Gold price developments last week

Gold prices have fluctuated strongly this week due to commercial statements and speculation about the policy of the US Federal Reserve (FED). Despite its positive performance, the precious metal has yet to break out of the recent price range.

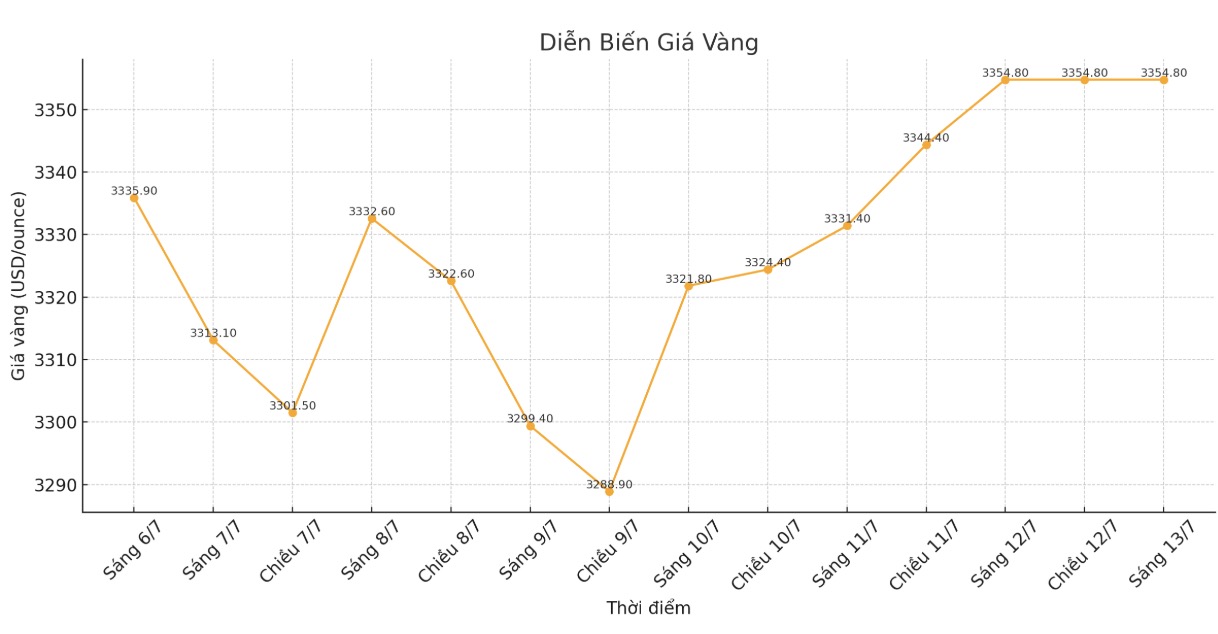

Spot gold opened the week at $3,338.55 an ounce. After falling below $3,300/ounce at 6:30 a.m. EDT, prices rebounded as US traders returned after a long holiday, pushing gold to $3,336/ounce at the end of the North American session and peaking at $3,345/ounce at 6:00 p.m.

However, this increase was so fast that prices were pulled down to $3,320/ounce by Asian and European traders. By 11:00 a.m. on Tuesday, North American traders had pushed prices down below $3,300/ounce, turning it into resistance levels that held the market flat for the rest of the session.

North American traders continued to lead the trend, bringing gold prices back above $3,300/ounce when opening the session on Wednesday. During the night, Asian and European traders pushed prices up to nearly $3,330/ounce.

The strong increase continued in the Asia session on Thursday evening, when gold prices first surpassed the 3,336 USD/ounce mark at 20:30 and then broke the peak of the week of 3,345 USD/ounce at around 06:00 on Friday morning.

At 11:15 a.m., spot gold prices hit a weekly peak of $3,368.86/ounce. The price then tested the support zone at $3,350/ounce and fluctuated within a narrow range of $5,500 around $3,355/ounce before entering the weekend.

