In a truly historic moment for the precious metals market, gold futures surpassed $3,350/ounce.

The event comes amid a "perfect storm" of economic factors, as the Trump administration imposes new import tariffs and rising geopolitical tensions, boosting unprecedented demand for gold - a safe-haven asset.

Record increase

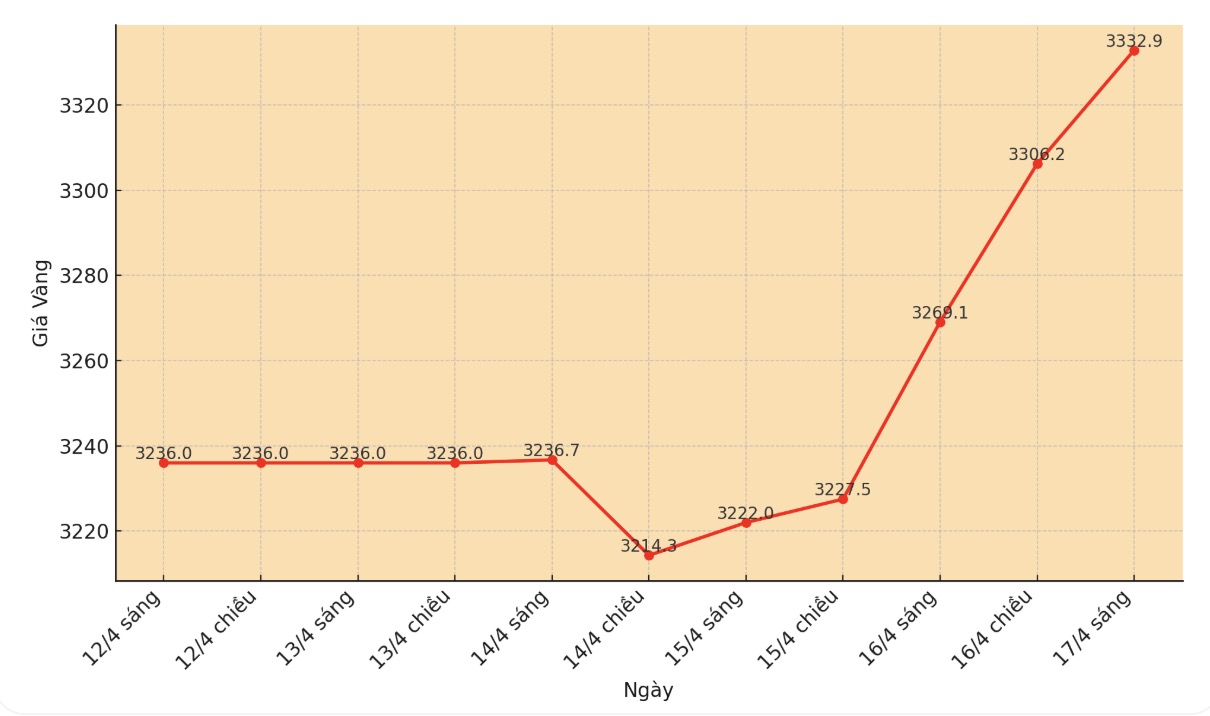

The most active gold futures traded (June 2025) have increased by about 256 USD for just three consecutive trading days (Wednesday, Thursday and Friday last week).

Notably, this increase comes right after gold prices fell $195 in the first session of the week on April 7. In just three sessions, gold has not only recovered all the decline but also set an all-time high of $3,254.9/ounce.

After a $28 correction on Monday and a slight recovery of $20 yesterday, gold prices today broke out with a three-digit increase. The June contract increased by 110.8 USD (equivalent to 3.41%) and closed the session at an unprecedented level of 3,354.4 USD/ounce.

Factors that promote

Investors are pouring into gold to protect their portfolios from economic uncertainty stemming from President Donald Trump's trade policies.

The full inflationary impact of new import tariffs is still unclear, but concerns about rising imported commodity prices are causing the market to strongly shift to gold.

Although the weakening of the USD has been a significant factor in the gold price increase in recent months, in today's strong increase, this factor only played a small role. USD Index decreased by 0.57% to 99.025 points, accounting for only about 16.4% of gold's $110 increase.

Since the beginning of the year, gold prices in June have increased by 24.75%. In particular, the weakening of the USD contributed about 36% to this increase. However, the main factor comes from the extremely optimistic market sentiment, which is said to account for 64% of gold's increase in 2025.

US stock market continues to be under pressure

Meanwhile, the US stock market continues to be under a lot of pressure. Today's session recorded the Dow Jones index down 1.74%, Nasdaq down 2.99% and the S&P 500 down 2.24%. Since the beginning of the year, the S&P 500 has lost 10.88%, Nasdaq decreased by 15.11% and Dow Jones decreased by 7.69%.

Uncertainty over President Donald Trump's import tax policies is clearly becoming a market driver, pushing investors to gold as a safe haven. This is not an exaggeration, but a reality clearly reflected by the market.

See more news related to gold prices HERE...