Domestic gold prices increase sharply

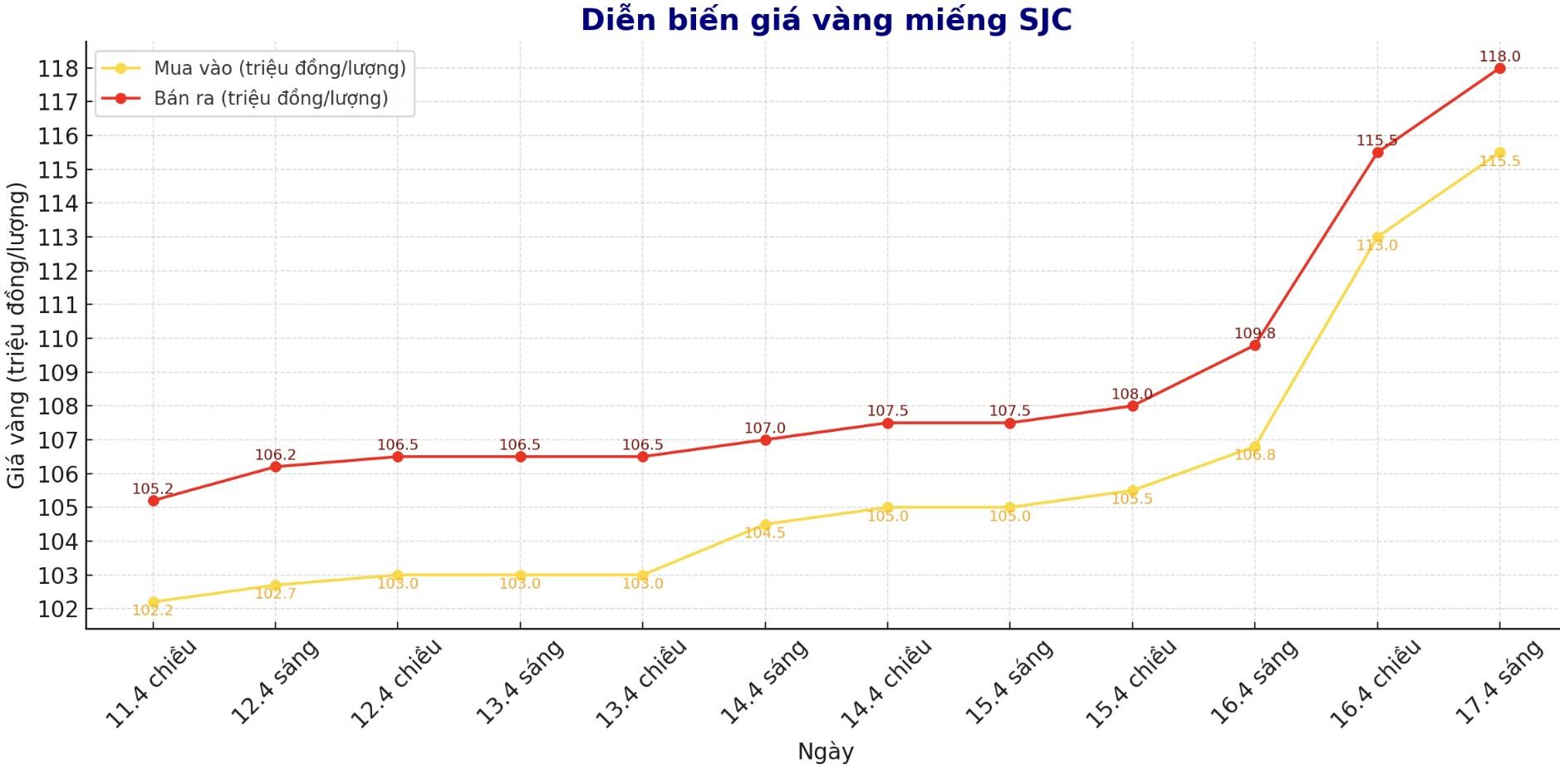

As of 9:15 a.m. on April 17, the price of SJC gold bars was listed by Saigon Jewelry Company SJC, DOJI Group and Bao Tin Minh Chau at 115.5 - 118 million VND/tael (buy - sell).

The recorded increase was 8.7 million VND/tael for buying and 8.2 million VND/tael for selling compared to the previous session. The difference between buying and selling remains high, at about 2.5 million VND/tael.

