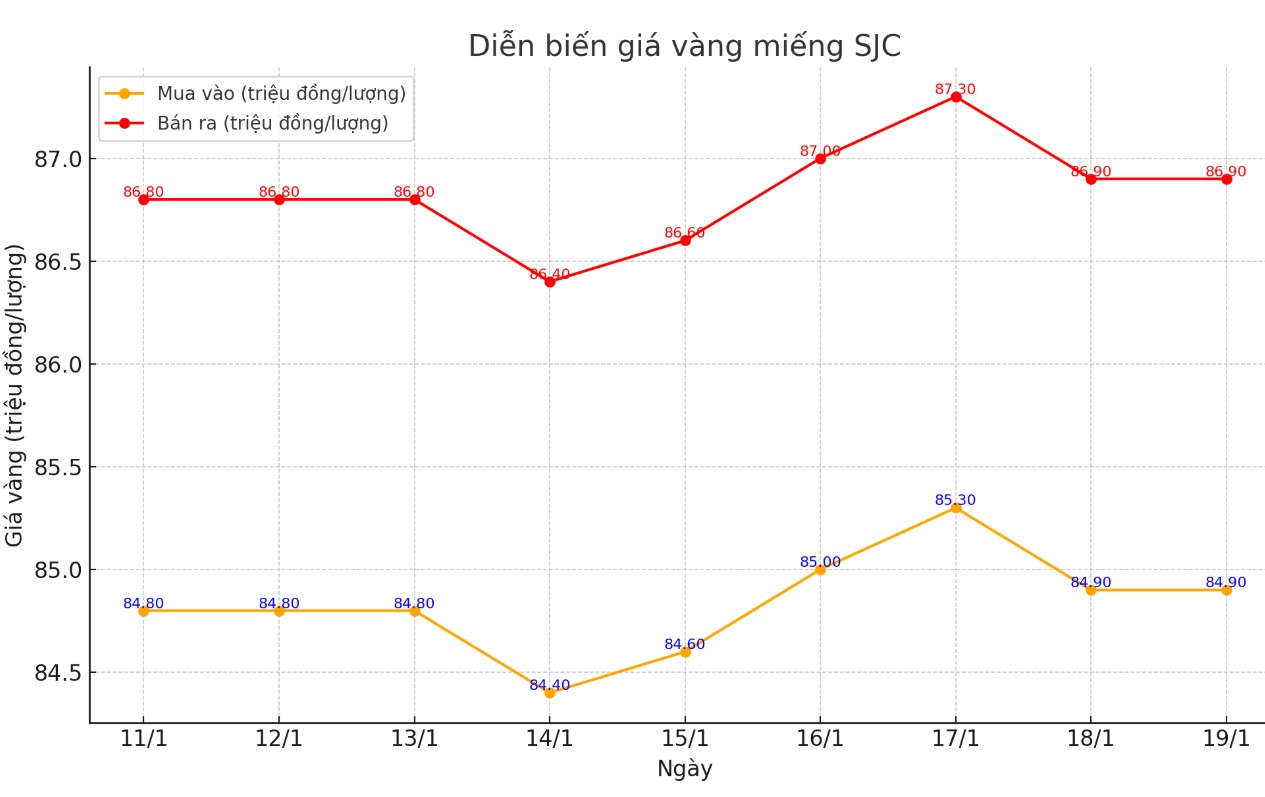

Update SJC gold price

As of 5:00 p.m., DOJI Group listed the price of SJC gold bars at 84.9-86.9 million VND/tael (buy - sell).

Compared to the closing price of last week's trading session, the price of SJC gold bars at DOJI increased by 100,000 VND/tael for both buying and selling.

The difference between buying and selling prices of SJC gold at DOJI Group is at 2 million VND/tael.

Meanwhile, Saigon Jewelry Company SJC listed the price of SJC gold at 84.9-86.9 million VND/tael (buy - sell).

Compared to the closing price of last week's trading session, the price of SJC gold bars at Saigon Jewelry Company increased by VND 100,000/tael for both buying and selling.

The difference between buying and selling prices of SJC gold at DOJI Group is at 2 million VND/tael.

If investors buy SJC gold at DOJI Group and Saigon Jewelry Company SJC in the session of January 12 and sell it in today's session (January 19), they will lose 1.9 million VND/tael.

Currently, the difference between buying and selling gold prices is listed at around 2 million VND/tael. Experts say that this difference is very high, causing investors to face the risk of losing money when investing in the short term.

