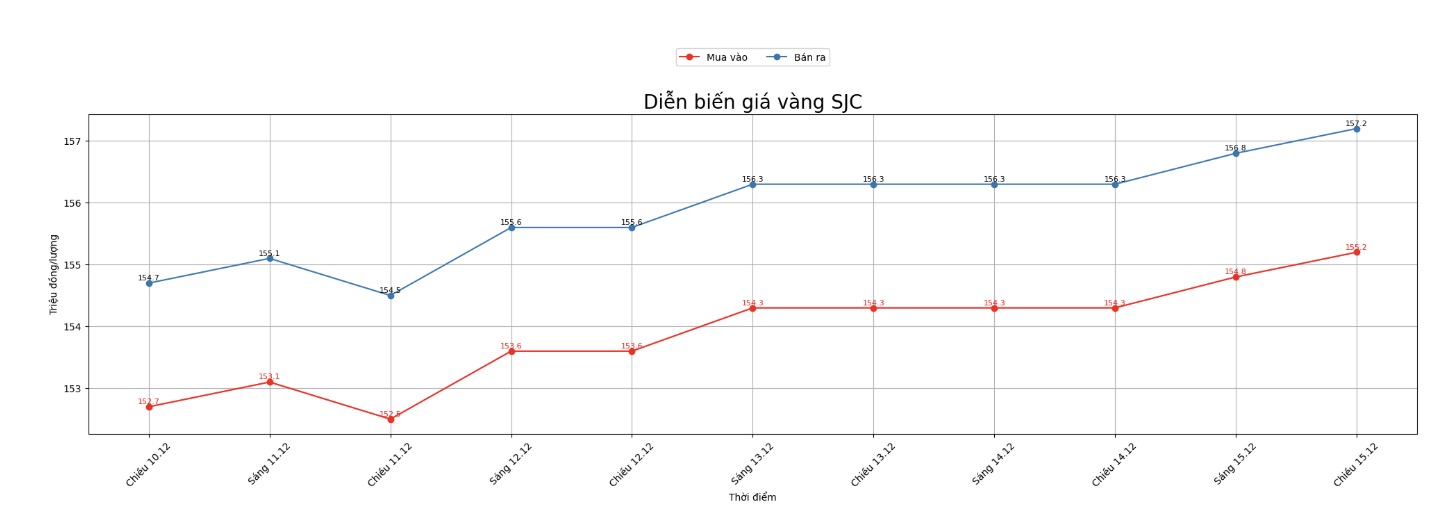

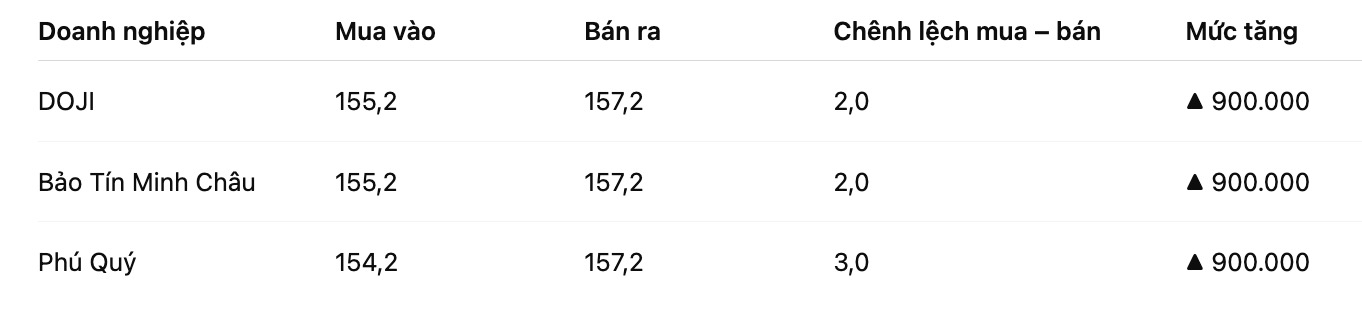

SJC gold bar price

As of 7:00 p.m., DOJI Group listed the price of SJC gold bars at VND155.2-157.2 million/tael (buy in - sell out), an increase of VND900,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 155.2-157.2 million VND/tael (buy - sell), an increase of 900,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 154.2-157.2 million VND/tael (buy - sell), an increase of 900,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

