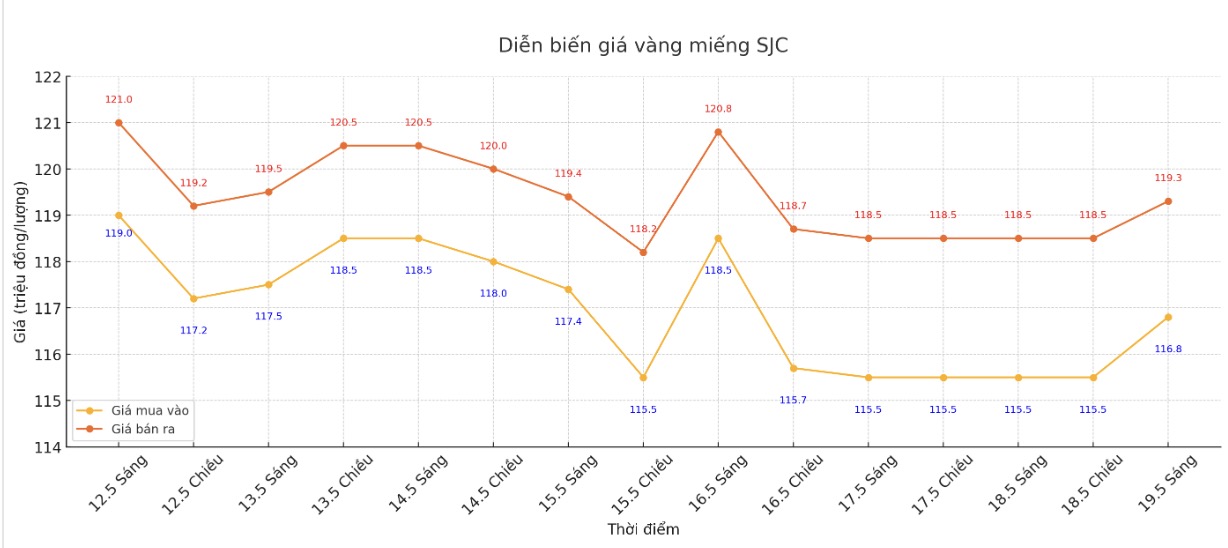

Updated SJC gold price

As of 9:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND116.8-19.3 million/tael (buy - sell), an increase of VND1.3 million/tael for buying and an increase of VND800,000/tael for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

At the same time, DOJI Group listed the price of SJC gold bars at 116.8-119,3 million VND/tael (buy - sell), an increase of 1.3 million VND/tael for buying and an increase of 800,000 VND/tael for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 116.8-119,3 million VND/tael (buy - sell), an increase of 1.3 million VND/tael for buying and an increase of 800,000 VND/tael for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 116.3-119,3 million VND/tael (buy - sell), an increase of 1.3 million VND/tael for buying and an increase of 800,000 VND/tael for selling. The difference between buying and selling prices is at 3 million VND/tael.

9999 round gold ring price

As of 9:00 a.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 112-115 million VND/tael (buy in - sell out), an increase of 1 million VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 114.3-117.3 million VND/tael (buy - sell), an increase of 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 112.3-115.3 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions, the difference between buying and selling is 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

World gold price

At 9:00 a.m., the world gold price listed on Kitco was around 3,217 USD/ounce, up 15.3 USD/ounce.

Gold price forecast

Gold prices have just had their biggest week of decline since November 2024. Many experts warn that gold prices may lose the $3,000/ounce mark.

According to a survey by Kitco News, most Wall Street experts have turned to a pessimistic trend towards gold this week. Meanwhile, individual investors have also reduced their expectations of price increases, after two consecutive weeks of market weakness.

Mark Leibovit - founder of VR Metals/Resource Letter news agency feels that gold may have made a short-term peak. "The upcoming risk is that prices could fall to the $2,900/ounce zone," he said.

Marc Chandler, managing director at Bannockburn Global Forex, noted that gold prices fell as much as 4.25% last week, the strongest decline since November.

Alarming indicators are currently being stretched, but that does not mean there will be no more profit-taking. If the price breaks through the 3,120 USD/ounce mark, it could continue to fall to the 3,030 - 3,045 USD/ounce range, he said.

Chandler added that despite mixed US interest rates last week, the Dollar Index is still rising for the fourth consecutive week. He said that gold prices near record levels may have limited central banks' purchases: Maybe record highs have caused central banks to stop racing in the market.

Alex Kuptsikevich - senior market analyst at FxPro - assessed that after gold lost about 4% of its value last week, strong fluctuations have exhausted buyers.

Basically, the safe-haven appeal of gold is declining as market uncertainty is easing at least in the short term. Gold prices have been pushed down to $3,120/ounce. Then there was a bounce of about 120 USD, but the increase was quickly extinguished" - he said.

The final hope for buyers is the 50-day moving average, near $3,160/ounce. If gold remains above this level, the recent decline can still be considered a technical adjustment, said Kuptsikevich.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...