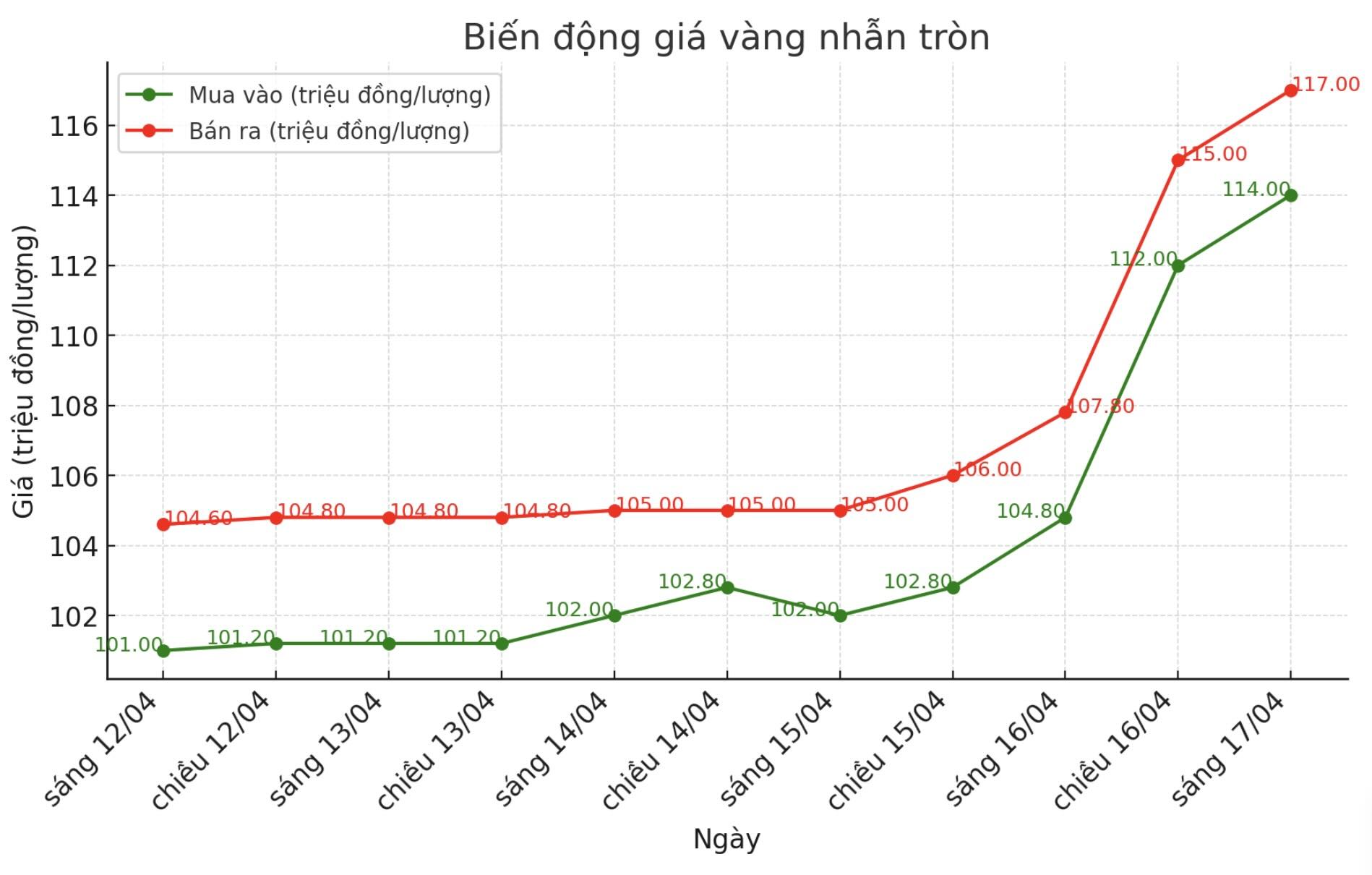

In the gold ring group, the price also increased sharply. DOJI listed Hung Thinh Vuong 9999 round gold rings at 114 - 117 million VND/tael (buy - sell), an increase of 9.2 million VND/tael in both directions.

Bao Tin Minh Chau announced the price of gold rings at 114.5 - 117.5 million VND/tael, an increase of 8 million VND/tael compared to yesterday. The difference between buying and selling prices is up to 3 million VND/tael.

