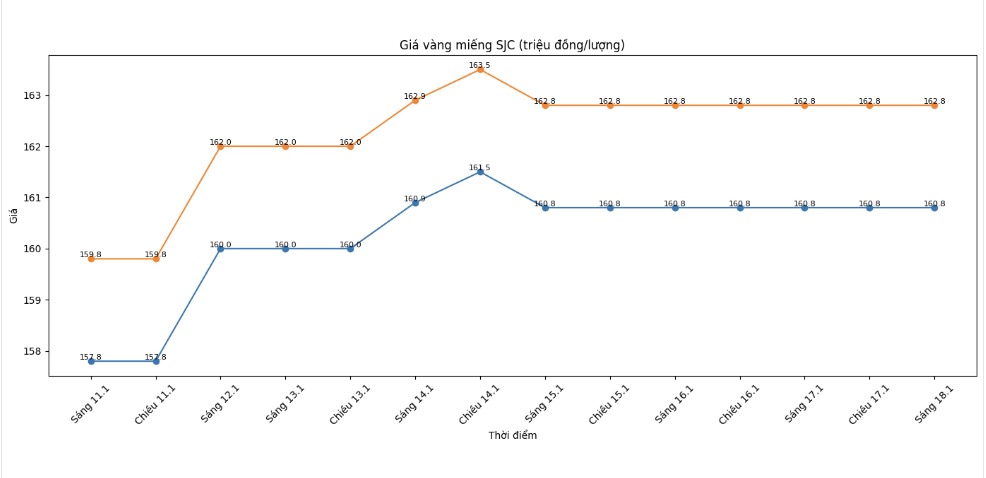

SJC gold bar price

Closing the weekly trading session, Saigon SJC Jewelry Company listed SJC gold prices at 160.8-162.8 million VND/tael (buying - selling). The buying - selling difference was 2 million VND/tael.

Compared to the closing session of the previous week (November 11, 2025), the price of SJC gold bars at Saigon Jewelry Company SJC increased by 3 million VND/tael in both directions. The difference between buying and selling prices of SJC gold at Saigon Jewelry Company SJC is at the threshold of 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 160.8-162.8 million VND/tael (buying - selling). The buying - selling difference is at 2 million VND/tael.

Compared to a week ago, the price of SJC gold bars was increased by 3 million VND/tael by Bao Tin Minh Chau in both directions.

If buying SJC gold at Saigon Jewelry Company SJC and Bao Tin Minh Chau on November 11th and selling it on today's session (January 18th), buyers will make a profit of 1 million VND/tael.