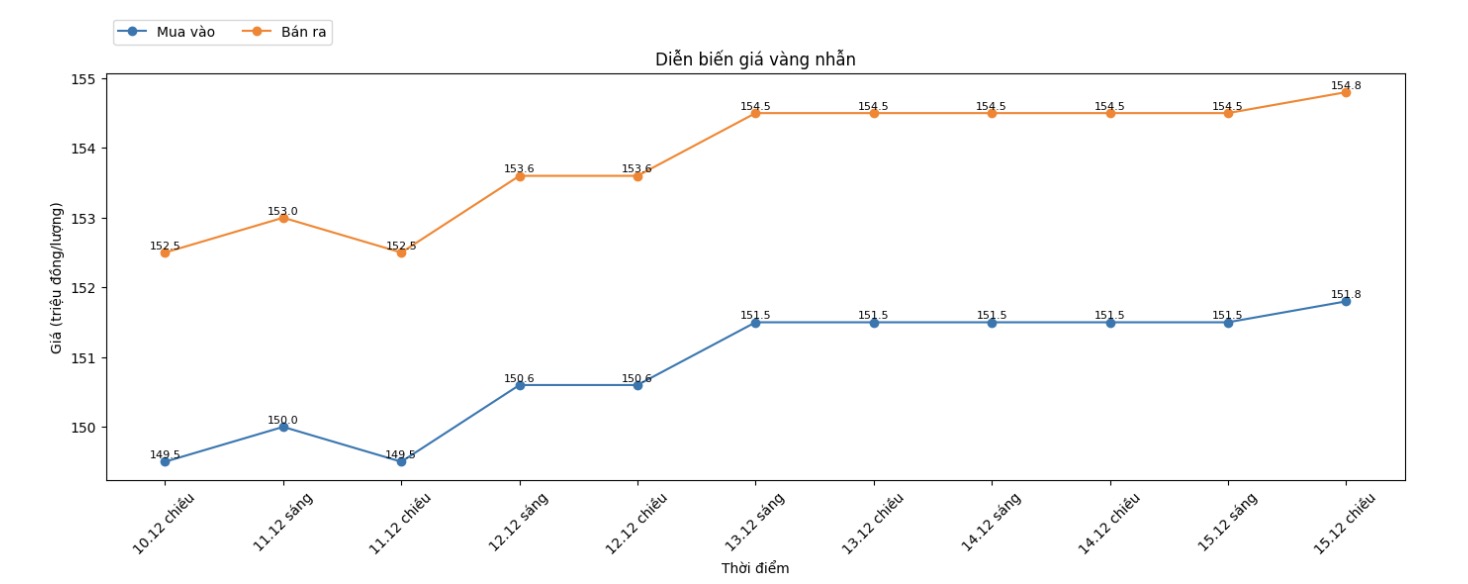

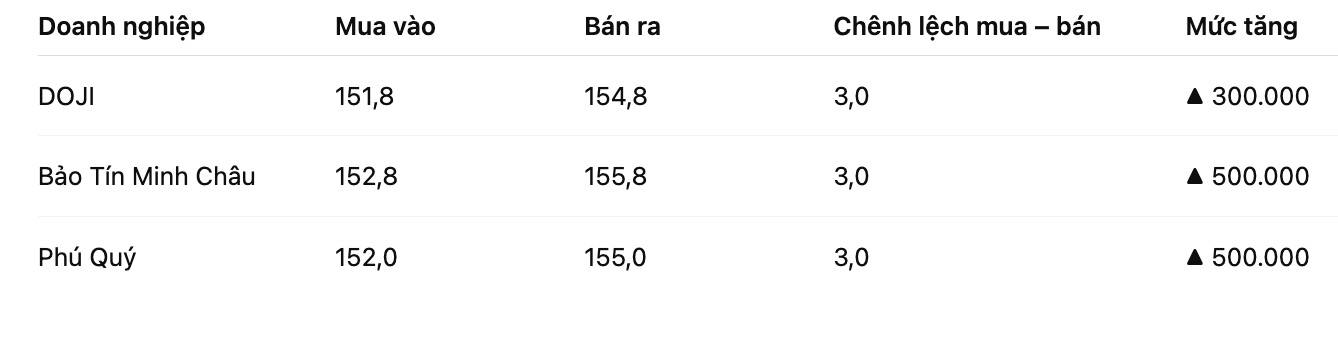

9999 gold ring price

As of 7:00 p.m., DOJI Group listed the price of gold rings at 151.8-154.8 million VND/tael (buy - sell), an increase of 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 152.8-155.8 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 152-155 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

