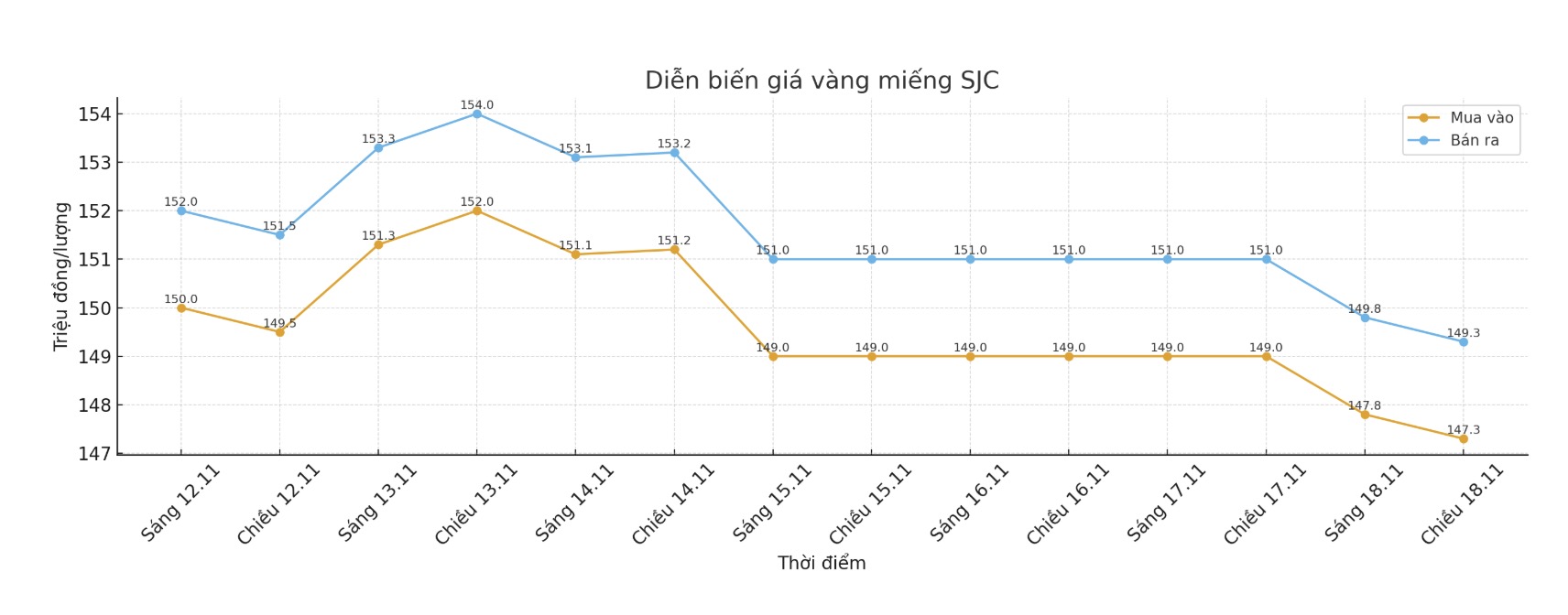

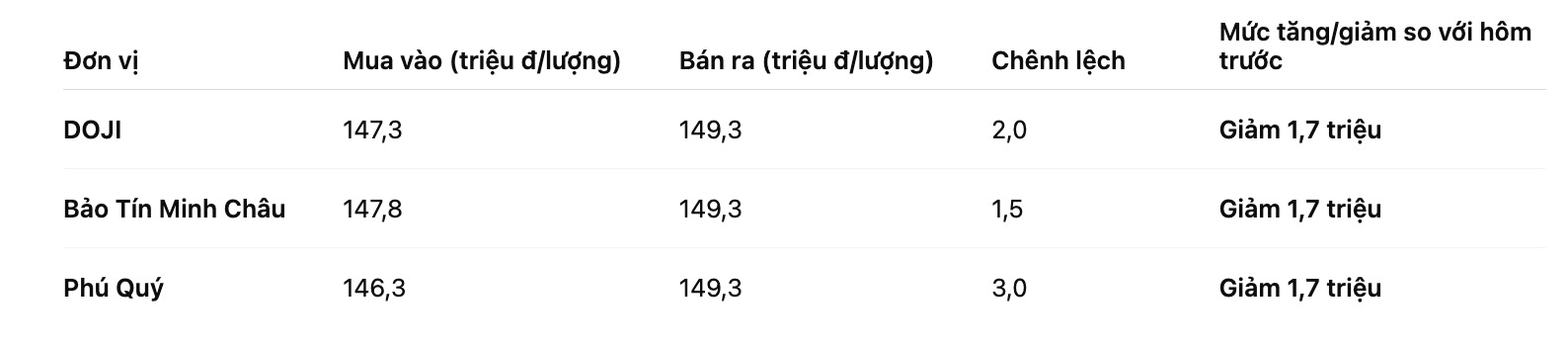

SJC gold bar price

As of 10:35 p.m., DOJI Group listed the price of SJC gold bars at 147.3-149.3 million VND/tael (buy in - sell out), down 1.7 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 147.8-149.3 million VND/tael (buy in - sell out), down 1.7 million VND/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 146.3-149.3 million VND/tael (buy in - sell out), down 1.7 million VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

