Update SJC gold price

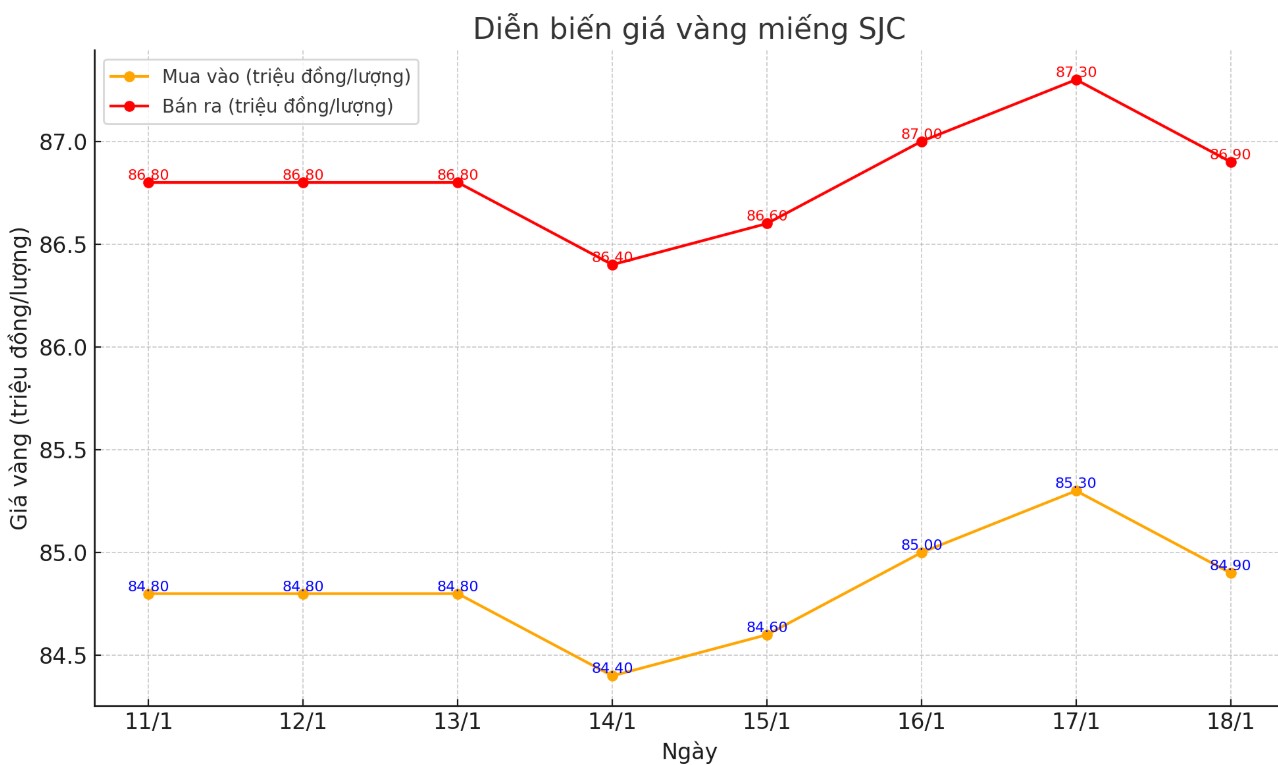

As of 7:00 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND84.9-86.9 million/tael (buy - sell); down VND400,000/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Meanwhile, DOJI Group listed the price of SJC gold at 84.9-86.9 million VND/tael (buy - sell); down 400,000 VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 84.9-86.9 million VND/tael (buy - sell); down 400,000 VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

