Commenting on short-term gold prices on Kitco, many experts gave quite positive forecasts.

“I’m still bullish, although there is potential for a correction,” said James Stanley, senior market strategist at Forex.com. Gold has just broken out of a triangle pattern that has been forming over the past few months.

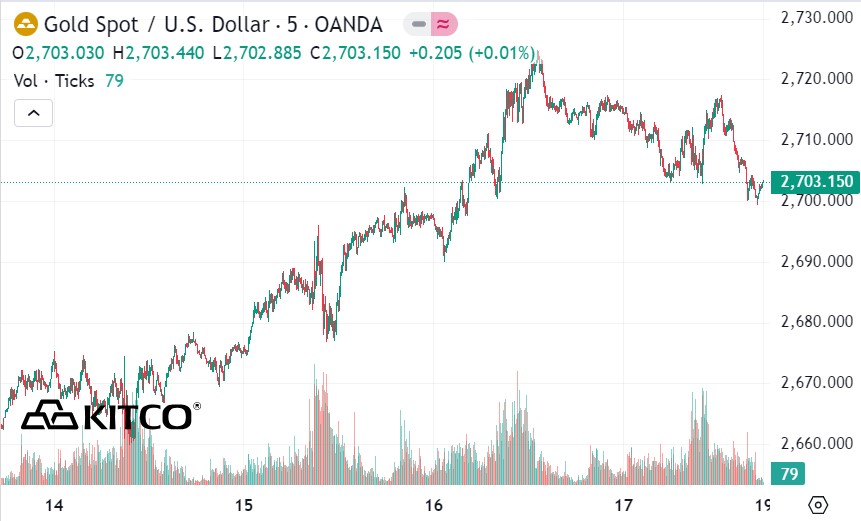

Spot gold is testing resistance at $2,721/oz. This level has resulted in two strong reactions and this week it was the third. However, I think a slight correction to a higher low could be attractive for a continuation of the trend at this point."

Kevin Grady, president of Phoenix Futures and Options, agrees, seeing plenty of support for further gains: “I think the market has held some key levels. There are investors who are willing to buy on dips.

What pushed prices down was some weak investors or uncertain long positions, causing them to panic and exit the market. But I think stronger investors, such as central banks, came in and they continued to buy," Grady said.

Grady is bullish on the precious metal through 2025: “I think gold will hit $3,000 this year. The only issue is how the tariffs play out.”

However, Grady said it was difficult to predict where gold prices would go in the short term. “It’s hard to say where the price will go, but I still think there are strong investors in the market. Any dip in the price will be taken advantage of by them to buy,” he said.

Marc Chandler - CEO at Bannockburn Global Forex - predicts gold prices will hit a new record high in 2025 and the short-term outlook is also very positive.

“I like precious metals. Gold could hit new highs before facing a correction. Gold peaked in late October 2024 at around $2,790/oz and bottomed in mid-November at around $2,537/oz. Since then, prices have been rising in an inconsistent manner. On January 16, gold approached the upper limit of its recent range at $2,725/oz and briefly consolidated ahead of the weekend,” he said.

“The news that the People’s Bank of China (PBOC) has resumed gold purchases, uncertainty surrounding the policies and priorities of the new US administration, and the slight decline in US interest rates could encourage buying as gold prices correct,” Chandler added.

John Weyer, director of commercial hedging at Walsh Trading, analyzed the performance of gold prices from early 2025 in the context of the upcoming Donald Trump administration.

“We’re seeing a rally to start the new year and metals prices are continuing to rise,” Weyer said. “We’re seeing an extension of the tax cuts from 2017, but there’s also a lot of concern about what might happen with tariffs. There’s still a bit of uncertainty in the market.”

“I think gold can continue to rise gradually,” Weyer added. “I know a lot of people think gold is going to go through the roof. But I think it’s going to be a slower, more steady rise. The numbers in the U.S. aren’t terrible, but most of the rest of the world is sluggish. We’re not exactly booming, but we’re steady and still have a positive outlook for the economy.”

This expert pointed out that the increase in gold prices in the context of a stronger USD is very noteworthy.

“In traditional economics as I learned, gold and the US dollar usually have an inverse relationship. When both rise, it is usually a sign of safe haven money flowing from abroad. We have seen the US dollar strengthen over the past year and at the same time gold prices have continued to rise. I think this is mainly related to the fact that foreign economies are no longer attractive, and they are looking for a safer haven,” he said.

Weyer said he does not think gold is overbought at current levels. “I think gold will hold above $2,700 an ounce,” he said.