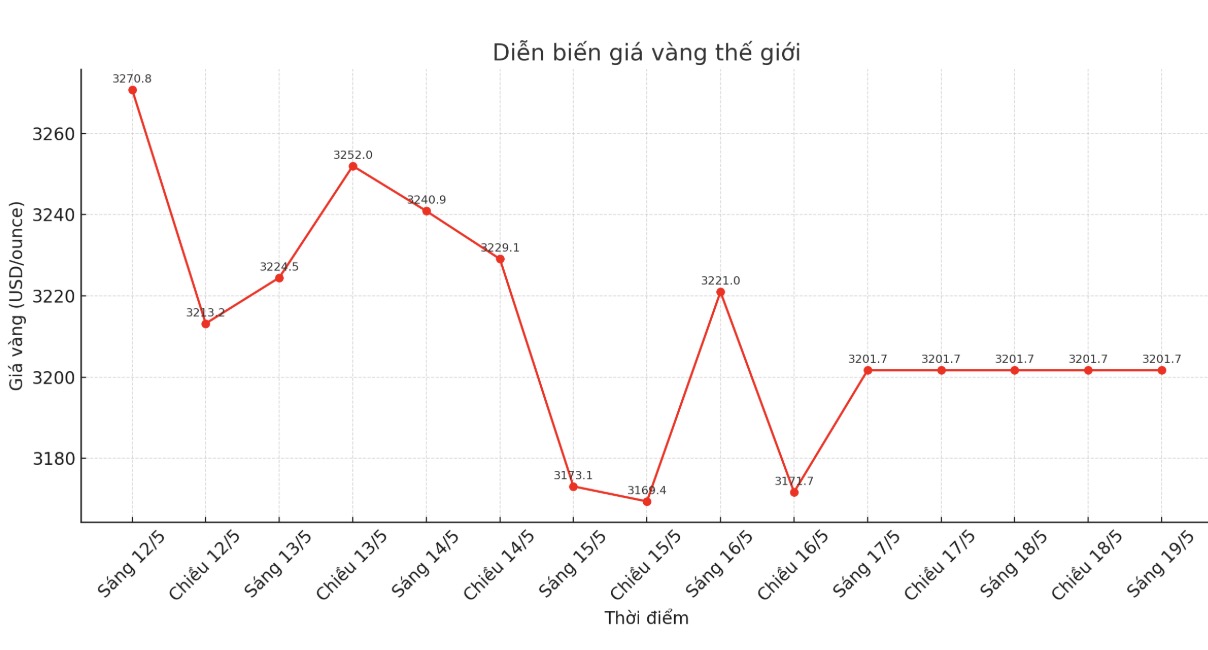

After a volatile trading week, gold prices continued to fall sharply, marking the largest weekly loss since November last year. Despite bottom-fishing demand over the weekend, many experts believe the precious metal is still facing downward pressure in the short term. Capital flows tend to shift to more risky assets in the context of a stable global market.

