As the US government falls into its longest-running shutdown in history, economists find it increasingly difficult to assess the health of the economy - and that uncertainty is spreading to the gold market. Now, analysts are looking for directional signals from other sources such as the stock market and the US dollar.

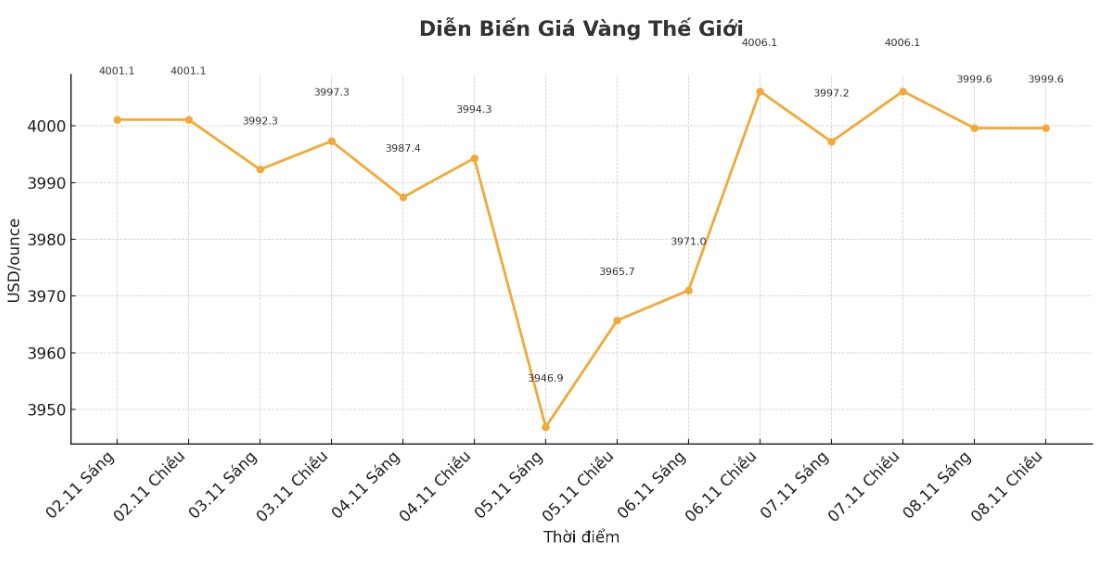

The gold market is preparing to close the trading week almost unchanged from the beginning of the week, with the threshold of 4,000 USD/ounce emerging as an important resistance level and a psychological barrier. Although most experts agree that the long-term fundamental factors of gold are still solid, they believe that the market needs a new "catalyst" to create momentum for increase.

Analysts say that gold prices may move sideways in the next few weeks, but the upside prospects are still greater than the downside risk.

Gold prices are likely to fluctuate within a narrow range. Although trade policy tensions have somewhat subsided, the conflict has not been resolved. Therefore, gold will still be popular as a safe haven asset, even as the USD has recently strengthened. We also continue to expect the US Federal Reserve (FED) to cut interest rates more strongly than the current expectations of the market. As the US economic situation becomes clearer after the data is released again, gold prices could benefit," said Ms. Barbara Lambrecht, commodity analyst at Commerzbank, on Friday.

Mr. Michael Brown - senior analyst at Pepperstone - also said that gold still has room for price increase, although it can continue to trade in the sideways zone. According to him, the $4,000/ounce mark "will be a difficult challenge to overcome".

I think gold is forming a fairly wide range of $3,900-4,400/ounce which could be a reasonable trading range in the near term. The risk is still leaning towards price increases not only because of the need for shelter and concerns about uncontrolled inflation, but also because demand from central banks and reserve funds remains strong, he said.

Typically, the first trading week of the month is a time of high employment data, but because the US government has closed for the 38th day, economists are forced to rely on private sector data - which is quite controversial.

On Wednesday, the ADP reported that the US economy created 42,000 more jobs in October, exceeding forecasts. However, the following day, Challenger, Gray & Christmas reports said US businesses cut more than 150,000 jobs in October - the highest in more than 20 years.

Meanwhile, the Institute for Supply Management (ISM)'s service PMI recorded a slight increase in employment, but the labor market remains in a narrowing area.

Despite the mixed signals, economists say the labor market is slowing, which could force the Fed to cut interest rates next month - a factor supporting gold prices until the end of the year.

The consolidation of gold around $4,000/ounce reflects a tug-of-war between positive fundamentals such as strong central bank demand and safe-haven psychology with technical pressures from profit-taking and a strong US dollar. The upcoming Fed meeting is the focus of attention, as the market considers whether the next interest rate cuts will help gold escape the current price range, said Mr. Neil Welsh, Head of Metals Department of Britannia Global Markets.

According to the CME FedWatch tool, the market currently rates the probability of the Fed cutting interest rates next month at 66%. The rate fell sharply after last week's FOMC meeting, when Fed Chairman Jerome Powell warned that a December rate cut "is not a certain thing".

In addition to monetary policy, analysts are also watching the US stock market as a factor that could make a turning point for gold. Many noted that gold has promoted its role as a portfolio diversifier as US stocks hit a record peak.

Gold could return to rally as the US stock market begins to lose points, said Phillip Streible, chief strategist at Blue Line Futures. Gold remains an attractive asset as the risk of stagflation increases.

Another factor that could boost gold prices is the weakening of the US dollar. Despite a seven-week increase, the USD index has failed to hold above the 100-point mark and is likely to close the week at 99.5.

With the US government expected to remain closed next week, the market will not have new inflation data or retail sales for reference.

See more news related to gold prices HERE...