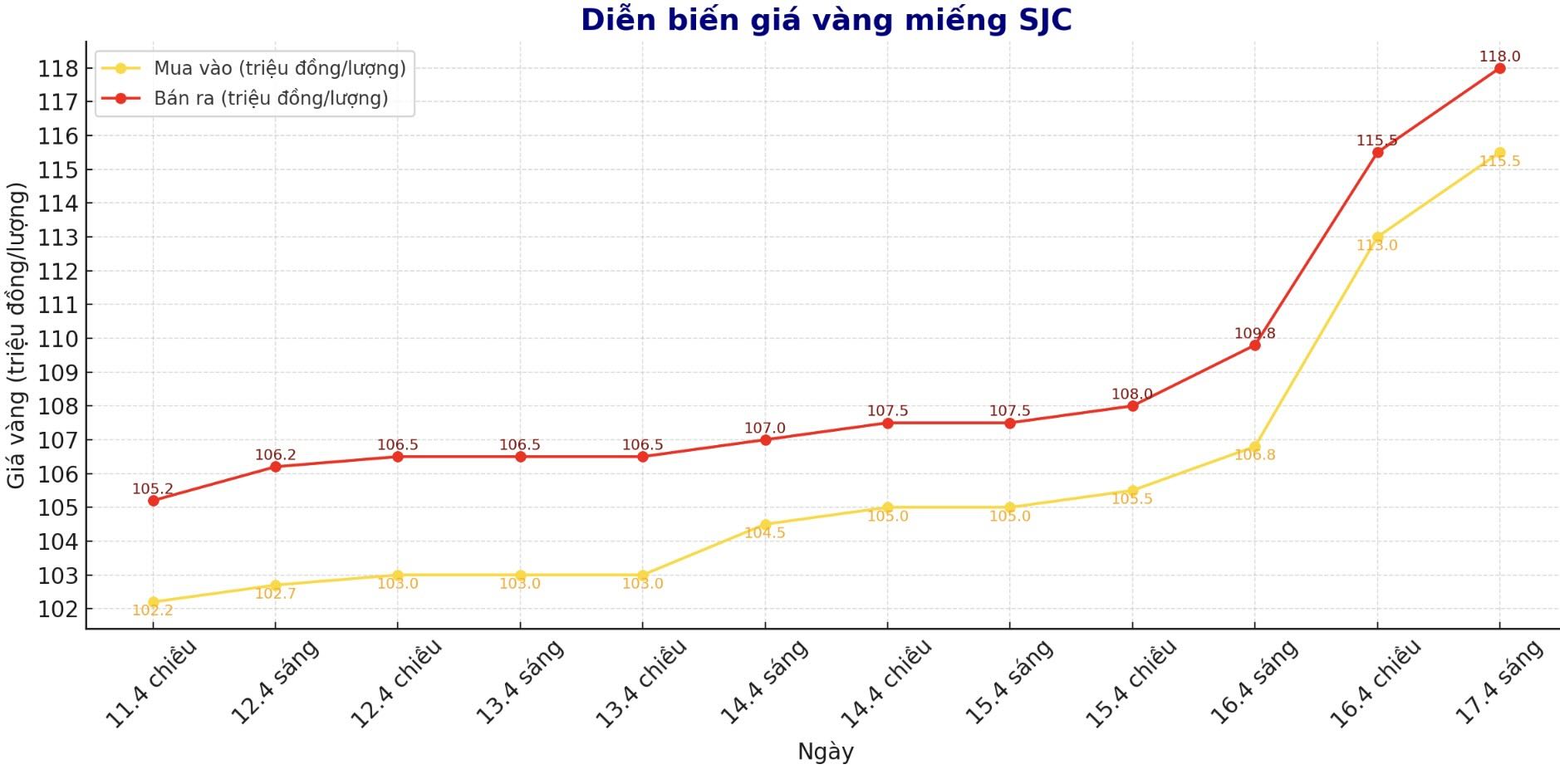

Updated SJC gold price

As of 9:15 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND115.5-118 million/tael (buy - sell), an increase of VND8.7 million/tael for buying and VND8.2 million/tael for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

At the same time, DOJI Group listed the price of SJC gold bars at VND 115.5-118 million/tael (buy - sell), an increase of VND 8.7 million/tael for buying and an increase of VND 8.2 million/tael for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 115.5-118 million VND/tael (buy - sell), an increase of 8.7 million VND/tael for buying and an increase of 8.2 million VND/tael for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