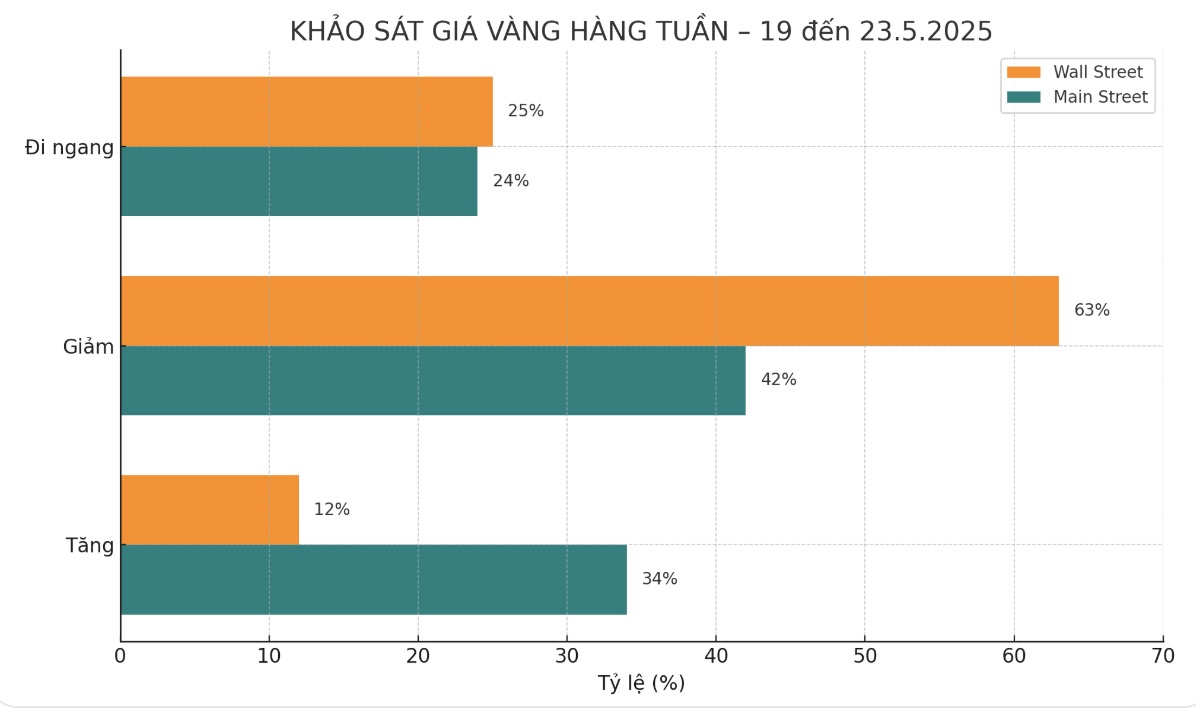

According to a survey by Kitco News, most Wall Street experts have turned to a pessimistic trend towards gold this week. Meanwhile, individual investors have also reduced their expectations of price increases, after two consecutive weeks of market weakness.

Mark Leibovit - founder of VR Metals/Resource Letter news agency feels that gold may have made a short-term peak. "The upcoming risk is that prices could fall to the $2,900/ounce zone," he said.

Marc Chandler, managing director at Bannockburn Global Forex, noted that gold prices fell as much as 4.25% last week, the strongest decline since November.

Alarming indicators are currently being stretched, but that does not mean there will be no more profit-taking. If the price breaks through the 3,120 USD/ounce mark, it could continue to fall to the 3,030 - 3,045 USD/ounce range, he said.

Chandler added that despite mixed US interest rates last week, the Dollar Index is still rising for the fourth consecutive week. He said that gold prices near record levels may have limited central banks' purchases: Maybe record highs have caused central banks to stop racing in the market.

Alex Kuptsikevich - senior market analyst at FxPro - assessed that after gold lost about 4% of its value last week, strong fluctuations have exhausted buyers.

Basically, the safe-haven appeal of gold is declining as market uncertainty is easing at least in the short term. Gold prices have been pushed down to $3,120/ounce. Then there was a bounce of about 120 USD, but the increase was quickly extinguished" - he said.

The final hope for buyers is the 50-day moving average, near $3,160/ounce. If gold remains above this level, the recent decline can still be considered a technical adjustment, said Kuptsikevich.

However, he warned: In our opinion, last month could be the start of a broader correction, adjusting the entire growth cycle that has lasted for the past three years.

The sellers are having an advantage not only because the gold price is high according to historical standards, but also because of the greedy mentality returning to the US stock market, pulling cash flow away from gold to seek profits in stocks".

He also pointed out: The bond market is moving in the same direction, as rising government bond yields make unyielding gold less attractive.

Sean Lusk - co-head of commercial defense at Walsh Trading - said that US President Donald Trump's trade policies are starting to take effect, making market sentiment more optimistic.

Things that were once very uncertain are now gradually becoming clearer. Of course, there are still many uncertainties, but the US has signed a trade deal with the UK, and is making positive progress in the Middle East, both in terms of investment and the prospects for peace, he said.

This expert said that we cannot look at the developments in the past 7-10 days but think that the situation is getting worse: "In reality, it is quite positive. It is likely that this momentum will continue, opening up new markets for US businesses. And ascertainty increases, the reason for holding gold as a safe haven asset will decline.

Technically, he warned: The gold market has entered an unprecedented level, up to $3,500/ounce. Since the election, prices have risen nearly $1,000, and we are seeing a necessary correction. Currently, the key support zone is around $3,180 - $3,200/ounce.

This opens up the possibility of the gold market returning to test the $3,000/ounce mark, he stressed.

Kitco senior analyst Jim Wyckoff said that gold prices this week will continue to fluctuate within a wide range and may fluctuate in a tug-of-war, as the market awaits new fundamental factors to lead the trend.