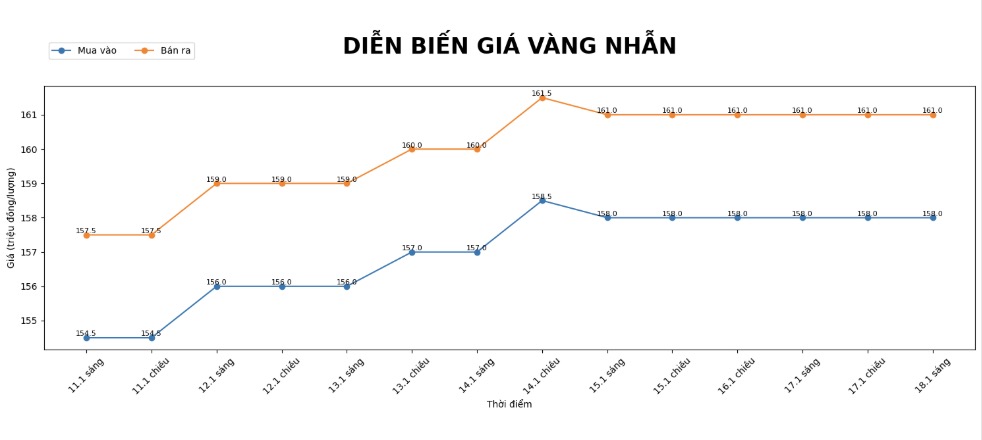

9999 gold ring price

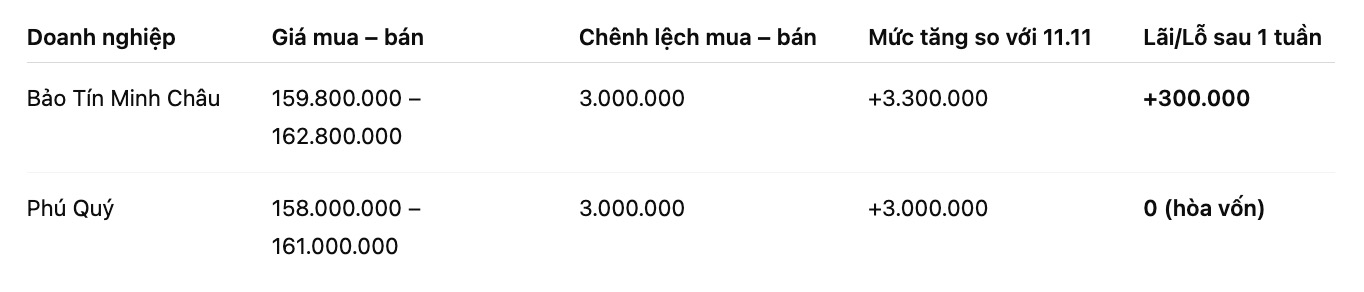

Bao Tin Minh Chau listed the price of gold rings at 1598.8-162.8 million VND/tael (buying - selling); an increase of 3.3 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at 158-161 million VND/tael (buying - selling), an increase of 3 million VND/tael in both directions compared to a week ago. The buying - selling difference is at 3 million VND/tael.

If you buy gold rings in the session on November 11 and sell them in today's session (January 18), buyers at Bao Tin Minh Chau will make a profit of 300,000 VND/tael, while the profit of gold rings buyers in Phu Quy is equal to the capital.

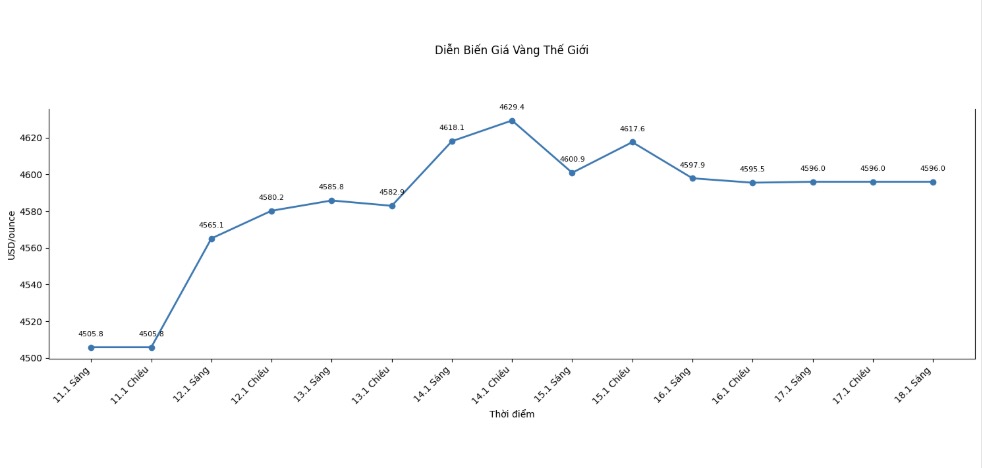

World gold price

Closing the weekly trading session, world gold prices were listed at the threshold of 4,596 USD/ounce, up sharply by 90.2 USD compared to a week ago.

Gold price forecast

The developments of the gold market in recent sessions show a clear stalemate after a strong increase to set a new record. World gold prices, although closing the week in a high zone, have seen quite strong corrections as investor sentiment has become more cautious in the face of monetary policy signals from the US.

According to international experts, short-term pressure on gold prices comes from the recovery of the USD and US bond yields, in the context of expectations that the US Federal Reserve (Fed) will soon cut interest rates gradually cooling down. Statements related to the process of finding a successor to the current Fed Chairman have caused strong fluctuations in global financial markets, leading to profit-taking activities in the precious metal market.

Mr. Neil Welsh - Head of Metals at Britannia Global Markets - said that gold fluctuating around the 4,600 USD/ounce mark reflects a necessary accumulation period after a period of hot gains. According to him, this is not a sign that the upward trend has ended, but rather the market's self-balancing process before determining the next growth momentum.

From a technical perspective, some experts warn of the risk of short-term correction as quantitative indicators are in the overbought zone. Mr. Lukman Otunuga - senior market analyst at FXTM, said that if gold prices persistently fall below the important support zone around 4,570 USD/ounce, the market may witness a deeper correction to lower levels. However, in a positive scenario, if it surpasses the recent peak, gold still has the opportunity to move towards new highs.

However, most opinions still agree that the long-term outlook for gold has not been broken. The underlying factors such as geopolitical instability, concerns about the independence of monetary policy, the trend of central banks increasing gold reserves, and global financial risks continue to play a supporting role for the precious metal.

In the short term, gold prices are forecast to fluctuate strongly following upcoming messages from the Fed and global economic and political developments. Investors are recommended to be cautious with "price chasing" decisions in the high zone, and closely monitor correction phases to re-evaluate opportunities in the medium and long term.

See more news related to gold prices HERE...