Gold price forecast for next week

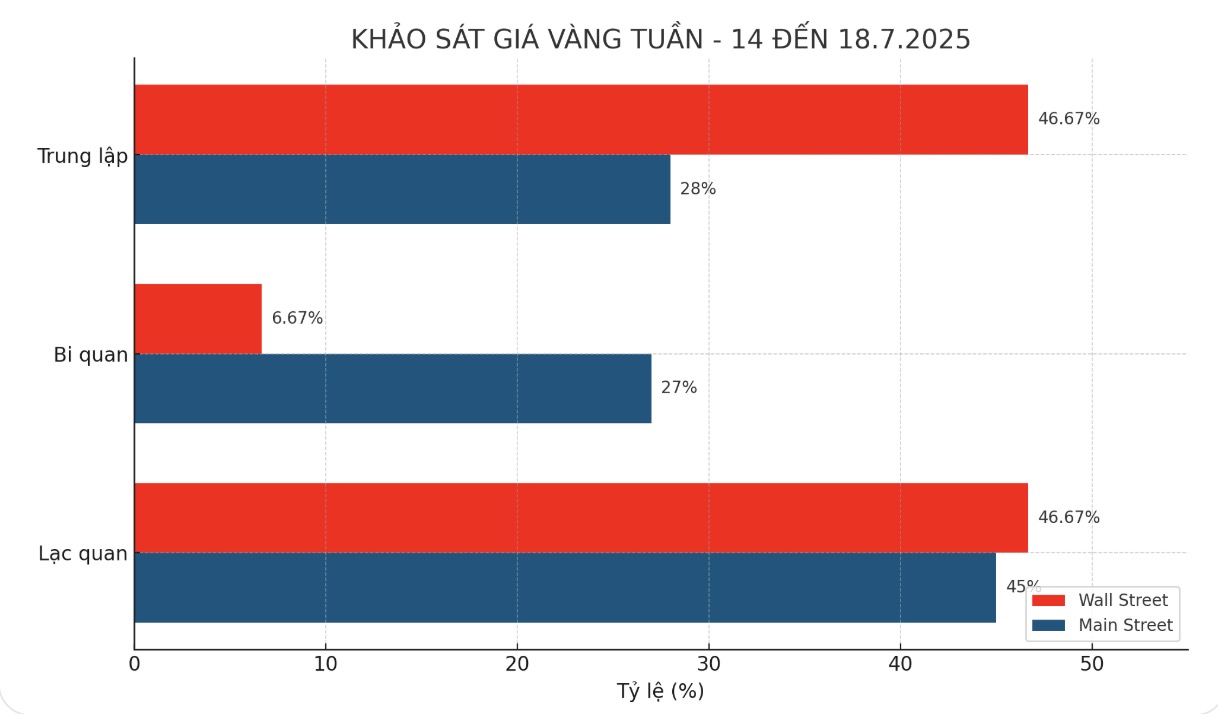

The weekly gold survey of an international financial information platform shows that industry experts share a mix of optimism and neutrality on the short-term outlook for gold prices, while retail investors turn their backs on the upward trend.

Of the 15 experts participating in the survey, 7 predict gold prices will increase; 1 person believes prices will decrease, and the remaining 7 people (47%) believe gold prices will go sideways.

Meanwhile, 231 people participated in Kitco's online survey. The majority of retail investors have previously been leaning towards an upward trend, and are now starting to fluctuate. There are 104 people predicting gold prices to increase, 63 people saying prices will decrease and 64 people saying prices will continue to move sideways next week.

Notable US economic data next week

After a quiet week due to the US holiday, the market will return to a more normal pace of economic data next week.

The US will release the consumer price index (CPI) for June and the Empire State Production Survey on Tuesday. Next, the June Producer Price Index (PPI) will be released on Wednesday.

On Thursday, investors will monitor the June retail sales report, the Philadelphia Area Manufacturing Survey (Phili Fed) and the US weekly jobless claims.

The trading week will end on Friday morning with a report on the number of houses started in June and preliminary results of the consumer confidence survey conducted by the University of Michigan.

See more news related to gold prices HERE...