Although the gold market last week bounced impressively, the large buying-selling gap and unsynchronized adjustment between product lines made it almost impossible for investors to fully enjoy the price increase.

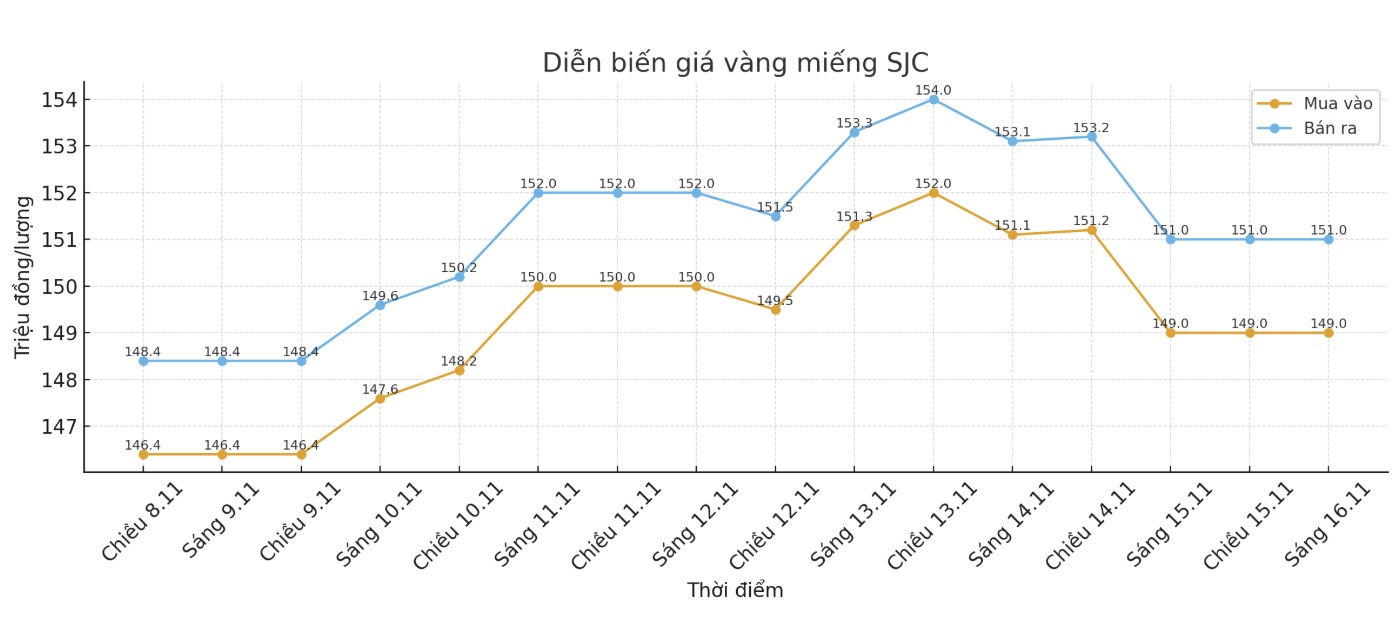

At the end of the trading session on November 16, Saigon Jewelry Company SJC listed the price of gold bars at 149 - 151 million VND per tael, an increase of 2.6 million VND compared to the end of last week. Bao Tin Minh Chau also adjusted the price of SJC gold bars to the same level, recording an increase of 2.1 million VND for buying and 2.6 million VND for selling, respectively.

However, the difference between buying and selling at these units is still at 2 million VND per quantity, causing gold bar buyers on November 9 and selling on November 16 to only earn about 600,000 VND in profit.

Compared to the market's announced increase, this profit is too modest and reflects the buying - selling range, which has "disadvantaged" most of the profits.

