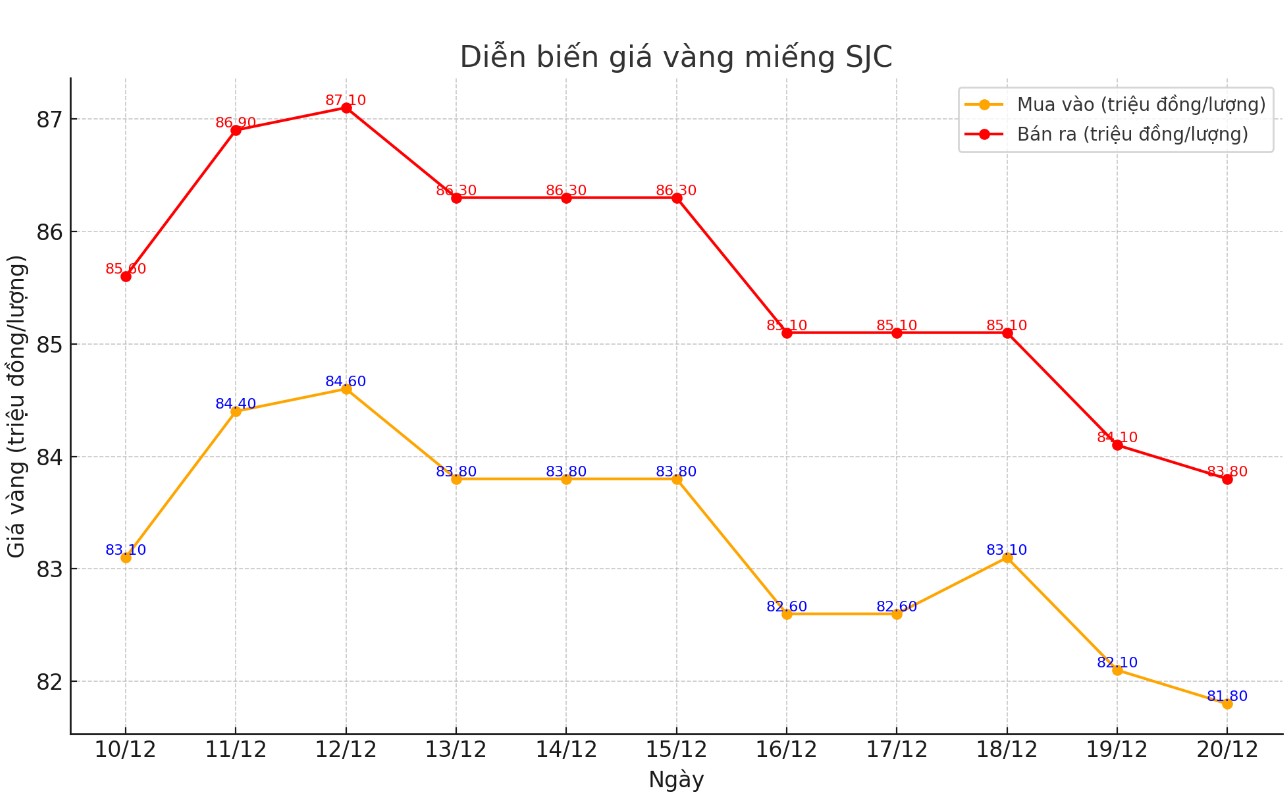

Update SJC gold price

As of 7:30 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND81.8-83.8 million/tael (buy - sell); down VND300,000/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Meanwhile, DOJI Group listed the price of SJC gold at 81.8-83.8 million VND/tael (buy - sell); down 300,000 VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 82-83.8 million VND/tael (buy - sell); down 100,000 VND/tael for buy and down 300,000 VND/tael for sell.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 1.8 million VND/tael.