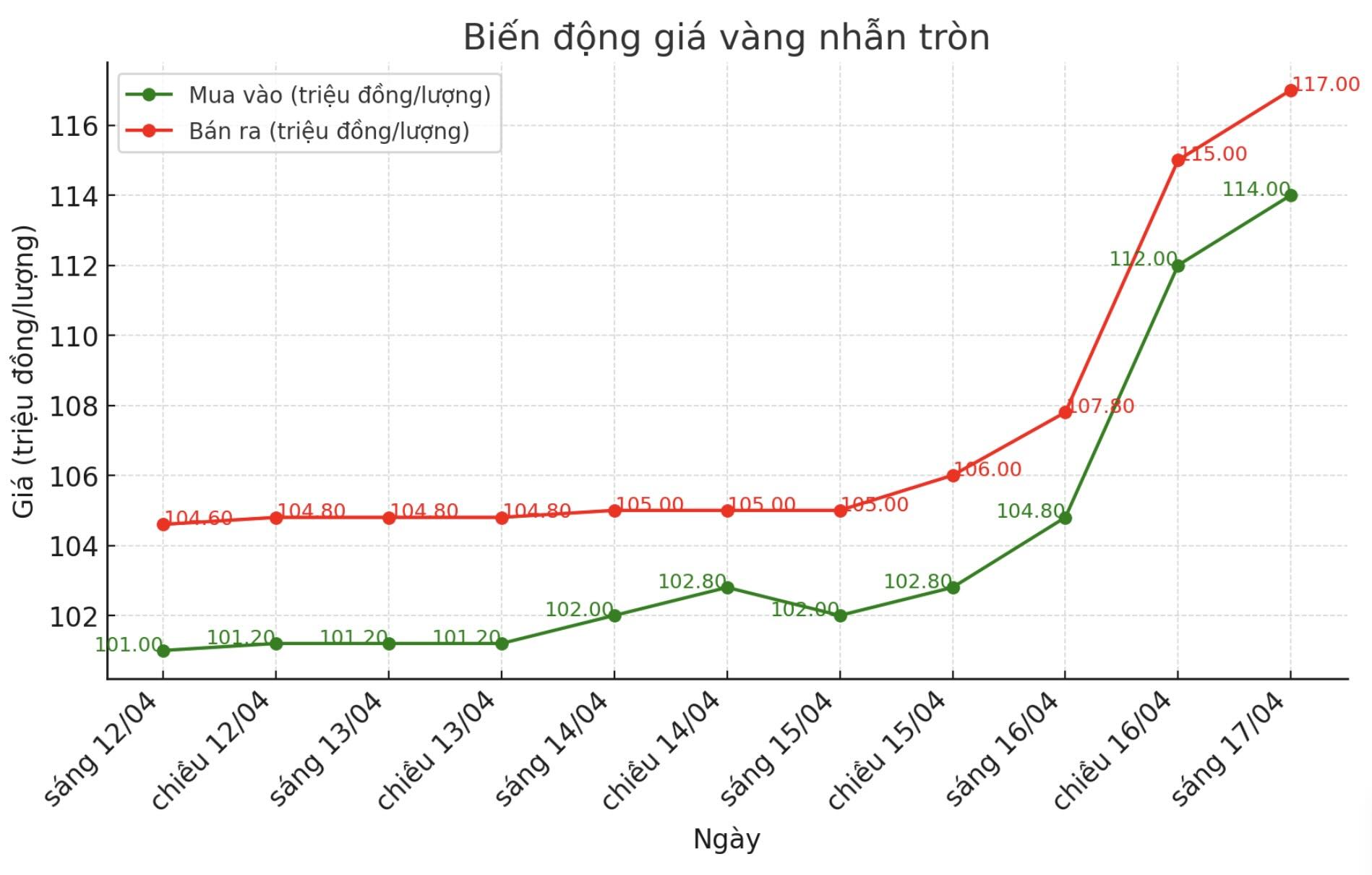

9999 round gold ring price

As of 9:00 a.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 114-117 million VND/tael (buy - sell), an increase of 9.2 million VND/tael for both buying and selling. The difference between buying and selling prices is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 114.5-117.5 million VND/tael (buy - sell), an increase of 8 million VND/tael for both buying and selling. The difference between buying and selling is 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed to an excessively high level, causing risks for individual investors to increase.