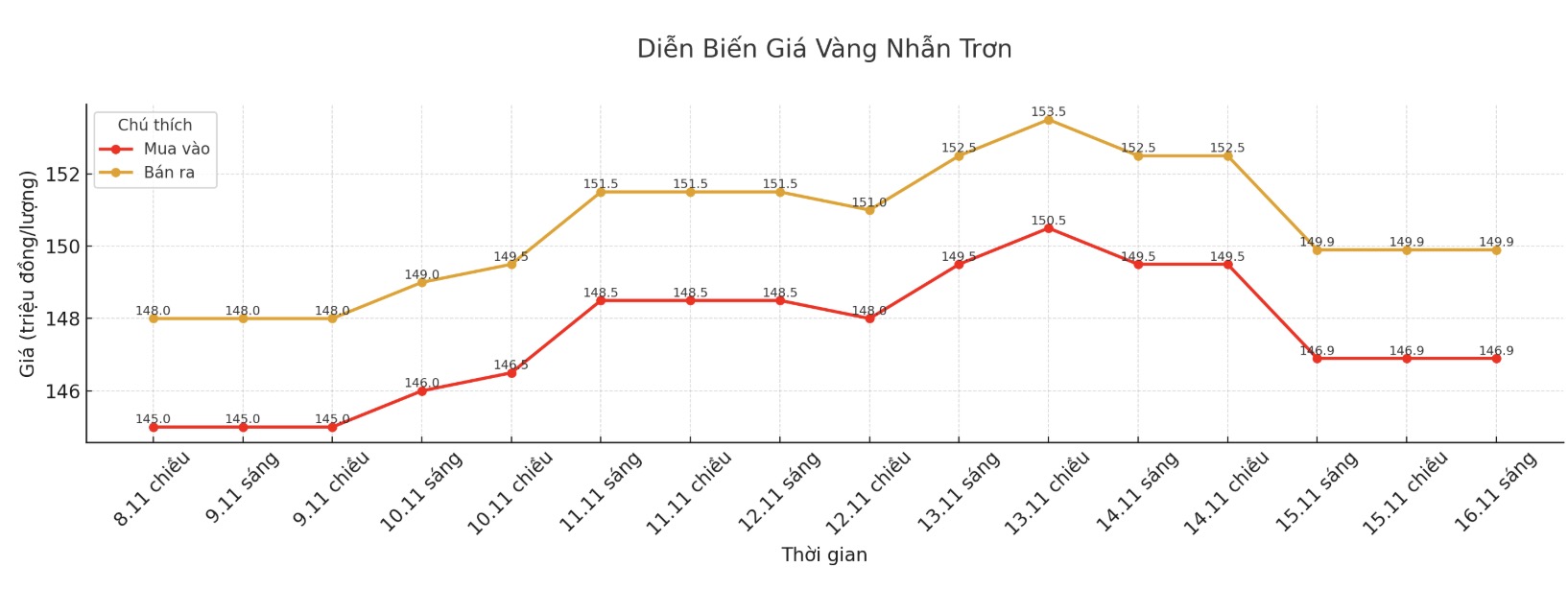

The development is even more unfavorable for gold rings. At Bao Tin Minh Chau, the price of 9999 gold rings is listed at 147.8 - 150.8 million VND pertaining to an increase of 2 million VND compared to last week. Phu Quy Group raised the price of gold rings to 147.5 - 150.5 million VND, an increase of 2.1 million VND in both directions.

However, the difference between buying and selling at these enterprises is up to 3 million VND per quantity, significantly higher than that of gold bars. This gap causes gold ring buyers to suffer losses despite the price increase: The loss is up to 1 million VND per quantity at Bao Tin Minh Chau and 900,000 VND per quantity at Phu Quy if bought on November 9 and sold on November 16.