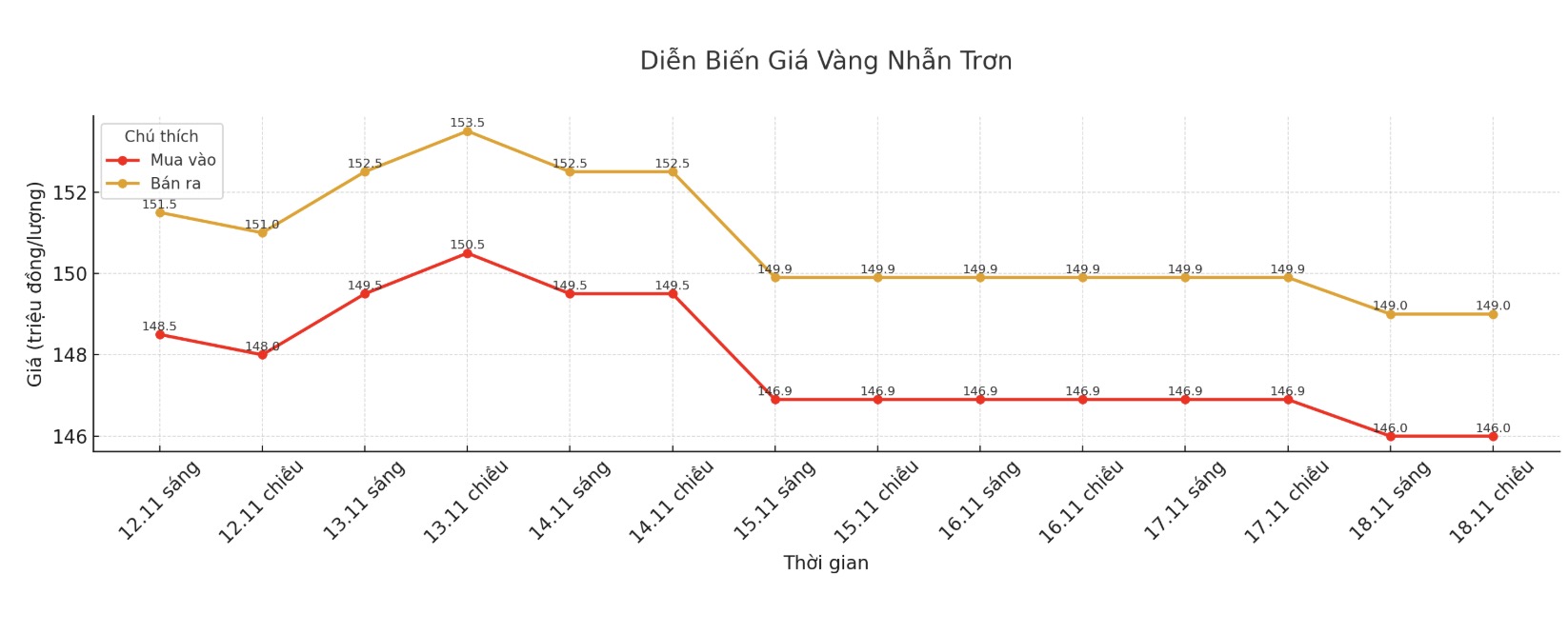

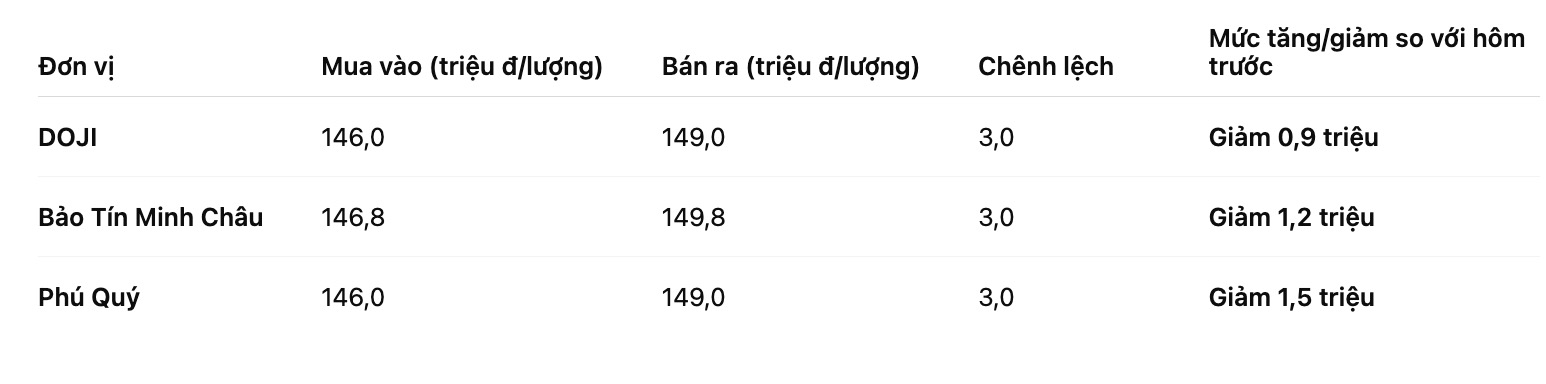

9999 gold ring price

As of 10:35 p.m., DOJI Group listed the price of gold rings at 146-149 million VND/tael (buy in - sell out), down 900,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 146.8-149.8 million VND/tael (buy - sell), down 1.2 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 146-149 million VND/tael (buy - sell), down 1.5 million VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

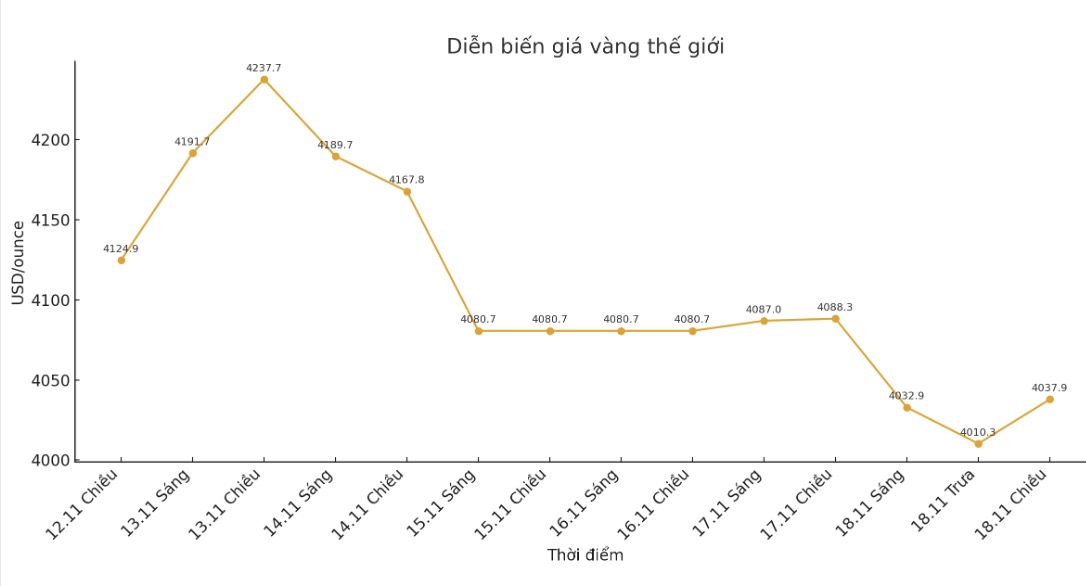

World gold price

The world gold price was listed at 7:40 p.m., at 4,037.9 USD/ounce, down 50.4 USD compared to a day ago.

Gold price forecast

Gold prices fell for the fourth consecutive session on Tuesday, under pressure from a strong US dollar and growingly low expectations of the possibility of the US Federal Reserve (FED) cutting interest rates next month.

The US dollar is a little stronger today and the number of speculative positions has also decreased in the past week. The gold market is likely to enter a sideways period of accumulation," said Marex analyst Edward Meir.

USD Index remains stable against major currencies after a strong increase in the previous session. A stronger US dollar makes gold more expensive for investors holding other currencies.

The focus this week will be a series of US economic data, including the September non-farm payrolls report released on Thursday, to assess the health of the world's largest economy.

The probability of the Fed cutting interest rates next month fell to behind-the-scenes to behind-the-scenes to 42%, down from nearly 100% shortly after the September decision. This development reduces investment appetite for gold" - ANZ commented in a report.

According to Dilin Wu - research strategist at Pepperstone, on the one hand, expectations of the FED cutting interest rates in December are decreasing, creating pressure for gold prices to weaken. On the other hand, concerns about the slowing growth rate of the US economy and internal disagreements within the FED have boosted demand for gold as a safe haven.

Notable US economic data for the week

Wednesday: Minutes of the Federal Open Market Committee (FOMC) meeting.

Thursday: Philly FED Production Survey, Weekly Unemployment claims, existing home sales.

Friday: S&P's preliminary PMI, University of Michigan Consumer Confidence Index (edited version).

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...