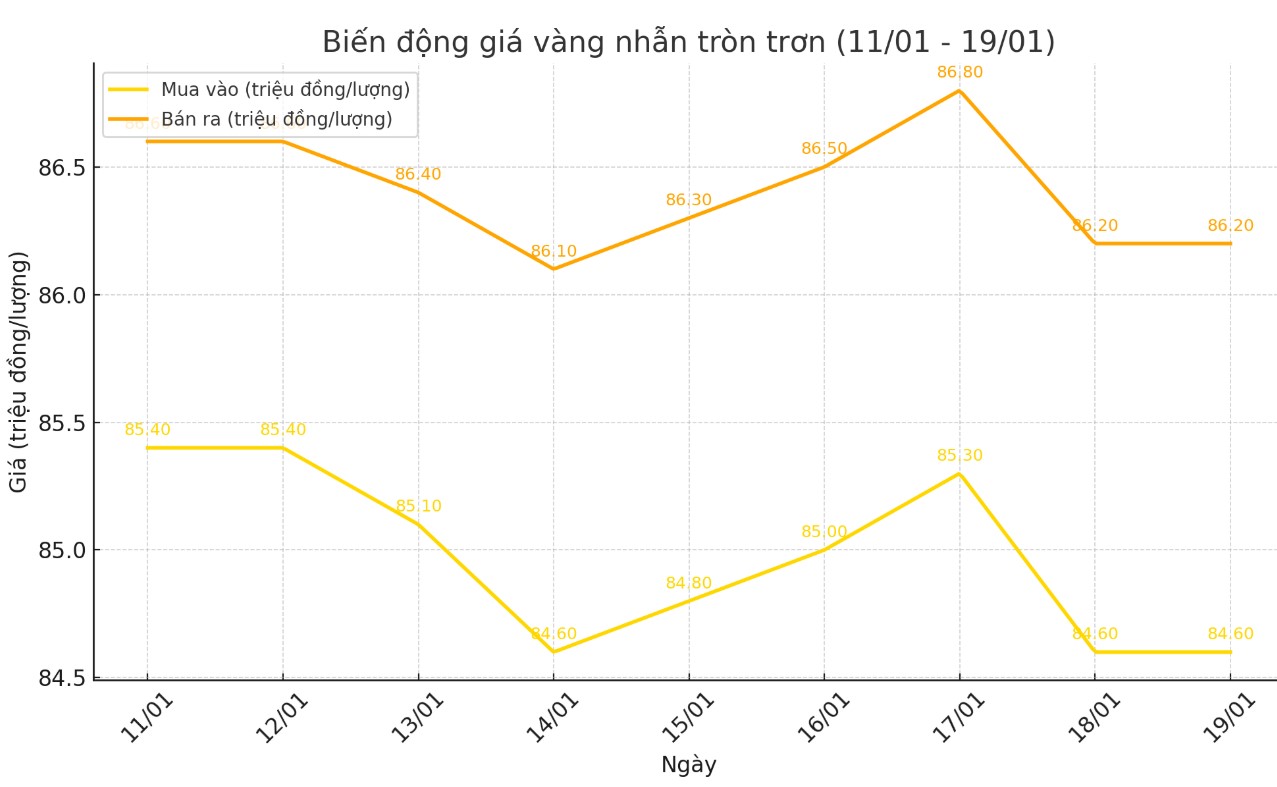

9999 round gold ring price

As of 5:00 p.m. today, the price of round gold rings at DOJI is listed at 84.6-86.2 million VND/tael (buy - sell); down 800,000 VND/tael for buying and down 400,000 VND/tael for selling compared to the closing price of last week's trading session.

Bao Tin Minh Chau listed the price of gold rings at 84.9-86.85 million VND/tael (buy - sell); down 600,000 VND/tael for buying and down 50,000 VND/tael for selling compared to the closing price of last week's trading session.

If buying gold rings in session 12.1 and selling in session today (19.1), the loss investors will have to accept when buying at DOJI and Bao Tin Minh Chau is 2 million VND/tael.

In recent sessions, the price of gold rings has often fluctuated in the same direction as the world market. Investors can refer to the world market and expert opinions before making investment decisions.

World gold price

At the close of the weekly trading session, the world gold price listed on Kitco was at 2,703.1 USD/ounce, down 13.8 USD/ounce compared to the close of the previous week's trading session.