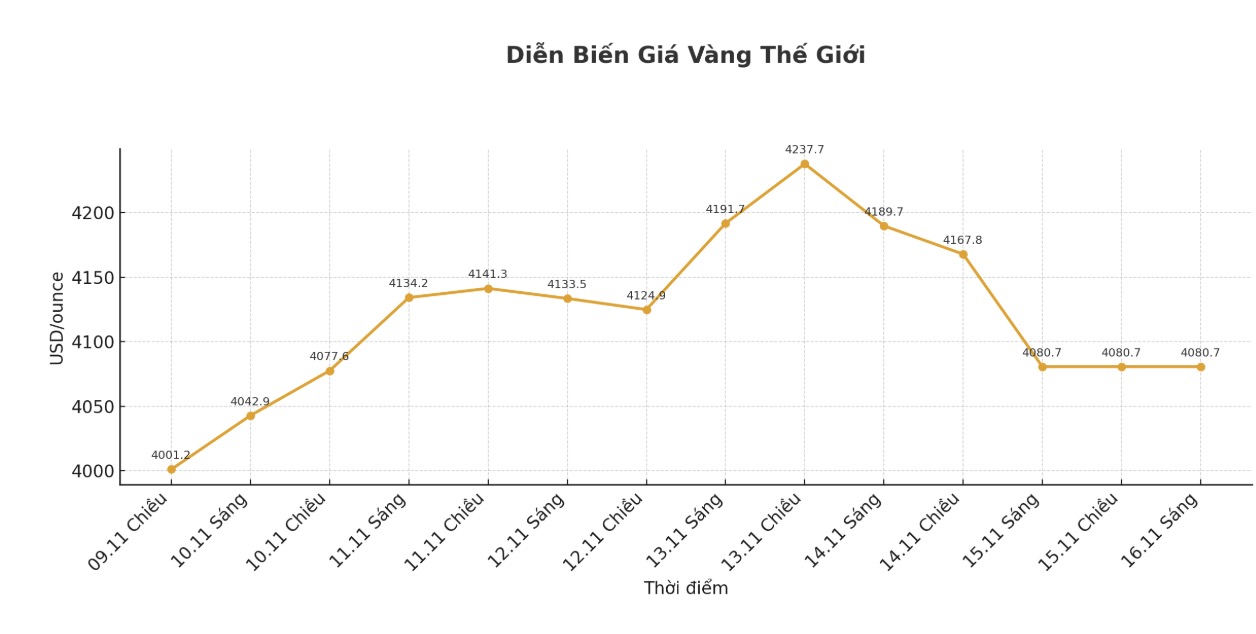

Domestic gold prices increased due to the impact of the international market. After many sessions of strong fluctuations, world gold prices also ended the trading week in green at 4,080.7 USD/ounce, up 79.5 USD compared to a week before.

In reality, although gold has always been considered a safe haven, the level of risk is still present if the margin of difference is too large. Investors need to closely observe the trends of each product and the time of trading, because not always increasing prices means making a profit. Last week was clear evidence: Gold increased sharply, but many buyers still suffered heavy losses after only a few days of holding.

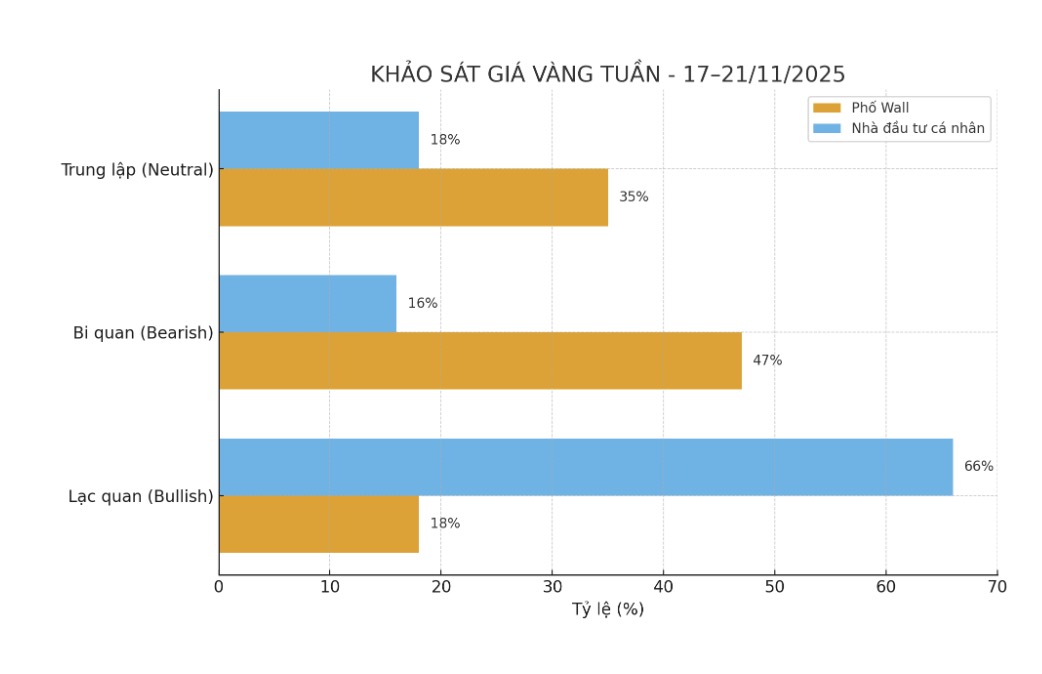

In particular, Wall Street experts are giving a less positive assessment of the gold price outlook next week. 17 Wall Street experts participated in a gold price survey. Of these, eight (47%) predict gold prices will fall in the short term. Six experts (35%) are neutral for next week, while only three (18%) see prices continuing to rise.

Domestic gold prices are often affected by the world market. If world gold decreases, domestic gold is likely to decrease accordingly. Combining the difference between buying and selling up to 2-3 million VND/tael, gold buyers are likely to suffer heavy losses when surfing.

See more news related to gold prices HERE...