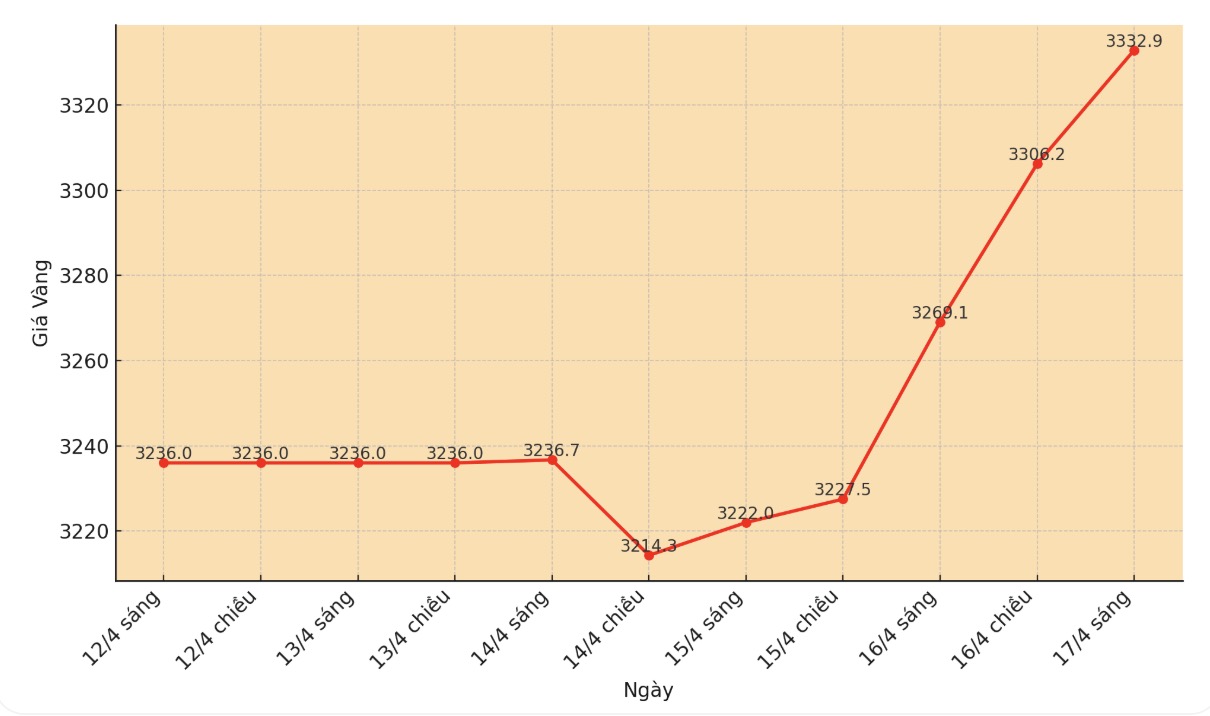

At the same time, the world gold price listed on Kitco was at 3,332.9 USD/ounce. With the selling rate at Vietcombank on April 17 being VND/USD 26,060, the world gold price is equivalent to about VND 104.72 million/tael.

Thus, domestic SJC gold bars are currently about 13.28 million VND/tael higher than world gold prices.

Unusual increase poses many risks to investors

Within 24 hours, the world gold price increased by 68.9 USD/ounce - equivalent to about 1.7 million VND/tael at the current exchange rate. However, also during this period, domestic gold prices skyrocketed to VND9 million/tael.

This increase is more than 5 times higher than the world, showing that the domestic gold market is reacting excessively to the global trend. This is a sign that an imbalance between supply and demand or speculative psychology is strongly dominating the domestic market, posing many potential risks to investors.

Not only has the domestic gold price increased sharply, but there are also risks because the difference between buying and selling is being pushed up very high. For gold rings, the difference is up to 3 million VND/tael, while gold bars are 2.5 million VND/tael.

In the context of rapid and strong price fluctuations, buyers may face the risk of losses immediately after making a transaction if the market adjusts in the opposite direction.

Currently, the price of SJC gold bars is still determined by the State Bank through the listing of sales to 4 major commercial banks and SJC enterprises. However, the domestic-international price difference continues to widen, showing that regulatory tools are still limited in stabilizing the market.

In the current context of strong fluctuations, experts recommend that investors should be alert, cautious and avoid buying and selling according to crowd psychology to minimize risks.

Talking to PV of Lao Dong Newspaper, Dr. Nguyen Tri Hieu - an economic expert, said that the ideal difference is about 300,000 VND/tael. When the difference reached 300,000 to 500,000 VND/tael, gold traders began to make high profits. However, if the difference increases by more than 1 million VND/tael, the risk of losses will fall on gold buyers, especially when the gold price is adjusted down.

"Gold buyers are taking on a very high risk when the buy-sell gap is too large. Gold traders are only willing to buy at low prices but sell at high prices to ensure profits. In case the gold price is adjusted, gold buyers may suffer heavy losses" - Mr. Hieu said.