the current accumulation zone is currently peaking around $3,422/ounce and bottoming around $3,275/ounce. Crossing the US CPI on Tuesday and announcing tariffs to the EU could help clarify the situation. Few people are really optimistic about gold. It seems like a matter of timing rather than a trend, he said.

Prices will increase, said Darin Newsom, senior market analyst at Barchart.com. I dont look at charts or news anymore. As long as the US situation does not have major fluctuations, gold will continue to be a safe haven, especially before every weekend.

James Stanley, senior market strategist at Forex.com, also sees prices moving up. Anti-regulatory transactions are rising strongly, while gold is falling behind Bitcoin and silver in the short term. But I think it is just an unusual phenomenon. Over the past two weeks, gold has reacted strongly after re-evaluating the supporting trend line. I think the long-term position is still leaning towards buyers and we can still continue to see gold move up, like the past 17 months since the 2,000 USD/ounce test last February.

I will remain neutral on gold next week. The main factor is still what happens to the USD around tax or policy announcements, which is unpredictable, said Colin Cieszynski, chief market strategist at SIA Wealth Management.

Meanwhile, Daniel Pavilonis, senior commodities broker at RJO Futures, is analyzing the potential impact of the US budget bill on gold's rally.

Economic data to watch next week

Tuesday: US Consumer Price Index (CPI), Empire State Manufacturing Survey.

Wednesday: US Producer Price Index (PPI).

Thursday: US retail sales, Philly Fed Manufacturing Survey, Weekly jobless claims.

Friday: Number of housing under construction in the US, University of Michigan Preliminary Consumer Confidence Index.

See more news related to gold prices HERE...