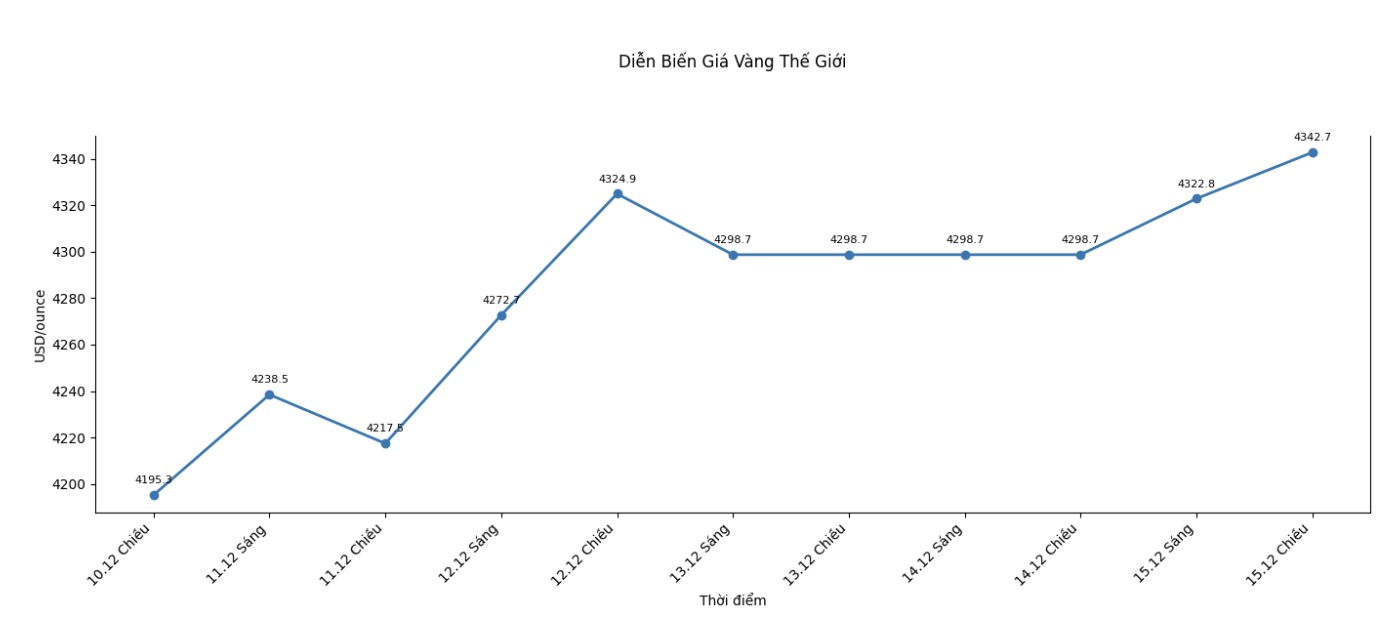

World gold price

The world gold price was listed at 6:00 p.m., at 4,342.7 USD/ounce, up 44 USD compared to a day ago.

Gold price forecast

The latest weekly gold survey with Wall Street experts shows many optimistic forecasts for the short-term outlook for gold prices, while individual investors also slightly increased their uptrend rate.

There were 13 Wall Street experts participating in the survey. There are 11 experts, equivalent to 85%, who believe that gold prices will continue to increase this week, while no one predicts that prices will decrease. The remaining two analysts, accounting for 15% of the total, said the precious metal will trade sideways this week.

Increase - Mr. Adrian Day, Chairman of Adrian Day Asset Management, commented. The resumption of large-scale Treasury bond purchases by the US Federal Reserve (Fed) is creating a positive support for gold prices.

Similarly, Mr. James Stanley - senior market strategist at Forex.com said that gold prices this week increased:

" James Stanley - senior market strategist at Forex.com - said that gold prices are still in a strong uptrend. According to him, gold has just broken out of a technical model of price increase, while the only remaining notable resistance is the all-time high.

At the moment, there is no reason to turn to the negative view, Mr. Stanley said. He said gold is in a favorable position to continue to rise in the long term, with the prospect of price increase lasting until 2026. This expert affirmed that he will maintain an optimistic view on gold until there are clear signs of cooling inflation, enough for the Fed to slow down monetary policy to tighten".

Economic data to watch next week

The economic news announcement schedule next week will record a series of interest rate decisions from central banks, along with some US economic data that have been delayed for a long time.

On Monday, the market will receive a Empire State manufacturing survey. On Tuesday morning, the US will release the non-farm Payrolls report for both October and November, along with retail sales in November, followed by the US preliminary PMI for December.

By Thursday, traders will focus on monitoring the monetary policy decision of the Bank of England (BoE), followed immediately by the interest rate announcement of the European Central Bank (ECB). On the same day, the market will also receive a series of important US data including the consumer price index (CPI) in November, weekly jobless claims and the Fed Philadelphia (Phyilly Fed) manufacturing survey.

The trading week will close on Friday morning with a report on US existing home sales in November.

See more news related to gold prices HERE...