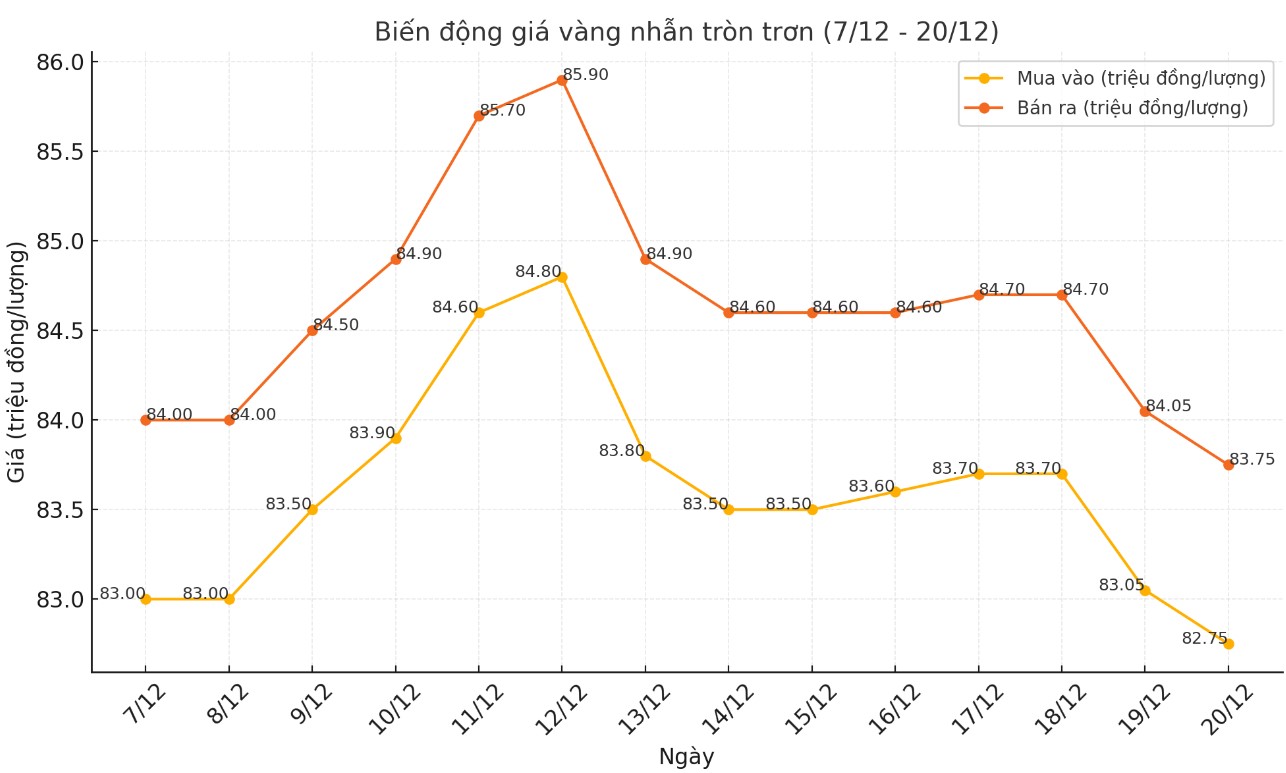

Price of round gold ring 9999

As of 5:50 p.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 82.75-83.75 million VND/tael (buy - sell); down 300,000 VND/tael for both buying and selling compared to the close of the previous trading session.

Bao Tin Minh Chau listed the price of gold rings at 82.3-83.8 million VND/tael (buy - sell), down 800,000 VND/tael for buying and down 300,000 VND/tael for selling compared to the closing price of yesterday's trading session.

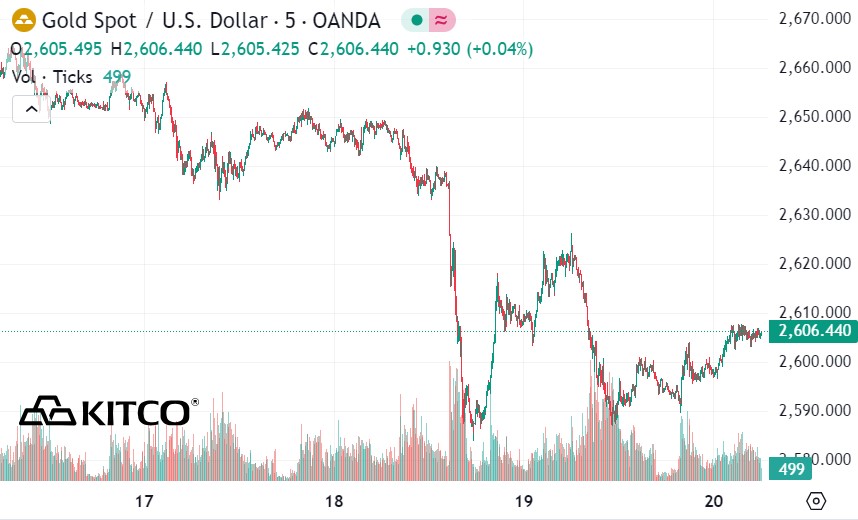

World gold price

As of 5:50 p.m., the world gold price listed on Kitco was at 2,606.44 USD/ounce, down 7.4 USD/ounce compared to the close of the previous trading session.

Gold Price Forecast

World gold prices fell sharply despite the decline in the USD index. Recorded at 5:50 p.m. on December 20, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 107.915 points (down 0.22%).

Precious metals fell after the US Federal Reserve (FED) made a decision on monetary easing policy, signaling a slowdown in the pace of interest rate cuts. Markets are focused on US personal consumption expenditure (PCE) data due later in the day.

Mr. Soni Kumari - commodity strategist at ANZ assessed that gold prices are currently in a consolidation phase, as investors closely monitor developments related to the possibility of Mr. Donald Trump returning to the White House in early 2025. At the same time, the FED is expected to consider each meeting to evaluate economic data and Mr. Trump's trade policy.

Investors are also waiting for core PCE data - the Fed's preferred inflation measure - to look for further signals on the US economic outlook.

The decision to cut interest rates by another 0.25 percentage points, along with a cautious economic forecast and the possibility of the Fed slowing the pace of rate cuts, sent gold prices falling to their lowest level since November 18 on December 18.

Data released on December 19 showed that the US economy grew more than expected in the third quarter of 2024. At the same time, the number of unemployment claims fell more than expected, reinforcing expectations that the FED will continue to maintain a cautious stance when easing policy.

Higher interest rates make gold, a non-yielding asset, less attractive.

Spot gold could retest support at $2,582 an ounce, according to Reuters technical analyst Wang Tao.

See more news related to gold prices HERE...