In the context of many fluctuations in the world gold market, the large difference between buying and selling in the domestic market is a clear warning sign. If gold prices turn down, buyers will face a huge loss. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

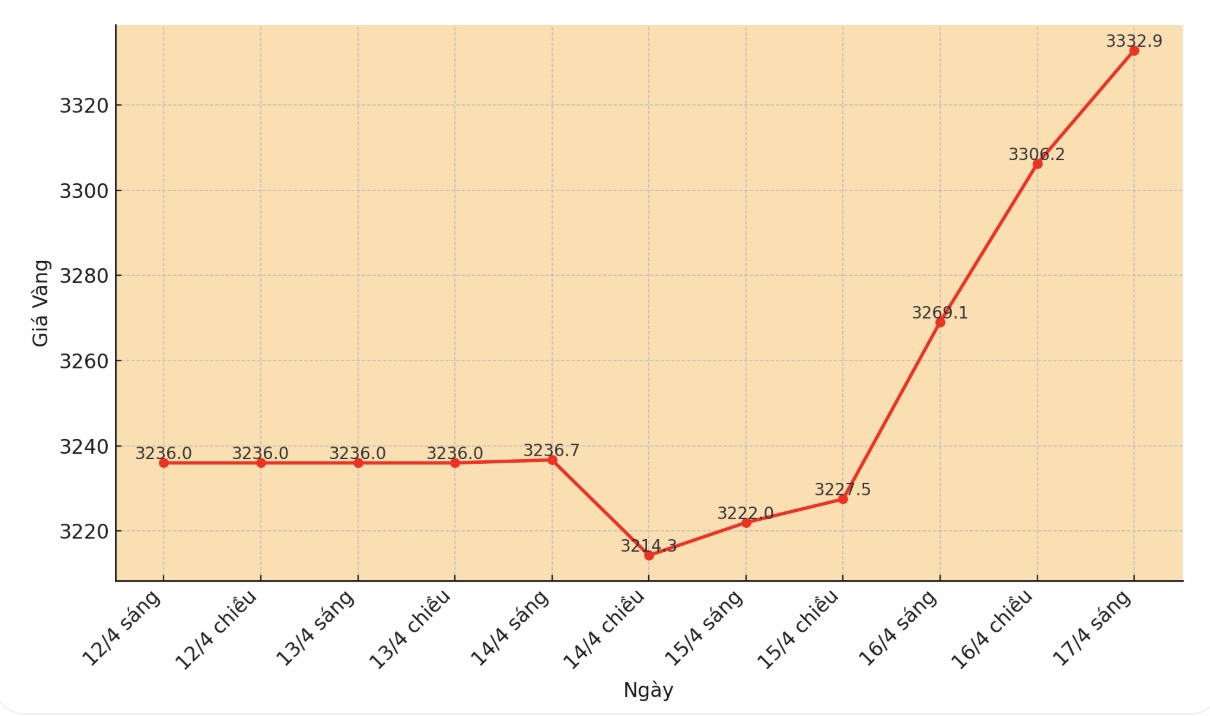

World gold price

At 9:15 a.m., the world gold price listed on Kitco was around 3,332.9 USD/ounce, up 68.9 USD compared to the beginning of the trading session yesterday morning.

Gold price forecast

According to Kitco, the gold market has witnessed strong growth despite US consumers still maintaining good purchasing power in the context of increasing concerns about economic recession.

According to the US Commerce Department's report on Wednesday, retail sales increased 1.4% in March, after increasing 0.2% in February. The consumer data was stronger than expected, with economists forecasting a 1.3% increase.

Over the past 12 months, retail sales have increased by 4.6%, the report said.

David Erfle - founder of JuniorMinerJunky.com commented that gold prices skyrocketed as geopolitical tensions, economic instability and drastic trade policies from the US pushed investors into safe-haven assets. The gold rally may just be the beginning.

Gold is starting to soar. The chaos and instability of Donald Trump's administration in his second term has turned the situation into an event that has forced investors to pay loans, affecting the process of reducing the use of financial leverage.

Thousands of billions of dollars in market value were erased and then added to the portfolio. This has created a lot of anxiety among investors and caused some investors to shift some of their capital into the gold sector," Erfle told Kitco's senior mining editor and host, Paul Harris.

Amid this volatility, the USD index has fallen below 100 and long-term bond yields have surged. Erfle said the combination has removed Treasury bonds from their traditional safety asset role and opened up opportunities for gold's dominance.

The US Federal Reserve (FED) can only control short-term interest rates... With $9 trillion worth of bonds needing to be restructured and higher interest rates, this is a real problem, he said.

According to a report from SP Angel, Chinese investors and the People's Bank of China are actively buying gold.

A survey from Bank of America with fund managers shows that gold is currently the "most popular transaction", meaning that there are too many optimistic traders who are focusing too much on the gold market.

See more news related to gold prices HERE...