Gold price developments last week

The first full trading week of 2025 for gold started on a rocky note, but the rally continued to build throughout the week. By Friday, market participants were predicting further gains as they prepared for Donald Trump’s presidency.

Spot gold opened the week at $2,690 an ounce, but all momentum turned bearish Sunday night and early Monday. By 5:15 a.m. ET, spot gold had fallen to $2,678 an ounce. By 8:30 a.m., the precious metal was trading at $2,665 an ounce.

The North American market opened with a brief rally above $2,670 an ounce, but that didn’t last. By 2 p.m., spot gold had fallen to $2,657 an ounce.

However, this was the lowest level of the week. By 7:30 p.m., gold was back above $2,670 an ounce. Minutes before the market opened on Tuesday, gold fell to $2,661 an ounce, but North American traders pushed it back above $2,670 an ounce. After testing this support level just before 9 p.m., gold began to rise steadily and has not turned around.

A better-than-expected CPI report on Wednesday morning pushed spot gold to $2,693 an ounce, a new weekly high at the time, after a late-morning retest of $2,680 that became new support.

By 3:00 a.m. ET, spot gold had broken clear of the $2,700/ounce resistance level. By the opening of the North American market on Thursday, gold was trading at $2,717/ounce.

Gold prices hit a weekly high of nearly $2,725 an ounce just after noon ET on Thursday. While the market saw some price volatility on Thursday and Friday, multiple retests of the $2,700 an ounce level showed it holding as solid support through the end of the week.

What do experts predict about gold prices?

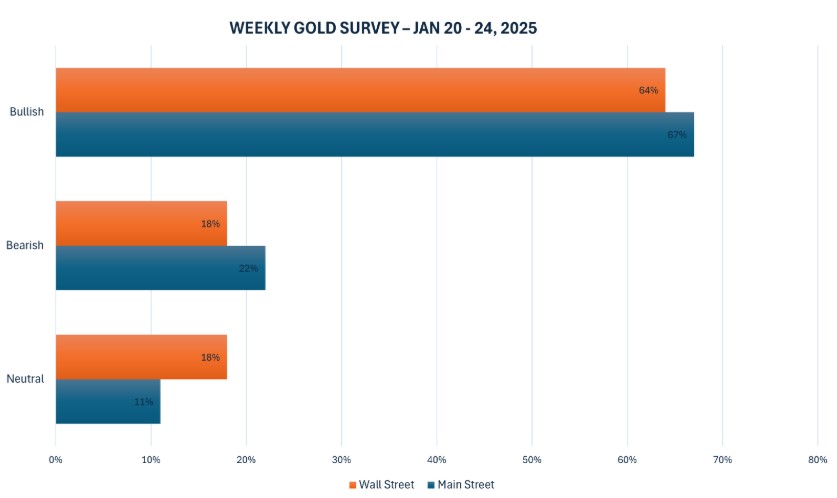

The latest Kitco News weekly gold survey shows strong bullish sentiment from industry experts and retail traders ahead of Donald Trump’s second inauguration.

This week, 11 analysts took part in Kitco News' gold survey, with nearly two-thirds of participants predicting gold prices will rise in the coming days.

Seven experts (64%) expect gold prices to rise next week. Two analysts (18%) predict the precious metal will fall. The remaining two choose to stay on the sidelines until the situation becomes clearer.

Meanwhile, Kitco's online poll drew 156 votes, with retail investors slightly more bullish than experts.

105 retail traders, or 64 percent, expect gold prices to rise next week. Thirty-four, or 22 percent, expect the precious metal to fall. The remaining 17 investors, or 11 percent, expect gold prices to move sideways in the short term.

Economic calendar affects gold price next week

The economic calendar is relatively light next week, but a key political event will capture market attention: President-elect Donald Trump's inauguration for a second term on Monday. Traders are awaiting more information on the scope and details of his proposed tariff policies.

Thursday will see the US weekly jobless claims report, and Friday's S&P Flash PMI data and US existing home sales will round out the calendar.

See more news related to gold prices HERE...