9999 round gold ring price

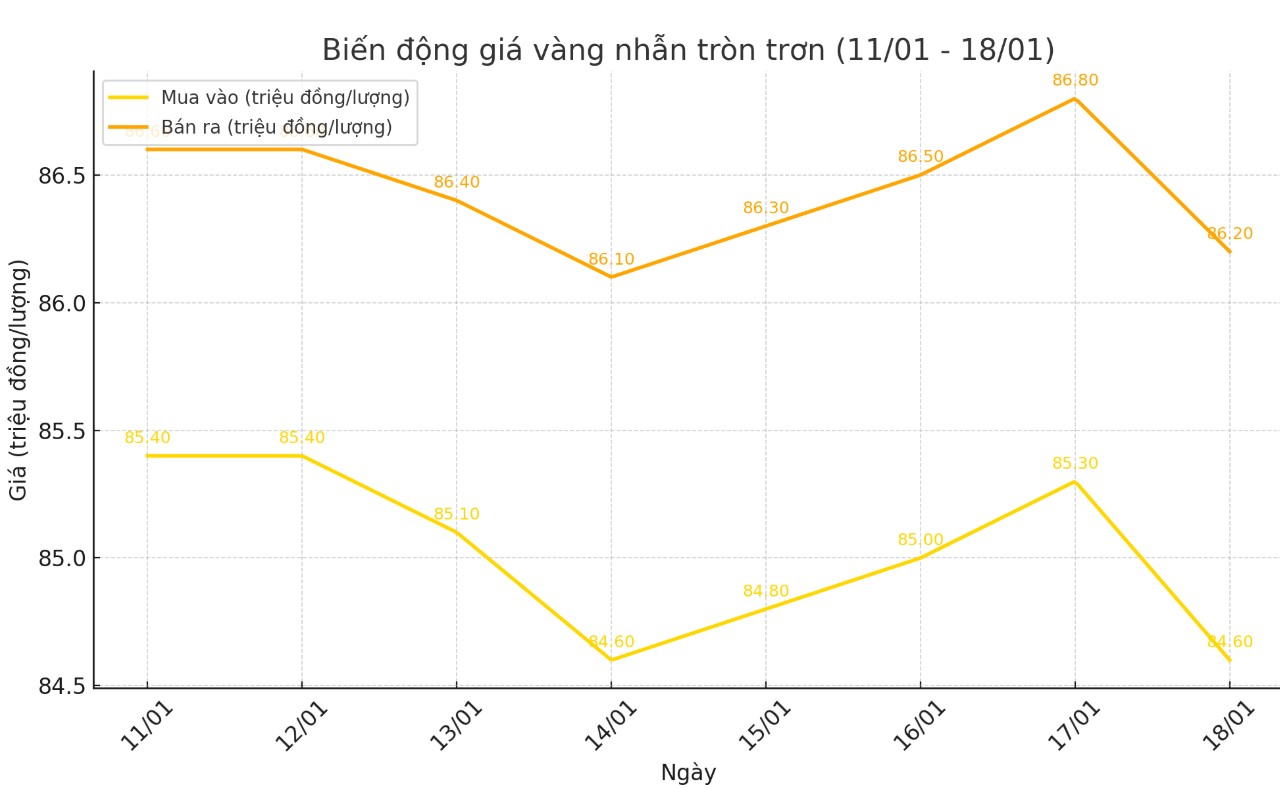

As of 6:30 p.m. today, the listed price of round gold rings was at 84.6-86.2 million VND/tael (buy - sell); down 700,000 VND/tael for buy and down 600,000 VND/tael compared to the closing price of yesterday's trading session.

Bao Tin Minh Chau listed the price of gold rings at 84.9-86.85 million VND/tael (buy - sell), down 650,000 VND/tael for buying and down 400,000 VND/tael for selling compared to the closing price of yesterday's trading session.

World gold price

As of 6:38 p.m., the world gold price listed on Kitco was at 2,703.1 USD/ounce, down 1 USD/ounce compared to the same time of the previous session.

Gold Price Forecast

World gold prices fell slightly amid an increase in the USD index. Recorded at 6:38 p.m. on January 18, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 109,200 points (up 0.35%).

Gold prices fell as investors took profits after a recent rally, pushing the precious metal to a four-week high on Thursday, according to Kitco.

The gold market has been volatile over the past week, mainly influenced by US macroeconomic data and expectations of the Fed’s monetary policy. The market has recorded a clear up-down cycle, reflecting the sensitivity of gold prices to economic and political factors.

David Meger, director of metals trading at High Ridge Futures, told CNBC that the weekend correction was largely profit-taking. Uncertainty over the policies that President Donald Trump is about to bring is one of the factors supporting gold.

There are a lot of questions about the status of tariffs and how they will be implemented, and many investors are looking to gold as a way to hedge against some downside risks if these new policies hurt growth, said Nitesh Shah, commodity strategist at WisdomTree.

Traders predict the US Federal Reserve (FED) will cut interest rates twice in 2025. Notably, FED Governor Christopher Waller has hinted at the possibility of further rate cuts if economic data continues to weaken.

The market is awaiting Donald Trump's inauguration on January 20. His broad trade tariff policies are expected to increase inflation and spark trade wars, which could boost gold's "safe haven" status.

See more news related to gold prices HERE...