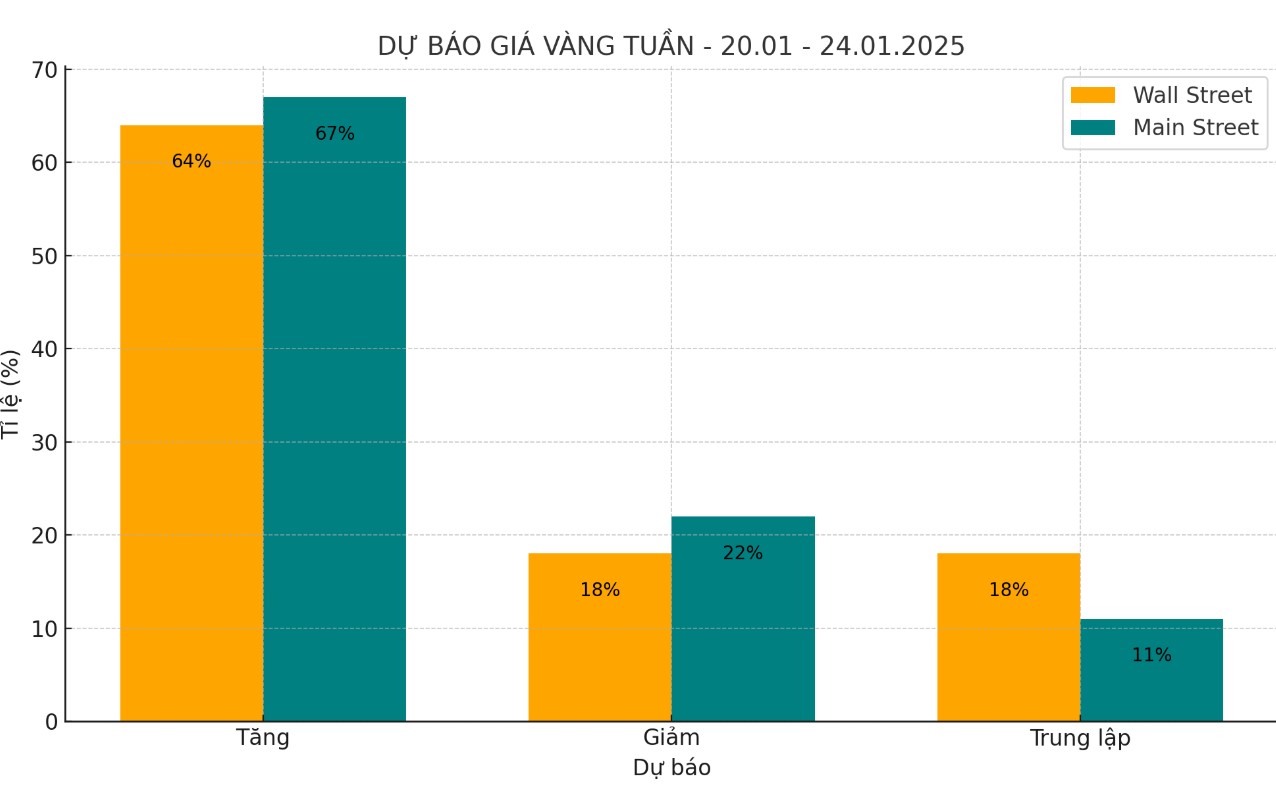

Gold Price Forecast

World gold prices are under pressure this weekend amid an increase in the USD index. Recorded at 5:00 p.m. on January 19, 2025, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 109,200 points (up 0.35%).

The latest Kitco News weekly gold survey shows strong bullish sentiment from industry experts and retail traders ahead of Donald Trump’s second inauguration.

John Weyer, Director of Commercial Hedging at Walsh Trading, analyzed the performance of gold prices from early 2025 in the context of the upcoming Donald Trump administration.

“We’re seeing a rally to start the new year and the metal continues to rise,” Weyer said. “We’re seeing an extension of the tax cuts from 2017, but there’s also a lot of concern about what might happen with tariffs. There’s still a bit of uncertainty in the market. I think gold could continue to rise gradually,” Weyer added.

“I’m still bullish, although there is potential for a correction,” said James Stanley, senior market strategist at Forex.com. Gold has just broken out of a triangle pattern that has been forming over the past few months.

Spot gold is testing resistance at $2,721/oz. This level has resulted in two strong reactions and this week it was the third. However, I think a slight correction to a higher low could be attractive for a continuation of the trend at this point."

Meanwhile, Kitco's online poll drew 156 votes, with retail investors slightly more bullish than experts.

105 retail traders (64%) expect gold prices to rise next week. 34 (22%) expect the precious metal to fall. The remaining 17 investors (11%) expect gold prices to move sideways in the short term.

See more news related to gold prices HERE...